Pune Municipal Corporation Budget 2015-16

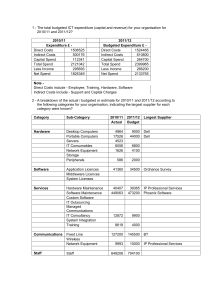

advertisement

In association with PUNE MUNICIPAL CORPORATION BUDGET 2015-16 BUDGET MAKING PROCESS Administrative ward 15 administrative wards prepare their budget Departments The HoDs of various departments prepare the department budget Commissioner The Commissioner prepares the budget on basis of the information received Standing Committee The SC modifies the Commissioner’s Budget General Body It is the final authority to approve the budget <Insert section description here> COMPONENTS OF THE BUDGET Revenue Income Income that is recurring in nature All receipts are considered as revenue incomes by PMC. Eg. Rents, grants, fees and charges Capital Income Income that is non recurring or one time PMC does not account any income as capital income Eg. Sale of land, lease of land PMC Budget Revenue Expenditure Expenditure that is recurring Eg. Salaries, O&M Capital Expenditure Expenditure that is non recurring and massive in terms of amount. Eg. Acquisition of land, purchase of real estate, construction of buildings. Even income coming from sale of land, development charges is accounted as revenue income by PMC. 2015-16 PMC BUDGET Expenditure Side 5000 5000 4500 4500 4000 4000 3500 3500 Amount in Rs. Cr Amount in Rs. Cr Revenue Side 3000 2500 2000 1500 1000 500 0 Revenue Income (B.E) Capital 4,480 income, 0 2015-16 3000 2500 2000 1500 1000 500 0 Revenue Expendit ure(BE) 2,240 Capital Expendit ure(BE) 2,240 2015-16 Note that hence forth all the figures are rounded off to the nearest 100. TRENDS IN PMC BUDGET Over the past 4 years, actuals have been 70-75% of the budget estimates. Average annual increase of 6% in both Budget and Actuals Budget estimates Actuals 4480 4170 4150 3630 3250 3200 27% 14.5% 2780 40% 18.5% 2960 2980 2340 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 BREAK UP OF REVENUE INCOME BUDGET ESTIMATES 4500 4% 5% 4000 8% 6% 3500 0% 3000 9% 16% 13% 2000 10% 8% 15% 1000 5% 7% 15% 11% 10% 17% 9% 16% 19% 22% 15% 7% 5% Octroi Local Body Tax Property Tax Water Tax Own Source Income Others Grants Loans 5% 21% 14% 3000 18% 0% 2500 0% 0% 2000 0% 6% 11% 25% 0% 39% 500 8% 7% • ~77 percent of the BE • Own source income mostly from development charges 9% 16% 13% 9% 2% 10% 2500 1500 A C T UA L S 40% 40% 34% 33% 29% 0 1% 0% 1500 0% 12% 0% 8% 0% 9% 12% 13% 21% 21% 5% 4% 9% 22% 5% 14% 0% 15% 0% 18% 1000 6% 13% 0% 500 40% 39% 39% 35% 0% 0 2010-11 All figures in crores 2011-12 2012-13 2013-14 1. OCTROI/ LBT BUDGET ESTIMATES ACTUALS Octroi/LBT Octroi/ LBT 1660 1460 1250 1440 1500 940 1090 1150 1030 910 For 2014-15, revised estimates are same as budget estimates Octroi replaced with LBT in April 2013 – led to shortfall in 2013-2014 LBT to be abolished effective August 2015 – replacement not yet finalized 2. PROPERTY TAX BUDGET ESTIMATES 10% hike Property Tax 6% hike 470 500 530 ACTUALS Property Tax 930 740 380 540 440 290 600 For 2014-15, revised estimates are same as budget estimates Collection Efficiency is just 35% implying lots of untapped potential for more revenue 3. BUILDING AND DEVELOPMENT CHARGES BUDGET ESTIMATES ACTUALS Development charges and Builing permissions Development charges and building permissions 900 800 530 340 620 610 740 610 600 580 For 2014-15, revised estimates are same as budget estimates Actuals have remained relatively flat despite boom in real estate construction KEY OBSERVATIONS Large variance between actual and budget on the revenue side which eventually leads to less spending than budgeted Lack of diversification of revenue with 3 sources accounting a majority of the revenue Dependency on grants is less compared to most other ULBs but this will change once LBT is abolished Borrowing capacity not being tapped to fund capital projects especially where there is revenue potential from these capital assets BREAK UP OF REVENUE EXPENDITURE A C T UA L S BUDGET ESTIMATES Actuals are ~90% of estimates. (quite realistic) 2500 1% 2% 2000 2% 2% 3% 4% 5% 6% 1500 6% 3% 3% 0% 0% 4% 37% 0% 11% 43% 0% 10% 43% 1800 29% 39% 1% 7% 38% 0% 9% 0% 8% 41% 2% 3%0% 1200 1000 0% 9% 44% 2% 3% 0% 0% 10% 600 400 2% 3% 2% 0% 10% 52% 51% 2010-11 2011-12 2% 2% 2% 37% 35% 34% 32% 800 55% 39% 1600 1400 39% 40% 1000 500 5% 4% 4% 2% 0% 9% 0% 9% 48% 47% 2012-13 2013-14 200 0 0 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 Major expenditure is on salary of employees followed by others. Salary O&M Depreciation Other Works to be done by ward office Loan Repayments and interest Ward level works 1. SALARY BUDGET ESTIMATES ACTUALS Salary Salary 1240 750 600 510 B.E 570 B.E 820 830 B.E B.E 820 660 680 B.E B.E 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2010-11 2011-12 2012-13 2013-14 Actuals Actuals Actuals Actuals For 2014-15, revised estimates are same as budget estimates Actual spend growing at 8% 2015-16 show staggering rise of 50% due to inclusion of education department salaries and approval of 3,500 new posts 2014-15 RE 44 percent of estimate revenue expenditure spent on salaries 4.7 lakhs per head employee salary 2013-14 Actuals 47 percent 2014-15 of actual revenue expenditure spent on salaries 4.6 lakhs per head employee salary *Note that simple average method is used to calculate per head salary 2. OPERATION AND MAINTENANCE BUDGET ESTIMATES O&M 170 150 130 ACTUALS O&M 160 170 160 150 130 130 110 BE BE BE BE BE BE 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2010-11 2011-12 2012-13 2013-14 For 2014-15, revised estimates are same as budget estimates O&M expenditures include maintenance and repair works. These have been consistently 8-10% of the total expenditures Easy to estimate if database on assets is maintained CAPITAL EXPENDITURE BUDGET ESTIMATES ACTUALS Capital Expenditure 2250 Capital Expenditure 2240 1410 2180 1990 1230 1250 2011-12 2012-13 700 1900 1900 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2010-11 2013-14 VARIANCE IN CAPITAL EXPENDITURE 2200 2000 1900 2200 2200 1900 35% 34% 1300 35% 1200 65% 1400 700 Budgeted Actuals 2010-11 Budgeted Actuals 2011-12 Budgeted Actuals 2012-13 Budgeted Actuals 2013-14 Budgeted Budgeted 2014-15 2015-16 Note that PMC does not provide break down of actuals. Major expenditures are on Roads, Water and Sewerage, and JNNURM projects Consistently over estimated by 35% or more Analysis as per the functions of PMC. Not department wise analysis as each function can be performed by one or more departments METHODOLOGY FOR FUNCTIONAL ANALYSIS (AS DEVELOPED BY DR. RAVIKANT JOSHI, CRISIL) 18 function of Municipal Corporations as per the 74th Amendment Act. Urban planning including town planning. Regulation of land-use and construction of buildings. Planning for economic and social development. Safeguarding the interests of weaker sections of society, Slum improvement and upgradation. Urban poverty alleviation. Planning and Regulation Urban Poverty Alleviation & Social Welfare Provision of urban amenities and facilities such as parks, gardens, playgrounds. Promotion of cultural, educational and aesthetic aspects. Urban forestry, protection of the environment and promotion of ecological aspects. Urban Forestry, recreational infrastructure & Culture Public health, Burials and burial grounds; cremations, cremation grounds and electric crematoriums. Sanitation conservancy and solid waste management. – Public Health Sanitation Solid waste management Cattle pounds; prevention of cruelty to animals. Vital statistics including registration of births and deaths. Fire services., Regulation of slaughter houses and tanneries. Other Services & support functions Public amenities including street lighting, parking lots, bus stops and public conveniences. Roads and bridges. Water supply for domestic, industrial and commercial purposes. – Water & sewerage services Public Works and civic amenities REVENUE INCOME BY FUNCTION Share of tax collection is highest Second highest is from planning and regulation Third highest share is from water and sewerage service. 315 185 697 102 89 76 592 Public Education 723 349 984 548 540 781 Public Health 548 Water & Sewerage Service 2035 1146 Public works & Civic Amenities Sanitation and Solid Waste Management 334 296 Urban Poverty Alleviation and Social Welfare Urban Forestry, Recreational Infrastructure & Culture 91 882 Other Services and Support Functions 1346 1518 2046 Planning and Regulation 1471 General Administration and Tax Collection Actual Actual Actual Actuals Revised Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 In Rs Cr REVENUE EXPENDITURE BY FUNCTION General administration shares ~2530% of expenditure. Water and sewerage shares ~17-19% of expenditure Public education shares ~17-19% 13 10 203 15 140 137 90 17 179 156 104 340 16 345 296 36 28 32 324 280 265 182 202 123 155 267 317 264 11 243 14 17 34 322 262 220 143 318 354 Urban Poverty Alleviation and Social Welfare Urban Forestry, Recreational Infrastructure & Culture Public works & Civic Amenities Sanitation and Solid Waste Management Public Health 84 Water & Sewerage Service 234 28 297 311 358 Actuals Actuals Actuals Actuals Revised Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 62 632 64 279 Public Education 162 209 28 37 Other Services and Support Functions Planning and Regulation 404 General Administration In Rs Cr SALARY TRENDS- FUNCTIONAL WISE Salary expenses are most for Sanitation and Solid Waste Management, which includes, road cleaning, sewage and waste transportation. The second highest expenditure is on general administration 9 17 47 124 10 24 53 141 12 23 61 15 13 188 271 85 65 174 74 95 29 73 123 34 117 59 52 21 104 134 132 110 Actuals Actuals Actuals Actuals Revised Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 50 45 19 60 28 Urban Poverty Alleviation and Social Welfare Urban Forestry, Recreational Infrastructure & Culture 200 91 170 Public Education Public works & Civic Amenities 66 155 62 57 24 15 28 Other Services and Support Functions Sanitation and Solid Waste Management Public Health Water & Sewerage Service Planning and Regulation 218 General Administration CAPITAL EXPENDITURES BY FUNCTION 64 71 84 Major share is for Public works & civic amenities (~35%) Second highest share is of planning & regulation (~27%) Third highest share is of water and sewerage (~17%). 2015-16 Budget shows a rise of 86% for sanitation and solid waste. (reasondecentralized waste management plants) 63 78 129 71 74 114 721 710 106 24 249 702 62 67 269 677 64 41 317 96 80 166 790 60 39 393 134 83 143 747 62 54 378 130 116 142 772 117 36 369 Other Services and Support Functions Public Education Urban Poverty Alleviation and Social Welfare Urban Forestry, Recreational Infrastructure & Culture Public works & Civic Amenities Sanitation and Solid Waste Management Public Health Water & Sewerage Service 529 523 486 603 505 28 19 6 5 0 0 2010-11 BE 2011-12 BE 2012-13 BE 2013-14 BE 2014-15 BE 2015-16 BE Planning and Regulation General Administration In Rs Cr PRIORITIES- DEPARTMENT WISE Sr. No Department Revenue Capital Expenditure Expenditure Total % Of Total Budget 1 Water 354 369 723 16% 2 Road Improvement Department 85 585 670 15% 3 Sanitation And Solid Waste Management 262 117 380 8% 4 Education 340 34 374 8% 5 Public Health 162 36 198 4% 6 Slum Improvement 33 58 91 2% In Rs Cr WATER DEPARTMENT 450 400 In Budget 2015-16, a hike of 50% in water tax is proposed. Hence, the 66% rise in income. Variance in Capital expenditures is huge. 350 In Rs Cr 300 250 200 150 100 50 0 2010-11 2011-12 2012-13 2013-14 2014-15 Revenue Income (Actuals) Revenue Expenditure (Actuals) Capital Expenditure (Actuals) Revenue Income (BE) Revenue Expenditure (BE) Capital Expenditure (BE) 2015-16 WATER DEPARTMENT Water Supply by PMC = 1232 Million Litres/day Total expenditure by water department (2015-16) = 500 crores Cost of supplying per litre water per day = Rs. 4 / litre-day Population served = 2.7 million people (2011 census population is 3.1million PMC water supply coverage is not 100%) Cost of supplying water per person per litre per day = Rs. 5/ person-day Total water tax collected = Rs. 400 crores Tax collected per person per day = Rs. 4/ person-day *Assuming entire population served is paying the tax ROAD IMPROVEMENT Revenue Income Revenue Expenditure Capital Expenditure 600 300 300 200 100 100 200 200 100 100 600 100 200 100 200 200 200 100 Actuals Actuals Actuals Actuals Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 Income and revenue expenditure show a flat trend SANITATION AND SOLID WASTE MANAGEMENT Revenue Income Revenue Expenditures 260 180 160 140 220 200 30 20 20 20 10 20 Actuals Actuals Actuals Actuals Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 Capital Expenditures 120 110 60 60 60 60 BE BE BE BE BE BE 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 Tax collected from citizens is the major source income Major expenditure is towards salaries. Includes road cleaning, waste transport vehicles, cleaning of drainage and chambers, sanitation of slum habitats, sewage water transport vehicles SANITATION AND SOLID WASTE MANAGEMENT Budget 2015-16 Quantity of garbage collected = 1500 – 1600 tones Revenue expenditure = 260 Cr Capital Expenditure = 120 Cr Total expenditure = 380 Cr Cost of sanitation and solid waste management = Rs. 1 Cr/day Revenue generation through sewerage tax = Rs. 8 Lacs/day Revenue as % of Cost = 8% EDUCATION DEPARTMENT PRIMARY EDUCATION REVENUE INCOME (Rs.cr) 2010-11 Actuals 2011-12 Actuals 2012-13 Actuals 2013-14 Actuals 2014-15 RE 2015-16 BE 50 60 60 70 70 72 Government Grants Income for Primary Education department is through government grants Major Revenue Expenditures (2015-16) are in the form of: Salaries Dearness Allowance Pension 32% 25% 21% Capital Expenditures (2015-16) are in the form of various development works (68%) in the schools followed by provisions for incomplete work (25%) Number of schools Number of students Students per school 275 84191 300 Total expenditure = 320 cr Expenditure per school = 1.2 cr Annual Exp per child =38,000 SECONDARY EDUCATION REVENUE INCOME (Rs.cr) 2010-11 Actuals 2011-12 Actuals 2012-13 Actuals 2013-14 Actuals 2014-15 RE 2015-16 BE Fees and Charges 0.0 0.0 0.0 0.0 0.0 25.0 Grants 13.8 12.6 21.8 15.8 25.0 25.0 Income for Secondary Education department is through government grants The major revenue expenditures (2015-16) are on: Salaries PMPML bus service 50% 27% The capital expenditure (2015-16) is for construction of toilets- Amount is 3 lakhs. (only one head) Total expenditure on Secondary Education = Rs. 54 cr Number of Secondary Schools = 16 Expenditure per school = Rs. 3.4 cr PUBLIC HEALTH 16 Revenue Income Health assistance programmes for Members & Employees 14 Income from Hospitals In Rs Cr 12 10 26% Sale of forms 4% 58% 8 6 Miscellaneous receipts 51% 45% 4 49% 8% 3% 2 22% 31% 0 2% 2010-11 Actuals 4% 2011-12 Actuals 49% 8% 0% 35% 4% 2012-13 Actuals Grants and assistance 56% 9% 0% 28% 4% 2013-14 Actuals 1% 9% 1% 7% 27% 24% 9% 7% 2014-15 Revised Fees/ charges/ licence Birth and Death Department 2015-16 Budgeted Major income is from funds received for health assistance to employees and members Fees and charges seem to be a consistent source of revenue (no fluctuations) Other grants show a decreasing trend. PUBLIC HEALTH Revenue Expenditure (2015-16) Salaries Material purchase Grants/ assistance to weaker sections 56.4% 23% 10% Capital Expenditure (2015-16) Development works in hospitals Provisions for incomplete works of previous years Development of crematoriums 48% 26% 25% Budget 2015-16 Total Revenue Expenditure = Rs. 161.5 cr Total Capital Expenditure = Rs. 36.3 cr Total Expenditure = Rs. 200 cr Total Number of Hospitals and Clinics = 87 Expenditure per clinic/hospital= Rs. 2.3 cr SLUM IMPROVEMENT Revenue Income 20 18 Photo pass receipts 16 Miscellaneous 14 Housing scheme 15% 12 In Rs Cr Sevice charges Health assistance scheme Grants 78% 10 19% 8 68% 6 4 2 0 73% 72% 22% 69% 0% 2015-16 BE 27% 3% 2014-15 BE 66% 18% 9% 2013-14 Actuals 28% 1% 2012-13 Actuals 14% 0% 2011-12 Actuals 0% 2010-11 Actuals Fees/charges/ license 2015-16 Budget has estimated 78% of income from service charges. (480 % rise) Post 2011-12, there has been no expense on housing scheme for the SC/STs. SRA Grants constitute ~20% of total SLUM IMPROVEMENT 35.0 30.0 Revenue Expenditures ~60% is spent of salaries ~30% on ward office works ~10-15% on toilet repairs Percentages relate to actuals Ward office works Toilet repairs 27% 33% Scheme implementation 25.0 7% 28% 20.0 8% In Rs Cr Miscellaneous 10% 0% 19% 0% 15% 10% 48% 37% 65% 0% 0.0 Grant/ assistance 49% 68% 6% 0% 8% 0% 0% 7% 6% 0% 2010-11 Actual 2011-12 Actual 2012-13 Actual 2013-14 Actual Material expenses Honanarium 10.0 48% Salary Road repairs 29% 15.0 5.0 School repairs Electricity expenses 4% 6% 7% 2014-15 BE 2015-16 BE Drainage repairs Babasaheb Ambedkar Hostel expenses SLUM IMPROVEMENT CAPITAL EXPENDITURES (2015-16) 1% 2% 7% 39% 51% Construction of Toilets Development works Improvements in Dalit vasti SRA Ward office works 51% is allotted to development of works 39% for construction of toilets 91 crores are allocated for slum improvement in 2015-16 Budget, which is 2 % of the total budget The latest Environment Status Report for 2012-13 says there are 564 slums in the city, of which, 353 (64%) are declared - their existence is officially recognized and they are provided basic services, 211 (36%) are undeclared and ineligible for basic services from the municipal corporation. There are approximately 11.89 lakh people residing in slums, which constitutes about 40% of the city’s total population. URBAN TRANSPORT FUND (NOT A DEPARTMENT) Revenue Income Revenue Expenditure Capital Expenditure 990 940 840 940 810 630 590 420 390 440 410 380 220 250 220 310 100 110 Budgeted Budgeted Budgeted Budgeted Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 Actuals are not available Revenue Income comes from JNNURM grants, advertisement permission fee, hawker fee, deposits for road repairs, street tax. Revenue Expenditure is for road repairs, street lights, PMPML allocations, PMPML salaries and pension, PMPML passes Capital expenditures are for road repairs, public transport project, procurement of buses under JNNURM, vehicle management department, electricity department. OBSERVATIONS ON THE BUDGET DOCUMENT 45 revenue income heads 58 revenue expenditure heads 18 capital expenditure heads • No prioritization. • Inappropriate classification of line items • Actuals for capital expenditures are missing • Extra-ordinary receipts and payments lack clarity. • Some places object heads and accounting heads are used in combination. • Summary sheets and detailed sheet totals do not match. No one-on-one connection between revenue heads and cost heads WOMEN AND CHILD DEVELOPMENT FUND- L BUDGET Falling trend in L Budget allocations. ~80-90% is in the form of revenue expenditures. Year on year growth is (-) 1% 5% Percentage of total budget 5% 4% 4% 3% 3% 2% 2% 1% 1% 0% Budgeted Budgeted Budgeted Budgeted Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 % 0f total 3% 4% 5% 5% 4% 2% Note: Actuals are not available Major expenditures are towards education of children followed by slum improvement till 2014-15. In 2015-16,major expenditure is towards PMPML (55%) 5 percent of expenditures, after deduction of committed expenditures, should be towards women and child development fund BACKWARD CLASS FUND – ‘B’ BUDGET 6% Rising trend in allocations to B Budget. 5 percent of the entire budget shall be allocated for the backward class citizen’s from 1992-93. Year-on-year growth is 23%. Percentage of total budget 5% 4% 3% 2% 1% 0% Budgeted Budgeted Budgeted Budgeted Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 % 0f total Budget 2% 3% 3% 3% 4% 5% Note: Actuals are not available Dalit population (Census 2011) - 4,53,421 (14 % of total population) Non Dalit Population (Census 2011) - 26,71,037 Per capita allocation = Rs 5212 per person URBAN POOR BUDGET – P BUDGET Revenue Expenditure Capital Expenditure 1400 1200 Amount in Cr 1000 800 600 400 200 0 Budgeted Budgeted Budgeted Budgeted Budgeted Budgeted 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 ~40 percent of the total budget is considered at urban poor budget. Example, Slum improvement department’s entire budget is included in P Budget. Road department’s 40% budget is included in P budget. Note: Actuals are not available A representative budget: As the Pune City has 40% of the total population staying in slums, the PMC departments that have works that seemingly benefit the poor have been considered to spent 100 percent of their budget as urban poor budget. Budget Per Capita & Quality of Budget Estimates City Bangalore Chennai Jaipur Surat Hyderabad Mumbai Pune 2011 Pop (Lacs) 84.4 46.5 30.5 44.7 67.3 124.4 31.2 ULB Area 741 426 467 327 923 437 244 Per capita allocation 7,974 9,615 3,980 10,202 8,247 28,414 14,356 Receipts Revised 2014-15 (Rs Cr) Pune 4,150 4,479 Chennai Bangalore Revised 2014-15 (Rs Cr) Pune 35,347 5,688 6,396 Hyderabad Jaipur Budget 2015-16 (Rs Cr) 7% Mumbai Surat Payments 3,205 3,598 1,115 1,217 3,960 4,447 2,894 6,730 4,150 4,479 Budget 2015-16 (Rs Cr) 7% Mumbai 11% Hyderabad 11% Surat 8% Jaipur 11% Chennai 57% Bangalore 35,347 4,599 5,550 4,020 4,560 1,083 1,214 12% 11% 4,432 4,471 2,927 17% 6,730 1% 56% Data from municipal budgets Proportion of Capital Expenditure Capex Other Expenses Salaries 33 50 Rs 2,240 Cr 22 Rs 985 Cr 32 28 Rs 1,254 Cr Mumbai Pune 48 62 67 69 35 27 20 25 25 19 17 Surat Hyderabad 8 Bangalore Chennai 14 Figures in % Estimates for the year 2015-16 Data from municipal budgets Capex Budget vs Capex Requirement • Pune with a projected 2030 Population of 10 million • coverage. will be the 5th most populous city in India • It will contribute USD 76 billion (Rs. 4,56,000 Cr) in • Only 50% sewage is treated and only 6% is recycled • Household level solid waste coverage of only 53% and only terms of City GDP placing it higher than all Indian cities except Delhi, Mumbai, Kolkata and Bangalore. • Water supply duration is inconsistent, partial household meter 28% of waste is segregated • Creation of the necessary infrastructure and services Share of public transport at 22% as compared to a best in class average of 50-80% to support this growth will require closing the gaps in • Road drainage network only 52% of required capacity several areas. • 33% of people in PMC live in slums Budget 2015-16 Per Capita Capex (Rs.) 7,178 Required Per Capita Annual Capex (Rs.) 12.6 % Water & Sewage 24% 9,418 1.3 % 2.7 % Solid Waste Road Drainage 16.8 % Roads 33.2 % Public Transport Budget 2015-16 Per Capita Opex (Rs.) 7,178 Required Per Capita Annual Opex (Rs.) 6,960 33.4 % Slums Based on the 2010 McKinsey Global Institute Report ”India’s urban awakening: Building inclusive cities, sustaining economic growth”. Population and GDP are projected figures for year 2030. Own Revenues Revenue Receipts (Rs Cr) 40,000 35,000 Own Revenue (Rs Cr.) 2015-16 Grants & Loans 2015-16 (Rs Cr.) 30,000 25,000 20,000 3,194 15,000 10,000 5,000 2,902 499 1,894 - Bangalore Chennai Figures in Rs Cr Mumbai Pune Estimates for the year 2015-16 Data from 2015-16 municipal budgets What should we ask for? Budgets are presented on time, are reasonably detailed and not hugely overestimated What Works Capital expenditure as a % of total expenditure is healthy; so are Own Revenues compared to both Total revenues and Capital expenditure Participatory Budgeting a huge plus Fiscal Responsibility What else should we ask for? Medium Term Fiscal Plan Audited Financial Statements Fiscal Decentralisation Own Revenues Land-based financing Profession tax Entertainment tax Accountability for Expenditure for Performance A Model of Accountability for Expenditure Ward Quality Score Works Budgets Infra & Services Urban Capacities and Resources ASICS- UCR Score ASICs-UCR Financial Management Score 5.6 4.8 3.8 1.4 1.9 Bangalore 3.5 2.5 2.1 4 3.9 3.3 3.2 2.3 1.5 Chennai Hyderabad Jaipur Mumbai ASICS UCR - Financial Management Parameters Is the ULB empowered to set and collect the following taxes? << pertains to Fiscal Autonomy Property tax 14th FC recommends States to Entertainment tax help ULBs enhance the scope of Profession tax these 4 revenue sources Advertisement tax What is the Percentage of Own Revenues to Total Expenditure for the ULB? Pune Surat Pune’s Performance Y N N N 96.36 Is the ULB authorised to raise borrowings without State Government/ Central Government approval? << pertains to Fiscal Autonomy N Is the ULB authorised to make investments or otherwise apply surplus funds without specific State Government/ Central Government approval? << pertains to Fiscal Autonomy Y What is the Per Capita Capital Expenditure of the ULB? Taking Mumbai as 10. 4,010 Is the budget of the ULB realistic? Is difference between Budget and Actual <15%? N Is the ULB required by law to have a Long-Term and/or Medium-Term Fiscal Plan ? N 4 2.7 2.9 3.6 3.5 Bangalore Transparency, Accountability and Participation 3.1 4.4 Transparency, Accountability and Participation Chennai Hyderabad Jaipur Mumbai Pune Surat ASICS TAP – Financial Parameters Pune’s Performance Is the State PDL compliant with the Model PDL with respect to: • Audited financial statement on quarterly/annual basis? • Details of plans, income and budget Y Y Has the ULB adopted open data standards and principles in respect of: • Financial information (budgets) of the corporation and of respective wards. • Quarterly audited financial reports Is the ULB required by its Municipal Act to carry out an Internal Audit within a predetermined frequency, at least annual? Are the annual accounts of the ULB mandated to be audited by an independent/external agency? Are the internal audits and audited annual financial statements of the ULB available in the public domain? Does the governing legislation of the ULB require the auditor to submit its report to the Council and/or the State Legislature? Does the ULB have a participatory budgeting process in place? N N Y N N Y Y