C39CN_C4 - Heriot

advertisement

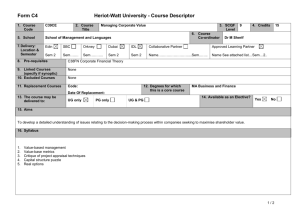

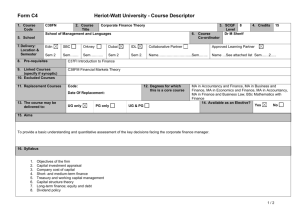

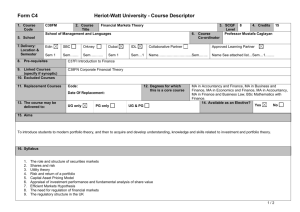

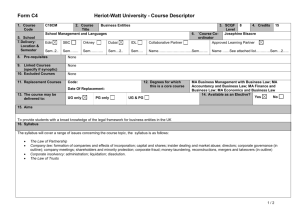

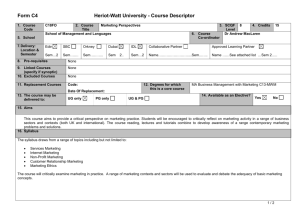

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C39CN 5. School School of Management and Languages 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem 1 Sem……. Sem……….. Sem 1 Sem 1. Name…………………….....Sem..…... Name See attached list…Sem 1 8. Pre-requisites 2. Course Title Mergers & Acquisitions 3. SCQF Level 6. Course Co-ordinator 9 4. Credits Dr J-P Marney C38FN Corporate Financial Theory 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only MA in Business and Finance UG & PG 14. Available as an Elective? Yes No 15. Aims To develop a detailed understanding of issues relating to mergers and acquisitions, and corporate restructuring. 16. Syllabus 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. M&A definitions, terminology Types of M&A, market for corporate control today Motives for M&A, economic and non-economic History of M&A, Merger Waves, UK & US. Analysis and explanations Why grow by acquisition? M&A vs organic growth Financial performance of merged companies: academic evidence, event studies The merger process; friendly deals, hostile takeovers Takeover defence strategies Valuation of companies Accounting for M&A, financing of acquisitions Implementing the deal; reasons for success and failure Regulation of the takeover market; UK and EU Strategic alliances, joint ventures Corporate restructuring, divestments, MBOs, corporate distress 1/2 15 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Scholarship, Enquiry and Research (Research-Informed Learning) After completing this course, students should be able to o o o o o o Personal Abilities discuss takeover trends, processes and defences, critically evaluate the various motives for mergers and acquisitions and evaluate the wealth effect, understand and explain the regulation of takeovers in UK and EU, discuss agency problems in takeover situations, evaluate corporate restructuring decisions from the shareholder’s point of view, evaluate financial distress and bankruptcy costs. Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT After completing this course, students should be able to o o o o construct and present, both oral and written, well balanced arguments, critically evaluate information gathered from a variety of sources, appreciate different sources of information, their relevance and value, and how they can be used in the area of finance, demonstrate a professional awareness of merger activity, not just in the UK, but also in Europe and the USA. 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Coursework Examination ALPs only: Examination 2 Hours 2 Hours Duration of Exam Diet(s) (if applicable) 30% 70% 100% None None Examination 2 hours Resit Examination 2 hours Resit 20. Date and Version Date of Proposal April 2011 Date of Approval by School Committee Date of Implementation September 2011 Version Number 2/2 1.0