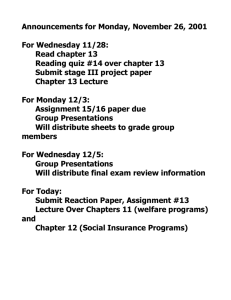

FICA HI Health insurance

advertisement

Employee Benefits, Insurance Payroll Deductions And Taxes Warning: This Is One Very Scary Lecture ! By Paul A. Thomas The University of Georgia Vacation Pay Most companies grant paid vacations to their employees. Employees earn the benefit by working. Vacation pay must be accrued over the period in which it is being earned. Sick Leave Accruals Maximum accrual 200 days Good news: if you retire from state service, accrued sick leave helps pay for your health insurance throughout retirement! Based on Actual Time Put In Attendance rules coverage: - at least 1/2 time and/or have annual salary - if hourly, at least 1/2 time for 19 pay periods Earn sick leave, holidays, vacation 5 personal days (use within the year) Retirement Plans Can put away money toward retirement on a tax-deferred basis Investment options Can start or discontinue at any time. The real question is, how much are you willing to contribute to the plan as a business? Matching? 100% Support? • Traditional IRA or Roth IRA…what’s best for you • Simple IRA • 401(k) • Annuities • Wealth Accumulation Vesting Requirements 10 years of full-time service credit Can request refund of contributions after you leave (if under 10 years) Years of Service 2 4 6 8 10 Non-forfeitable % 20% 40% 60% 80% 100% Death Benefits Remember, the extent of the death benefits often affects the overall cost of the plan. Choose beneficiaries Maximum: 3 times salary Minimum: 1/2 salary or $10,000 (whichever is less) Survivor’s Benefit Program HMO’s Use primary care physician Referrals for other providers No claim forms to submit No deductibles Small co-pays Long term care insurance offers the following benefits: • Financial protection if a disabling injury would require ……..nursing home care • A monthly income • Protection for a lifetime of retirement savings • Group plans available with no initial underwriting Example: 2003 Bi-weekly Cost Individual Family Empire Plan $15.57 $64.68 CDPHP $12.52 $68.08 HMO-Blue $41.39 $169.84 MVP $22.79 $110.27 Dental Participating dentist: full coverage Non-participating dentist: partial reimbursement on a fee schedule Vision Participating provider: free exam free pair plan-covered glasses or contact lenses with $25 copay Non-participating provider: $10 toward exam $35 toward glasses or contact lenses Flexible Spending Accounts Health Care Spending Account: a way to use your pre-tax dollars on un-reimbursed medical, dental and vision costs Dependent Care Advantage Account: a way to use your pre-tax dollars to pay for child and elder care while you are at work Savings Bonds Payroll deduct any amount toward purchase When purchase price is reached, bond is issued National Bond and Trust Co. 1-800-426-9314 • May be included in the health insurance package • Group plan with all employees covered for the same amount; the life insurance ends at termination or retirement • Employees offered the opportunity to “buy up” to a larger amount • Permanent insurance is made available through payroll deduct • Key person insurance • Executive compensation using life insurance • AFLAC supplemental insurance provides for a deficiency in health insurance coverage. • AFLAC supplemental insurance covers things not included in traditional health policies including deductibles, travel expenses, out-of-network charges, and loss of earning power Forecast for 2004 Double digit increases in cost of employer sponsored health plans Fact that health plan increases are 8 times current inflation rate Increases vary little by plan type National average for typical family premium was $9,068 in 2003 compared to $7,954 in 2002 Estimated than 20% of uninsureds are eligible for employer sponsored health plan Health Insurance / Prescription Drugs Most sought after benefit! Legislation is Changing! Prescriptions may be included in health insurance plan Individual / family coverage No single factor…all issues add to increases Malpractice insurance rates Rising hospital and physician costs Newer and more expensive technology Longer life expectancy Prescription drugs Loss of investment income Mandated benefits and government regulations • Group or individual • Safety net if employee is unable to work for an extended period of time • Can be offered on a voluntary basis • Relatively inexpensive group plan if paid for by the employer • Important as part of a Buy/Sell Agreement Other Insurance Considerations Medical Assistance Police Department & Security Fire Department Neighborhood Conditions - Is it changing? Basic Stock Bonus Plans This is a defined contribution plan that provides for employee benefits in the form of employer stock unless the employee elects to receive cash. “Employer contributions need not be dependent on employer’s profits as is the case with 401(k) plans. If stock is distributed, the tax on its appreciation is deferred until its taxable sale. As with profit sharing plans, there must be a definite predetermined formula for allocating contributions among participants, but no formula for determining the amount of overall contributions is required.” Reg. 401-1(b)(1)(iii). Basic Stock Bonus Plans Advantages of Stock Bonus Plans: No cash flow drain on corporation since it usually contributes its own stock rather than cash. The stock is either: unissued stock or treasury stock (stock purchased by the corporation on the open market). The corporation may deduct the market value of the stock, with no gain or loss recognized by the employer on the excess market value over cost. If employees receive stock, the tax on its appreciation is deferred until its taxable sale. If employees receive cash, then they are taxed upon distribution. Employee Stock Ownership Plans (ESOPs) This is a stock bonus trust that is tax exempt under Code Sec. 401(a). Technically, it is a defined contribution plan that is either: A qualified stock bonus plan; or, A stock bonus and money purchase plan. An ESOP must invest primarily in employer securities. Roth IRAS— Comparison with Traditional IRAs The major differences between a traditional IRA and a Roth IRA include: Earnings from a Roth IRA may be exempt from income tax; earnings from a traditional IRA are taxed when withdrawn. Contributions to a Roth IRA are never tax deductible; contributions to a traditional IRA may be tax deductible. The owner of a Roth IRA has penalty-free access to contributions (but not to accumulated earnings), at anytime. Individuals with earned income cannot contribute to traditional IRAs beginning in the year they reach age 70½. Age is not a restriction for Roth IRA contributions. The minimum distribution and incidental death benefit rules that apply to traditional IRAs do not apply to Roth IRAs prior to the owner’s death. Payroll Deductions When you pay someone $8.00 an hour, this is just the beginning of what you actually have to pay out for that employee. Employer Payroll Taxes Social Security (FICA) tax State unemployment compensation tax Federal unemployment compensation tax I want your money Salary Expense Salary Expense to the employer is the gross salary of all employees. Employees pay their own income and FICA taxes as well as union dues. The employer serves as a collecting agent and sends these amounts to the government and union. Workmen’s Compensation The State and Federal governments require that business owners put aside a percentage of each employees income to cover the benefits granted by the government if you are injured on the job. Usually this is about 5% of the employees salary for the first $10,000. Example: If your employee earns $10,000, you must pay $500 If your employee earned $34,56, you must pay $172 Unemployment Compensation Employers pay 5.4% to the states and 0.8% to the federal government on the first $7,000 of each employee’s annual earnings. The state government uses the money to pay unemployment benefits to people who are out of work. FICA OASDI FICA Old Age Survivors and Disability Insurance. FICA OASDI is calculated as your gross earnings times 6.2%. Incomes over $87,000 that have already had the maximum FICA OASDI amount of $5394 withheld will not have additional FICA OASDI withholdings. FICA Medicare FICA Medicare is calculated as the gross earnings times 1.45%. Unlike FICA OASDI, there is no annual limit to FICA Medicare deductions. FICA HI Health insurance (FICA-HI) (1.45% applied to all employee earnings) Federal Tax Withholding Calculations Calculate your Federal income tax withholdings by following these four steps: 1. Take taxable gross wages times pay periods per year to compute your annual wage. 2. Subtract the value of exemptions allowed ($3,000.00 times withholding allowances claimed) 3. Determine annual tax with tables (single and married respectively) 4. The amount of tax is then divided by the number of pay periods per year to arrive at the amount of federal withholding tax to be deducted per pay period. Calculating Tax Rates – Joint Tax Filing 1997 Example: $00000 - $41,201 $41,201 - $99,600 $99,601- $151750 $151,751-$270,050 $271,051- and up Example: Family Income of $110,000 $41,200 x 0.15% = $ 6,180.00 $ 99,600 - $41,200 x 0.28% = $16,352.00 $110,000- $99,600 x 0.31%= $ 3,224.00 --------------$25,756.00 15% 28% 31% 36% 39.6% Types Of Taxes A tax can be progressive, proportional, or regressive. Progressive tax A tax whose average rate increases as income increases. Proportional tax A tax whose average rate is constant at all income levels. Regressive tax A tax whose average rate decreases as income increases. SALES TAXES AND EXCISE TAXES How Taxes Work: The division of the burden of a tax between the buyer and the seller. If the price rises by the full amount of the tax, then the burden of the tax falls entirely on the buyer. If the price rises by a lesser amount than the tax, then the burden of the tax falls partly on the buyer and partly on the seller. If the price doesn’t change, then the burden of the tax falls entirely on the seller. SALES TAXES AND EXCISE TAXES Figure 8.1 shows the effects of a tax on CD players. With no tax, the price of a CD player is $100 and 5,000 CD players a week are bought. A $10 tax on CD players shifts the supply curve to S + tax. SALES TAXES AND EXCISE TAXES 3. The price rises to $105—an increase of $5 a CD player. 4. The quantity decreases to 2,000 CD players a week. 5. Sellers receive $95—a decrease of $5 a CD player. SALES TAXES AND EXCISE TAXES The government collects tax revenue of $20,000 a week the purple rectangle. The burden of the tax is split equally between the buyer and the seller— each pays $5 per CD player. Trimming salary increases Reducing number of employees Hiring more part-time or seasonal employees without benefits Shifting medical costs to employees Changing to higher deductibles Increasing co-pays Cutting benefits for future retirees Payroll Accounting System Record Hours Worked or Units Produced Compute Gross Pay, Deductions, and Net Pay Complete Payroll Register Maintain Payroll Ded Records Update Emp Earnings Records Prepare Paychecks Record Payroll in Accounting Books Prepare Various Payroll Reports Interest Payments Simple Interest – A one time fee paid at the end of a lending contract Discount Interest – A one time fee paid at the beginning of a lending contract Compound Interest – a fee calculated as a series of payments made at regular intervals during a contract Investment: The Law Of Seventy Any investment that earns interest will double in size over a given interval. The doubling time of any investment can be found by dividing the percent annual interest rate into 70. Doubling Time = 70 ---------------------------Percent Interest Rate Example: An investment earning 7% will double in 70 / 7 = 10 Years, ….. And at 14%, 70/14 = 5 Years! Amortization Schedule The schedule needed to Kill off the loan. Equity = Current Market Value – Unpaid Mortgage Value Points = An up-front, pre-paid interest payment to the bank, in return for a lower interest rate over the life of the loan. 1 Point = ¼ % reduction most years. Property Taxes Tax is assessed at a stated millage per $1000 of Fair Market Value of the property. Assessment varies by community Homestead Exemption Rates may apply. Only 40% Of the Fair Market Vale is assessed for Taxes School Exemptions (10,000) County Exemptions (10,000) Local Example Athens Property Taxes State Tax Athens Clarke Co M&O School M&O Millage Rate 0.25% 20.8% 19.25% Taxes May Be Paid Through A Mortgage Escrow Acct. Fixed Rate Vs Variable Rate Mortgages Fixed Rate has a permanent Rate for life of loan Variable Rate floats based upon the Prime Rate Be sure to ask for a Life Of The Loan Cap! Depreciation Current Assets are taxed! Because assets such as durable goods wear out They depreciate in value with use. Most depreciation occurs in the first few years ( New Cars!) You can report This to the IRS and save money! Depreciation Methods Straight Line Depreciation: Yearly depreciation = Initial Cost - Salvage Value --------------------------------Estimated Life of Unit Sum of Years Digits Method – Complicated ! Double Declining Balance Method – Even Worse !!! Units of Production Method – Based upon miles driven or units produced by a machine. A $300,000 welding machine has a salvage value of $60,000 1st year use: 100,000 welds / 400,000 lifetime welds = 25% A $240,000.00 machine would be depreciated 25% = $60,000 Exit Strategy A means of identifying where you are today… What are your objectives for growth while actively working\ in the business… And a written plan for the sale or succession of your business Conservatively, 2 out of every 3 family businesses will not survive to the second generation! Many of these failures are due to poor or no business succession planning. 1. My business will have significant value, whether or not I am involved. Yes or No 2. I am prepared to consider transferring ownership of my business Yes or No 3. I am prepared to consider transferring control of my business lifetime. Yes or No 4. I need the cash flows from the business to support my future life-style. Yes or No 5. My spouse’s financial security is not tied to the future success of the business. Yes or No 6. There is a logical successor to me in the management of the business. Yes or No 7. I believe that ownership interests should be limited to active officers. Yes or No 8. My estate is sufficiently diversified so that inactive children may be fairly treated, compared with those receiving business interests. Yes or No 9. It is very important to me that the transition of my business be orderly. Yes or No 10. My key employees are comfortable with my plans for business continuation and will therefore plan to stay with my firm - rather than seeking more secure employment. Yes or No 11. Death taxes (equal to 50% of my estate) will not interfere with my plans for business continuation and family equity. Yes or No Succession Planning for the owner of the family business creates family dilemmas and difficult financial decisions. In the real world, complexities require compromise and often defy EASY solutions: • What if Dad’s pension plan is inadequate or not completely funded? • What if Dad looks at the Florida condo as his coffin? • What if the child is skilled, but a nerd? Charming, but a dope? • active/inactive • What if there are two children? • get along/don’t speak • smart/smart • smart/dumb Running A Greenhouse Business Is Really Complicated!