External Analysis:

The Identification of Industry

Opportunities and Threats

Chapter 2

External Analysis

• Analyzing the dynamics of the industry in

which an organization competes to help

identify:

– Opportunities: conditions in the environment

that a company can take advantage of to

become more profitable

– Threats: conditions in the environment that

endanger the integrity and profitability of the

company’s business

Defining an Industry

• Industry

– A group of companies offering products or

services that are close substitutes for each

other

• Competitors

– Rival companies that serve the same basic

customer needs

Defining an Industry (cont’d)

• Sector

– A group of closely related industries

• Market segments

– Distinct groups of customers within a market

that can be differentiated from each other

based on their distinct attributes and demands

• Changing industry boundaries

The Computer Sector:

Industries and Segments

The Computer Sector

Where is the customer?

The Computer Sector:

Industries and Segments

Strategic Groups Within

Industries

•

•

Formed within an industry when some

companies follow the same basic product

positioning strategy, which is different

from that of other companies in other

groups

Companies can position their products in

terms of distribution channels, market

segments, product quality, technological

leadership, customer service, pricing

policy, advertising policy, promotions

Strategic Groups in the

Pharmaceutical Industry

Insert Figure 2.3

Implications of Strategic Groups

• A company’s closest competitors are those

in its strategic group

• Each strategic group may face a different

set of opportunities and threats

The Role of Mobility Barriers

• A company may decide to move from one

strategic group to another where the five

forces are weaker and higher profits are

possible

• Mobility barriers are similar to industry

entry and exit barriers and must be

weighed carefully

Industry Analysis:

Background

• Industrial economics: focus on “common

good” or competitive pricing

• Selected measures of competition (high, if)

– Level of concentration (low)

• Concentration – percent of total sales controlled by

largest 4, 8, 12 players in the industry

– Presence of economies of scale (high)

– Product differentiation (low)

– Natural barriers, i.e. fixed supply (low)

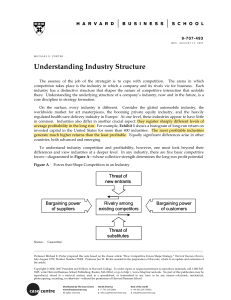

Porter’s Five Forces Model

Source: Adapted and reprinted by permission of Harvard Business Review. From “How Competitive

Forces Shape Strategy,” by Michael E. Porter, Harvard Business Review, March/April 1979 © by the

President and Fellows of Harvard College. All rights reserved.

Porter’s Five Forces Model

• An industry is competitive (if . . .)

– Risk of entry (high, low barriers)

– Intensity of Rivalry (high)

– Bargaining power of buyers (high)

– Bargaining power of suppliers (high)

– Presence of substitute products (yes)

• Complementors added later

Risk of Entry

• Natural barriers - oil fields, mines

• Barriers created over time –

– Brand loyalty (due to advertising, etc.)

– Cost advantage (due to cheap funds, control

of inputs, production)

– Economies of scale (production and

distribution susceptible to scale economies)

– Switching costs (microsoft to apple, oil to coal)

– Regulation

Intensity of Rivalry:

Industry characteristics

• Industry demand

– Is long-term demand growing? stagnant?

declining?

• Exit barriers

– Cost of shutting down business and/or moving

to another.

Intensity of Rivalry:

Due to industry structure

• Fragmented (large number of competitors)

– retailing

• Consolidated (4, 8, 12 competitors control

80% of the industry)

– cement

• Monopoly

– AT&T before the break-up

Power of Buyers:

High if . . .

• Numerous participants selling to few

buyers

• Buyers purchase large quantities

• Participants depend on a set of buyers for

a large percent of their business

• Buyers have low switching costs

• Buyers can purchase from more than one

• Buyers can threaten to enter the industry

Power of Suppliers:

High if . . .

• Product of suppliers few substitutes

• Profitability of supplier not dependent on

industry purchases

• Industry has switching cost problems if

they move to a new set of suppliers

• Suppliers can threaten to enter

• Industry can not threaten to enter

suppliers’ industry

Substitutes

• Distinction between competing and

substitute products

– Coke and Pepsi are not substitutes; they are

close substitutes but not within this definition

– Coffee is a substitute for tea or caffeine drink

– Substitute for a car when going to Las Vegas?

San Francisco?

– Substitute for a computer?

Complementors

• Adds value to an industry’s products

– Software industry and computer industry

• Others:

– Hotel and airlines

– Malls will group movies and restaurants in

same sector of the mall

– Mobile phones and developers of messages

to be texted

Industry Life Cycle Analysis

• The strength and nature of the five forces

change as an industry evolves through its

life cycle

• Managers must anticipate how the forces

will change as the industry evolves and

formulate appropriate strategies

Stages in the Industry Life Cycle

Industry Life Cycle

• Addresses industry demand (intensity of

rivalry)

• Emergence of industry standard normally

propels industry into growth phase

– At the development or embryonic phase,

different configurations compete

– As a standard emerges, industry demand

goes through a period of higher rate of growth

Shakeout: Growth in Demand

and Capacity

Limitations of Models for

Industry Analysis

• Life cycle issues

– The embryonic stage can sometimes be

skipped or short

– Industry growth can be revitalized

– The time span of the stages can vary

• Innovation and change

– Innovation can unfreeze and reshape industry

structure

– An industry may be hypercompetitive, with

permanent and ongoing change

Limitations of Models for

Industry Analysis (cont’d)

• Company differences

– The importance of company differences

within an industry or strategic group can

be underemphasized

– The individual resources and

capabilities of a company may be more

important in determining profitability

than the industry or strategic group

Exercise:

Strategy in Action

• 2.1 Japanese Brewing Industry:

– What were key barriers to entry into industry?

– How did these change and what remained to

be barriers for, say, an American brewer?

• 2.2 Breakfast Cereal Industry:

– Why was it necessary for pricing discipline to

emerge?

– Are consumers better off?

The Role of the

Macroenvironment

Rate of change?

•

•

•

•

•

•

Economic indicators – interest rates, etc.

Technological changes

Political/Regulatory

Demographic changes

Social forces

Are these in some order?

The Global and National

Environments

• Globalization of production and markets

– Lower barriers to cross-border trade and

investment

– National differences in the cost and quality of

factors of production

– “Home” and “foreign” markets and

competitors are blurring

– Intensified rivalry

– Intensified rate of innovation

– Many new markets are open

Additional Thoughts

• “Multi-nation” and “Global”

• Factor conditions, industry structure in other

countries allow for innovation

• These innovation often travel across borders

– The internet is obviously one reason

– Personal travel

– Companies finding limited growth options at home

• Entry barriers

– Tariff

– Non-tariff

National and Competitive

Advantage

Source: Adapted from M.E. Porter, “The Competitive Advantage of Nations,” Harvard Business Review,

March-April, 1990, p. 77.