Chapter 13: Profit Planning

advertisement

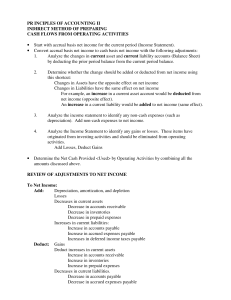

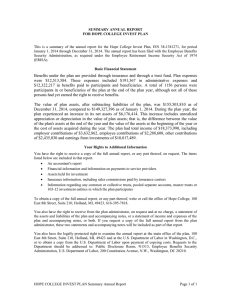

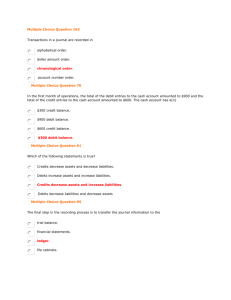

Profit Planning Profit Planning What is it? Why is it important? Financial changes occur constantly Trace in your company Benchmark others Importance of Accounting Accounting Records Balance Sheet Financial structure Assets Current Assets Cash Accounts Receivable Inventory Short-term investments and Prepaid expenses Fixed Assets Buildings, machines, trucks Financial Structure Liabilities Current Liabilities Accounts Payable Notes Payable Long-term Liabilities Bonds and mortgages Working capital Owners’ Equity Retained Earnings Income Statement Revenues Expenses Fixed Variable Profit What makes a Successful Small Business? Dun & Bradstreet More liquidity Value balance sheet as much as income statement Stability over rapid growth Long-term planning Profit Planning Process 1. Establish the Profit Goal 2. How much to do want to make? What rate of return do investors want? Determine the Planned Sales Volume Sales forecast 3. Factors Estimate Expenses the Planned Sales Volume Variable v. fixed costs Profit Planning Process 4. Determine the Estimated Profit 5. Compare Estimated Profit with Profit Goal 6. Sales income + Other income - Expenses Did it meet goals? List Possible Alternatives to Improve Profits Increasing sales income Decreasing planned expenses Decreasing cost per unit / new products Profit Planning Process 7. Determine How Expenses Vary with Changes in Sales Volume 8. Can base on history? Determine How Profits Vary with Changes in Sales Volume Breakeven point Profit Planning Process 9. Analyze Alternatives from a Profit Standpoint 10. Change sales price Change media/ advertising budget Reduce variable costs Change quality of products Stop making and selling low-margin products Select and Implement the Plan