Corporate Taxes & Capital Structure?

advertisement

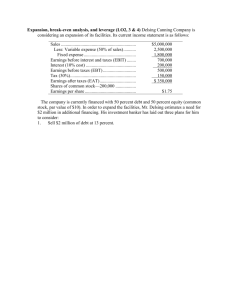

Corporate Finance-II EMBA Winter Semester 2009 Lahore School of Economics Financial leverage & Capital structure policy Chapter-17 Financial leverage & Capital structure policy Learning Objectives Capital structure? Effect of Financial Leverage? M&M Propositions? Corporate Taxes & Capital Structure? Optimal Capital Structure? Bankruptcy Process & Costs? The Capital Structure Question What is it?…. How much Debt relative to Equity should a firm have? What should be the Borrowing policy? Capital Structure Restructuring.. If a firm wants to increase D/E ratio (increase borrowing) What could it do…? (keeping its assets same) Capital Structure Restructuring.. If a firm wants to increase D/E ratio (increase borrowing) What could it do…? (keeping its assets same) Issue Bonds & use the cash proceeds to buy Shares! Capital Structure Restructuring.. If a firm wants to decrease D/E ratio (reduce borrowing) What could it do…? (keeping its assets same) Capital Structure Restructuring.. If a firm wants to decrease D/E ratio (reduce borrowing) What could it do…? (keeping its assets same) Issue Stock & use the cash to pay off Debt! Firm value & Stock Value – An Example The Market value of JJ Sprint company is $1000. The company currently has no debt, & JJ Sprint’s 100 shares sell for $10 each. Further suppose that JJ Sprint restructures itself by borrowing $500 & then paying out the proceeds to shareholders as an extra dividend of $5 per share. Firm value & Stock Value – An Example Debt plus Dividend No Debt Debt Equity Firm Value I II III $0 $500 $500 $500 1000 750 500 250 1000 1250 1000 750 Debt plus Dividend I Equity Value reduction II III -250 -500 -750 Dividends 500 +500 500 Net Effect +250 0 -250 Firm Value & Stock Value This means.. Change in the value of the firm is the same as the net effect on the stockholders. Financial Managers can try to find the Capital structure that maximizes the value of the firm Capital Structure How should the firm approach this decision?.. Maximization of shareholder value Maximization of Share price Same as: Maximizing the whole value of the Firm! Capital Structure & The cost of Capital Alternatively: Firm should focus on Minimizing WACC. As, WACC is the appropriate discount rate for the firm’s overall Cash flows. Because values & discount rates move in opposite directions: Minimizing WACC should result in: Maximizing Value! Capital Structure & The cost of Capital And so.. Optimal Capital Structure (D/E ratio) represents lowest possible WACC Also called: TARGET Capital Structure The effect of financial leverage Effects of Financial Leverage?.. Financial Leverage refers to the extent to which a firm relies on Debt. More Debt means MORE leverage THE Effects of Financial Leverage - Example We consider case of company X which has no debt & is considering restructuring to include debt in its capital structure. We look at DEBT & NO DEBT situations Taxes are ignored THE Effects of Financial Leverage - Example Current Assets Proposed $8,000,000 $8,000,000 0 4,000,000 8,000,000 4,000,000 0 1 Share Price 20 20 # of Shares 400,000 200,000 10% 10% Debt Equity Debt-Equity Ratio Interest Rate THE Effects of Financial Leverage - Example Current Capital Structure: No Debt Recession EBIT Normal Expansion $500,000 $1,000,000 $1,500,000 Interest ? ? ? Net Income ? ? ? ROE ? ? ? EPS ? ? ? THE Effects of Financial Leverage - Example Current Capital Structure: No Debt Recession EBIT Normal Expansion $500,000 $1,000,000 $1,500,000 0 0 0 500,000 1,000,000 1,500,000 ROE 6.25% 12.5% 18.75% EPS 1.25 2.50 3.75 Interest Net Income THE Effects of Financial Leverage - Example Current Capital Structure: Debt - $4 Million Recession EBIT Normal Expansion $500,000 $1,000,000 $1,500,000 Interest ? ? ? Net Income ? ? ? ROE ? ? ? EPS ? ? ? THE Effects of Financial Leverage - Example Current Capital Structure: Debt - $4 Million Recession EBIT Normal Expansion $500,000 $1,000,000 $1,500,000 Interest 400,000 400,000 400,000 Net Income 100,000 600,000 1,100,000 ROE 2.50% 15.50% 27.50% EPS 0.50 3.00 5.50 THE Effects of Financial Leverage - Example Leverage & EPS EPS No Debt EPS Debt $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 Recession Expected Expansion THE Effects of Financial Leverage - Example Leverage & ROE ROE No Debt ROE w /Debt 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% Recession Expected Expansion THE Effects of Financial Leverage - Example Leverage & Net Income Net Income No Debt Net Income w/Debt $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 Recession Expected Expansion EPS Becomes sensitive to Leverage EPS & EBIT Slopes (Leverage) EPS No debt 5 EPS w /debt Debt Advantage 4 3 EPS 2 Debt disadvantage 1 0 -1 0 400000 800000 -2 -3 EBIT 1200000 THE Effects of Financial Leverage - Example Finding the BE point.. With NO Debt… EPS = EBIT/400,000 shares With DEBT EPS = (EBIT-$400,000 / 200,000 shares) Break even point is the point where EBIT is such that EPS under both scenarios is same: Break Even EBIT = ? THE Effects of Financial Leverage - Example Finding the BE point.. With NO Debt: EPS = EBIT/400,000 shares With DEBT: EPS = (EBIT-$400,000 / 200,000 shares) Break even point is the point where EBIT is such that EPS under both scenarios is same: EBIT = 800,000 & EPS = $2 This is the indifference point Capital Structure & Break Even Point Leverage is … Beneficial if EBIT is ABOVE Break-even EBIT & Not beneficial if EBIT is BELOW Break-even EBIT Capital Structure & Break-even point - Example Suppose ABL has decided to increase its D/E ratio. It wants to increase Debt from Rs 1,500,000 to 10,000,000. The interest rate on this will be 16%. ABL has 750,000 shares outstanding which sell for Rs 85. If the restructuring increases the ROE. Calculate the indifference point or BE point for ABL! Capital Structure & Break-even point - Example Step 1: Calculate Interest Expense under both scenarios: Interest expense current capital structure: = Debt * Interest Rate = 1500000*0.16 = 240000 Interest Expense NEW Capital Structure: = Debt * Interest Rate = 10000000 x .16 = 1600000 Capital Structure & Break-even point - Example Step 2: Calculate No. of shares outstanding under both scenarios Total # of shares under Current Capital structure = 750,000 # of shares repurchased under New Capital structure: = Increase in Debt / Price per share = (10M – 1.5M)/85 = 100,000 Total # of shares outstanding under new capital structure = Already Outstanding Shares – Shares Repurchased = 750,000 – 100,000 = 650,000 Capital Structure & Break-even point - Example Step 3: Getting Break-even EBIT Break-even point is the point where EPS under both scenarios is equal: EPS WITH Current Capital Structure: = (EBIT – 240,000)/750,000 EPS with NEW capital Structure: = (EBIT – 1.6mm)/650,000 Capital Structure & Break-even point - Example Step 3: Getting Break-even EBIT Break-even point is the point where EPS under both scenarios is equal: Break-even EBIT: (EBIT-240000)/750,000 = (EBIT – 1.6M)/650,000 EBIT – 1.6M = 650000/750000 x (EBIT – 240000) EBIT – 1.6M = (0.866 EBIT) – 207840 0.134 EBIT = 1.6M – 207840 EBIT = 10,389,254 Capital Structure & Break-even point - Example Verifying EPS: If EBIT is 10,389,254 then using equations we get: No Debt: EPS = (10389254 - 240000)/750,000 = 13.53 Debt: EPS = (10389254 – 1.6M)/650,000 = 13.52 Capital Structure Leverage Conclusions.. Capital Structure Leverage Conclusions.. 1. Effect of Leverage depends on EBIT. When EBIT is high, leverage is beneficial 2. 3. Leverage increases returns (indicated by ROE & EPS) Risk increases with Leverage (variability of ER’s) Corporate Borrowing & Home Made Leverage Home Made Leverage: The use of personal borrowings to change the overall amount of financial leverage to which the individual is exposed. Home Made Leverage Example Proposed Capital Structure Recession EPS Earnings for 100 shares Expected Expansion 0.50 3.00 5.50 50 300 550 Net Cost = 100 shares * $20 = $2000 Original Capital Structure & home made Leverage EPS 1.25 2.50 3.75 Earnings for 200 shares 250 500 750 Less: Interest @ 10% 200 200 200 Net Cost = (200 shares *20) – Amount Borrowed = 2000 Corporate Borrowing & Home Made Leverage 1. Home Made Leverage simply means, the investors can replicate the firm’s capital structure by using the same D/E ratio’s. 2. And investors can adjust their D/E to get different payoffs. Thus, this implies… The firm’s choice of capital structure does not matter! Therefore, The stock price should not be affected by capital structure, although the payoff’s do. ASSIGNEMENT # 4 (5Quetsions) Q1: XYZ Corp has no debt outstanding & a total Market Value of $150,000, EBIT is projected to be $15,000, if economic conditions are normal. If there is strong Expansion in the economy, then EBIT will be 30% higher. If there is recession, then EBIT will be 60% lower. XYZ is considering a $60,000 debt issue with a 5% interest rate. The proceeds will be used to repurchase shares of stock. There are currently 2500 shares of stock outstanding. Ignore taxes for this problem. A) Calculate EPS under each of the three economic scenarios before any debt is issued. Also, calculate the percentage change in EPS when the economy expands or enters a recession. B) Repeat Part (a) assuming that XYZ goes through with recapitalization. What do you observe? Q#1 (Continued) C) D) E) F) Repeat part (a) & (b) assuming XYZ Corp has a tax rate of 35%. Suppose XYZ Corp has a Market to Book ratio of 1. Calculate ROE under each of the three economic scenarios before any debt is issued. Also, calculate percentage change in ROE for economic Expansions & Recession assuming No taxes. Repeat Part (D) assuming the firm goes through recapitalization. Repeat part (D) & (E) assuming the firm has a tax rate of 35%. Q#2 Break – EVEN EBIT A) B) C) Malang Fabric Manufacturing is comparing two different capital structures, an all equity plan (Plan I) & a levered plan (Plan II). Under Plan I, Malang would have 150,000 shares of stock outstanding. Under Plan II there would be 60,000 shares of stock outstanding & 15 million Rupees in Debt outstanding. The interest rate on debt is 10% and there are no taxes. If EBIT is 2million Rupees which plan will result in the higher EPS? If EBIT is 7million Rupees, which plan will result in the higher EPS? What is the Break – Even EBIT? Q#3 Break – Even EBIT with Taxes A) Shantou Beverage is comparing two different capital structures. Plan I would result in 1,100 shares of stock outstanding 17 million yaun in Debt. Plan II would result in 900 shares of stock & 28 million yaun in Debt. Interest rate is 10%. Ignoring taxes, compare both these plans to an all equity plan assuming that EBIT will be 10 million yaun. The all – Equity plan would result in 1,400 shares of stock outstanding. Which of these plans has the Highest EPS? The lowest? Q#3 Continued B) C) D) In part (A), what are the Break – even levels of EBIT for each plan as compared to that for all – equity plan? Is one higher than the other? Ignoring taxes, when will EPS be identical for Plans I & II. Repeat Parts (A), (B) & (C) assuming that the corporate tax rate is 40%. Q#4 Home Made Leverage Valencia Items, a prominent consumer products firm is debating whether or not to convert its all equity capital structure to one that is 40% debt. Currently, there are 2,000 shares outstanding and the price per share is 70 Euros. EBIT is expected to remain at 16,000 Euros per year forever. The interest rate on new debt is 10% & there are no Taxes. A) Ms. Aznar, a shareholder of the firm owned 100 shares of stock. What is her Cash flow under the current capital structure? Assume that she keeps all 100 of her shares. Q#4 Continued B) Suppose Valencia does convert, but Ms Aznar prefers the current all Equity capital structure. Show how she could unlever her shares of stock to recreate the original capital structure. C) Suppose Valencia does not convert, but Ms Aznar prefers a capital Structure that is 70% Debt. Show how she could lever her shares of stock to recreate the original capital Structure. Q#5 Home Made leverage ABC Co. & XYZ Co. are identical firms in all respects except for their capital structure. ABC is all-equity financed with $600,000 in stock. XYZ uses both stock & perpetual Debt; its stock is worth $400,000 & the interest rate on its debt is 9%. Both firms expect EBIT to be $75,000. Ignore Taxes. A) Maichin owns $30,000 worth of XYZ’s stock. What rate of return is she expecting? B) Show how Maichin could generate exactly the same cash flows & rate of return by investing in ABC & using home Made leverage. Financial leverage & Capital structure policy Learning Objectives Capital structure? Effect of Financial Leverage? M&M Propositions? Corporate Taxes & Capital Structure? Optimal Capital Structure? Bankruptcy Process & Costs? Capital Structure & the cost of Equity Capital M&M Proposition I with no Taxes What we have just discovered regarding Capital Structure & the firm’s value through home-made leverage is proposed by Franco & Merton as the M&M proposition I which states: The Value of the Firm is Independent of its capital structure Or It is irrelevant how a firm chooses its financing M&M Proposition IThe Pie Model M &M Pie Stocks M&M Pie Bonds Stocks, 30% Bonds, 70% Bonds, 30% Stocks Stocks, 70% Bonds The cost of Equity & Financial Leverage M&M Proposition II with no taxes Although Firm’s value may not change, D/E is certainly affected… The cost of Equity & Financial Leverage M&M Proposition II with no taxes WACC = (E/V) x Re + (D/V) x Rd If we re-arrange for cost of equity –Re- we get: Re = WACC + (WACC-Rd)*(D/E) Or Re = Ra + (Ra-Rd)*(D/E) This is M&M Proposition II! (Ra = WACC) The cost of Equity & Financial Leverage M&M Proposition II with no taxes Re = Ra + (Ra-Rd)*(D/E) (Ra = WACC) It says cost of Equity depends on 3 things: Ra = required return on Firm’s assets Rd = Firm’s cost of Debt D/E = Firm’s debt/equity ratio Cost of equity & wacc: m&m Proposition I & II WITHOUT taxes Required Return Re (cost of equity) WACC Ra Rd (cost of debt) D/E (debt to equity ratio) The cost of Equity & Financial Leverage M&M Proposition II without Taxes Point to Note: WACC does not depend on the D/E ratio Another way to look at M&M II is: The firm’s overall Cost of Capital (WACC) is unaffected by its Capital Structure As debt increases, cost of equity also increases to offset lower debt cost! So the WACC stays the same! Assumptions used in M&M II Capital markets are perfect •Markets are frictionless. •Perfect competition in product and securities markets. •Information efficiency. •Agents are perfectly rational and maximize utility. There are no costs to bankruptcy All cash flow streams are perpetuities and no growth is allowed. Managers always maximize shareholders’ wealth •(imply no agency costs) Homemade leverage is a perfect substitute M&M Proposition without taxes Evidence on Capital Structure 1) More profitable firms tend to use less leverage. 2) High-growth firms borrow less than mature firms do. 3) Firms’ asset base influence capital structure choice. 4) Stock market generally views leverage-increasing events positively. 5) Tax deductibility of interest gives firms an incentive to use debt. M&M II Without Taxes Example Company X has WACC of 12%. It can borrow at 8%. If X chooses a capital structure of 80% Equity & 20% debt. Calculate the cost of equity? If X changes to 50% equity & 50% debt, what is cost of equity? What happens to WACC given different Capital Structures? M&M II WITHOUT TaxesExample Company X has WACC of 12%. It can borrow at 8%. If X chooses a capital structure of 80% Equity & 20% debt. Calculate the cost of equity? Step 1: Get cost of equity, Re Re = Ra + (Ra-Rd)*(D/E) = 12% + (12-8%)*(.25) = 13% M&M II WITHOUT TAXESExample Company X has WACC of 12%. It can borrow at 8%. If X chooses a capital structure of 80% Equity & 20% debt. If X changes to 50% equity & 50% debt, what is cost of equity? Re = Ra + (Ra-Rd)*(D/E) = 12% + (12-8)*(1) = 16% M&M II WITHOUT TAXESExample Company X has WACC of 12%. It can borrow at 8%. If X chooses a capital structure of 80% Equity & 20% debt. What happens to WACC given different Capital Structures? Step 2: Get WACC for both cases (80/20 & 50/50) WACC (80/20) = (.8*13%) + (.2*8%) = 12% WACC (50/50) = (.5*16%) + (.5*8%) = 12% NOTE: WACC does not change with change in Capital Structure! M&M Proposition II – Business & Financial Risk Total systematic risk of firm’s equity has two parts: Business Risk Equity risk which comes from the nature of firm’s operating activities Financial Risk Equity risk which comes from the capital structure choice M&M Proposition II – Business & Financial Risk According to M&M II with No Taxes, there are two types of Risks inherent in cost of equity: Business Risk Depends on the nature of the business & is compensated through Ra (WACC) Financial Risk Depends on debt financing & is compensated through [(Ra – Rd)*D/E] - zero for all equity company M&M Proposition II – Business & Financial Risk Point to Note: A Firm’s Cost of Equity increases as debt increases …purely because of financial risk portion– NOT business risk Financial leverage & Capital structure policy Learning Objectives Capital structure? Effect of Financial Leverage? M&M Propositions? Corporate Taxes & Capital Structure? Optimal Capital Structure? Bankruptcy Process & Costs? M&M Proposition I & II WITH CORPORATE TAXES Features of Debt: 1. Interest is tax deductible (good) 2. Failure to pay debt causes bankruptcy (not good) We look at taxes first… M&M Proposition I & II WITH CORPORATE TAXES – Example We look at 2 firms… Firm E (equity) & D (debt) 1. Same LHS of balance sheet = same assets 2. D has issued $1000 worth of perpetual Bonds at 8% 3. Interest bill is $80 per year forever 4. Tax rate is 30% M&M Proposition I & II WITH CORPORATE TAXES – Example Firm E EBIT Firm D 1,000 1,000 0 80 1000 960 Taxes (30%) 300 276 Net Income 700 644 Interest EBT M&M Proposition I & II WITH CORPORATE TAXES – Example Cash flow from Assets Firm E $1,000 Firm D $1,000 Taxes 300 276 Total 700 724 EBIT M&M Proposition I & II WITH CORPORATE TAXES – Example Cash flow To Stockholders Firm E $700 Firm D $644 To Bondholders 0 80 700 724 Total M&M Proposition I & II WITH CORPORATE TAXES – Example We Observe… Debt firm D will earn $24 extra every year. This means… Debt firm’s value is more than E by PV of $24 Perpetuity So.. Risk of this additional $24? Since this Tax shield is derived from interest, therefore, the risk is same as that of debt… Which means, it’s discount rate is same 8% as debt. M&M Proposition I & II WITH CORPORATE TAXES – Example M&M Proposition I & Taxes Value of Tax Shield… PV of tax shield = PV of Tax Benefit (Perpetuity): PV of tax shield = 24/ .08 = (.30 * 1000 *.08)/.08 = (0.30*1000) = 300 PV of interest tax shield = (T*D*Rd) / Rd =T*D M&M Proposition I & Corporate Taxes Putting it together… We have seen, Value of Firm D (Vd) > value of Firm E (Ve) by PV of Tax shield In other words… Vd = Ve + (T*D) Lets look at an interpretation… M&M I with taxes Firm’s value increases with Debt due to Interest Tax Shield (slope = T) Value of the firm Value of firm with Debt Value No Debt Ve=value w/no debt Total Debt M&M PROPOSITION I with taxes This means… Value of Firm goes UP by the tax rate T.. For every $1 additional Debt, Value of Firm increases by $0.3 Or The NPV per dollar of Debt is $0.3 Therefore: Higher debt results in lower WACC (since the Mkt value is higher) M&M Proposition I & II WITH CORPORATE TAXES – Example Firm E EBIT Firm D 1,000 1,000 0 80 1000 960 Taxes (30%) 300 276 Net Income 700 644 Interest EBT M&M Proposition I & II WITH CORPORATE TAXES – Example Suppose that cost of capital (Unlevered) for Firm E is 10%. Firm E’s cash flows is $700 every year forever & since it has no debt then, appropriate Discount Rate is 10%. Then, Value of Firm E Value of Firm D = NI / Ra = 700/ 0.10 = 7,000 =? M&M Proposition I & II WITH CORPORATE TAXES – Example Suppose that cost of capital (Unlevered) for Firm E is 10%. Firm E’s cash flows is $700 every year forever & since it has no debt then, appropriate Discount Rate is 10%. Then, Value of Firm E Value of Firm D = NI / Ra = 700/ 0.10 = 7,000 = Vu + (T*D) = 7,000 +( 0.30*1000) = 7,300 M&M PROPOSITION I with taxes Conclusion: Debt Increases Value of Firm due to Tax shield! So…. The more Debt, the better A Firm should maximize borrowing M&M II with corporate Taxes - Preview M&M Proposition II without Taxes: WACC = (E/V) x Re + (D/V) x Rd Re = Ra + (Ra-Rd)*(D/E) If, we introduce taxes, then? (Ra = WACC) M&M II with corporate Taxes - Preview M&M Proposition II without Taxes: WACC = (E/V) x Re + (D/V) x Rd Re = Ra + (Ra-Rd)*(D/E) (Ra = WACC for unlevered firm) If, we introduce taxes, then: WACC = (E/V) x Re + (D/V)*Rd*(1-T) Re = Ra + (Ra – Rd)*(1-T)*(D/E) (Ra = WACC for unlevered firm) M&M Proposition II WITH CORPORATE TAXES – Example We look at 2 firms… Firm E (equity) & D (debt) 1. Same LHS of balance sheet = same assets 2. D has issued $1000 worth of perpetual Bonds at 8% 3. Interest bill is $80 per year forever 4. Tax rate is 30%, Cost of Capital for Firm E = 10% 5. Value of Firm E = 7,000 & Value of Firm D = 7,300 6. Re for Firm L = ? 7. WACC for Firm L = ? M&M Proposition II WITH CORPORATE TAXES – Example ReL = Ra + (Ra – Rd)*(1-T)*(D/E) = 10% + (10 – 8%)*(1-0.30)*(1000/6300) = 10.22% WACCL = [(E/V) *Re] + [(D/V)*Rd*(1-T)] = [(6300/7300)*10.22%] + [(1000/7300)*8*(0.70)] = 9.6% M&M Proposition II WITH CORPORATE TAXES Re Re = 10.22% Ra = 10% WACC = 9.6% WACC Rd*(1-t) Rd = 5.6% D/E = 1000/6,300 Debt-Equity Ratio M&M Proposition I & II WITH CORPORATE TAXES – Example You are given following information about XYZ co. : EBIT = $151.52 T = 0.34 D = 500 Ru = 0.20 The cost of debt capital is 10%. What is the value of XYZ’s Equity? What is the cost of Equity Capital for XYZ? What is the WACC? M&M Proposition I & II WITH CORPORATE TAXES – Example Step 1: Calculate Value of the firm if it had NO Debt: Vu = EBIT(1 – T) / Ru = $500 Step 2: Calculate Value of the Firm with Debt: VL = Vu + (T*D) = 500 + (0.34*500) = 670 M&M Proposition I & II WITH CORPORATE TAXES – Example Step 3: Calculate Value of Equity: E = VL – D = 670 – 500 = 170 Step 4: Calculate Cost of Equity: ReL = Ra + (Ra – Rd)*(1-T)*(D/E) = 0.2 + (0.2 – 0.1)*(1-0.34)*(500/170) = 39.4% M&M Proposition I & II WITH CORPORATE TAXES – Example Step 5: Calculate WACC WACC = (E/V) x Re + (D/V)*Rd*(1-T) = [(170/670)*39.4%] + [(500/670)*10%*(1-0.34)] = 14.92% Bankruptcy Costs What is Bankruptcy?… Bankruptcy Costs What is Bankruptcy?… As the Debt-Equity Ratio rises, so too does the probability that the firm will be unable to pay its bondholders what was promised to them. When this happens, ownership of the firm’s Asset is ultimately transferred from the stock holders to Bondholders. A firm becomes Bankrupt when the Value of its Assets equal the Value of its Debt. Bankruptcy Costs - drivers Stockholders: try to avoid bankruptcy while in control Bondholders: want bankruptcy to get their money This makes both groups fight… Disrupting operations of the business & reducing the value of sales & assets! Bankruptcy Costs Three types of Bankruptcy Costs… Direct bankruptcy costs Indirect bankruptcy costs Bankruptcy Costs – Direct Bankruptcy Costs Direct bankruptcy costs… When value of Assets = Debt Means… Equity = 0, and firm is economically bankrupt! The administrative costs associated with the legal process of turning assets to bondholders Bankruptcy Costs – Indirect Bankruptcy Costs Indirect bankruptcy costs… When a firm has significant problems in meeting debt obligations, it is in financial distress The costs associated with AVOIDING a bankruptcy filing. NOTE: Costs associated with bankruptcy exceed tax-related gains from leverage Optimal Capital Structure Good Points (Low D/E) Tax shield adds value Probability of Bankruptcy is low Benefit of Debt outweighs costs (at low D/E) Bad points (High D/E) Possibility of financial distress increased Benefit of Debt offset by Financial distress costs! Optimal Cap Structure obviously is b/w these 2 extremes