EXTRA Final Exam Review Packet

advertisement

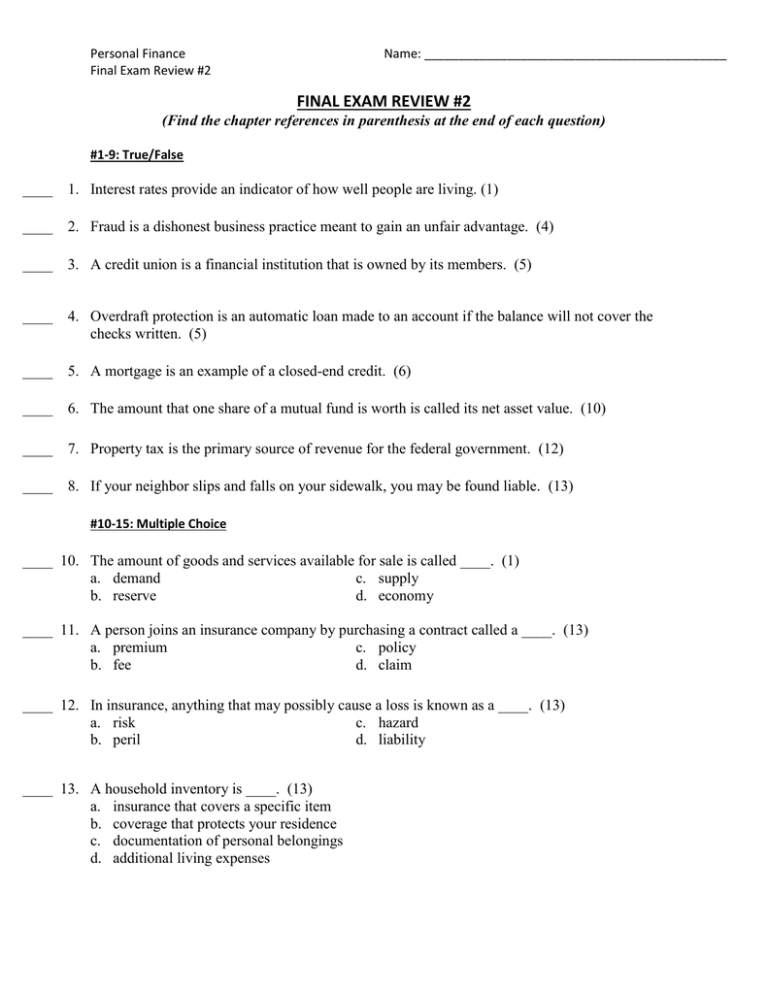

Personal Finance Final Exam Review #2 Name: ____________________________________________ FINAL EXAM REVIEW #2 (Find the chapter references in parenthesis at the end of each question) #1-9: True/False ____ 1. Interest rates provide an indicator of how well people are living. (1) ____ 2. Fraud is a dishonest business practice meant to gain an unfair advantage. (4) ____ 3. A credit union is a financial institution that is owned by its members. (5) ____ 4. Overdraft protection is an automatic loan made to an account if the balance will not cover the checks written. (5) ____ 5. A mortgage is an example of a closed-end credit. (6) ____ 6. The amount that one share of a mutual fund is worth is called its net asset value. (10) ____ 7. Property tax is the primary source of revenue for the federal government. (12) ____ 8. If your neighbor slips and falls on your sidewalk, you may be found liable. (13) #10-15: Multiple Choice ____ 10. The amount of goods and services available for sale is called ____. (1) a. demand c. supply b. reserve d. economy ____ 11. A person joins an insurance company by purchasing a contract called a ____. (13) a. premium c. policy b. fee d. claim ____ 12. In insurance, anything that may possibly cause a loss is known as a ____. (13) a. risk c. hazard b. peril d. liability ____ 13. A household inventory is ____. (13) a. insurance that covers a specific item b. coverage that protects your residence c. documentation of personal belongings d. additional living expenses Personal Finance Final Exam Review #2 ____14.A disadvantage of renting is ____. (7) a. more responsibilities b. high initial costs Name: ____________________________________________ c. restricted activities d. eligibility for tax deductions ____ 15. A driver’s insurance premium rates will probably increase if he or she ____. (13) a. moves to a rural area b. buys an auto that requires simple repairs c. takes a driver training course d. receives several traffic tickets #16-22: Short Answer (vocab) 16. The cost of credit on a yearly basis, expressed as a percentage. (6) 17. The income a person receives. (6) 18. An entity (bank, finance company, credit union, business, or individual) to which money is owed. (6) 19. A last resort legal process in which some or all of the assets. (6) 20. A time period during which no finance charges are added to a credit card account. (6) 21. Sells its shares openly in stock markets where anyone can buy them. (9) 22. Remains stable during periods of decline in the economy. (9)