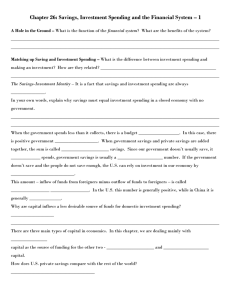

The Market for Loanable Funds

advertisement

The Market for Loanable Funds For the economy as a whole, savings always equals investment spending In a closed economy, savings is equal to national savings In an open economy, savings is equal to national savings plus capital inflow Equilibrium Interest Rate The Loanable funds market is a hypothetical market that illustrates the market outcome of the demand for funds generated by borrowers and the supply of funds provided by lenders Equilibrium Interest Rate The price that is determined in the loanable funds market is the interest rate, r. It is the return that a lender receives for allowing borrowers the use of a dollar for one year, calculated as a percentage of the amount borrowed Equilibrium Interest Rate The rate of return on a project is the profit earned on the project expressed as a percentage of its cost. A business will want a loan when the rate of return on its project is greater than or equal to the interest rate Interest rate 12% 4 Demand for loanable funds, D 0 $150 450 Quantity of loanable funds (billions of dollars) Interest rate Supply of loanable funds, S 12% 4 0 $150 450 Quantity of loanable funds (billions of dollars) Equilibrium Interest Rate Savings incur an opportunity cost when they lend to a business; the funds could instead be spent on consumption Whether a given individual becomes a lender by making funds available to borrowers depends on the interest rate received in return Equilibrium Interest Rate The equilibrium interest rate is the interest rate at which the quantity of loanable funds supplied equals the quantity of loanable funds demanded Interest rate 12% r* Projects with rate of return 8% or greater are funded. Offers not accepted from lenders who demand interest rate of more than 8%. 8 Projects with rate of return less than 8% are not funded. 4 Offers accepted from lenders willing to lend at interest rate of 8% or less. 0 $300 Q* Quantity of loanable funds (billions of dollars) Equilibrium Interest Rate 1. 2. Match up of funds is efficient The right investments get made: the investment spending projects that are actually financed have higher rates of return than those that do not get financed The right people do the saving: the potential savers who actually lend funds are willing to lend for lower interest rates than those who do not Shifts of the Demand for Loanable Funds Changes in perceived business opportunities 1. 2. Business opportunities in the 90s with the Internet Changes in government’s borrowing Changes in budget deficits can shift the demand curve An Increase in the Demand for Loanable Funds Interest rate . . . leads to a rise in the equilibrium interest rate. r2 r1 An increase in the demand for loanable funds . . . Quantity of loanable funds (billions of dollars) Shifts of the Demand for Loanable Funds Fact that an increase in the demand for loanable funds leads, other things equal, to a rise in the interest rate has one especially important implication: Beyond concern about repayment, there are other reasons to be wary of government budget deficits Crowding out occurs when a government deficit drives up the interest rate and leads to reduced investment spending Shifts of the Supply of Loanable Funds 1. Changes in private savings behavior: Between 2000 and 2006 rising home prices in the United States made many homeowners feel richer, making them willing to spend more and save less This shifted the supply of loanable funds to the left. 2. Changes in capital inflows: The U.S. has received large capital inflows in recent years, with much of the money coming from China and the Middle East. Those inflows helped fuel a big increase in residential investment spending from 2003 to 2006. As a result of the worldwide slump, those inflows began to trail off in 2008. Interest rate r1 . . . leads to a fall in the equilibrium interest rate. r2 An increase in the supply of loanable funds . . . Quantity of loanable funds (billions of dollars) Inflation & Interest Rates Anything that shifts either the supply of loanable funds curve or the demand for loanable funds curve changes the interest rate. Historically, major changes in interest rates have been driven by many factors, including: changes in government policy. technological innovations that created new investment opportunities. Inflation & Interest Rates However, arguably the most important factor affecting interest rates over time is changing expectations about future inflation. This shifts both the supply and the demand for loanable funds. This is the reason, for example, that interest rates today are much lower than they were in the late 1970s and early 1980s. Inflation & Interest Rates Real interest rate = nominal interest rate - inflation rate In the real world neither borrowers nor lenders know what the future inflation rate will be when they make a deal. Actual loan contracts, therefore, specify a nominal interest rate rather than a real interest rate. Inflation & Interest Rates According to the Fisher effect, an increase in expected future inflation drives up the nominal interest rate, leaving the expected real interest rate unchanged. The central point is that both lenders and borrowers base their decisions on the expected real interest rate The Fisher Effect Nominal interest rate S10 14% E10 D10 S0 4 E0 D0 0 Q* Quantity of loanable funds The Interest Rate in the Short Run As explained before, using the liquidity preference model, a fall in the interest rate leads to a rise in investment spending, I, which then leads to a rise in both real GDP and consumer spending, C The rise in real GDP doesn’t lead only a to a rise in consumer spending but it also leads to a rise in savings, at each stage of the multiplier process, part of the increase in disposable income is saved The Interest Rate in the Short Run How much do savings rise? Savings-investment spending identity states that total savings in the economy is always equal to investment spending When a fall in interest rate leads to higher investment spending, the resulting increase in real GDP generates exactly enough additional savings to match the rise in investment spending The Interest Rate in the Short Run In the short run, the supply and demand for money determine the interest rate, and the loanable funds market follows the lead of the money market When a change in the supply of money leads to a change in the interest rate, the resulting change is real GDP causes the supply of loanable funds to change as well Interest Rates in the Long Run In the long run, changes in the money supply don’t affect the interest rate Interest Rates in the Long Run What determines the interest rate in the long run is supply and demand for loanable funds In the long run, the equilibrium interest rate is the rate that matches the supply of loanable funds with the demand for loanable funds when real GDP equals potential output