Dell's Strategy

advertisement

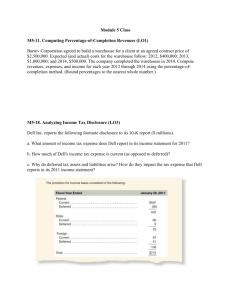

Dell Inc. Case Study By: Dan McLindon Kyle McDaniel Jeremy Smiley Tom Anderson Ray Moorman Key Question for Dell Can Dell overtake HP as the world leader in personal computers with its current strategies of Build to Order and Direct to Consumer sales? Secondary Questions What contributed to Dell’s success and rapid growth in the late 1990’s? Why is Dell choosing to become more like HP? What does Dell do well and where does it struggle? Can Dell ever be successful in B2C market in developing countries with Direct to Consumer distribution? What is Dell? A computer manufacturer? A consumer electronics company? An IT service partner? What is their focus? What is Dell doing today to set itself apart from the competition in the highly competitive and rapidly evolving personal computer industry? Dell Computer Company Overview Founded 1984 by Michael Dell Vision PC’s could be built to order & sold directly to customers 2 Major Advantages of Business Concept 1. Bypass distributors & retailers eliminated markups 2. B2O reduced risks & costs of having inventory Sell Direct & B2O Business Model Success 2003 – most efficient procurement, mfg, & dist in PC industry. Gave profit & costs advantage over rivals PEST Analysis for Dell Issue Threats/Opportunities Ranking (1-5) Political 2008 Economic downturn Threat – economy also impacting government spending and infrastructure investments 3 Economic 2008 Economic downturn Threat – companies and individuals cut IT spending 3 Rising incomes and demand for IT in BRIC countries, especially SE Asia and Eastern Europe Opportunity - ½ of world’s population Growth in popularity of social networking and mobile society Opportunity – increasing demand for servers and network gear. Explosion in data information, content, digital revolution Opportunity – Dell can provide hardware and services to drive 4 Global expansion of Internet Opportunity – requires installation of millions of servers 5 Category Social 4 4 Technological Industry Overview (Supply) Porter’s five forces: Threat of substitute products High Bargaining power of suppliers Rivalry among existing competitors Bargaining power of buyers Low for generics High for key parts High High Threat of new entrants Low Porter’s Five Forces Factor Analysis Impact Threat of substitute products Mobile and smart phones may replace the common PC for certain segments. Servers need to run the networks behind phones. Bargaining power of suppliers Standardized technology. Long-term value chain partnerships. Key components suppliers have more power. A shift to outsourcing may destroy key relationships. Bargaining power of buyers Commodity status. B2B customers can also negotiate prices on hardware, software, service contracts, bundles. With standardization comes commoditization. Competitive rivalry Lots of well established players in markets which Dell competes. Competing on cost. Compression of profit margins. Cost reductions strategies rule. Threat of new entrants Slim profit margins. Commodity status. Well established players. Differentiation will be key! Currently A $1.5 Trillion IT Industry Services, $613B Hardware, $560B Software, $327B • Explosion of the digital era • World’s data doubles every 3 years • Social networking craze • Blogs, online video, My Space, Facebook • Emerging markets with ½ the world’s population • All working together to create DEMAND! Is There Further Growth Out There in the PC Market? Shipments of PC’s(millions) 1980 - 2012 450 400 350 300 250 200 PC's Shipped 150 100 50 1980 1985 1990 1995 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 0 2007 PC Vendor Market Share U.S. Market 28% 32% 24% 5% 5% Worldwide Dell HP Apple Acer Toshiba All Others 19% 47% 15% 8% 7% 6% HP Dell Acer Lenovo/IBM Toshiba All Others 4% Dell’s PC business model has not translated into global leadership. But the growth opportunity is there! Build to Order Advantages Selling direct to customers cuts out the middleman, which increases Dell’s margins. Disadvantages Customers not able to touch and feel the product, which is a large ticket purchase Mass customization using standard parts Build to order requires innovation and allows Dell to control their costs and investment in manufacturing technologies enables them to pass savings to customer. and facilities. Build to order allows for JIT, reducing costly inventories of components, which may quickly become obsolete. Competitors have been able to outsource to third party manufactures, pushing the burden of component inventory costs onto suppliers. Conclusion – Dell has spent its time and money on innovation to become an efficient manufacturer of computer hardware. Was that an effective use of their resources? Build to Order Enabled success in late 1990’s • Dell low cost leader. • Improved reputation for quality. Allowed Dell to control quality and be first to market with new products. • Competitors tried to copy, but with limited success. Long learning curve. • Businesses like to customize a solution that fits exactly what they need. • BTO gives Dell the ability to control quality and the opportunity to sell Still works additional value adds to enterprise customers. well in B2B • Difficulty with distribution in emerging BRIC countries, especially China. • Competitors have closed the gap on price and product offerings by outsourcing manufacturing. Struggling • Dell even starting to outsource laptops in B2C Dell Inc. Product Timeline Year Product Current Position In Market Success of Failure? 1984 PCs 2nd behind HP (15% market share) Success 1995 Website Revenues greater than Yahoo, Google, eBay and Amazon combined Success Late 1990’s X86 Servers 1st domestically, 2nd behind HP globally (11% global market share) Success 2001 Data-routing switches and Data storage devices Storage – 5% market share Routing – 2% market share TBD 2002 Large Enterprise IT services <1% market share Success, rapidly growing revenues 2002 White label PC N/A TBD, forecast to achieve $380 million in sales (2003) 2003 Printers 20% market share in US, 5% global TBD 2003 Consumer Electronics N/A TBD 2003 Retail POS systems N/A TBD Conclusion – Expanding product set into several highly competitive markets with well established players. Strategy is be the low cost leader. Internal Analysis – Core Competencies Core Competency Build to order Description •Build to order business model allows for JIT, keeping inventory costs down. Keeping manufacturing in-house enables control of quality and faster new product releases. Direct to Customer Sales •Cuts out retail markup. Allows Dell to maintain higher profit margins and charge lower price. B2B value added services •Services like asset tagging and software downloading differentiate Dell from competitors. Enabled by inhouse manufacturing. Build to order B2B valueadds Direct to Customer Sales Red – Easy for competitors to develop Yellow – Possible for competitors to develop Green – Very difficult for competitors to develop Dell's Geographic Performance (Operating Incomes) $3,500.00 $3,000.00 $2,500.00 $2,000.00 $ (in millions) U.S. Business U.S. Consumer $1,500.00 EMEA Asia-Pacific/Japan $1,000.00 $500.00 $- 2000 2002 2004 2005 2006 2007 2008 $(500.00) U.S. Business & EMEA markets showing strongest growth trends. Internal Analysis – Markets Served Operating Income Net Revenues Americas B2B Americas B2B 14% 12% US Consumer 25% 51% US Consumer 25% EMEA 10% 62% EMEA -1% AsiaPacific/Japan AsiaPacific/Japan Conclusion – Dell is strong in the US B2B market, but that strategy does not translate to success in B2C. Only 39% of sales generated outside US, compared to 67% global sales by HP. Internal Analysis - Manufacturing Heavily invested in facilities and technology Hampering growth in emerging BRIC markets Already starting to outsource laptops Build to Order/D2C Sales Enables valueadds for B2B No longer low cost leader due to outsourcing Conclusion – Dell already starting to outsource its competitive advantage. Can it still compete with HP in the B2C market? Will outsourcing manufacturing impact their advantage in B2B market? SWOT Analysis for Dell Strengths •JIT, lean mfg practices lowers inventory costs = less risk for innovations & price increases •Desktop manufacturing •Customer Support – focus on 90% customer satisfaction worldwide (Asia 92%, Europe 90%) •Website sales = 50% of sales •Long term relationships with suppliers – picked top 1 or 2 & stuck with them as long as they kept costs down and innovated product Weaknesses •B2C in Asian Markets – need to touch & feel •Customer support – US satisfaction = 80% •Outsourcing manufacturing – has lead to quality issues before •Limited distribution network •Laptop manufacturing Opportunities Threats •2nd billion people coming online •Expansion into new products – focus on inefficiencies in supply chain •Listening to consumers – cont. to utilize IdeaStorm to innovate products & support based on customer feedback •Horizontal Integration – acquire software co’s •White Box PC’s – go to market in China where private label/generic PC’s are strong •Entering retail sales in 2007 as market share to consumers dropped (forgetting competitive advantage of B2O) •Profit pool HP has to compete with, lower costs of PC’s to undercut Dell and make up for loss with profit from other HP products •Standardizations in technology have allowed competitors to outsource manufacturing, enabling lower prices Elements of Strategy Cost Efficient Build to Order Dell’s Strategy Competition has tried to emulate with limited success Although other vendors have not replicated Dell’s strategy, they’ve done enough to close the cost advantage gap. Dell’s lean manufacturing techniques work best in production of desktop PCs. Consumer tastes have shifted to laptops. Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy Partner with Suppliers Dell’s Strategy IBM, HP, Sony, Toshiba, Fujitsu abandoned vertical integration for strategic outsourcing of components in the early 1990s. Partnering with suppliers to utilize their expertise is a given at this point, no contribution to competitive advantage. Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy Direct Sales Dell’s Strategy Competitors have not been able to shorten their supply chain as effectively as Dell Competitors have had difficulty implementing the sell direct strategy because it cannibalizes other sales channels. Disadvantage in some foreign markets where small business and individual customers want more of a hands on shopping experience. Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy Expansion of products and services Industry is evolving with new products. Dell has demonstrated success in entering product segments and succeeding as the low cost provider. Examples are servers and networking equipment. Name recognition from desktops and notebooks gives consumers confidence to try other products. Dell’s Strategy Opportunity for growth is large outside of PCs and servers where Dells market share is negligible. Market share is ≤5% in data storage, networking, printers, and IT services. Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy Customer Service and Technical Support Dell’s growing pains with off shoring support services are behind them. Processes and best practices standardized world wide. Voice of the customer – regional forms, IdeaStorm Dell’s Strategy Custom websites for large customers, product design services, value add services Below customer satisfaction goal in Americas Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy R&D focused on customer needs Advocate for customers needs – useful, cost effective technologies Quality Control streamlines the assembly process and reduces costs Dell’s Strategy Growing budget -- $600M in 2008 Facilitates entry into new products and services Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy More cost effective than proprietary technology Use of Standardized Technologies Standardized technologies are upgradeable Strategy is easily replicated Dell’s Strategy Contribution towards a future competitive advantage… Cooling Warming Elements of Strategy Cost Efficient Build to Order Partner with Suppliers Use of Standardized Technologies Dell’s Strategy R&D focused on customer needs Direct Sales Customer Service and Technical Support Expansion of products and services Contribution towards a future competitive advantage… Cooling Warming Dell vs HP HP Dell Operating philosophy Build to Stock, outsource manufacturing, large distribution network of retailers and resellers around the world Build to Order, control manufacturing, direct to customer sales on own website Key products Global leader in PCs, servers, and printers. 67% sales outside USA. US leader in PCs and servers, 2nd behind HP globally . 39% of sales outside USA. Market Share in PC Sales 18.8% Globally 23.9% in USA 14.9% Globally 28% in USA Financials $104.3 billion revenue, $7.3 billion profit (2007) $61.1 billion revenue, $3 billion profit (2008) Key Acquisitions 2002 – Compaq 2008 – EDS 2005-2008 - $7 billion on other software, tech, and service companies 2007-2008 spent $2 billion on software capabilities for valueadded services US Market Share – Dell vs. HP 40 % of Market Share 35 30 25 Dell HP 20 15 10 5 0 1998 2000 2002 2004 2005 2006 2007 Conclusion – From 2005 declining trend in both US & World Market Share for Dell. HP has gained market share during that time. Possible reason for HP’s success is acquisitions (Compaq 2002, EDS 2008) Contributors to HP's Operating Income $5,000.00 $4,000.00 HP acquires EDS $3,000.00 Printing and Imaging $2,000.00 Personal Computing Systems $ (in millions) Enterprise Systems and Software $1,000.00 HP Services $- 2001 2002 2003 2004 2005 2006 2007 $(1,000.00) Dell should continue focusing efforts on growing IT services business and look for acquisition of IT services company to continue to compete and hold market share against HP. Leading Providers of Information Technology (2007) IBM 7% Accenture EDS 3% 3% Fujitsu 3% HP 2% CSC 2% Dell 1% All Others 79% Acquisition of CSC would give Dell increased IT services market share of 3.3% vs. HP’s 5.3% combined market share (with EDS) Recommendations Acquire a larger IT services company to supplement Dell's current IT services department - CSC is a possibility 1. Gain immediate market share Focus on critical customers by creating dedicated department head's with authority to meet the demands of the following groups: 2. Large Companies (larger than 400 employees) (already exists, continue current services) - Small-Med companies (less than 400 employees) - Government Agencies - Higher Education Universities - K-12 Primary School Systems Focus on speed of service, customization to meet needs of each organization, build loyalty with groups who have more frequent demand and servicing needs. Recommendations 3. Hire product development specialists from product/branding focused companies. 4. Helps Dell to get a fresh perspective on their product and new ideas for development. Redesign laptop and PC brands to make them more exciting for personal use consumers. Dell's competing with HP and Apple who are creating products customers desire. Financials indicate consumer products are struggling vs. competition. Increase R&D budget to create more exciting models. Recommendations 5. Sell only a couple standard model PC's and laptops in retail centers like Wal-Mart and Best Buy – out of sight, out of mind mentality for consumers. 6. Allows Dell to appeal to everyday customers who don't desire custom computers. Use suppliers/manufacturers to build these standard models with no changes to the specs – keep costs down. Continue to build PC’s and custom laptops in-house to take advantage of logistics and efficiencies This also builds brand awareness with consumers who may want custom computers. Allow current marketing programs to target higher-end users who desire personalized PC’s. Acquire Chinese PC/laptop maker to enter Chinese market – Increase revenues from Asia-Pacific/Japanese market.