ECONOMETRICS 1 BSC III SECTION C Practice questions Suppose

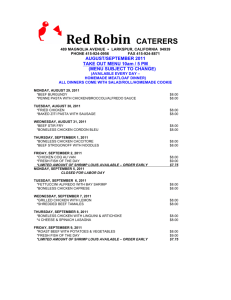

advertisement

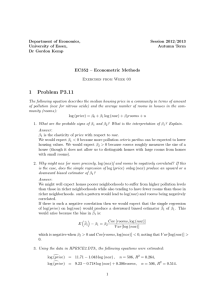

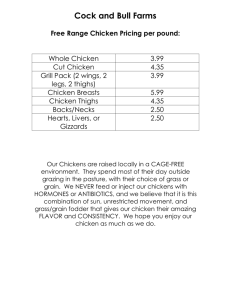

ECONOMETRICS 1 BSC III SECTION C Practice questions 1) Suppose you were asked to consider the following demand function for chicken: where Y = per capita consumption of chicken, lb, X2 = real disposable per capita income, $, X3 = real retail price of chicken per lb, ¢, X4 = real retail price of pork per lb, ¢, and X5 = real retail price of beef per lb, ¢. (i) (ii) (iii) What is the economic interpretation of β2, β3, β4, and β5? Hypothesize signs for each variable. Now suppose someone maintains that chicken and pork and beef are unrelated products in the sense that chicken consumption is not affected by the prices of pork and beef. What would this mean for the values of β4, and β5? Write down the constrained regression equation for the above assumption? Now suppose using the time-series data for U.S from 1960-1982, the following equations are obtained. (iv) R-squared= 0.9823 R-squared=0.9801 where the figures in parentheses are the estimated standard errors. Calculate the Fratio. Now state the F-critical at 5% significance level and state your decision with respect to the assumption made in part (iii). (v) 2) The following equation describes the median housing price in a community in terms of amount of pollution (nox for nitrous oxide) and the average number of rooms in houses in the community (rooms): (i) What are the probable signs of β1 and β2? What is the interpretation of β1? Explain. (ii) Why might nox [more precisely, log(nox)] and rooms be negatively correlated? If this is the case, does the simple regression of log(price) on log(nox) produce an upward or downward biased estimator of β1? Using the data in HPRICE2.RAW, the following equations were estimated: (iii) Is the relationship between the simple and multiple regression estimates of the elasticity of price with respect to nox what you would have predicted, given your answer in part (ii)? Does this mean that -.718 is definitely closer to the true elasticity than -1.043? Questions from Studenmund, Chapter 6: 3) Question 4 4) Question 6 5) Question 13