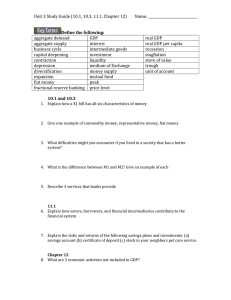

2.1 Economic Growth YEAR 12 MACROECONOMICS 2021 -22 Introduction Economic growth is the rate of change in real GDP of an economy over time. Recall that nominal GDP is the total value of final goods and services produced within an economy in a given time period, measured at current prices. Real GDP is the total value of final goods and services, measured at constant (base year) prices. Thus, real GDP removes the effects of inflation and allows for comparison over time. When making comparisons across countries, we often use real GDP per capita. We also distinguish between short run and long run economic growth. Real GDP in the UK (Source: ONS) Short run economic growth Short-run economic growth is an increase in the real GDP of an economy over a given period of time, utilizing current resources and technology. Short-run growth is actual economic growth: it reflects an increase in actual real output (as opposed to ‘potential output’). Capital goods B KB KA On the production possibility curve (PPC) diagram, actual economic growth is shown by a movement from an output combination at point A to point B, where more of both capital and consumption goods are being produced. A PPC CA CB Consumer goods Causes of short run economic growth Recall from the AD-SRAS model that short run equilibrium real GDP can increase due to an increase in either aggregate demand or short run aggregate supply. Can you recall the definitions of aggregate demand and aggregate supply? Make sure you can list all the factors that cause AD and SRAS to increase and explain why (see earlier notes). Aggregate demand and short run economic growth Recall that AD = C + I + G + (X – M). Therefore, any increase in a component of aggregate demand – consumption, investment, government spending or net exports – will result in an increase in aggregate demand (shown by a rightward shift of the AD curve). Reminder of some of the factors that can cause AD to increase (not an exhaustive list): • • • • • Increase in income or wealth Increase in consumer confidence or business confidence A lowering of interest rate Higher government spending or lower taxes An increase in net exports (due to changes in the exchange rate or relative inflation) Short run economic growth caused by an increase in aggregate demand Price Price Level Level SRAS SRAS1 An increase in aggregate demand (shown by a shift from AD1 to AD2) leads to an extension of SRAS. Actual real GDP increases from Y1 to Y2. PL2 PL2 PL1 AD2 AD1 AD 1 Y1 Y2 Real GDP Aggregate supply and short run economic growth Recall that anything that lowers firms’ costs of production will lead to an increase in short run aggregate supply. Some factors that cause an increase in SRAS (not an exhaustive list): • Fall in the price of raw materials • Fall in the price of imported components • Reduction in real wage rates • Lower costs of finance for firms and lower corporation tax Short run economic growth caused by an increase in aggregate supply Price Price Level Level SRAS1 SRAS1 SRAS2 PL1 PL PL22 AD1 AD Y1 Y2 Real GDP An increase in short run aggregate supply (shown by a shift from SRAS1 to SRAS2) leads to an extension of AD. Actual real GDP increases from Y1 to Y2. Anderton p205-6: Economic growth in the UK Read the extract on p205-6. How it Happened - The 2008 Financial Crisis: Crash Course Economics #12 – YouTube The financial crisis - 10 years on (adobe.com) a) Using Figure 10, what can you say about economic growth in the UK during 2000 to 2014? Remember ‘ends, trends and bends’. b) Based on the extract, how did the various components of aggregate demand contribute to the recession following the 2007-8 financial crisis? Suggested answers: 1. Economic growth was just above 4% in 2000, while by 2014, it had fallen to roughly 2.5%. Economic growth was fairly volatile during this period, and the overall trend was negative. The economy experienced a negative growth rate from approximately 2008 Q2 to the end of 2009. 2. Consumption was low because households were already indebted and did not want to spend more through borrowing. There was also an increase in income taxes in 2010, a freeze on public sector pay between 2010-14 and global commodity prices were rising. These led to further decrease in consumption spending. Investment in new capital goods by firms fell because of a lack of domestic demand and foreign demand for UK exports. Government spending went down and taxes went up, in an effort to cut the budget deficit (new ToryLib Dem coalition government in 2010). Net exports fell because UK’s trading partners, especially the EU, were also in a recession. Thus, there was a fall in all components of AD (C, I, G and NX), leading to a fall in short run economic growth. Anderton p207: Data Response Question – use specific figures wherever possible 1. A recession is typically defined as real GDP falling for two consecutive quarters. From the data, we can see that Portugal and the Eurozone as a whole experienced a negative rate of growth of (nominal) GDP from roughly the middle of 2008 to the middle of 2010. Portugal slipped back into negative growth from 2011 to 2013, while the Eurozone experienced a milder recession between 2012 and 2013. 2. Investment is the addition to the capital stock of an economy. The capital stock is one of the factors that determines the potential output of an economy (long run economic growth). The data shows actual output or short run economic growth. Nevertheless, we can see a positive link between the growth in investment (Fig 15) and growth in output (Fig 12). For example, for Poland, a steady growth in investment during 2005 to 2007 was accompanied by an increase in short run economic growth. During 2012, Portugal had the largest decline in investment and also the lowest growth rate of real GDP. Anderton p207 3. ‘Economic performance’ can be measured by looking at economic growth / unemployment/ inflation and the current account on the balance of payments. Growth: Poland seems to have fared better than Portugal/Eurozone. Even when Portugal and EU were in a recession, Poland was experiencing a positive (though falling) rate of growth of output. Unemployment: Between 2001 and 2007, the unemployment rate in Poland was much higher than that in Portugal and EU. However, 2008 onwards, the situation was reversed. Inflation: Poland had higher inflation than Portugal/EU for substantial parts of the period 2001 to 2016. There is no data on the net exports or the current account. We also do not have any information on consumption. Therefore, it is not possible to say conclusively whether Poland’s economic performance was better or worse than Portugal/EU. However, it is possible to say that Poland experienced stronger economic growth during this time (perhaps at the cost of higher inflation). Long run economic growth Long run economic growth is an increase in an economy’s potential level of real output over time (an increase in the productive capacity of an economy). Note that we are looking at potential real GDP, as opposed to actual. Capital goods PPC2 PPC1 The economy has increased its productive capacity, as shown by the production possibility curve shifting outwards from PPC1 to PPC2. Consumer goods Causes of long run economic growth An increase in the long run aggregate supply of an economy will lead to an increase in potential real GDP. Recall that anything which increases the quantity and quality of factors of production will increase long run aggregate supply; this is shown by the LRAS curve shifting to the right – see section 1.3. Also recall that the LRAS curve can be drawn as neoclassical or New Keynesian. Neoclassical LRAS Price level LRAS1 Yf1 New Keynesian LRAS LRAS2 Yf2 Price level Real GDP LRAS1 Yf1 LRAS2 Yf2 Real GDP In both cases, an increase in LRAS means that there is an increase in potential real GDP or full employment output, from Yf1 to Yf2 LRAS and long run economic growth Some factors that can cause an increase in LRAS (not an exhaustive list) are: • An increase in the quantity and/or quality of capital • An increase in the size of the labour force • An increase in labour productivity • Increased (geographic/occupational) mobility of the workforce • An increase in land (new natural resources) • Technological progress • More favourable attitudes to enterprise (increase in the number of risk-taking entrepreneurs) • Better institutional structure (improved financial services sector, business-friendly government policies, improved infrastructure) A closer look at some key terms 1. Productivity This refers to the output per unit of factor input in a given period of time. For example, an increase in labour productivity means that output per worker per year has increased. An improvement in the quality of capital will often lead to an increase in labour productivity as workers have better capital with which to work. 2. Infrastructure This is the large-scale physical capital that is necessary for economic activity to take place. Examples: roads, railways, energy supply networks, ports and airports and telecommunications. The majority of large-scale capital for infrastructure is provided / funded by the government. 3. Institutions This refers to the established system of rules which facilitate socio-economic interactions. A highly effective institutional structure is characterised by • • • • • a stable and democratic political system a well-functioning legal system and judiciary, including the protection of property rights effective and efficient financial system free press a developed welfare system (including universal access to education and health care) that protects the most vulnerable in society With effective institutions, private owners of capital are more likely to undertake investment, while entrepreneurs are more likely to take risks and re-invest profits. This will lead to an increase in the productive capacity of the economy over time. Anderton p212: Comparing UK living standards over time 1. First we need to calculate Real GDP in 2013 measured in 1971 prices. Recall that Real GDP = (Nominal GDP/ GDP deflator) x 100 Real GDP in 2013 = (1713.3/1136.3) x 100 = £150.78 billion Real GDP per capita in 2013 = £(150,780m/64.2m) = £2348.60 (at 1971 prices) Real GDP per capita in 1971 was £(60,900m/55.5m) = £1097.30 Therefore, real GDP per capita in 2013 was (2348.6/1097.3=) 2.14 times higher than in 1971. Anderton p212 2. a) Better off: higher GDP per capita, higher percentage of households owning domestic appliances, higher life expectancy, greater home ownership, greater number of people going to university, more women working, fewer people smoking. In each case, explain why this means people are ‘better off’ and remember to quote specific figures from the data in your answer b) Worse off: increase in percentage of obese people, much greater volume of traffic (longer journey times), mortgage payments are a larger fraction of income for first time buyers (harder to get on property ladder). Again, refer to specific figures. 3. From question 2a, we can see that the increase in per capita real GDP between 1971 and 2013 was accompanied by a rise in many other indicators of living standards. However, we have also seen in 2b that people were worse off when it came to other indicators. Furthermore, the data does not tell us anything about the distribution of income; therefore, we cannot say whether ‘everyone’ in the UK was better off. It is likely that the doubling of real GDP per capita raised living standards on average, but we do not know how indicators like long-term unemployment, health problems and home (and wealth) ownership changed for different parts of the population during these decades. Consequences of economic growth Introduction Recall that one of the policy objectives of the government is positive and stable economic growth. In the short run, this means minimising the effect of fluctuations in economic activity and it usually involves demand management (stabilising) policies. In the long run, the goal is to achieve sustained and sustainable economic growth, which requires supply-side policies. Benefits of economic growth 1. Higher employment: Economic growth will lead to an increase in employment as firms demand more labour to produce more goods and services. Incomes of households will increase, while costs associated with unemployment are likely to fall. 2. Higher living standards: Economic growth leads to increased employment and higher incomes for households. This means that they can afford to increase consumption of goods and services. If there is an increase in per capita real GDP, then we can say that economic growth leads to higher standards of living. 3. Increasing tax revenue: Economic growth has a positive effect on government finances; there will be higher (income and corporation) tax revenues while benefit payments are likely to fall. If this additional sum is spent on services like health and education or on infrastructure projects, then this could further increase potential output. Benefits of economic growth 4. Multiplier and accelerator effects: Economic growth encourages investment in capital by firms (accelerator) and the increased investment can lead to further multiplier effects on national income. If increased investment increases the quantity and/or quality of capital, this will increase long run aggregate supply and further enhance growth. 5. Increased business confidence: Economic growth normally has a positive impact on company profits and business confidence. It has a positive impact on the stock market (assets values increase, thus increasing wealth) and could encourage entrepreneurship and growth of businesses. 6. Greater opportunity for the government to redistribute income: Since government finances are likely to improve with economic growth, the government can focus on transfer payments and policies to reduce poverty and inequality. Costs of economic growth 1. Growth might become unsustainable, meaning that current growth in the productive capacity of the economy leads to a fall in the potential output of the economy for future generations. For example, there is the danger of exhausting non-renewable resources such as oil or minerals, over-grazing, over-fishing and greater pollution. To avoid this, we need to look for alternative renewable resources and have stricter regulations on pollution. 2. Rising income and wealth inequality: The benefits of economic growth tend to accrue to those at the top of the income distribution and this may carry on into future generations (through inheritance and better opportunities). Despite high growth rates of GDP, some people in developing countries live in absolute poverty, whereas some in developed economies live in the relative poverty (more on this later). 3. Growth and happiness: Research shows that happiness and income are positively related at low levels of income, but once basic needs are met, increasing the quantity of goods consumed does not make any difference to happiness and well-being (Easterlin paradox). Some interesting video links Global Wealth Inequality - What you never knew you never knew (See description for 2017 updates) – YouTube World Inequality Report 2018 - YouTube How climate change is making inequality worse, especially for children - BBC News Benefits and Costs of Economic Growth (2019 Update) | tutor2u