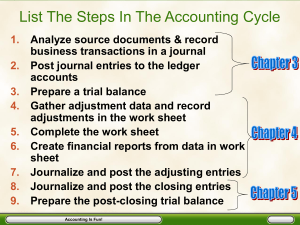

Accounting Mid Term Review Chapter 1

advertisement

Accounting Mid Term Review Chapter 1- Starting a Proprietorship: Changes That Affect the Accounting Equation What is Accounting? What are Statements? What is a Service Business? What is a Proprietorship? What is an Asset? What is Owner’s Equity? What is a Transaction? The accounting equation What is Capital? How transactions effect accounts? o Ex-When a business pays cash for supplies….supplies ______________. Accounts Receivable Accounts Payable What is an expense? When a company receives cash from a customer for a prior sale, the transaction increases __________ and decreases _____________. Chapter 2- Analyzing Transactions into Debit and Credit Parts What is an account? What is a T account? In a T account, amounts recorded on the left side are called _______and right side are called________. What does Normal Balance mean? What is a Chart of Accounts? Account balances _____________ on the normal balance side of an account. A business paid cash for supplies. How is this transaction recorded? A business sold services on account. How is this transaction recorded? A business bought supplies on account. How is this transaction recorded? What happens when a business pays cash on an account? What happens when a business receives cash from owner as an investment? What happens when a business pays cash for insurance? What happens when a business receives cash on account? Chapter 3- Journalizing Transactions What is a journal? What is a Special Column Amount? How are transactions recorded in a Journal? What is an entry? What is a source document? What is an invoice? What are the parts of an entry? Remember that Account balances increase on the normal balance side of an account. What is a receipt? What is a check? Because expenses decrease owner's equity, increases in expenses are recorded as ___________. Remember that before a transaction is recorded in a journal, the transaction is analyzed into its debit and credit parts. Know which accounts have a normal debit balance. What is Proving Cash? How should errors be corrected? Are dollars and cents signs and decimals points used when writing amounts on ruled accounting paper so as not to be confusing? Yes or No. If you pay $300.00 cash on account to Supply Depot you would debit _________________and Credit _______________. Chapter 4- Posting to a General Ledger Remember that a separate form for each account is used to summarize all the changes to a single account. Does a Journal show all changes in a single account? What is a chart of accounts? What is a ledger? Remember that a general ledger contains all accounts needed to prepare financial statements. Are accounts in a general ledger arranged in the same order as they appear on financial statements? Do all businesses in similar industries use the same chart of accounts? What is file maintenance? What is posting? When is the posting reference recorded? Remember that all journal entry amounts are posted to the general ledger from the general journal. What is proving cash? What is a correcting entry? The amounts that are posted differently from a journal to a general ledger are from which column? o -General ______________ What are the steps for opening an account? Why is a Post Reference used? Chapter 5- Cash Control Systems In accounting, Money is referred to as ______________. What is a check? What is a checking account? Cash receipts are journalized when? What is an endorsement? What is a blank endorsement? Remember that ownership of a check and be transferred more than once. What is a postdated check? What is a bank statement? What is an outstanding check? What is a dishonored check? What is petty cash? What is a debit card? What is an EFT?