FinalExamStudyGuideJan2015

advertisement

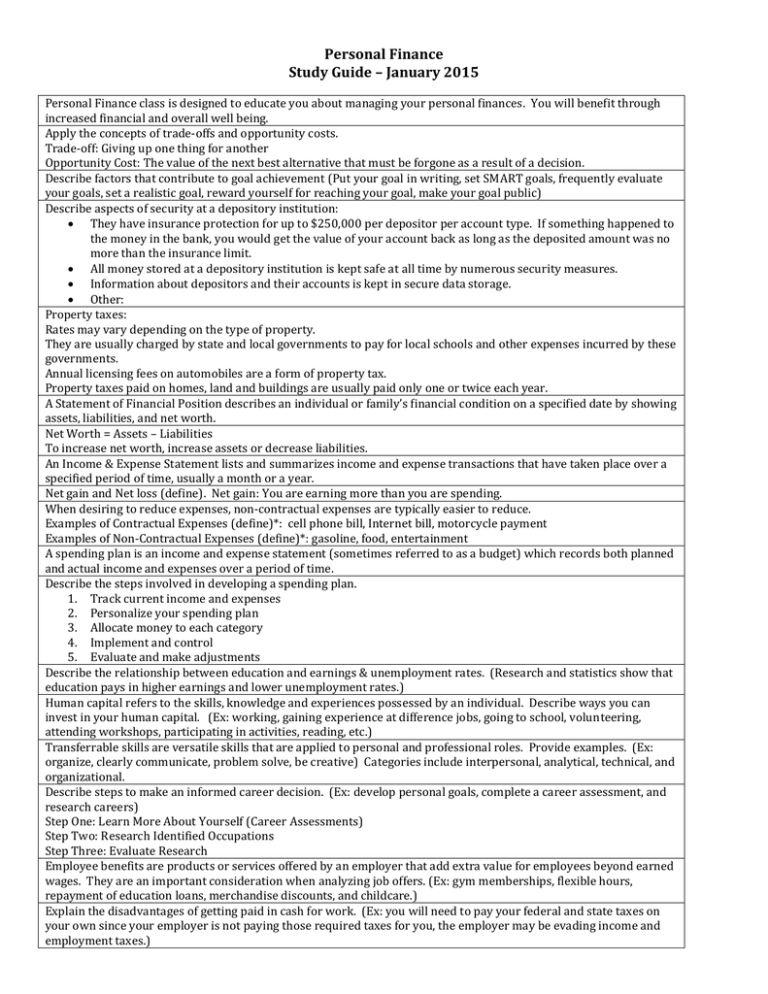

Personal Finance Study Guide – January 2015 Personal Finance class is designed to educate you about managing your personal finances. You will benefit through increased financial and overall well being. Apply the concepts of trade-offs and opportunity costs. Trade-off: Giving up one thing for another Opportunity Cost: The value of the next best alternative that must be forgone as a result of a decision. Describe factors that contribute to goal achievement (Put your goal in writing, set SMART goals, frequently evaluate your goals, set a realistic goal, reward yourself for reaching your goal, make your goal public) Describe aspects of security at a depository institution: They have insurance protection for up to $250,000 per depositor per account type. If something happened to the money in the bank, you would get the value of your account back as long as the deposited amount was no more than the insurance limit. All money stored at a depository institution is kept safe at all time by numerous security measures. Information about depositors and their accounts is kept in secure data storage. Other: Property taxes: Rates may vary depending on the type of property. They are usually charged by state and local governments to pay for local schools and other expenses incurred by these governments. Annual licensing fees on automobiles are a form of property tax. Property taxes paid on homes, land and buildings are usually paid only one or twice each year. A Statement of Financial Position describes an individual or family’s financial condition on a specified date by showing assets, liabilities, and net worth. Net Worth = Assets – Liabilities To increase net worth, increase assets or decrease liabilities. An Income & Expense Statement lists and summarizes income and expense transactions that have taken place over a specified period of time, usually a month or a year. Net gain and Net loss (define). Net gain: You are earning more than you are spending. When desiring to reduce expenses, non-contractual expenses are typically easier to reduce. Examples of Contractual Expenses (define)*: cell phone bill, Internet bill, motorcycle payment Examples of Non-Contractual Expenses (define)*: gasoline, food, entertainment A spending plan is an income and expense statement (sometimes referred to as a budget) which records both planned and actual income and expenses over a period of time. Describe the steps involved in developing a spending plan. 1. Track current income and expenses 2. Personalize your spending plan 3. Allocate money to each category 4. Implement and control 5. Evaluate and make adjustments Describe the relationship between education and earnings & unemployment rates. (Research and statistics show that education pays in higher earnings and lower unemployment rates.) Human capital refers to the skills, knowledge and experiences possessed by an individual. Describe ways you can invest in your human capital. (Ex: working, gaining experience at difference jobs, going to school, volunteering, attending workshops, participating in activities, reading, etc.) Transferrable skills are versatile skills that are applied to personal and professional roles. Provide examples. (Ex: organize, clearly communicate, problem solve, be creative) Categories include interpersonal, analytical, technical, and organizational. Describe steps to make an informed career decision. (Ex: develop personal goals, complete a career assessment, and research careers) Step One: Learn More About Yourself (Career Assessments) Step Two: Research Identified Occupations Step Three: Evaluate Research Employee benefits are products or services offered by an employer that add extra value for employees beyond earned wages. They are an important consideration when analyzing job offers. (Ex: gym memberships, flexible hours, repayment of education loans, merchandise discounts, and childcare.) Explain the disadvantages of getting paid in cash for work. (Ex: you will need to pay your federal and state taxes on your own since your employer is not paying those required taxes for you, the employer may be evading income and employment taxes.) Understand various deductions that come out of a paycheck. List required deductions (Ex: federal income tax, state income tax, Social Security, and Medicare) Medicare is provided by the Federal Government and its main purpose is to help pay for health care for those over 65. Savings provides the foundation for financial security. Investing is used to pay for long-term goals, such as retirement. The philosophy of “pay yourself first” dictates than an individual should set aside a predetermined amount of money for saving before using any money for spending. Describe how an individual can use the concept of “trade-offs” to achieve financial goals. (Ex: giving up eating out to set aside money for an emergency fund.) Describe the concept of “time value of money” and strategies that will likely result in the largest return on investment. (Ex: Invest as long as possible and at the highest interest rate possible.) Identify various savings tools suitable to meet specific needs. (Ex: Checking accounts are appropriate for managing everyday purchases because they are very liquid and accessible.) For investment purposes, diversified portfolios are beneficial because they decrease risk by investing money in a variety of investment tools. The most common relationship between risk and return can be stated as: “higher risk indicates higher return”, but also higher risk of loss. Managing money poorly can result in a low credit score. Describe consequences of a low credit score. (Ex: You may be denied the privilege of borrowing money, interest rates on loans will be higher since you carry a higher credit risk for the lender) Describe strategies to build a positive credit history. (Ex: obtain a secured credit card, make payments on time, maintain available credit on revolving loans, do not apply for excessive credit) Describe the process of borrowing money. (Understand that you are spending future income) Explain the difference between open-end and closed-end credit. (Ex: Closed-end credit requires equal payments on a regular basis until the loan is repaid. Open-end credit (also known as revolving credit) is extended, as a line of credit established in advance, so you do not have to apply for credit each time credit is desired. Compare the total amount repaid on credit card loans based on making the minimum monthly payment, making payments larger than required, or paying the balance off in full each month. (Paying the minimum will make the final amount paid substantially higher than the amount initially charged to the card.) Describe actions that can make you vulnerable to identity theft (using a computer without updated spyware, responding to an email from a depository institution, throwing mail in the garbage) and suggest strategies to protect yourself from identity theft. Describe the benefits of having insurance. (Ex: Insurance combined with emergency savings provides a sense of financial security and peace of mind.) Define and apply insurance concepts such as premium, deductible, and co-insurance.* Describe the steps involved in the “Planned Buying Process.” (Ex: First step is to evaluate the opportunity costs and trade-offs of making the purchase) Describe the difference between renter’s insurance and homeowner’s insurance and identify when each would be needed. Identify the risks of being “upside down” in a loan. (Owing more on the loan than the asset is worth) Define “goals” and differentiate between short-term and long-term goals (Ex: Short-term goals are less than a year, long-term more than a year) Describe and identify each of the give elements of a SMART financial goal: Specific – State exactly what is to be done with the money involved. Measurable – State the exact dollar amount Attainable – Create a step-by-step plan outlining exactly how the goal can be reached Realistic – Think through the trade-offs and opportunity costs to analyze the consequences of your goal to make sure it isn’t unattainable Time Bound – Specifically state when the goal will be reached Define “Cost of Living Index” and apply the formula in the decision making process. (Ex: Salary ÷ Cost of Living Index = Real Wage) (Remember to move the decimal to the left when calculating) Identify and describe various methods of getting paid. (Ex: paper paycheck, payroll card, direct deposit) Describe the difference between gross pay and net pay and calculate each. Gross income – amount of money earned before payroll taxes. Net income – amount of money left once all deductions have been taken from gross income.) Calculate net worth (assets – liabilities) Understand the relationship between income, net worth, and wealth. Identify the features of various savings and investment tools (Ex: CD-funds deposited are held for a certain length of time.) Identify the features of various savings and investment tools (Ex: Money Market – tiered investment rates) Identify the features of various savings and investment tools (Ex: Mutual Funds – diversified investments) Calculate the rate of return on an investment. (Ex: Interest earned on a fixed amount in one year ÷ original investment or “principal”.) Describe the process and impact of compounding interest. The Rule of 72 is a technique for estimating the number of years required to double your money at a given rate of return. A guideline for the amount of money that should be maintained in an emergency fund is six months worth of expenses. Apply the Rule of 72 (72 ÷ the length of time indicates the interest rate that would be required for your money to double within that stated time.) Apply the Rule of 72 (Ex: 72 ÷ interest rate indicates the length of time for the money to double.) Describe safety tips for online shopping. (Ex: use a credit card, look for the lock symbol or https, etc..)* Use the Rule of 72 to estimate the growth of debt if no payments are made and no late charges are assessed. List the types of information that are most vulnerable to identity theft. Describe steps you can take to reduce the likelihood of fraudulent use of credit cards. (Ex: sign the back of the card with your signature and “please see picture ID.” Describe actions you can take to minimize the risks associated with identify theft. (Ex: check each credit report at least once each year.) Premium refers to money paid to an insurance company to purchase a policy. Deductible refers to the out-of-pocket money paid by the policyholder before an insurance company will cover the remaining costs attributed to the loss. Describe the difference between property and liability insurance (Ex: property insurance pays for loss to the insured person whereas liability insurance pays for loss to other people. A rental agreement (also know as a lease) is a contract specifying the tenant’s and the landlord’s legal responsibilities. A security deposit is money paid to a landlord to cover potential cleaning costs and repair costs at the end of the lease. Describe costs that would be included in calculating “transportation expenses” on a spending plan. (Ex: loan payment, fuel, parking fees, insurance) Describe ways to develop a positive credit history. (Ex: Maintain reasonable amounts of available credit) Analyze and compare terms of a credit card offers and apply the information to choose a card to best suit an individuals needs based on how they will use the card.