Threat of Substitutes

advertisement

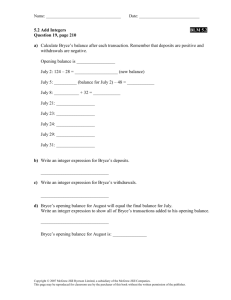

Power of Substitutes: Economics of Cross-Price Elasticities MANEC 387 Economics of Strategy David J. Bryce David Bryce © 1996-2002 Adapted from Baye © 2002 The Structure of Industries Threat of new Entrants Bargaining Power of Suppliers Competitive Rivalry Threat of Substitutes From M. Porter, 1979, “How Competitive Forces Shape Strategy” David Bryce © 1996-2002 Adapted from Baye © 2002 Bargaining Power of Customers Demand and the Prices of Other Products • In addition to its own price, consumption of a good depends on other factors – – – – – Prices of other goods Product quality Income Preferences Advertising • Changes in these factors results in a “change in demand” – shift of the demand curve David Bryce © 1996-2002 Adapted from Baye © 2002 Changing Prices of Rival Products • Substitute goods – an increase (decrease) in the price of good X leads to an increase (decrease) in the consumption of good Y. • Complementary goods – an increase (decrease) in the price of good X leads to a decrease (increase) in the consumption of good Y. David Bryce © 1996-2002 Adapted from Baye © 2002 Substitute Goods Calculators (Y) When the price of good X falls, the consumption of substitute good Y also falls. Y1 Y2 X1 David Bryce © 1996-2002 Adapted from Baye © 2002 X2 Computers (X) Complementary Goods Software (Y) When the price of good X falls, the consumption of complementary good Y rises. Y1 Y2 X1 David Bryce © 1996-2002 Adapted from Baye © 2002 X2 Computers (X) Elasticity and the Power of Substitutes • Substitutes are defined by product function, not by product form • Substitutes have power to reduce prices when buyers have high cross-price elasticity between a firm’s product and substitute products – Close relative price/performance ratio – Consumer tastes & preferences favor substitute’s features – Low switching costs David Bryce © 1996-2002 Adapted from Baye © 2002 Cross Price Elasticity of Demand • Cross-price elasticity gives the sensitivity of demand of good X to changes in the price of good Y %DQx hQx,Py = %DPy • Cross-price elasticity of demand defines the strength of the relationship between X and Y hQx,Py > 0: hQx,Py < 0: David Bryce © 1996-2002 Adapted from Baye © 2002 substitute products complementary products Strength of Substitutes and Complements • With strong substitutes, many customers will consume the substitute good if a firm raises its prices – Coke v. Pepsi – Suburban v. Expedition • With strong complements, many customers will reduce consumption of a firm’s product if price of the complement is raised – Personal computers and software – Hamburger buns and E-coli tainted hamburger David Bryce © 1996-2002 Adapted from Baye © 2002 MRS Defines the Strength of Substitutes Good Y • Marginal Rate of Substitution – the rate at which a consumer is willing to substitute one good for another and stay at the same satisfaction level. S3 S2 S1 S3 > S2 > S1 David Bryce © 1996-2002 Adapted from Baye © 2002 Good X Strength of Substitutes • Willing to exchange perfect substitutes one-for-one, i.e., indifference curve has a slope of –1 • Imperfect substitutes exchange at different rates • Diminishing marginal satisfaction creates imperfect substitutes David Bryce © 1996-2002 Adapted from Baye © 2002 Good Y Imperfect Substitutes Imperfect Substitutes Perfect Substitutes Good X Cross-Price Elasticity at AT&T • According to an FTC Report, AT&T’s cross price elasticity of demand for long distance services is 9.06 • If competitors reduced their prices by 4 percent, what would happen to the demand for AT&T services? David Bryce © 1996-2002 Adapted from Baye © 2002 Impact of AT&T Rivals’ Price Cuts • 9.0 is a high cross-price elasticity – customers are sensitive to rival prices so we would expect to see a loss of market share – 1% reduction in rival prices generates a 9.06% reduction in demand for AT&T services, so – 4% reduction in rivals prices generates a 36.24% reduction in demand for AT&T services • Stealing market share so easily tempts all firms to cut prices substitutes have power over AT&T prices David Bryce © 1996-2002 Adapted from Baye © 2002