Closing Entries

advertisement

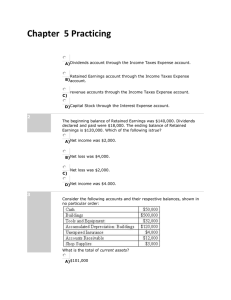

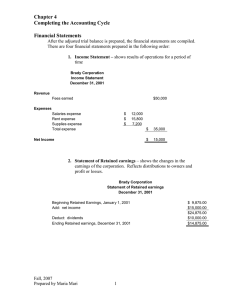

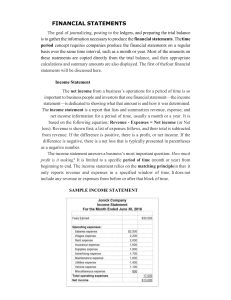

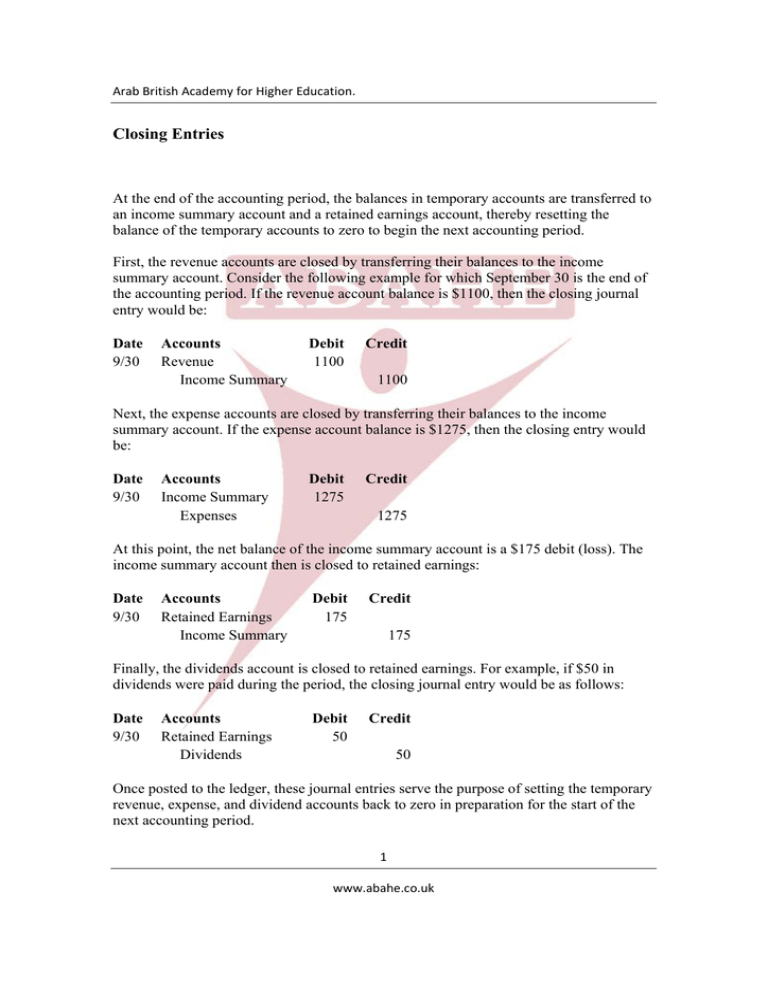

Arab British Academy for Higher Education. Closing Entries At the end of the accounting period, the balances in temporary accounts are transferred to an income summary account and a retained earnings account, thereby resetting the balance of the temporary accounts to zero to begin the next accounting period. First, the revenue accounts are closed by transferring their balances to the income summary account. Consider the following example for which September 30 is the end of the accounting period. If the revenue account balance is $1100, then the closing journal entry would be: Date 9/30 Accounts Revenue Income Summary Debit 1100 Credit 1100 Next, the expense accounts are closed by transferring their balances to the income summary account. If the expense account balance is $1275, then the closing entry would be: Date 9/30 Accounts Income Summary Expenses Debit 1275 Credit 1275 At this point, the net balance of the income summary account is a $175 debit (loss). The income summary account then is closed to retained earnings: Date 9/30 Accounts Retained Earnings Income Summary Debit 175 Credit 175 Finally, the dividends account is closed to retained earnings. For example, if $50 in dividends were paid during the period, the closing journal entry would be as follows: Date 9/30 Accounts Retained Earnings Dividends Debit 50 Credit 50 Once posted to the ledger, these journal entries serve the purpose of setting the temporary revenue, expense, and dividend accounts back to zero in preparation for the start of the next accounting period. 1 www.abahe.co.uk Arab British Academy for Higher Education. Note that the income summary account is not absolutely necessary - the revenue and expense accounts could be closed directly to retained earnings. The income summary account offers the benefit of indicating the net balance between revenue and expenses (i.e. net income) during the closing process. 2 www.abahe.co.uk