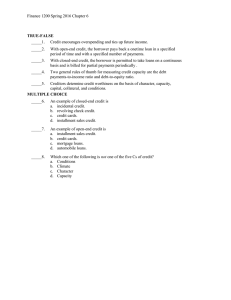

FAST FACTS: CONSUMER INSTALLMENT LOANS

advertisement

FAST FACTS: CONSUMER INSTALLMENT LOANS Consumer installment lenders depend on repeatedly refinancing existing consumers for bulk of their loan volume. Industry data show that over 75% their lending is due to refinancing existing consumers, generating new fees and interest each time.i Instructions to employees of Security Finance, a national consumer installment lender, show their business thrives on getting people into debt but not letting them out: “push the renewals, by getting the customer to renew their accounts it will be harder for that customer to pay us out.”ii Consumer installment lenders typically charge the highest amount permitted by law. In its 2012 annual report to investors, the national consumer installment lender, World Acceptance, noted “that virtually all participants in the small-loan consumer finance industry charge at or close to the maximum rates permitted under applicable state laws in those states with interest rate limitations.”iii Similarly, in an in-depth examination of the consumer installment lending industry, the NC Commission on Banks determined that “licensees were charging the maximum blended rate allowable.”iv Consumer installment loans are typically secured by personal property, mitigating risk to lender but not to borrower. Lenders typically take security interest in personal property, including automobiles, to reduce lender’s risk of loss. In North Carolina, where many of the national chains operate, the regulator reports that more than 86% of consumer installment loans were secured with some type of personal property.v Loans difficult to repay then put both borrower’s property and financial stability at risk. Consumer installment lenders have been the target of serious allegations of predatory lending. A jury in Tulsa County, Oklahoma awarded a mentally disabled man with a 59 IQ, $1.75 million dollars in punitive damages for perpetually flipping him into one high-rate, highfee loan (approximately 200 percent APR each) after another. Unfortunately, this was not an isolated incident – a former manager testified, “once a borrower enters a loan shop, he’s one the road to destruction, ruin and bankruptcy.” Finally, thru discovery in the Oklahoma case, it was revealed that direct financial incentives to engage in loan flipping went from the loan officer level all the way to the executive vice president. Military families are vulnerable to high-cost installment loans. The Military Lending Protection Act protects young soldiers and sailors from many high-cost loans but does not apply to longer-term, installment loans regardless of price.vi Worse, there is substantial evidence that lenders target military families with high-cost, installment loans.vii Installment loans are made at a fraction of the cost in other states. For example, in North Carolina, lenders make millions of dollars of loans, profitably, capped at 30 to 18 percent annual interest rates and is limited to twice yearly fees of $15-$25.viii Why do [Washington] families deserve less? Addressing the needs of the unbanked/underbanked and Internet loans are red herrings. If over 75% of installment loans are refinances of existing loans, borrowers are not graduating too less expensive forms of credit. And a recent Pew report found that permissive (i.e. high-cost) small loan laws did not affect usage of Internet loans.ix i N.C. Commissioner of Banks, 2010 Consumer Finance Annual Report. See also, SEC filings of World Acceptance Corp, a South-Carolina based lender, reporting that over 75% of its lending is refinancing existing loans: “For fiscal 2010, 2009 and 2008, the percentages of the Company's loan originations that were refinancings of existing loans were 76.4%, 75.0% and 73.3%, respectively” World Acceptance Corporation, SEC Filing10-K, 2010. ii Graham, Ginnie, “Small loans, big business.” Tulsa World. November 27, 2005, http://www.hwhlaw.com/content/newsdisp.asp?contentid=47 iii World Acceptance Corporation, SEC Filing 10-K, March 31, 2012 iv N.C. Commissioner of Banks, “The Consumer Finance Act: Report and Recommendations to the 2011 General Assembly.” February 2011 v N.C. Commissioner of Banks, 2010 Consumer Finance Annual Report vi http://www.consumerfed.org/pdfs/Studies.MilitaryLendingAct.5.29.12.pdf vii http://www.huffingtonpost.com/2011/01/24/at-fort-sill-okla-highint_n_813378.html viii N.C. Commissioner of Banks, “The Consumer Finance Act: Report and Recommendations to the 2011 General Assembly.” February 2011. “Over the past 12 years, the majority of licensees have been profitable, and the aggregate industry net worth more than doubled between 1998 and 2009.” ix http://www.pewstates.org/research/data-visualizations/state-payday-loan-regulation-and-usage-rates85899405695