Finance - Harris Academy

advertisement

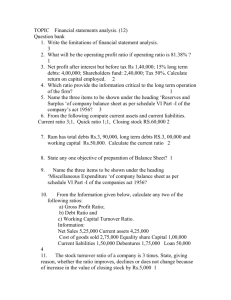

FINANCE Financial Management Higher Business Management FINANCE Role and importance of financial management Efficient management of finance is crucial to an organisation’s success. It has to: ensure adequate funds are available for the resources needed to help achieve the organisational objectives ensure costs are controlled ensure adequate cash flow establish and control profitability levels. FINANCE Duties of financial management Maintain financial records Pay bills and expenses Collect accounts due Monitor funds Pay wages and salaries Provide information for managers and decision-makers within the business FINANCE Annual accounts There are four main financial statements used (called Final Accounts): trading account profit and loss account balance sheet cash flow statement. FINANCE Answer a question Explain the role of the finance department in an organisation. (4 marks) 2010 8 minutes FINANCE Peer marking You are going to swap answers. Has your partner answered well? Does the answer make sense? Is it worth a mark? Solution FINANCE Control costs – the finance department will help control costs of an organisation, which should help it be more profitable. Monitor cash flow – will closely monitor cash flow and take corrective action if any problems arise to ensure proper liquidity. Plan for the future – by analysing past and future trends the department will hopefully make decisions that will improve the organisation’s efficiency. Monitor performance – use the final accounts to analyse how the organisation has performed and help improve any areas of weakness identified. Make decisions – the department will make use of the information it has to plan budgets and make financial decisions; this should help an organisation’s performance and profitability. FINANCE Trading, profit and loss account The trading account records how much money is made from selling goods against how much they cost to make. The gross profit is calculated in the trading account. The profit and loss account shows the business income and expenditure. The net profit is calculated in the profit and loss account. FINANCE Trading account format £ Turnover (or sales) Cost of sales Opening stock Purchases 60,000 105,000 165,000 Less: Closing stock (35,000) Gross profit £ 350,000 130,000 220,000 Profit and loss account format FINANCE £ Gross profit Other income Interest received £ 220,000 7,000 227,000 Expenses Rent Wages Insurance Net profit 18,000 75,000 5,000 98,000 129,000 FINANCE Profit and loss account key terms Trading account – summary of trading where gross profit is calculated. Sales – income received through selling goods/services. Cost of sales – cost of items sold. Opening stock – value of stock at the beginning of the financial period. Closing stock – value of stock at the end of the financial period. FINANCE Profit and loss account key terms Purchases – cost of goods bought to sell on to customers. Purchase returns – total value of goods purchased by business but returned to suppliers. Sales returns – total value of goods purchased by customer but returned to the business. Expenses – outgoings such as overheads, rent, wages. FINANCE Interpretation of trading, profit and loss accounts Was this year’s trading result good or bad, compared with last year? Was this year’s trading result good or bad, compared with a competitor? Has our gross profit improved this year? Are we utilising our stock effectively and efficiently? Has our net profit improved this year? Does our net profit compare favourably with that of other organisations in the same industry? FINANCE Balance sheet The balance sheet shows a snapshot of a precise point/date in time. It is a record of assets and liabilities. Capital = assets – liabilities FINANCE Balance sheet Assets Liabilities and capital Balance FINANCE Assets Assets – what a business owns. Fixed assets – have a lifespan of more than 1 year, eg machinery, motor vehicles. Current assets – constantly changing, eg stock, debtors, bank, cash. FINANCE Liabilities Liabilities – what is owed by the business. Current liabilities – eg trade creditors (suppliers of goods on credit), bank overdraft, short-term loans (less than 1 year). Long-term liabilities – normally longer than 1 year, eg mortgage, bank loan. FINANCE Capital Capital – provided by the owner of the business and treated as being owed to the owner of the business. Profits – may increase capital. Drawings – may decrease capital. Reserves – monies retained by the business. FINANCE Liquidity Liquidity shows us whether a business has enough assets to cover its debts. Turning assets into cash to pay off debts is what normally happens. Stock is the hardest to turn into cash. Why? FINANCE Working capital Working capital is: current assets – current liabilities If a business has too much working capital then it is not using its resources properly. If a business has too little working capital, then it may not be able to pay off short-term debts. FINANCE Interpretation of balance sheet Have we enough working capital to avoid cash flow problems? Can we improve our trade credit? Is our debt level serviceable? FINANCE Answer a question Distinguish between: a) gross profit and net profit fixed assets and current assets debentures and shares (6 marks) 2007 b) c) 10 minutes FINANCE Peer marking You are going to swap answers. Has your partner answered well? Does the answer make sense? Is it worth a mark? FINANCE Solution Gross profit is turnover less cost of sales – the money made on buying and selling goods. Net profit is the profit after all the firm’s expenses have been deducted from the gross profit. Fixed assets are items which the business owns and will be kept for longer than 1 year. Current assets are items which the business owns and will be kept for less than 1 year. Debentures is a loan where there fixed interest is paid over the stated period of the loan and then the full amount is paid back. Shares are investment in a company that receives a dividend each year if profits allow. What are ratios? FINANCE Click for clip Ratios are a way of comparing different figures. Ratios should only be used when comparing like with like (ie same size of business, same industry). Ratios can compare results with previous years or rival firms. Ratios, however, are historic and do not take into account other factors such as quality of workers, inflation, economic situation. FINANCE Uses of ratio analysis Compare current performance with firm’s previous years. Compare firm’s performance against similar organisations. Identify changes in performance to aid future actions. Identify trends over time. FINANCE Limitations of ratio analysis Information is historic. Comparisons must only be made with similar organisations (size, industry). Does not take external factors (PESTEC) into account. Does not take NPD or declining products into account. Does not take people issues (staff morale, staff turnover) into account. FINANCE Ratios Profitability Liquidity Gross profit percentage Net profit percentage Return on capital employed (ROCE) Current ratio Acid test ratio Asset usage Rate of stock turnover FINANCE Gross profit percentage Gross profit × 100% Sales revenue Measures profit made from buying and selling stock. For every £1 of sales, how much profit is made? Increase = more sales generated or cost of materials have fallen. Decrease = cost of materials may have gone up. FINANCE Net profit percentage Net profit × 100% Sales revenue For every £1 of sales, how much profit after expenses is made? Increase = handling expenses better. Decrease = expenses may have gone up. FINANCE Return on capital employed (ROCE) Net profit × 100% Capital employed If you invest £100 in a firm how much will you get back? ROCE should be measured against interest rates, since your savings can make money in a high-interest bank account. FINANCE Current ratio Current ratio = current assets:current liabilities Looks at how business can pay off its debts. A ratio of 2:1 is considered prudent, but does not take into account stock being held. Higher than 2:1 means money may not be invested in the business properly. Less than 2:1 may mean the firm is in danger of not being able to pay off debts (too much money tied up in stock?). FINANCE Acid test ratio Acid test = (current assets – stock):(current liabilities) This is a tougher ratio than the current ratio because it excludes stock, since stock is the hardest asset to transform into cash. This ratio should be around 1:1. FINANCE Rate of stock turnover cost of sales Stock turnover = average stock Stock hanging around is bad for the firm. Stocks can go off, out of fashion or out of date. This ratio works out how many times stock is used up. Note: Average stock is calculated by adding closing and opening stock and then dividing by 2. FINANCE Answer a question a) Describe ratios to ensure profitability and liquidity. (5 marks) 2008 a) Explain the limitations of using accounting ratios. (5 marks) 2010 12 minutes FINANCE Peer marking You are going to swap answers. Has your partner answered well? Does the answer make sense? Is it worth a mark? Solution to a) FINANCE Gross profit % measures the gross profit on each sale. Net profit % measures the profit after expenses on each sale. Mark-up – measures how much has been added to the cost of the goods as profit. Return on capital employed – measures the return on investment in the business. Current ratio – shows how able a business is to pay its short-term debts. Acid test ratio – ability to pay short-term debts after stock is deducted. Solution to b) FINANCE Information is historical, which means it could lead to bad decisions being made. Does not take into account external factors, eg the business may have performed well during a recession. Does not show staff morale, which may be poor and the business has therefore performed well. Recent investments are not shown, which could result in future increase in performance/profits. New products could just have been launched and again these may improve performance although ratios will not show this. Can only be used to compare against similar organisations, which may not be of great use in certain situations. Different accounting process used from one year to the next can alter ratios, which could result in the wrong decisions being made. FINANCE Budgets Budgets are statements of anticipated future expenditure covering a specific time period. Cash budgets – show expected receipts and payments on a monthly basis to help assess potential cash flow problems. FINANCE Uses of budgets To plan for the future (forecasting). Financial or goal-oriented target setting. Evaluation and analysis of performance. Delegation of financial responsibility (eg departmental budgets). Data and information collection. FINANCE How budgets help managers Make managers decisions accountable. Help check income and expenditure levels. Used in long-term planning. An aid to decision making. An aid for comparing projections with actual results. Used as a tool to act on problems. FINANCE Cash flow statements Cash budgets/cash flow statements contain estimated figures of the cash position of an organisation over a specific time period. Remember the closing balance is cash and not profit! Cash budgets are used to identify shortages or surpluses of cash resources. Click for clip FINANCE Cash budget FINANCE Cash budgets and the role of the manager Plan Borrow or not? Organise Bulk buying? Trade discounts? Command Departmental budgets Coordinate Departmental reports Control Measure performance Delegate Budgets spent by department managers Giving financial control may empower individuals Motivate FINANCE Cash flow management Liquidity – as mentioned, to check either shortages or surpluses of cash resources. Decision-making – the role of the manager can be aided by cash budgets. Projection – different variables and scenarios can be used (on a spreadsheet) to see what can affect the cash position of the organisation. FINANCE Answer a question Explain why managers use cash budgets. (5 marks) 2009 10 minutes FINANCE Peer marking You are going to swap answers. Has your partner answered well? Does the answer make sense? Is it worth a mark? Solution FINANCE Managers can compare actual figures with planned budgets and, if there are any deviations, take corrective action where required. Highlights periods where a negative cash flow is expected and allows for appropriate finance to be arranged for that period. Allows for investment to be made in times of excess cash flow to best utilise surplus profit. Corrective action can be planned in advance of cash deficits, for example a loan may be arranged. Allows managers to control expenditure and ensure they don’t go over the set budget. Used to set targets for workers and managers, which can be a motivational tool. FINANCE Users of financial information Shareholders – can determine if current performance is worthy of more investment or if other action required (sell shares or remove board at AGM). Potential shareholders – decide whether or not firm offers a good investment. Short-term creditors – should credit be granted to the firm? Long-term creditors – should money be loaned to the firm? Will it be paid back? FINANCE Users of financial information Government and local government – will analyse firm’s reports and business plans. Will the firm’s future plans impact on community (voters!)? Competitors – compare themselves with rivals to work out market share and how future plans may affect their own operations. Employees – can the firm pay better wages? Is the future sound (are their jobs safe)? Management – use information to analyse, compare and evaluate performance and plan for the future. FINANCE Sources of finance Click for clip FINANCE Internal sources of finance Retained profits – profit kept by company for future activities. Selling assets – money raised by selling off an asset no longer needed. Both are short-term sources. FINANCE External sources of finance Long-term (10+ years) Issuing shares – capital raised by selling shares. Debentures – a fixed-interest long-term loan. Loans – borrowing money, repaid over a time period with interest. Mortgages – a loan secured on property. FINANCE External sources of finance Medium-term (1–10 years) Leasing – renting equipment or premises. Hire purchase – acquiring an asset on credit followed by fixed payments. After last instalment purchaser owns asset. Loans. FINANCE External sources of finance Short-term (up to 1 year) Overdraft – borrowing more money than is available in bank account. Trade credit – businesses receive goods first, then pay later. Factoring – a specialist business collecting unpaid debts for a fee. FINANCE Additional sources of finance LEC, eg Scottish Enterprise Local authorities, eg South Lanarkshire Council Government partnerships, eg Business Gateway Grants and allowances, eg repayable grants, soft loans, subsidies EU grants, eg Regional Development Fund and Social Fund FINANCE Answer a question Describe four different sources of long-term finance available to a private limited company. (4 marks) 2010 8 minutes FINANCE Peer marking You are going to swap answers. Has your partner answered well? Does the answer make sense? Is it worth a mark? Solution FINANCE Bank loan – paid back over a number of years with interest. Commercial mortgage – a loan on property paid back over a long period with interest. Venture capitalists – invest in an organisation if a more risky venture is undertaken, but they may request a share in the organisation in return. Invite new shareholders to invest in the organisation. Local/national government grants, which do not have to be paid back but must meet certain criteria. Sell off unwanted assets to raise finance quickly. Debentures – issued to investors and interest payments are made yearly, with the lump sum paid back at an agreed time. Retained profits of the organisation reinvested into the business.