File - Alistair Bean & Assoc's Financial Services Limited

Alistair Bean & Assoc’s Financial Services

Limited.

Quarterly Newsletter Report – to September 2013

Around the World in 31 Days…

We have just returned from our amazing journey. I am happy to report that the World is thriving with Industry (and we had a fantastic time on our

Honeymoon as well).

Hawaii was its usual buzz of tourism, airports and the shops were full. Roads were busy and their economy carries on as a major world destination.

One of my highlights was that I got to save a Turtle that had fishing line entwined all around it’s flipper and a hook in its mouth – it’s hook becomes a permanent piercing but I was able to unwind and cut the line from its flipper so that it could swim freely and hopefully the tumour that had grown on its’ shoulder would now decrease. He seemed quite happy that I was able to assist and he gave me the thumbs up and swam away… I thought this experience to be a great privilege

Italy clearly showed that The Recovery in Europe was well underway.

Streets were crowded, Retail, Restaurants, Shipping and Ports were full,

Roads were crammed with Trucks and Trains never stopped. The Culture,

Art, Food and Wine met all my expectations. There were many crowded

Piazza’s, Museums shopping Malls and art Galleries. To see original art treasures was truly jaw dropping. I recall that I didn’t quite like Florence until we walked into the Piazza Della Signoria and saw all the sculptures by

the likes of Michelangelo, Donatello and many others, that I became awestruck and could have just stood there for hours taking all this in, not to mention The Duomo, The Ponte Vecchio, The Uffizi and so on.

Too many more sights to mention in Italy but we also got our 15 minute view of The Last Supper and every sight in Rome…Colosseum, St. Peters and etc., etc.

Hong Kong, the world’s business hub, is an example of almost complete efficiency. Whilst there, they announced that they were to increase the size of their airport. It currently caters for 400,000 flights per year, at the completion of this exercise they will be able to manage 600,000 flights, and a 50% increase to what is already one of the world’s largest economies can see nothing but exponential growth. We saw many sights here including the

Big Buddha, Hong Kong Disney and even The HSBC Building, which is quite a piece of Architecture.

It was nice to be home and witness that the world is in good stead, once again I realised that while the Planet is full of wonder, New Zealand with our

Clean and relatively quiet streets is simply paradise and we still live in the best place in the World.

In this Issue….

The Lay and the Technical

Market Summary

ABAFS 10

KiwiSaver

Insurance

Referral Rewards

Conclusion – The Short-Term and Long-Term

The Lay and The Technical

My intention is that I will always use as much of “The Lay” as possible.

I’m required for compliance reasons to also use “The Technical” so at the end of reach report I will provide a technical information. Please always come to me if you would like a definition of any Technical Term that I include in my report.

Market Summary

Currently The US Govts. Debt ceiling is affecting the entire world’s economies, this is more nuisance than anything else because the extreme it suggests is that America will go bankrupt, this is not going to happen but in the meantime its adverse effect negatively affects portfolio values. Panic has occurred and values have gone down but already as soon as they say they are going to agree you see immediate increases and even a one day record climb since January of this year – so like I say a ‘nuisance’, my recommendation is that you ignore this news until it’s over.

June was an excellent month while July and September saw some international nervousness and weakness in currencies (while the NZ dollar remained strong on higher domestic vs. international relative interest rates and other influences) all while waiting for the US debt ceiling issue to resolve.

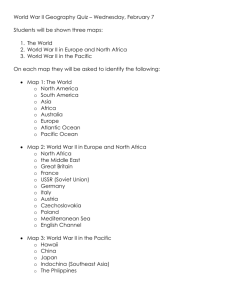

ABAFS Shares of note over the period 1 June to 30 Sept were

Air New Zealand $1.46 to $1.51 – more than doubled their profit and increased their shareholding in Virgin Australia

Auckland Airport $3.01 to $3.31 – Profit up 25.1%, passenger numbers now at 14.5million

Infratil

$538million

$2.28 to $2.47 – Announced earnings of

Ryman $6.59 to $6.95 – Commenced Construction in

Melbourne and awarded Company of the Year

Tourism Holdings $0.62 to $0.74 – Strong USA Profit and Merger of

Kea and United Campervans complete

Other Portfolio Investments of note were

PPS Australian Equities $1.99 to $2.03

$74.60 to $77.68 SP100 iShares

ABAFS 10

The ABAFS 10 is the Ten New Zealand Shares that I have personally selected for each portfolio. All Clients had the opportunity within your

Investment Plans to either choose 10 NZ Shares that I selected and recommended for you or the PPS NZ Equity Fund. All Clients chose the 10 Shares that I selected.

I have applied a simple mathematical equation to value this new Index and it is the total value of each individual share added together to measure its’ increase over time as detailed below

Index Value as at 1 July 2013 26.275

Index Value as at 30 Sept. 2013 27.705

For the quarter this has been a return of approx. 5.44% or 21.76%pa had you been invested in only the above shares from the beginning of

June to Sept 2013. This gives me great confidence that overall I have selected New Zealand Shares which I believe are providing value and growth opportunities for you. (Choosing one asset class only reduces diversity and is subject to relative Volatility)

This Quarter I have purchased Mighty River Power Shares for most clients. I have purchased MRP because the Issue price was originally

$2.50 and I have managed to purchase these between $2.20 and

$2.30 so I consider this to be a premium discount for a very secure company that has already provided a dividend for you and future dividends also look of real value. I used a combination of partial sale of previous shares that I purchased for you that I sold at a profit and also reduced Fixed Interest holdings. Individual Clients have had individual transactions all relative to original purchases and I am happy to detail these movements to you at your request and also at

Individual Client Review meetings.

I continue to intend on providing information in detail on each of the

ABAFS companies over the coming quarters, this month in detail is a commentary on Pacific Edge Limited

I selected Pacific Edge Limited for its growth potential. It was originally established out of Otago University and became a company with its unique discovery of non-invasive bladder cancer testing. As I write today they have just announced to the NZ Sharemarket that they have secured a network agreement with US Company, FedMed providing 40 million Americans access to their cancer tests and this has seen the share price increase from 50cents to 70cents and currently settling back at 67cents with over 2.1million shares traded today.

This is the announcement to the market which also further details

Pacific Edge Limited as a company.

PE Agreement with National Provider Network FedMed

10:20am, 16 Oct 2013 | GENERAL

15 October 2013

Pacific Edge Agreement With National Provider Network FedMed Gives 40 Million Americans

Access to Cxbladder

Dunedin, New Zealand and Hershey, PA

Pacific Edge (NZX:PEB), a cancer diagnostic company leading in the development and commercialisation of molecular diagnostic tests, has signed an agreement with FedMed, a national preferred provider network in the United States, to make Cxbladder available to an additional 40 million Americans.

The agreement with FedMed Inc has been finalised with Pacific Edge’s subsidiary in the USA,

Pacific Edge Diagnostics USA (PEDUSA).

The agreement provides FedMed’s contracted insurance carriers, third party administrators, health and welfare funds, and self-insured health plans with access to Cxbladder. More than 40 million Americans have access to FedMed’s National Provider Network of over 550,000 physicians, 4,000 hospitals and 60,000 ancillary care providers nationwide.

Pacific Edge Chief Executive Officer, David Darling, says the agreement is further recognition for Cxbladder and its ability to enable clinicians to detect urothelial carcinomas, including cancers of the bladder, from a small urine sample. Combined with the simple to use Urine

Sampling System, the Cxbladder technology makes detection of bladder cancer a more effective proposition for both clinicians and patients alike.

The Chief Executive Officer of PEDUSA Jackie Walker says: “We are enthusiastic about the continued market acceptance of our Cxbladder test for bladder cancer detection.The Cxbladder proposition as a quick, cost effective, non-invasive and highly accurate cancer detection test is particularly appealing to US healthcare professionals, patients, and insurers who can see its positive benefits”.

“This is a big step forward for Cxbladder and further supports our direct marketing efforts to clinicians and cancer patients.” Negotiations are underway with other provider networks and insurers as well as integrated health systems, Medicare and Medicaid.

“Gaining traction in the world’s largest health market is generally acknowledged as a lengthy process for new products and therapies. However, the signing of the FedMed partnership,

coming so soon after our CLIA certification, is a sign of significant and rapid progress by Pacific

Edge in this market.”

Additionally, Pacific Edge has seen significant commercialisation progress over the last 12 months in New Zealand with the successful completion of clinical validation studies and the signing of its first client District Health Boards.

The commercialisation program for Cxbladder has hit all its milestones on time and within budget in the lead-up to the official launch in the US in July 2013. It has gained recognition from clinicians globally from the publication of the peer reviewed multi-centre international study in the Journal of Urology in September 2012.

PEDUSA’s custom built, commercial laboratory was completed in September 2012 to process

Cxbladder samples, was certified earlier this year by CLIA to enable the laboratory to offer

Cxbladder as a Laboratory Developed Test (LDT) to clinicians and physicians.

“The building blocks are in place, sales people are active in the market and Pacific Edge remains confident of reaching its target of revenues of $100 million from Cxbladder sales in the USA within five trading years,” David Darling says.

There are approximately 10,500 urologists in the US with an expected annual seven million cases of patients with blood in their urine (hematuria) which will result in approximately one million of those patients receiving urological evaluation to determine if they have bladder cancer.

Currently more than $1 billion a year is being spent in the US investigating this hematuria.

For more information contact:

David Darling

Chief Executive Officer

Pacific Edge Ltd

P: +64 (3) 479 5800

ABOUT PACIFIC EDGE

Pacific Edge Limited (NZX: PEB) is a New Zealand based cancer diagnostic company specialising in the discovery and commercialisation of diagnostic and prognostic technology for the early detection and monitoring of cancer.

Products in development and in clinical trials are accurate and simple to use genomic and proteomic tools for the earlier detection, improved characterisation and better management of gastric, bladder, colorectal cancers and melanoma. The company has recently completed and released its first product for the detection of bladder cancer, Cxbladder, and is actively marketing the product to urologists in New Zealand, Australia and soon to be Spain and the US. www.pacificedge.co.nz

ABOUT PACIFIC EDGE DIAGNOSTICS

Pacific Edge takes its exciting cancer detection tests to market through its wholly owned subsidiaries, Pacific Edge Diagnostics NZ Ltd and Pacific Edge Diagnostics USA Ltd, and selected commercial partners in Australia and Spain, Healthscope and Oryzon respectively. www.pacificedgedx.com

ABOUT Cxbladder

Cxbladder is a proprietary, accurate molecular diagnostic test that enables the non-invasive detection of bladder cancer from a small volume of urine. It provides general practitioners and urologists with a quick, cost effective and accurate measure of the presence of the cancer, and provides urologists with the opportunity to reduce their reliance on the need for invasive tests such as cystoscopy. The recently published, Journal of Urology in September 2012, multi-centre international clinical study recruited 485 patients from Australia and New Zealand.

Results show that Cxbladder out-performed all of the benchmark technologies in the clinical trial and detected nearly all of the tumours of concern to a urologist; At a performance of 82% sensitivity and 85% specificity the test sees 100% of T1, 100% of T2, 100% of T3, 100% of Tis and 100% of upper urinary tract cancers as well as greater than 95% of high grade tumours. www.cxbladder.com

KiwiSaver

I consider KiwiSaver to be an absolute essential to those who qualify – it’s free money from the Government!! Anyone who is under 65 should have KiwiSaver so if you, your family or any of your acquaintances do not have KiwiSaver contact me immediately to arrange.

Also if you would like me to report and provide printouts of your existing KiwiSaver that you may have, let me know and we will discuss further.

Insurance

Insurance is an absolute essential to protect wealth, health, assets and also forms part of Business and Trust Succession Planning.

Part of my service is to Offer Personal Insurance Covers to all my Clients and their Families and Businesses. I have had many year’s experience with

Insurance and specialise in Personal Business Covers and also High Risk

Personal Covers for Clients that perhaps are hard to insure.

I have Signed Agency Agreements with Asteron Life, Fidelity Life and

Partners Life. I would like to offer all Clients the opportunity for me to quote on any current covers you have to ensure that you are getting the best premiums.

I offer Life, Trauma, Total and/or Temporary Disablement Covers, Income

Protection, Mortgage Protection and Health Covers and are able to discuss various other covers including Cancer Cares and Funeral Covers.

Again I’d be delighted to hear from either Yourselves, Your Children or any other Family Members and Friends.

Referral Rewards

Bottles of Moet for Investment or Insurance Referrals !

Last quarter I rewarded 6 Clients for either referrals to new Clients or the

New Client themselves. This was very successful so I am to extend to

December, more bottles of Moet to anyone who refers a new Client to me and also to the new Client.

I will also reward for any Insurance referral and the new Client.

Conclusion – The Market is continually dynamic

Our Currency is still very strong reflecting the strength of the NZ Economy.

China announced this week that their currency, The Yuan, set a record high.

This suggests to me that while worldwide currencies are generally all low to help their economies, eventually they will have to increase as we are all buying from the Chinese – it’s not going to happen tomorrow but it will happen primarily to help purchasing power (one dreads to think what our petrol prices would be if our currency wasn’t so strong).

The strength of our currency allows us to purchase overseas investments at excellent prices. This combined with the Panic of The US allows me buying opportunities on your behalf which I continually look out for on a daily basis while managing your portfolios.

I will have your quarterly reports out to you this week. Thank you for your continued patronage.

Finally a Personal moment, as many of you know, Virginia and I were married on Friday 6 th September and as mentioned above we had an amazing Honeymoon, I thought you may like to see some wedding photo’s

Please feel free to discuss any of the above with me, I plan to visit you all before Xmas.

Have a great Spring

Warm Regards,

AL.

The Technical……

*Market Summary

Rising geopolitical concerns in the Middle East and a continued focus on the potential scaling back of asset purchases by the US Federal Reserve (the Fed) weighed on financial markets in the month of

August. The MSCI All Country World Index fell -2.0% in local currency terms. Returns for unhedged NZbased investors (+0.8%) were assisted by the weakening NZ dollar.

In local equity markets, Australia outperformed New Zealand for the second straight month. Stocks were flat in NZ, while the Australian market rose 2.5%, backed by the recovery in the more cyclical sectors such as consumer discretionary, industrials and materials. These sectors were assisted by the release of more positive economic indicators in China, which helped ease concerns over the extent of the slowing in economic activity in this important economy.

Global listed property stocks fell during the month, with higher interest rates yields weighing on the sector. The UBS Global Listed Property Index was down -5.6%. The Australian listed property sector was down -0.2%, while NZ listed property fared better to end the month up 1.0%.

Global government bonds were down -0.1%, with markets coming to grips with the prospect of a reduction in the Fed’s bond purchase program. The US 10-year bond reached a fresh two-year high during the month. NZ government bonds were down -1.1% as longer-dated bond yields followed their

US counterparts in moving higher. An upward revision to Fonterra’s dairy forecast was the latest in a string of positive data prints for New Zealand. This has lifted the outlook for local interest rates, despite the Reserve Bank of New Zealand’s preference to avoid tightening monetary policy on concern that it could have an unwelcome effect on the NZ dollar.

US Federal Reserve tapering still front of mind for investors…

Investors again factored in the likelihood that the Fed will soon begin to taper their Quantitative Easing

Program (QE). The minutes from the latest FOMC meeting in August, while generally neutral in tone, were interpreted by many as being consistent with the Fed commencing the tapering process in

September in what has been dubbed as SepTaper.

Economic data was also, for the most part, seen as being consistent with the Fed reducing stimulus, despite signs of weakness in new home sales, as the number of new people claiming jobless benefits declined to its lowest level since 2007. At the same time economic data in Europe showed significant improvement in the month with GDP results released confirming that the euro region had emerged from recession in the June quarter. This saw markets scale back the potential for additional stimulus by

European central banks over the period ahead.

The focus on SepTaper saw government bond yields move higher in half of the month, continuing their recent trend. Concerns over the Middle East late in the month saw yields ease lower to an extent though. This rise was broad-based across most developed economies, with US 10-year bond yields rising to a two-year high of 2.90% before ending the month 19bp higher at 2.77%. By contrast, the improvement in economic activity in Europe saw bond yields fall in Italy and Spain.

Fragilities remain in emerging markets…

Despite the more positive economic data in China, emerging market shares continued to lag developed markets as expectations for a reduction in Fed stimulus (and eventually the removal of stimulus), along with concerns over public policy settings and external balances in some countries saw continued investor outflows, especially in Asia. This was particularly notable in India and Indonesia where equity markets and currencies both fell markedly.

The primary consideration here is what effect a sharp deterioration in financial and economic conditions in these countries could have on conditions in the region, and secondly what effect could contagion to the rest of the region have on the recovery unfolding in developed markets. At this stage, it seems the risk is relatively contained, however the situation should not be underestimated and will be a key focus for investors in coming months.

Oil prices may hinder the US recovery…

Meanwhile, concerns over the Middle East escalated, given significant unrest in Egypt and more recently in Syria. This drove crude oil prices higher by more than 5% and weighed on sentiment as markets began to factor in the possibility of Western military intervention in Syria.

The flow-on effect that higher oil and petrol prices can have on disposable income is a risk that should not be ignored. Over the last five years there have been a number of stalls in the economic recovery in the US that arguably were preceded by a period of high oil prices. It is of some comfort that prices are largely being driven by increased demand rather than a lack of supply. However, should the conflict in

Syria persist for an extended period or ignite broader tensions in the Middle East, then prices could become uncomfortably high.

Aussie dollar remains under pressure

Finally, in Australia, the Reserve Bank of Australia (RBA) lowered the cash rate by a further 25bp to

2.50% at the start of the month. Despite the RBA retaining a bias to ease policy further, Australian bond yields moved higher in lock step with global bond yields. Along with the prospect for Fed tapering, this saw the AUD move a further -0.6% lower to just above US$0.89. The NZD/AUD cross has risen 7.2% over the last six months. This helped drive the NZ Trade Weighted Index (TWI) above 76, approaching the record highs reached earlier in the year.

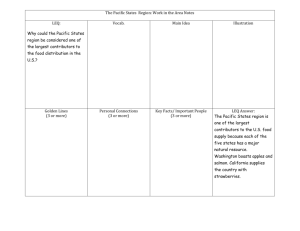

Major asset class monthly performance

25%

20%

15%

10%

5%

0%

-5%

Major asset class year-to-date performance

1%

0%

-1%

-2%

-3%

-4%

-5%

-6%

*Sourced from OneAnswer

Alistair Bean Grad Dip Bus Stud., AFA FSP 29347

Alistair Bean & Assoc's Financial Services Limited alistair.bean@abafs.co.nz www.abafs.co.nz cell: 021 552-587 ph: 03 3556-360

A copy of my Personal Disclosure Statement is available on Request

Disclaimer: Important information

To the maximum extent permitted by law Alistair Bean & Assoc's Financial Services Limited disclaim any liability or responsibility to any person for any direct or indirect loss or damage that may result from any act or omission by any person in relation to, or in reliance on, the information supplied in this document

(“Document”).

Neither Alistair Bean & Assoc's Financial Services Limited nor any of their respective directors, or any other person guarantees, either partially or fully, the capital value or performance of any Investments mentioned in the above document.

This Document is not intended to constitute, does not constitute, and should not be construed as constituting, investment advice nor is it a substitute for commercial judgment or other professional advice. Investors, or potential investors, in the Funds should: (i) conduct independent due diligence on any of the Funds; and (ii) obtain independent investment and professional advice, prior to acting in reliance on this Document.

This Document has been provided for information purposes only and is subject to change. The content of this

Document is intended to be of a general nature and does not take into account an investor’s, or potential investor’s, financial situation, investment objectives, or risk tolerance.

Past performance is not indicative of future performance. The actual performance realised by any given investor:

(i) will depend on many things; (ii) is not guaranteed; and (iii) may be negative as well as positive. Unless otherwise indicated, returns are shown after Fund expenses and before tax. This is represented by the change in unit price plus any applicable tax credits.

No representation or warranty is given as to the accuracy or completeness of any of the information provided in this Document.

Investments in any of the Funds referred to in this Document are subject to many investment risks including possible delays in repayment, loss of income, or the total loss of the principal invested.

This Document is not intended as, and is not to be taken as, an offer or solicitation with respect to the purchase or sale of any interest in the Funds.

This Document is intended for investors who understand the investment risks associated. Some, or all, of the

Investments mentioned in this Document may not be suitable for certain investors. Investors, or potential investors, should consider whether: (i) an investment is appropriate for their risk profile; and (ii) they will meet the suitability requirements relating to such investments.

The information contained in this Document is intended only for the person or entity to which it is addressed. If you have received this Document in error please contact Alistair Bean & Assoc's Financial Services Limited.

No part of this Document may be reproduced, provided or distributed without the prior written consent of Alistair

Bean & Assoc's Financial Services Limited.