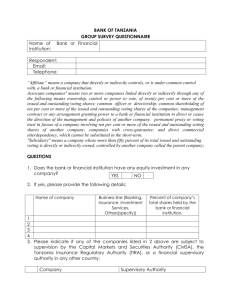

16 Treasury Stock Transactions of a Subsidiary

advertisement

Chapter 10 Consolidated Financial Statements: Special Problems McGraw-Hill/Irwin ©The McGraw-Hill Companies, Inc. 2006 Scope of Chapter 2 Changes in parent company’s ownership interest in a subsidiary. Subsidiary with preferred stock outstanding. Stock dividends distributed by a subsidiary. Treasury stock transactions of a subsidiary. Indirect shareholdings and parent company’s common stock owned by a subsidiary. Changes in Parent Company’s Ownership Interest in a Subsidiary Changes in a parent company’s ownership interest occur in the following scenarios: Parent company acquisition of minority interest. Parent company sale of a portion of its subsidiary common stockholdings. Subsidiary’s issuance of additional shares of common stock to the public. 3 Parent Company Acquisition of Minority Interest Purchase accounting is applied to: Parent company’s or subsidiary’s acquisition of all or part of minority interest in net assets of the subsidiary. Even if business combination has been accounted for as a pooling prior to June 30, 2001 when pooling was denied to subsequent business combinations by the FASB. Note: Any other approach would be inconsistent with the basic premises of pooling accounting. 4 Parent Company Acquisition of Minority Interest: Accounting Treatment 5 If the parent pays more than carrying amount for the minority interest, the difference is attributed to goodwill. If the parent company pays less than carrying amount for the minority interest, the difference, generally immaterial, may be treated as an offset to goodwill recognized in prior acquisitions of the subsidiary's common stock. Parent Company Sale of a Portion of its Subsidiary Common Stockholdings 6 A parent company may be able to control its subsidiary effectively without a majority ownership. It may sell portions of its subsidiary’s common stock for cash or other business combinations. Such a sale involves accounting for and income statement display of the disposal of a business segment. Accounting for this sale is similar to accounting for disposal for any non-current asset. Parent Company Sale of a Portion of its Subsidiary Common Stockholdings: Accounting Treatment 7 The carrying amount of the common stock sold is removed from the parent’s Investment in Subsidiary common stock ledger. The difference between carrying amount and cash/fair market value of other consideration received is recognized as gain/loss on disposal of stock. This gain/loss is not an extraordinary item under generally accepted accounting principles. Specific identification is required to account for the carrying amount if control is acquired by installment purchase. Subsidiary’s Issuance of Additional Shares of Common Stock to the Public 8 The parent company may instruct the subsidiary to issue new common stock to obtain funds. The parent company and minority stock holders waive their preemptive right to obtain new stock. Subsequently the parent company’s ownership percentage changes. The funds obtained is available to the consolidated group via intercompany transactions. Subsidiary’s Issuance of Additional Shares of Common Stock to the Public: Accounting Treatment A subsidiary's issuance of additional shares of common stock to the public results in: 1. 2. 9 Non-operating gain or loss to the parent company. An increase in the minority interest in net assets of the subsidiary. The amounts are computed by comparing the parent's and minority stockholders' interests in the net assets of the subsidiary before and after the subsidiary's issuance of common stock to the public. Subsidiary’s Issuance of Additional Shares of Common Stock to the Parent Company The Subsidiary may issue additional common stock to the Parent Company directly. This may happen if the Parent Company desires to increase its investments in the Subsidiary or 10 If the Parent Company desires to reduce the influence of the minority stock holders. Subsidiary’s Issuance of Additional Shares of Common Stock to the Parent Company: Accounting Treatment Results in: 1. 2. 11 A non-operating gain or loss to the parent company A change in the minority interest in net assets of the subsidiary. Computation of these amounts is carried out in the same way as for subsidiary issuances of common stock to the public. Subsidiary with Preferred Stock Outstanding Some combinees in a business combination have outstanding preferred stock which lead to: 12 Parent company acquiring all of the subsidiary’s preferred stock together with all/majority of it’s common stock. Parent company acquiring less than 100% of the subsidiary’s preferred stock. Subsidiary with Preferred Stock Outstanding: Accounting Treatment If a parent company does not acquire all the outstanding preferred stock: In accordance with the going-concern principle: – the amount of the lump-sum acquisition cost of the investment in the subsidiary that is allocated to the preferred stock is based on the call price of the preferred stock. – The cost assigned to the investment in the subsidiary's preferred stock does not enter into the measurement of goodwill. 13 Subsidiary with Preferred Stock Outstanding: Accounting Treatment The minority interest of preferred stockholders in the net assets of the subsidiary is measured by the call price of the preferred stock. The parent company's investment in the subsidiary's preferred stock is accounted for: 1. 2. 14 By the cost method, unless the subsidiary passes dividends on cumulative preferred stock. In that case, the parent uses the equity method of accounting for the passed dividend. Stock Dividends Distributed by a Subsidiary Stock dividends declared by a subsidiary for which the parent company uses the equity method of accounting do not require any journal entries by the parent. The working paper elimination reflects the post-stock dividend balances of the subsidiary's stockholders' equity ledger accounts. Note: AICPA has stated that the retained earnings in the consolidated financial statements should reflect the accumulated earnings of the consolidated group not distributed to the shareholders of, or capitalized by, the parent company. 15 Treasury Stock Transactions of a Subsidiary Treasury stock owned by a subsidiary on the date of the business combination is treated as retired stock in the preparation of consolidated financial statements. A working paper elimination is prepared to account for the retirement . Methods used: 1. 2. 16 Par Stated Value Indirect Shareholding and Parent Company’s Common Stock Owned by a Subsidiary Indirect/Reciprocal shareholdings are involved where the following relationships exist: Indirect: 1. 2. 17 One subsidiary and the Parent company jointly owning a controlling interest in another subsidiary. A subsidiary company itself being the parent company of its own subsidiary. Reciprocal: Subsidiary’s ownership of shares of the parent company’s common stock. Indirect Shareholding and Parent Company’s Common Stock Owned by a Subsidiary: Accounting Treatment 18 Indirect Ownership: Equity method of accounting should be applied for the operating results of the various subsidiaries. Reciprocal Ownership: Treasury Stock treatment should be applied for consolidation purposes.