giest of lesson

advertisement

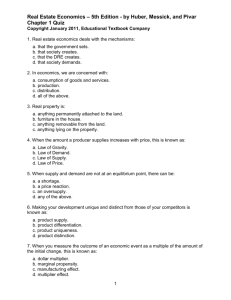

NATIONAL INCOME AND RELATED BASIC CONCEPTS Dr. Asad Ahmad PGT (Economics) K V, Guna (MP) Bhopal Region Duration – 80 Minutes OBJECTIVES *Student will be able to recall the circular flow of National Income. *Student will be able to recognize the difficult concept which will included in National Income. *Student will able to understand the concept of domestic territory and other concept. *Student will able to understand the concept of NIT, NFYA and Depreciation. *Student will be able to differentiate between the values which will be included in N.I. and which will not be included in National Income. LEARNING OUTCOMES *They will able to know the basic concepts of National Income in Macro Economics. TEACHING MATERIAL *Power Point Presentation, White Board, Marker. METHODS OF TEACHING *Question Answer Method *Group Discussion Method *Deductive Method *Demonstration Effect GIEST OF LESSON STOCK- A stock is a quantity measured at a particular point of time. FLOW- A flow is a quantity measured over a specified period of time. ECONOMIC TERRITORY- Economic Territory is the geographical Territory administrated by a government within which person goods and capital flow freely. But the purpose of National Income Accounting we also includes following- (1)Political territory including territorial water (2) Ships and aircraft owned and operated by normal residents in one or more countries, (3)Fishing vessels, oil and natural gas rigs operated by residence of a country in international water or engaged in extraction in these areas where a country has exclusive right of operation, (4)Embassies, consulates and military establishment of a country located abroad. NORMAL RESIDENT- Normal Residents refers to an individual or an institution which who ordinarily resides in the country for a period of more than one year and whose center of economic interest lies in that country. Following are not included in this –(1)Foreign tourist and visitors, (2)Foreign staff of embassies, officials, diplomats and members of armed forces, (3)International organizations, (4)Employee of international organizations, (5)Border workers and (6)Crew members of foreign vessels, commercial travelers and seasonal workers. FACTOR INCOME- Factor Income is the income received by the factors of production for rendering factor services in the process of production (wage, rent, interest and profit). TRANSFER INCOME- Transfer Income refers to the income received without rendering any productive services in return (old age pension , unemployment allowances). FINAL GOODS- Final Goods are those goods which are used either for consumption or for investment (Cloths, TV set , Cars, Machinery ). INTERMEDIATE GOODS- Intermediate Goods are those goods which are used either for resale or for further production (Milk purchase by dairy shop, tyres purchased by a cycle shop). CONSUMPTION GOODS- Consumption Goods are those goods which satisfy the wants of the consumers directly (Bread, Butter, Shirts etc). CAPITAL GOODS- Capital Goods are those goods which help in production of goods and services (Machinery, equipments, Plants etc). DEPRICIATION- Depreciation refers to the fall in the value of fixed assets due to normal wear and tear, passage of time and expected obsolescence (Change in technology). INDIRECT TAXES- Indirect Taxes are taxes which are imposed by the government on the production of sale of goods and services. SUBSIDIES- Subsidies are the financial assistance given by the government to an enterprise on the production of a certain commodity. NET INDIRECT TAX= Indirect tax - subsidies NET FACTOR INCOME FROM ABROAD- Net Factor Income From Abroad refers to the difference between the factor income received from the rest of the world and the factor income paid to the rest of the world. Net Factor Income From Abroad = Factor Income Received from Abroad – Factor income paid to Rest of the world TEACHER’S ACTIVITY The topic will be introduced to the Students by asking simple question based on their previous knowledge like*What is economics all about? *Which branch of economics deals with the aggregates? *What is national income? After asking some questions, teacher will explain the concepts and provide them additional knowledge by adopting various teaching methods. Teachers carefully monitors the activity of the student and ask oral questions to access the level of understanding. STUDENT’S ACTIVITY Students listen to the introductory remarks by the teacher and answer the questions asked. Student Silently and carefully learn the concept with great interest and note the relevant information in their note book. PROJECT *Prepare a list of Final Goods and Intermediate Goods. *Show the end-use classification of Goods and Services by a flow chart. ASSIGNMENT KNOWLEDGE BASED QUESTIONS *Define Domestic Territory? *What do you mean by consumer goods? *What Is factor income? *Give the meaning of depreciation. UNDERSTANDING BASED QUESTION *Distinguish between Factor income and Transfer income. *What is the difference between Capital goods and Economics goods. *Give the difference between Economic Territory and Political Territory. APPLICATION BASED QUESTION 1. Identify the normal resident*Indian official working in the Indian Embassy in U.S.A. *A Japanese tourist who stays in India for 2 month. *Indian going to Pakistan for watching cricket match. *Indians working in UNO office, located in U.S.A. *Indian employees working in WHO, located in India. *Indian Muslims going for the Haj pilgrimage. 2. Classify the following as intermediate goods and final good. *Paper purchase by publisher. *Milk purchased by household. *Purchase of rice by a glossary shop. *Raw material used by manufacturing firms. *Construction of houses by the consumer household. *Fertilizers used by farmers. *Purchase of pulses by a consumer. REFERENCES *Introductory Macro Economics- Mr. Sandeep Garg *Introductory Macro Economics- Ms Deepa Shree *NCERT Text Book *websites- www.cso.nic.in, www.gov.nic.in ************************************************************************** CONSUMER’S EQUILIBRIUM – INDIFFERENCE APPROACH Mrs. Alpha Reji PGT (Economics) Kendriya Vidyalaya, MHOW (MP) Bhopal Region Duration – 80 Minutes OBJECTIVES *Student will remember the meaning of the terms indifference curve, Budget line and Equilibrium. *Student will understand the condition of equilibrium. *Student will be able to relate the theoretical aspect of IC analysis in their day to day life when purchasing more than one commodity.. LEARNING OUTCOMES *The student will use this principle in their daily life while purchasing goods, so that judicious use of income or resources is possible. *Student will able to answer question based on indifference curve analysis. TEACHING MATERIAL *Power Point Presentation, White Board, Marker, Chocolates. METHODS OF TEACHING *Question Answer Method *Group Discussion Method *Deductive Method *Demonstration Effect GIEST OF LESSON Modern economist disregarded the concept of cardinal measure of utility. They were of the opinion that a consumer is in a position to rank various combination of goods and services in order of his preference. Thus Indifference Curve are used as a tool to show or enlist all combination of two goods that give equal satisfaction to the consumer. Consumer equilibrium refers to a situation in which a consumer derives maximum satisfaction with no intention to change it and subject to given prices and his given income. The point of maximum satisfaction is achieved by studying Indifference Map and Budget Line together. So a consumer always tries to remain at the highest possible IC subject to his budget constraint. For this the following condition need to be fulfilled. (1)Indifference Curve should be convex to the origin. (2)Slope of Budget Line should be equal to the slope of IC. (Px/Py = MRSxy) TEACHER’S ACTIVITY The topic will be introduced to the Students by asking simple question based on their previous knowledge like*What is an Indifference Curve? *How is a consumer rational? The teacher will then explain the concept of Marginal Rate of Substitution using an example. The teacher will give the students chocolates and perks and will explain how MRS will be diminishing and would result in convexity of the indifference curve. The teacher wil then derive the budget line using a numerical example. The teacher will now superimpose the indifference curve on the budget line to find the point of consumer’s equilibrium. The teacher will state the conditions for consumer equilibrium. (1)Indifference Curve should be convex to the origin. (2)Slope of Budget Line should be equal to the slope of IC. (Px/Py = MRSxy). The teacher will use power point slides to show the diagram and explain the conditions. (1) Why will the consumer not choose a bundle on IC’. (2)Why will the consumer not choose a bundle on IC’’. Teachers carefully monitor the activity of the student and ask oral questions to access the level of understanding. STUDENT’S ACTIVITY The students listen to the introductory remarks by the teacher and answer the questions asked. Student silently and carefully learns the concept with great interest and note the relevant information in their note book. RECAPITULATION *What do you mean by Indifference Curve? *Define budget line. *State the conditions of consumer equilibrium. ASSIGNMENT *Define Budget Line. *What is Marginal Rate of Substitution? *Explain with a numerical example, how marginal rate of substitution makes the indifference curve convex to the origin? Explain consumer equilibrium using indifference curve approach. *Not compulsory for all. PROJECT MORAL VALUE The consumer will be able to make conscious decision regarding expenditure. They will able to judiciously use the resources at their disposal. REFERENCES *Introductory Macro Economics- Mr. Sandeep Garg *Introductory Macro Economics- Ms Deepa Shree *NCERT Text Book *websites- www.cso.nic.in, www.gov.nic.in *************************************************************************** INVESTMENT MULTIPLIER AND ITS FUNCTIONING PRESENTED BY Mr. Anjani Kumar Resource Person Duration : 80 minutes (approx.) OBJECTIVES: Investment multiplier, its meaning and functioning. CONTENT: 1. 2. 3. 4. 5. Meaning of investment multiplier Diagrammatic presentation of multiplier Multiplier and MPC Algebraic relationship between multiplier and MPC Functioning of Investment Multiplier through numerical example METHODOLOGY: Problem solving method, demonstration, question answer method. TEACHING AID: Power Point Presentation, graphic and diagrammatic presentation EVALUATION OF MODULE: Self check question OVERVIEW: The concept of multiplier is an important contribution by Prof. JM Keynes. Keynes believed that an initial increment in investment increases the final income by many times. Multiplier expresses the relationship between an initial increment in investment and the resulting increase in aggregate income. CONTENT The operation of the multiplier ensures that a change in investment causes a change output (or change in national income) by an amplified amount, which is a multiple of the change in investment. Multiplier refers to the change in income to a change in investment. Symbolically, ΔY = K.ΔI Or, k = ΔY/ ΔI DIAGRAMMATIC PRESENTATION OF MULTIPLIER Multiplier and MPC: There exists a direct relationship between mpc and the value of multiplier. Higher the mpc, more will be value of multiplier and vice-versa. ALGEBRAIC RELATIONSHIP BETWEEN MULTIPLIER AND MPC We know that the value of output is equal to aggregate spending. Thus, Y=C+I We also know that any change in income (ΔY) is always equal to (ΔC+ΔI). Thus, ΔY=ΔC+ΔI Dividing both the sides by ΔY, we get, ΔY/ΔY=ΔC/ΔY+ΔY/ΔI Or 1/K= 1-mpc K=1/1-mpc K=1/mps MULTIPLIER AND MPC (ALTERNATE WAY) At equilibrium price, Y=C+I ………………..(I) We know, C=a+bY………………………..(2) Substituting value of C we get, Y=a+bY+I Y-bY =a+I Y(1-b)=a+I Y=1/(1-b)*(a+I) b is nothing but the mpc, so we have, Y=1/1-mpc*(a+I) To get the effect of a change in investment on income, we differentiate the equation to obtain ΔY=1/1-mpc *ΔI K=ΔY/ΔI = 1/1-MPC FUNCTIONING OF INVESTMENT MULTIPLIER: PRESENTATION BY A NUMERICAL EXAMPLE The working of the multiplier tells as to what will be the final change in income as a result of change in investment. Change in investment causes a change in income. As a result, there is a change in consumption which in turn leads to a multiple change in income. Symbolically, ΔI→ΔY→ΔC→ΔY The working of the multiplier can be explained with the help of the following table which is based on the assumption that ΔI=1000 and 0.8 (4/5) PROCESS OF INCOME GENERATION ROUND ΔI ΔY ΔC I 1000 1000 4/5*1000=800 II - 800 4/5*800=640 III - 640 4/5*640=512 IV - 512 4/5*512=409.6 - - - - - - - - - - - - TOTAL 5000 4000 From the above table , we learn that, ΔY=1000+800+640+512+………+∞ =1000+4/5*1000+(4/5)2*1000+(4/5)3*1000+……….∞ =1000[1+(4/5)+(4/5)2+(4/5)3+…………∞ [s=1+a+a2+a3+…..∞ = 1/1-a] Sum of an infinite GP series =1000[1/1-4/5] =1000*5 =Rs. 5000 Cr. KNOW YOURSELF 1. Explain the meaning of investment multiplier. What can be its maximum and minimum value and why? 2. Explain with the help of a numerical example how an increase in investment in an economy affect its level of income. 3. Briefly explain the relationship between MPC and investment multiplier. 4. What is meant by investment multiplier? Explain the relationship between mps and investment multiplier. 5. Explain the working of investment multiplier with the help of an example. 6. Explain the working of investment multiplier with the help of a diagram. 7. Giving reasons state whether the following statements are true or false. a) APS is always greater than zero b) Value of investment multiplier varies between zero and infinity c) The value of APS can never be greater than one d) If the ratio of MPC and mps is 4:1, the value of investment multiplier will be 4 e) There is an inverse relationship between the value of mps and investment multiplier. EXERCISE a) In an economy, 75% of the increase in income is spent on consumption. Investment is increased by Rs 1000 crore. Calculate i)total increase in income ii)total increase in consumption expenditure b) In an economy, the equilibrium level of income is Rs 12000 cr. The ratio of mpc and mps is 3:1. Calculate the additional investment needed to reach a new equilibrium level of income of Rs20000 cr. c) In an economy, mpc is 0.75. If investment expenditure is increased by 500 cr, calculate the total increase in income and consumption expenditure. d) In an economy, an increase in investment leads to increase in national income which is three times more than increase in investment. Calculate mpc. e) The saving function of an economy is S=-200+0.25Y. the economy is in equilibrium when income is equal to Rs 2000 cr. Calculate a) Investment expenditure at equilibrium level of income b) Autonomous consumption c) Investment multiplier f) In an economy, the actual level of income is Rs 500 cr whereas the full employment level of income is Rs 800 cr. The mpc is 0.75. Calculate the increase in investment required to achieve full employment equilibrium. g) In an economy, mps is 0.10. How much increase in investment is required so that national income rises by Rs 400 cr. REFERENCE Macroeconomics by M.L. Jhingan Macroeconomics by H.L. Ahuja Macroeconomics NCERT ************************************************************************ BASIC ECONOMIC ACTIVITIES Mr. Arun Kumar Patra PGT (Economics) Kendriya Vidyalaya, Chhatarpur (MP) Bhopal Duration – 80 minutes OBJECTIVES *Student will remember the meaning of Production, Distribution and Consumption. *Student will be able to relate the three basic economic activities each other. *Student will be able to categorized different economic activities in to three groups (Production, Distribution and Consumption). LEARNING OUTCOMES *The student will be able to apply economics. *Student will able to understand the broadness of economics and will extend their area of thinking. *Student will be able to relate the day to day activities with the economics. TEACHING MATERIAL *Power Point Presentation, White Board, Marker, Glass and Cloth. METHODS OF TEACHING *Question Answer Method *Group Discussion Method *Deductive Method *Demonstration Method GIEST OF LESSON Basic economic activities are Production, Distribution and Consumption. Basic Activities are the structure of economic building lies on these three pillars. Economic Activities – Which leads to income generation? Production refers to all activities which are undertaken to produce goods and services for generation of income and satisfying human wants or we mean creation of utility or value of goods and services (Production – Investment – Capital Formation). Distribution is that activity which studies how income generated in the process of production is distributed among the factors of production (Land- Rent, LabourWages, Capital-Interest, and Entrepreneur- Profit). Consumption is an economic activity which deals with the use of goods and services for the satisfaction of human wants. When a want is satisfied, the process is known as consumption. DIATRI PROD BUTIOCONS UCTIECO N UMPTI ON NO ON MY TEACHER’S ACTIVITY The topic will be introduced to the Students by asking simple question based on their previous knowledge like*The teacher will ask the students about their daily work and that of their parents. The teacher will note the activities and will group in to three groups. *Explain the broadness of economics and approach the students to be broad minded. *Discuss with the students why these activities are termed as basic. *The teacher will differentiate between economic activities and non economic activities. *The teacher will explain the concept of consumption, production and distribution. *The teacher will ask some recapitulation question to the students. *The teacher will give some assignment and project work to the students. Teachers carefully monitor the activity of the student and ask oral questions to access the level of understanding. STUDENT’S ACTIVITY Students listen to the introductory remarks by the teacher and answer the questions asked. Student silently and carefully learns the concept with great interest and notes the relevant information in their note book. RECAPTULATION *What do you mean by consumption? *Who is a producer? *Who is a service provider? *What is meant by economic activity? *Who is a consumer? ASSIGNMENT What do you mean by consumption? Give examples. What are basic economic activities? Why are they called basic activities? *Are the three basic activities interrelated? Give reasons in support of your answer.*Not compulsory for all. PROJECT List 20 activities performed by a farmer in his day to day life and group them into production, consumption, and distribution. REFERENCES *Introductory Macro Economics- Mr. Sandeep Garg *Introductory Macro Economics- Ms Deepa Shree *NCERT Text Book *websites- www.cso.nic.in, www.gov.nic.in *************************************************************************** MEASUREMENT OF NATIONAL INCOME Mr. D.P. Thapliyal PGT (Economics) KV OLF Raipur Dehradun Region Duration: 80 minutes (approx.) OVERVIEW Three related phases are measuring National Income i.e. Production, Income, and Expenditure which go continuously in a economy. Production process generates income; income gives purchasing power in the hand of people, this expenditure in the economy by measuring national income. OBJECTIVE This module enables the learner to understand: (1) How to calculate National Income through production (value added), income method and expenditure method. (2) All three methods give the same result. (3) Importance of factor income and market price. (4) Importance of net factor income from abroad. (5) Importance of Gross Capital formation. (6) Precautions taken while calculating national income. (7) Identification of growth of national income in the country. CONTENT National income refers to money value of final goods and services produced within domestic territory by normal residents and including net factor income from abroad during in an accounting year. Methods for calculating national income 1. Production method (Value added method) 2. Income method. 3. Expenditure method PRODUCTION METHOD This method measures national income through the value added by producing units. 1. Value of output = output x price 2. Value of output – intermediate consumption = Gross Domestic Product at MP. ( OR ) final production of primary, secondary, tertiarysector-intermediate production of primary, secondary ,tertiary sector 3. GDP at MP – depreciation-NIT + NFIA = NNP at FC Precautions: (a) Value of goods product for self-consumption must be included in the estimation of domestic product. (b) Value of second hands goods should not be included Activity: 1. Value of output----------------------------= GDP at MP 2. GDP at MP-------------------------------- Answer: = GNP at MP 1. Intermediate consumption 2. NFIA INCOME METHOD: In this method national income is calculated at factor cost I. II. III. Compensation of Employee Operating surplus Mixed income Add net factor income from abroad = National Income Activity 2: Call four students in front of other students and name each them as above mentioned and explain how to calculate. Precautions: 1. Transfer payment not to be included 2. Leisure time activities not to be included 3. Income from share & bonds not to be included EXPENDITURE METOD: In this method national income is calculated at MP 1. Private final consumption expenditure 2. Government final consumption expenditure 3. Gross domestic capital formation 4. Net export = GDP at MP- DEP –NIT +NFYA = NATIONAL INCOME Precautions In this method we should take following precaution: 1. Intermediate consumption should not be included 2. Expenditures on second hand goods not to be included 3. Expenditure on transfer payments not to be included National income and economic welfare National income is related to the welfare of economy. Welfare of economy shows standard of living of the economy. It increases GNP and increase in per capita income is sign of equitable distribution of income and sustainable development. SUM UP 1. There are three ways of calculating national income a) Production method (Value added method) b) Income method. c) Expenditure method 2. Steps of value added method are Value of output = output x price, Value of output – intermediate consumption = Gross Domestic Product at MP. 3. Steps of Income method are adding Compensation of Employees, Operating surplus, Mixed income, add net factor income from abroad = National Income. 4. The main steps of expenditure method are - Private final consumption expenditure, government final consumption expenditure, Gross domestic capital formation, net export = GDP at MP- DEP –NIT +NFYA. EXERCISE Q.1 No. 1 2 3 4 5 6 From the following date, calculate gross value added at factor cost: Particulars Amt.(Rs. In lakhs) Sales 180 Rent 5 Subsidies 10 Change in stock 15 Purchase of raw material 100 Profits 25 7 Imports 15 Q.2. From the following data Calculate National Income by – a) Income method b) Expenditure method Items Rs. crores i) Compensation of employees 800 ii) Pvt final consumption expenditure 1200 iii) Profit 500 iv) Rent 200 v) Govt. final consumption expenditure 800 vi) Interest 150 vii) Net factor income from abroad 20 viii) Net indirect taxes 190 ix) Mixed income of self-employed 630 x) Net exports (-)30 xi) Net domestic capital formation 500 xii) Consumption of fixed capital 150 REFERENCES 1) 2) 3) 4) Introductory Macro Economics Micro and Macro Economics Micro Economics Introductory micro and Macro Economics www.ncert.nic.com www.nos.org NCERT Mr. Sandeep Garg Mr. M. L. Jhingan Mr. B.L. Gupta ************************************************* CONCEPT OF PRODUCER’S EQUILIBRIUM AND ITS DETERMINATION BY MR-MC APPROACH PRESENTED BY Ms. Jayashree K.V. NO. 1 Gaya (Ptana) Patna Region Duration : 80 min. OBJECTIVES :- 1) Students will be able to recall the concepts of MR & MC. 2) Students will be able to understand the meaning of producer’s equilibrium. 3) Students will be able to find out the maximum level of output that a prudent producers will undertake . 4) The students will be able to ascertain the quantity produced by a rational producer with objective of profit maximization. LEARNING OUTCOMES :The students will be able to identify the rational behind the decision of the producer i.e maximization of output with minimum resources. TEACHING METHODS USED :1) 2) 3) 4) Lecture method. Question – answer method. Demonstration & quizzing method. Overall a deductive approach will be used for elaboration of the topic. TEACHING MATERIALS :1) 2) 3) 4) White board Marker and duster Power point slides on the topic. Chart papers etc GIST OF THE LESSON :A producer is said to be reach equilibrium at that level of output which gives him maximum profit and he has no tendency to change his output. A producer is said to be in equilibrium at a point where :1) MR = MC 2) MC cuts MR from below. According to the MR –MC approach the first condition of the producer’s equilibrium is that marginal cost should be equal to marginal revenue. But the MC can be equal to MR even after that level of output cost becomes less than the revenue i.e. MC<MR. Therefore MC=MR is a necessary but not a sufficient condition. The second condition is that MC cuts MR from below. TEACHER’S ACTIVITY :The topic will be introduced to the students by asking simple questions based on their previous knowledge. 1) Who is a producer? 2) What is the main objective for which a producer produces a commodity? 3) When will a producer be in equilibrium? The teacher will explain the meaning of producer’s equilibrium using MR-MC approach. The teacher will use power point slides to explain the various theoretical concepts i.e. definition & condition of producer’s equilibrium using MR-MC approach. The white board will be used for graphical presentation of the topic. The teacher will ask short questions to access the level of understanding like. Q1. Why will the producer not stop producing at point K level of output? Q2. At what level of output will the producer maximize his profit? RECAPTULATION :The teacher will use power point slides for quick recapitulation by asking simple questions. STUDENT’S ACTIVITY :The students listen to the introductory remarks of the topic and try to answer the questions ask by the teacher . They carefully listen the content of topic & note the relevant facts in their class work note-book . VALUES INCULCATED :Judicious use of scarce resources i.e. maximization of the output with minimum resources. HOME ASSINGMENT / PROJECT :Question for slow learners:1) What do you understand by producer’s equilibrium? 2) State only the condition of producer’s equilibrium. Questions for bright students:- 3) Is MR=MC a sufficient condition for producer’s equilibrium? Explain. 4) Find out the profit maximizing level of output :- Quantity Sold Marginal Cost Total Revenue 1 2 3 4 5 15 9 6 2 3 12 26 34 40 42 REFERENCE : Introductory Micro Economics –Text book NCERT Principles of Micro Economics – H. L. Ahuja Micro Economics -M. L. Jhingan Micro Economics - M.L. Seth Introductory Micro & Macro Economics – Ohri & Jain ************************************************************************ ECONOMIC REFORMS SINCE, 1991 PRESENTED BY Mr. R. N.MOHKER KENDRIYA VIDYALAYA A.F.S. AMLA (M.P.) DURATION: 40 MINUTES OBJECTIVE 1) 2) 3) 4) 5) To strengthen the growth impulses in the economy. To make our production units more efficient and highly productive. To increase the competitive of our production units. To make use of global resources for our own progress and development. Main objective of Liberalization means a reduced role for the Govt. and a greater role for the market sources. 6) The main objective of privatization is to make use of privately owned resources for collective welfare of the people. SPECIFIC OBJECTIVE Students will be familiar with Economic reforms and its impact on Indian Economy. LEARNING OUTCOME Students will be enabling to find out the changes appear in their surroundings after economic reforms as MNCs products and role in the Indian economy. TEACHING MATERIALS 1) PowerPoint presentation. 2) Foreign company’s (MNCs) products. 3) Services of foreign Intellectuals hired and examples according to the class situations. METHODOLOGY 1) Lecture method. 2) Question- cum – answer method. 3) Situation Analysis approach-cum- solution. GIST OF THE LESSON ECONOMIC REFORMS Economic reforms refer to the all those measures which aim at rendering the economy more efficiently, competitive and developed. Main economic reforms are: (1) Liberalization, (2) Privatization and (3) Globalization. NEED FOR ECONOMIC REFORMS 1) 2) 3) 4) 5) 6) Increase in fiscal deficit. Increase in adverse BoP. Gulf crisis. Fall in foreign exchange reserve. Rise in prices. Poor performance of P.S.U. NEW ECONOMIC POLICY LIBERALISATION Implying freedom of private enterprises from control imposed by the Govt. Industrial licensing removed Expansion of production area Freedom to import capital goods Financial reforms Fiscal reforms External sector reforms PRIVATISATION It implies partial or full ownership and management of public sector enterprises by the private sector. Disinvestment of PSU Withdrawal of Government ownership Efficient performance of private sector GLOBALISATION It is a process associated with increasing openness, growing economic independence and deepening economic integration in the world economy. Increase equity limit of foreign investment Partial convertibility Long term trade policy POSITIVE IMPACT OF THE L. P. G. POLICY 1) 2) 3) 4) 5) 6) 7) 8) A vibrant economy. A stimulant to industrial product. A check on fiscal deficit. A check on inflation. Consumer’s sovereignty. A substantial increase in foreign exchange reserves. Flow of F.D.I. Recognition of India is an emerging economic power. NEGATIVE EFFECT OF NEW ECONOMIC POLICY 1) Adversely affects the employment of unskilled Persons. 2) No importance is given to the small scale industries and agriculture. TEACHER’S ACTIVITY Checking the control of large Industrial houses on the financial resources of the country.Negative lists of imports contain those items for whose import license are still required. STUDENT’S ACTIVITIES 1) 2) 3) 4) Students will give the answers while asking the questions by the teacher. Students will note the Blackboard write-ups as important tips. Students will think the need of the economic reforms as critically based analysis. Students will note the home work & class work accordingly. PROJECT 1) Prepare a list of domestic Industries and Multinational companies. 2) Prepare a list of Exports and imports items in the Indian Economy. ASSIGNMENTS 1. 2. 3. 4. When was the new economic policy enforcing? Define Liberalization, privatization and globalization. Describe the need for economic reforms? It is said, new economic policy is liberal. Do you agree? Give arguments in support of your answer. 5. Mention the financial reforms introduced under the new Economic policy? REFERENCES 1. Indian Economic Development (N C E R T) 2. Indian Economic Development By T R Jain & V K Ohri. 3. Indian Economic development By I C Dingra. ************************************************************************* CENTRAL BANK AND ITS FUNCTIONS Presented by Urvashi Mishra P.G.T(Eco) K.V.No-1, Indore(MP) Bhopal Region Duration – 80 Minutes 1.Objectives*The students will be able to understand our banking system. * The student will be able to know about our monetary system and economic policy of govt. of India. *The student will be able to know how RBI controls banks in India. *The student will be able to know that RBI is the controlling authority of money supply in the market. 2.Learning Out comes.*The student will use this knowledge in there daily life. *They will understand the functions of RBI. 3.Teaching material usedCurrency notes for display. White board, marker, power point presentation. 4.Methodology*Question - Answer Method, *Display Cum Discussion Method. 5.Gist of the lesson – Definition-Central bank is the apex financial institution of a country which issues currency notes and regulates the banking system of the country. Functions of central bank*Currency Authority – Generally the central bank issues the currency notes in our country but the one rupee note is issued by ministry of finance. The Central Bank adopts certain minimum reserve system for issuing currency notes. *Banker to the governmentRBI accepts receipts and make payment for the govt. It provide short term credit to the govt. It provide foreign exchange reserve to the govt. to repay external loans. *Bankers bank and supervisorThe central bank acts as a banker to the commercial bank and supervises, regulates and controls the activity of commercial bank. *Controller of money supply and creditThe Central bank controls the money supply and credit in the best interest of the economy .The bank does this by taking various quantitative and qualitative instruments such as-bank rate, open market operations, cash reserve ratio, statutory liquidity ratio, change in margin requirements, moral suasion. I - Bank rate-It is the minimum rate at which the central bank of a country gives credit to the commercial bank. During inflation the central bank increases the Bank Rate to discourage commercial banks to take more loan. On the other hand during depression the Central bank decreases the bank rate as a result of which supply of credit in the economy increases. Bank rate as on 27/12/2010 is6%. II - Open market operation-It refers to the purchase and sale of govt. securities. During inflation the Central bank sales securities in the open market. his reduces the money supply in the economy and helps in reducing price level. During depression central bank purchase securities to increase money supply in the economy. III - Cash reserve ratio-It is the minimum percentage of total deposits which is required to be kept with the central bank. During inflation Reserve bank increases CRR. During depression it lowers the CRR. IV - Statutory Liquidity Ratio-It is the amount of cash which a commercial bank has to keep in the form of liquid asset in order to meet un anticipated withdrawals. At present SLR is 25%. V - Legal Reserve Ratio-It is the sum of cash reserve ratio and statutory liquidity ratio. LRR=CRR+SLR 6.Teacher’s Activity*The topic will be introduced to the pupil by asking simple questions based on their previous knowledge. *What is barter system? *What is money? *Where you deposit your money ? *The teacher will teach the student using all methods mentioned above. *The teacher will supervise the written work of the students 7.Students ActivityThe students will answer the questions asked by the teacher. They will see the different notes (one rupee, Five hundred etc) and will find out the difference. 8.Home Assignment1)What are the functions of central bank? 2)What is bank rate? 3)Explain how CRR is used to control money supply. 9.Project*Make a project based on the functions of central bank by flow chart. *Write down the current status of monetary policy of India and prepare a chart based on the current data. 10.ReferenceNCERT Text Book ., Macro economics-E .W. Sapiro. Introductory Macro Economics – Mr Sandeep Garg Concept of Cost Mr. Vijay Pratap Singh K V Lansdown Dehradun Region Duration – 80 Minutes Objective - To make the student aware the concept of cost of production. Specific objective – To aware the student about the various concepts of cost, Specially concept of variable & fixed cost. Learning outcome- The students will be able to explain the meaning, definition & concept of various costs. They will also be able to estimate various types of cost viz. Fc, vg etc. Teaching Material- Black board & power point presentation. Methodology- Lecture cum demonstration method. Question answer method. Gist of lesion- Meaning of cost “the expenditure incurred on inputs require to produced a commodity is known as the cost of production. Cost function – Cost function refers to the functional relationship between cost and output C = f (Q) Kinds of Cost - 1- Money cost 2 –Explicit and implicit cost 3 –Real cost 4 –Private and social cost 5- Opportunity cost Money Cost – Money cost refers to the total expense incurred by a firm for producing a commodity. Explicit Cost– Explicit cost refers to the actual payment made to outsider for purchasing and hiring service of the factor of production. Implicit Cost – Implicit cost refers to the cost of self-supplied factor. Real Cost – Real cost refers to the pain sacrifice discomfort and disutility involved in providing factor services to produce a commodity. Private Cost - Private cost refers to the cost of production incurred by an individual firm in producing a commodity. Social Cost – Social cost include the disadvantage, suffered by the society due to production of a commodity. Opportunity Cost - Opportunity cost is the cost of the next best alternative forgone. Classification of cost on the basis of time. Short Run Cost - Short run cost are those cost in which some cost are fixed and some cost variable . Long Run Cost – In long run cost all cost are variable cost. SHORT RUN COSTS Total variable cost – total variable cost refers to the cost which directly varies with the level of output. Schedule Output(units) 0 1 2 3 4 TVC (Rs) 0 6 10 15 24 Total Fixed Cost- Fixed cost refers to the those cost which do not vary with the level of output. Schedule Output Cost Toatl Cost – 0 20 1 20 2 20 3 20 4 20 TC = TVC + TFC TC= AQ TVC= BQ TFC= CQ TC= TVC+ TFC = BQ + CQ = AQ Teacher Activity – Teacher will develop the lesson plan with the help of question answered methods and then teach with the help of power point presentation. Student Activity – Student will note all the points and ask the question if any doubt. Project- Student will be asked to prepare a list of cost of various brand of colour television. Assignment – For slow lerner Q1 Define various type of cost? Q2 Find out TVC and MC from the following. Output TC 0 20 1 40 2 60 3 90 FOR BRIGHT – Explain the relationship between TC TVC TFC with the help of hypothetical schedule and diagram. Reference – Micro Economics of H.L AHUJA Introductory Micro Economics SANDEEP GARG *************************************************************************** PRODUCTION FUNCTION AND LAW OF VARIABLE PROPORTION Mr. Abhishek Chaturvedi PGT (Economics) Kendriya Vidyalaya, Ambajhari,Nagpur Bhopal Duration – 80 Minutes OBJECTIVES *Student will be able to recall the concept of TP, MP and AP. *Student will be able to recognize the determinants factors which are responsible for increasing returns, decreasing return and Negative Return to a factor. *Student will able to understand the convexity of TP curve. *Student will able to understand the slope of MP curve. *Student will be able to draw TP ad MP curve with the help of numerical schedule. *Student will able to correlate this law with other concepts like disguised unemployment in agricultural sector LEARNING OUTCOMES *They will able to use of formula to calculate MP, AP and TP. TEACHING MATERIAL *Power Point Presentation, White Board, Marker. METHODS OF TEACHING *Question Answer Method *Group Discussion Method *Deductive Method *Demonstration Effect GIEST OF LESSON Production function is the physical relationship between input and output. There are two types of production function (1) Short run production function and (2) Long run Production function. In short run period of time there are two types of factor- (1) Fixed Factor and (2) Variable Factor. There are three types of production (1) Total Production, (2) Average Production and (3) Marginal Production. Total Production refers to total quantity of goods produce by a firm during given period of time with given number of inputs. Average production refers to output per unit of variable input. Marginal Product refers too additional to total product when more unit of variable factor is employed. The law of variable proportion can be explained with the help of following schedule and diagram.. Fixed Factor Variable Factor (Land 1 in 1 acres) ( 1 Labour) 2 1 TP MP AP (Units) 10 (Units) 10 (Units) 10.0 30 20 15.0 3 45 15 15.0 1 4 52 7 13.0 1 5 52 0 10.4 1 6 48 -4 08.0 1 7 38 -10 05.4 Stages st I (Increasing returns to a factor) nd II (Diminishing returns to a factor) rd III (Negative returns to a factor) Our above schedule reveals the under mentioned stages. Stage 1 (Increasing returns to a factor)- In the first stage, TP increase at an increasing rate and MP is also increases. MP increases till point ‘P’ and TP increases at an increasing rate till point ‘Q’. Stage 2 (Diminishing returns to a factor)- In the second stage, TP increases at a decreasing rate and MP starts falling. This stage ends when MP becomes Zero and TP reaches its maximum point. In figure after point ‘P’, when MP starts decreasing and TP increases at a diminishing rate. This stage occurs between point ’P’ and point ‘S’. The stage ends when MP is zero at point ’S’ and TP is maximum at point ‘M’ Stage 3 (Negative returns to a factor)- In the third stage, TP starts decreasing and MP not only falls, but also becomes negative. In figure after point ‘S’ in MP curve and after point ‘M’ in TP curve. A rational Producer will always prefer to produce in the II stage of production. TEACHER’S ACTIVITY The topic will be introduced to the Students by asking simple question based on their previous knowledge like*What are the vital activities of any economy? *If a farmer wants to earn income, what should he do? *What is the meaning of production? *What are the main requirement which necessary for production? After asking some questions, teacher will explain the concepts and provide them additional knowledge by adopting various teaching methods. Teachers carefully monitors the activity of the student and ask oral questions to access the level of understanding. STUDENT’S ACTIVITY Students listen to the introductory remarks by the teacher and answer the questions asked. Student Silently and carefully learn the concept with great interest and note the relevant information in their note book. PROJECT Collect the data about Total Production, Marginal Production and Average Production from your near area of agriculture sector. ASSIGNMENT VERY SHORT ANS QUESTIONS 1. What is Production Function? 2. List any Four inputs used in production process? 3. What is the general slope of Marginal Production Curve? *What will u say about MP of a factor, when TP rises at an increasing rate? *When MP is falling and positive, at what rate TP is changing? SHORT ANS QUESTIONS 1. Explain the Relationship between TP and MP. 2. Explain the concepts of Short run and Long run. *There is always an ideal factor ratio. What happens if this ideal ratio is violated? LONG ANS QUESTION 1. Explian the Law of Variable Proportion with the help of diagram. *Do you agree that TP must increase in a situation of diminishing returns and AP may continue to rise even when MP starts declining? Why? REFERENCES *Introductory Micro Economics- Mr. Sandeep Garg *Introductory Micro Economics- Ms Deepa Shree *NCERT Text Book *websites- www.cso.nic.in, www.gov.nic.in ***