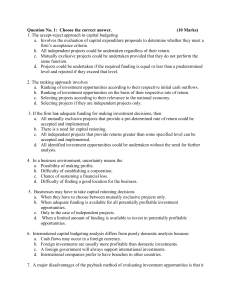

risk

advertisement