Unit 3 Study Guide

advertisement

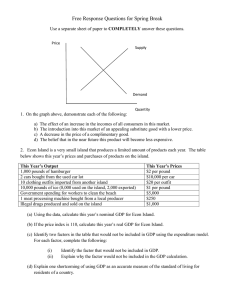

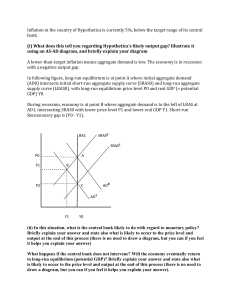

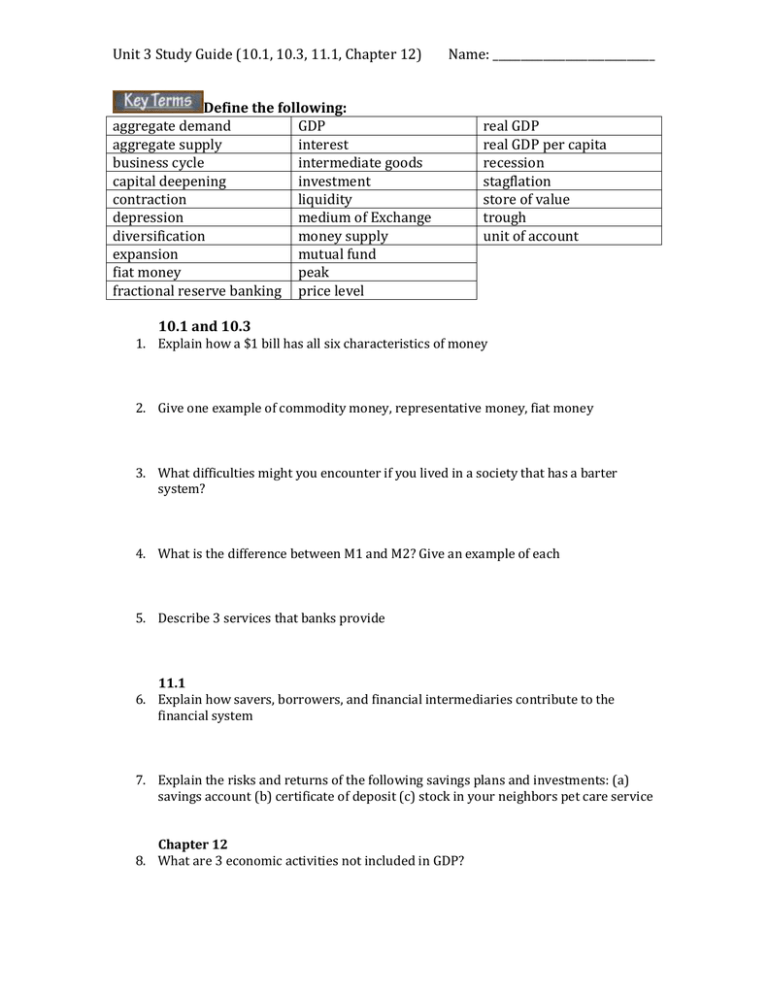

Unit 3 Study Guide (10.1, 10.3, 11.1, Chapter 12) Name: _____________________________ Define the following: aggregate demand GDP aggregate supply interest business cycle intermediate goods capital deepening investment contraction liquidity depression medium of Exchange diversification money supply expansion mutual fund fiat money peak fractional reserve banking price level real GDP real GDP per capita recession stagflation store of value trough unit of account 10.1 and 10.3 1. Explain how a $1 bill has all six characteristics of money 2. Give one example of commodity money, representative money, fiat money 3. What difficulties might you encounter if you lived in a society that has a barter system? 4. What is the difference between M1 and M2? Give an example of each 5. Describe 3 services that banks provide 11.1 6. Explain how savers, borrowers, and financial intermediaries contribute to the financial system 7. Explain the risks and returns of the following savings plans and investments: (a) savings account (b) certificate of deposit (c) stock in your neighbors pet care service Chapter 12 8. What are 3 economic activities not included in GDP? Unit 3 Study Guide (10.1, 10.3, 11.1, Chapter 12) Name: _____________________________ 9. If aggregate demand rises, what happens to real GDP? What happens to price level? 10. Which phase of a business cycle can lead an economy into recession? 11. Which point in a business cycle would you rather be, the peak or trough and why? 12. Why do economists measure real GDP per capita? Why is this a better way to compare economies of two different nations than real GDP alone? 13. How does capital deepening lead to economic growth? 14. What role does saving play in the process of economic growth? 15. How do patents encourage technological progress?