Noah Duran's Slides: Bernanke – Macro of Great Depression

The Macroeconomics of the Great Depression:

A Comparative Approach

Ben S. Bernanke

Journal of Money, Credit, and Banking,

Vol. 27, No.1 (February 1995)

• Depression obviously worldwide in nature

• Easier to identify forces that caused it when looking at multiple countries (larger data set)

• Monetary shocks transmitted around the world mainly through workings of the gold standard

– Channels of Effect

• Deflation –induced financial crisis

• Increases in real wages above market-clearing levels

• Money supply, output, and prices fell quickly during contraction and rose rapidly during recovery

• Both monetary and non-monetary forces operative at various stages of the depression

• Monetary factors played a causal role in the worldwide decline of prices and output, and in their eventual recovery

• Monetary contraction not a response to declining output, but instead the result of poorly designed institutions, short-sighted policy making, and unfavorable political and economic preconditions.

This reflects money’s influence on the real economy

• Countries who left the gold standard were able to reinflate money supply and price level, those remaining on the gold standard experienced more deflation

• Gold standard resumed after WWI

• Universal in Market economies by 1929

• Benefits never materialized

• 1931- Financial panic & Exchange rate crises

– Most countries left gold that year

• Nations adhering to gold standard during the interwar period suffered sharp declines in inside money stocks

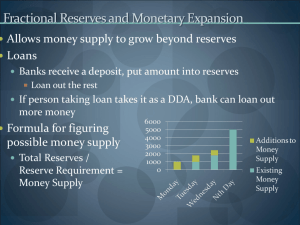

• M1 = (M1/BASE) * (BASE/RES) * (RES/GOLD) * PGOLD * QGOLD

• M1= MONEY SUPPLY

• BASE= MONETARY BASE

• RES= INTERNATIONAL RESERVES OF THE CB

• GOLD= GOLD RESERVES OF THE CENTRAL BANK, valued in domestic currency

• PGOLD= the official domestic-currency price of gold

• QGOLD=the physical quantity of gold reserves

• Under the gold standard, a country’s money supply is affected both by its physical quantity of gold reserves and the price at which its central bank stands ready to buy and sell gold. This said, an inflow of gold, or a devaluation raises money supply

• Money supplies of gold standard countries often large multiples of the value of gold reserves

• Sharp declines in inside money supply attributed to contractions in average money gold-ratio

• BASE/RES fell 6% from 1928-1930, 10% increase in US Gold reserves

• Decline in money-gold ratio not a result of conscious policy, rather a response to banking panics.

Banking panics…

• Led to sharp declines in Money multiplier

• Caused banks to substitute gold for foreign exchange reserves= lower RES/GOLD ratio

• CB’s attempt to increase gold reserves to protect currency results in gold scramble

– lower BASE/RES ratio

Lack of confidence in the domestic banking system led to a flight of short term capital, draining international reserves

Benefits of leaving the gold standard

• Decision to leave or stay reliant on internal and external political, economic, and philosophical beliefs (pride?)

• Experienced gold inflows starting in 1933

• Removal of external constraint on monetary reflation- allowed for a quicker, stronger recovery

• In countries leaving the gold standard, wholesale prices stabilized in 1932-1933, and began to rise by 1934. Countries remaining on the GS experienced deflation through 1935

Long lasting effects of monetary shocks

• Debt Deflation

• Induces financial distress in borrower firms and households (loss of net worth)

• Can also effect banks-Actual and potential loan losses- As borrowers distress increases, banks’ nominal claims replaced by claims on real assets

(withdrawals deprive banks of funds for lending)

• Forced to increase the liquidity and safety of assets reduces lending activity

Other possibilities

• Nominal wages slow to adjust in the face of monetary shocks (Countries off the gold standard fared better, lower wages and higher production)

• If nominal wages adjust imperfectly, falling price levels raise real wages employers respond by cutting workforce

• Countries with sticky wages experienced sharpest declines in manufacturing output

Conclusions

• Comparative approach most effective

• Monetary contraction was an important cause of the depression

• Monetary reflation important component of recovery

• More evidence needed to support incomplete adjustment of nominal wages as a factor leading to monetary nonneutrality