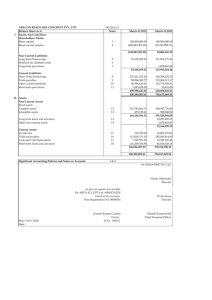

Financial Statement

advertisement

TOPIC Financial statements analysis. (12) Question bank 1. Write the limitations of financial statement analysis. 3 2. What will be the operating profit ratio if operating ratio is 81.38% ? 1 3. Net profit after interest but before tax Rs 1,40,000; 15% long term debts: 4,00,000; Shareholders fund: 2,40,000; Tax 50%. Calculate return on capital employed. 2 4. Which ratio provide the information critical to the long term operation of the firm? 1 5. Name the three items to be shown under the heading ‘Reserves and Surplus ‘of company balance sheet as per schedule VI Part -I of the company’s act 1956? 3 6. From the following compute current assets and current liabilities. Current ratio 3;1, Quick ratio 1;1, Closing stock RS.60,000 2 7. Ram has total debts Rs.3, 90,000, long term debts RS.3, 00,000 and working capital Rs.50,000. Calculate the current ratio 2 8. State any one objective of preparation of Balance Sheet? 1 9. Name the three items to be shown under the heading ‘Miscellaneous Expenditure ‘of company balance sheet as per schedule VI Part -I of the companies act 1956? 10. From the Information given below, calculate any two of the following ratios: a) Gross Profit Ratio; b) Debt Ratio and c) Working Capital Turnover Ratio. Information: Net Sales 5,25,000 Current assets 4,25,000 Cost of goods sold 2,75,000 Equality share Capital 1,00,000 Current liabilities 1,50,000 Debentures 1,75,000 Loan 50,000 4 11. The stock turnover ratio of a company is 3 times. State, giving reason, whether the ratio improves, declines or does not change because of increase in the value of closing stock by Rs.5,000 1 12. . Show the major headings on the liabilities side of the Balance Sheet of a company as per Schedule VI Part I of the Companies Act, 1956. 3 13. What are contingent liabilities? Mention any two examples. 14. Prepare a comparative income statement with the help of the following information: Particulars 1996 1997 Sales 2,00,000 3,00,000 Cost of goods sold 60% of sales 70% of sales Indirect expenses 50% of gross profit 40% of gross profit Income Tax 50% of net profit before 50% of net profit before tax tax 4 15. Prepare the Balance Sheet of Pyramid Ltd. as on March 31, 2008 from the following details: Share Capital Rs.12, 00,000/- General Reserve Rs. 3, 00,000/- 10% Debentures Rs. 4, 00,000/- Fixed Assets Rs. 17, 00,000/- Depreciation Rs. 2, 40,000/- Current Liability Rs. 5, 60,000/- Current Assets Rs.11, 40,000/- Discount on issue of Debentures Rs. 40,000/- Profit and Loss A/c (Credit Balance) Rs. 1, 80,000/- 4 16. The current ratio of a company is 2:1. State giving reasons which of the following would improve, reduce or not change the ratio : (1) Repayment of a Current Liability. (2) Purchased goods on cash. (3) Sale of office equipment for Rs.4000/- (Book Value Rs.5000/-). (4) Sale of goods Rs.11000/- (Cost Rs.10000/-). (5) Payment of dividend. 17.Net credit sales for 2007-08 are Rs.3, 50000/- and Debtor turnover ratio is 8 times calculate debtor at the end if debtors in the beginning are Rs.14,000/- less than those at the end. 3 18.A Company had Current Assets of Rs.3, 00,000/- and Current Liabilities of Rs.1, 40,000/-. Afterwards it purchases goods for Rs.20, 000/- on credit. Calculate Current Ratio after the purchase. 2 19.Current Ratio is 2.5, working capital is Rs.60, 000/-. Calculate the amount of Current Assets and Current Liabilities. 20. Prepare Common Size Income statement from the following: 4 Particulars 2008 (Rs) 2009 (Rs) Sales 4,00,000 5,00,000 Cost of goods sold 2,00,000 3,00,000 Administrative expenses 40,000 1,00,000 Other income 20,000 30,000 Income tax 60,000 70,000 21. Prepare Comparative Income statement from the following: 4 Particulars 2008 (Rs) 2009 (Rs) Sales 5,00,000 6,00,000 Cost of goods sold 3,00,000 4,00,000 Administrative expenses 20,000 80,000 Other income 10,000 20,000 Income tax 40,000 60,000 22. Following figures have been extracted from the books of Elite Producers: Net sales 3000000 Cost of goods sold 2000000 Net profit 300000 Current assets 600000 Current liabilities 200000 Debentures 250000 Compute any two of the following ratios: a. Gross Profit ratio b. Operating ratio c. Working capital turnover ratio 4 23. . From the following information prepare a comparative Income Statement of Victor Ltd: Sales Cost of goods sold Indirect Expenses 2008 Rs. 15,00,000 11,00,000 20% of Gross Profit Income Tax 2009 Rs. 18,00,000 14,00,000 125% of Gross Profit 50% 50% 24. From the following information calculate any two of the following ratios (4) i) Net Profit Ratio ii) Debt-Equity Ratio iii) Quick Ratio Rs. Paid up Capital Capital Reserve 9% Debentures Net Sales 20,00,000 2,00,000 8,00,000 14,00,000 Gross Profit 8,00,000 Indirect Expenses 2,00,000 Current Assets Current Liabilities 3,00,000 Opening Stock 50,000 Closing Stock : 2% more than opening stock. 4,00,000 25. From the following information, prepare a comparative income statement. (4) Particulars Net Sales Cost of goods sold 2009 (Rs.) 2008 (Rs.) 10,00,000 6,00,000 70% on Sales 60% on Sales Office and Administrative Expenses 1,50,000 1,60,000 Selling and Distribution Expenses 90,000 60,000 Other Income 20,000 10,000 50% 50% Rate of Income Tax 26.From the following information given below calculate any two of the following ratios: (4) a. Return on Investment b. Current Ratio c. Debt Equity Ratio Information: Net profit during the year - Rs.40,000; Fixed Assets Rs.1,00,000; Closing Stock - Rs.5,000; Other Current Assets - Rs.50,000; Current Liabilities - Rs.15,000; Equity Share Capital - Rs.50,000; 11% Preference Share Capital - Rs.25,000; Reserve and Surplus - Rs.10,000; 13% Debenture(a) A company has a loan of Rs.60,00,000 as part of its capital employed. Interest payable on the loan is 12% and ROI of the company is 25%. The rate of income tax is 40%. What is the gain to the shareholders due to the loan raised by the company. (2) *****