Enabling Information Confidentiality in Publish

advertisement

Enabling Information Confidentiality in

Publish/Subscribe Overlay Services

Hui Zhang Haifeng Chen Guofei Jiang

Xiaoqiao Meng

Kenji Yoshihira

NEC Labs America

Abhishek Sharma

University of Southern California

©NEC Laboratories America

1

Outline

Problem statement

Information confidentiality in pub/sub overlay services

Information foiling

Mechanism description

Performance metrics

Fake message generation schemes

Evaluation

Conclusions & future work

©NEC Laboratories America

2

Publish/Subscribe overlay services

Subscription

Publisher X

Event

Subscriber A

Broker network

Subscriber B

Publisher Y

©NEC Laboratories America

3

Information confidentiality in pub/sub services

Publish/subscribe decouples publishers and subscribes.

Events are characterized into classes, without knowledge of what (if

any) subscribers there may be.

Subscribers express interest in one or more classes, and only receive

messages that are of interest, without knowledge of what (if any)

publishers there are.

New confidentiality problems in this content-based routing

process

Can the broker network perform content-based routing without the

publishers trusting the broker network with the event content?

Information confidentiality

Can subscribers obtain dynamic data without revealing their

subscription functions (content) to the publishers or broker network?

Subscription confidentiality

Can publishers control which subscribers may receive particular

events?

Publication confidentiality

©NEC Laboratories America

4

Problem definition

Formulation of pub/sub confidentiality as a

communication problem.

Upon an event e, the broker determines if each subscription s

in the active subscription set matches the event based on a

function f(e; s), but without learning the information contained

in e and s.

Threat model: a broker is assumed to be computationally

bounded and exhibits a semi-honest behavior.

©NEC Laboratories America

5

Information foiling – the mechanism

©NEC Laboratories America

6

Information foiling – the mechanism

1. Subscriber: for each active subscription, generates ks foiling

subscriptions, and send them in a random order to the broker

which store them all as active subscriptions.

2. Publisher: for each event, generates kp foiling events, and send

them in a random order to the broker.

3. Broker: upon each arriving event e, decides the subset of the

active subscription set and send one notification for each

matched subscription.

4. (optional) Subscriber: upon a notification associated with one

authentic subscription, sends a confirmation request to the

publisher.

5. (optional) Publisher: upon a confirmation request, sends a reply

to the subscriber upon the authenticity of the related event.

©NEC Laboratories America

7

Information foiling – performance metrics

Assume the attacker has a function F : f{e, Ee} -> G,

that takes the composite message set {e, Ee} as input

and outputs a message set G {e, Ee} consisting of

messages that the attacker perceives as useful.

Metric 1: indistinguishability

defined as

, where I(e, G) = 1 if e 2 G; 0 otherwise.

Metric 2: truth deviation

dened as

, where D(e, g) is the difference

between the values of messages e and g.

Metric 3: communication overhead

it depends not only on the information foiling mechanism but

also on the actual data distributions of the authentic events

and subscriptions.

©NEC Laboratories America

8

Fake message generation – a probabilistic model

Consider an event message m with L attributes.

Let the value Vi for attribute Ai in m be a random variable taking

values in V according to a probability mass function pVi .

Let Vm = (V1, V2, …, VL), represent m, i.e., a vector of random

variables associated with message taking values in VL.

Each of the K foiling messages generated by the information

foiling scheme for m can be thought of as a random variable

vector taking values in VL.

We discussed three scenarios where different fake message

generation schemes are designed with the performance

requirements defined on the 3 metrics.

The scenarios are differentiated based on the foiler/attacker’s

knowledge on the pmf for Vm:

©NEC Laboratories America

9

Evaluation - methodology

Pub/sub service: stock quoting

Stock price volatility is a random walk with variance a normal

distribution [Black-Scholes model]

Fake message generation:

Sit = St + ni , where Sit is the i-th fake message for the authentic

stock price information St, and ni is white Gaussian noise.

Attacker’s strategy:

Uniform Sampling: The attacker picks each of the K+1 messages as

the correct message with the same probability.

Extended Kalman Filter : Use an extended Kalman filter to generate

estimates

, and then picks the observed message j which is

data trace:

finance.yahoo.com

©NEC Laboratories America

10

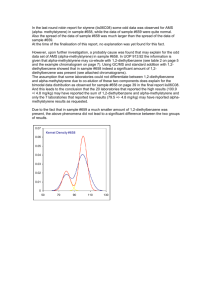

Evaluation results - 1

The curve labeled

“Sig. Events” shows

the probability of

correct guess by

the attacker when

the stock price

changes by a large

amount.

©NEC Laboratories America

11

Evaluation results - 2

A value of

“Factor-10”

means the

variance of the

noise was 10

times the variance

of stock price.

higher variance

for the added

noise achieves

a higher truth

deviation.

©NEC Laboratories America

12

Conclusion and Future Work

We propose a security mechanism called “information foiling” to

address new confidentiality problems arising in pub/sub overlay

services.

Information foiling extends Rivest’s ”Chaffing and Winnowing” idea.

Our scheme is complementary to the traditional cryptography-based

security schemes and offers probabilistic guarantees on information

confidentiality.

Many interesting open problems for future work.

The need for a stronger guiding theory to better understand

An analytic study on the fundamental trade-off between the fake

message number, indistinguishability, and truth deviation is

important.

Investigating the interaction between a foiler and an attacker in

game theory.

The designs of optimal FMG schemes for other interesting and

important application scenarios are needed.

©NEC Laboratories America

13

Thank you!

Questions?

©NEC Laboratories America