2012 CSMFO Common Reporting – Allison

CSMFO

2012 Annual Conference

Common Financial Reporting

Problems and How to Avoid Them

Presented by

Gregory S. Allison, CPA

UNC School of Government

Letter of Transmittal and

Independent Auditor’s Report

• Date of the letter of transmittal should be no earlier that the date of the independent auditor’s report

• Auditor’s opinion should opine on budgetary comparison information when presented as part of basic financial statements

MD&A

• Scope of analysis should be comprehensive

(and an actual analysis)

– Governmental and business-type activities

– General fund and other major funds

– Budgetary variances (original, final, and actual)

• 3 years of condensed financial data if comparatives are presented

• Include appropriate discussions of capital asset and long-term debt activity

Component Units

• Avoid blending component units that should be discretely presented and vice versa

• Component unit data should be complete and consistent

Statement of Net Assets

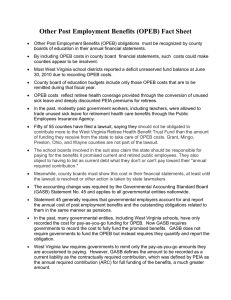

• Calculate the net pension /OPEB obligation correctly (e.g., include all contributions)

• Pension or OPEB liabilities are long-term, not current

• Debt should be reported net of related premiums or discounts

Statement of Net Assets (cont.)

• Invested in capital assets, net of related debt should be calculated correctly

– Unexpended bond proceeds (restricted)

– Bond issuance costs (not part of calculation)

– Internal borrowings (not part of calculation)

– Intangible capital assets (part of calculation)

– Refunding bonds (part of calculation, assuming they are replacing capital related debt)

Statement of Activities

• Levied taxes versus “shared” taxes

• Significant revenues should be reported separately

• Refrain from using the term “capital outlay” in accrual-based statements

Statement of Activities (cont.)

• Intergovernmental expenses should be reported within the appropriate functional category

• Only significant amounts should be reported as special items

– It is possible for special items to be reported at one level of reporting and not another (i.e., government-wide versus fund level)

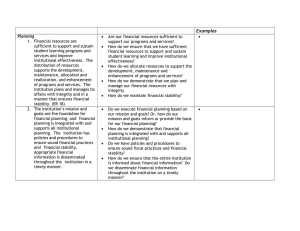

Fund Financials

• All major funds should be reported properly

• Reconciliations to the government-wide statement of activities should focus only on changes during the reporting period

Governmental Funds

• Certain accrued liabilities should only be reported in governmental funds “to the extent that the liabilities mature each period”

– Claims and judgments

– Compensated absences

– Termination benefits

– Landfill closure and postclosure care costs

– Pollution remediation obligations

– Operating leases with scheduled rent increases

Governmental Funds (cont.)

• New debt issuances (including refundings)

– Face value of debt as other financing source

– Premium reported as other financing source

– Discount reported as other financing use

– Bond issuance costs reported as expenditures

(note - potential that this will change with future guidance)

Governmental Funds (cont.)

• Other financing sources/uses

– Face value of long-term debt at issuance

– Original issue premiums and discounts

– Payments to escrow from proceeds of refunding bonds

– Sales of capital asset and insurance recoveries (if not a special item)

– Transfers

– Debt service on demand bonds classified as fund liabilities

– Reclassification of demand bonds as fund liabilities

Proprietary Funds

• Balance sheet/statement of net assets must be reported in a classified format (contrast with option at government-wide level)

• Provide detail on major categories of restricted net assets

• Capital contributions should be reported consistently (between government-wide and fund financials)

• New CIG guidance on asset transfers between funds

Proprietary Funds (cont.)

• “Cash flows from operating activities” is the residual category of the statement of cash flows

• Noncash events should be separately reported

– Capital asset contributions

– Changes in FMV of investments

– Inception of a capital lease agreement

Fiduciary Funds

• Pension plans and OPEB plans need to be reported as separate funds

• Provide sufficient detail on investments for pension and OPEB plans

• Employers must report on-behalf payments made directly to a pension or OPEB plan

Note Disclosures

• Adequately describe criteria used for identifying component units

• Disclose investment policies

• Disclose adopted fund balance policies

• Report changes in long-term liabilities at gross rather than net amounts