Document

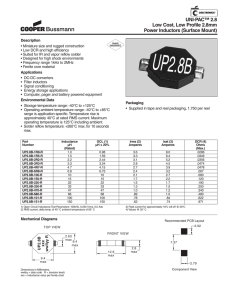

advertisement

Investment Managers Pien-Cheng (William) Wei Sashikanth Yenika Yue (Benjamin) Xu Yuqing Zhang Zeyu Chi Presented on 11/05/2015 Agenda Current Holdings UNP – Company Overview Industry Analysis UNP – Financial Analysis Peer Benchmarking Financial Projections Valuation Recommendation Current holdings Purchased: 100 shares @ $148.20 on April,2013 Cost basis: $14,820 2 for 1 split in June, 2014 Sold: 100 shares @ $108.00 on April, 2015 Gain on sale: $3,390 (+45.75%) Current market value: $8,819 (11/4) Gain: $1,409 (+19.01%) Company Introduction Incorporated in 1862 with headquarter in Omaha, Nebraska Operates railroads and offers freight transportation services Links 23 states in the western two-thirds of the country Has the largest railroad network of 31,974 route miles The only railroad serving all six major Mexico gateways Maintain a fleet of 8,500 locomotives and is served by around 50,000 employees Sources: Union Pacific 2014 10-k (Pg. 5), UNP website Business Overview ► ► ► Revenue: Freight revenue (94%) Other revenue (6%) Key Strategies Increase network and terminal capacity Replace old and less efficient locomotives with new and more efficient Key Risks Involved Fluctuating US$ Volatile fuel prices Regulations Sources: Union Pacific 2014 10-k (Pg. 25, 38), Factbook 2014 (Pg.12, 30) Freight Revenue Automotive Chemical 9% s 16% Industrial products 20% Intermod al 20% Agricultur al Products 17% Coal 18% Operating Expense Equipmen t & Other rents, 8% Depreciation, 13% Purchased Services & Materials, 17% Other, 6% Compensi on & Benefits, 33% Fuel, 23% SWOT analysis Strengths Weaknesses - - Diversified revenue streams Legacy pricing contracts Strong ROIC - - Opportunities - - Heavy dependence on few suppliers of rail and locomotives Affected by weather and climate change Volatile US$ and uncertain energy environment Threats Agricultural and industrial product growth Increasing energy exposure incl. high value added frac sand Only player with access to all 6 Mexico gateways - Intense internal and external competition Increased regulatory requirements like open access and revenue adequacy Low fuel prices Stock market prospects Sources: Yahoo Finance! Rail Transportation Industry - Overview Key Products and Services Operates short-haul and line-haul railroads, and intercity passenger trains Sensitive to import and export volumes, crude oil prices, demand for coal and chemical manufacturing 3.8% Bulk Freight 51.8% 42.7% Passenger Services Market Share 12.4% CAGR 3.0% 29.5% CAGR 4.6% 80,000 Intermodal Services Other Services Industry Revenue 100,000 1.7% 14.4% UNP BNSF 60,000 CSX Corp 40,000 Norfolk 15.2% Others 28.5% 20,000 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Source: IBISWorld Key Drivers Trade Value Growth % Increase in US Trade Value Improved economic growth in Mexico and Canada Rising global consumption Expected US job and wage growth Moderate growth in Industrial Production Index (IPI) Low crude oil prices Decrease in coal demand 15% 10% 5% (5%) (10%) (15%) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 6% % Change in IPI 4% 2% (2%) (4%) (6%) (8%) (10%) (12%) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Sources: IBISWorld Porter’s Five Forces Power of Suppliers High Threat of Substitute Products Rivalry among existing competitors Medium High Power of Buyers Medium Threat of New Entrants Low Financial Analysis Margin Analysis Return Analysis 40% 30% 35% 25% 30% 20% 25% 15% 20% 10% 15% 10% 5% 5% 2011 2010 2011 2012 Operating Margin % 2013 2014 Net Income Margin % Return on Equity Tax Burden Interest Burden Operating Profit Margin % Asset Turnover Leverage RoE Sources: Union Pacific 2014 10-k 2012 62.4% 93.7% 32.2% 0.5x 2.4x 20.3% 2013 2014 Return on Invested Capital Return on Assets DuPont Analysis 2011 62.5% 92.0% 29.3% 0.4x 2.4x 18.1% 2012 Leverage Analysis 2013 62.3% 94.7% 33.9% 0.5x 2.3x 21.2% 2014 62.1% 95.3% 36.5% 0.5x 2.5x 25.2% Debt/Equity Debt/Assets EBIT Interest Coverage 2010 52.0% 21.4% 8.3x 2011 47.9% 19.7% 10.0x 2012 45.3% 19.1% 12.6x 2013 45.1% 19.3% 14.2x 2014 54.2% 21.8% 15.6x Ratio Analysis 30% 40% Greenblatt Ratios 25% 20% 30% 15% 20% 10% 10% 5% UNP CP EBIT Margin % KSU HUBG NSC 2010 2011 2012 EBIT/Tangible Assets NI Margin % Productivity gains due to new locomotives 30% Originates and delivers 60% of traffic while it is 50% for peers 15% 2013 2014 EBIT/Enterprise Value Greenblatt Ratios – Peer Comparison 25% 20% 10% 5% UNP CP EBIT/Tangible Assets Sources: Union Pacific 2014 10-k, Yahoo Finance! KSU HUBG NSC EBIT/Enterprise Value Management Analysis Effective corporate governance policies 10 out of the 11 directors are independent Use of majority voting for annual board elections Issued options represented <1% of outstanding shares during the recent years No executive officers on board committees Peer Benchmarking CP transports merchandise freight of finished vehicles and auto parts, chemicals and plastics, crude oil and forest products • Network of about 13,700 miles serving from the business centers in Canada and US • Trans-loading, warehousing and distribution services of steel products KSU operates north/south rail route in the mid-west and southeast regions Network of about 6,500 route miles from the mid-west and southeast Customers including electric-generating utilities and intermodal transportation HUBG provides intermodal, truck brokerage and logistic services in North America Contracts with railroads to provide transportation for the shipment and freight brokerage Offers management services and technology solutions NSC has rail transportation of raw materials, intermediate products, finished goods and passenger trains Operates about 20,000 miles of road in 22 states, bimodal truckload transportation services Sources: Union Pacific 2014 10-k, Yahoo Finance! Peer Benchmarking (Contd.) Company Trailing P/E Forward P/E P/Sales P/BV Weight# CP 15.26x 17.15x 3.34x 5.67x 30% KSU 19.78x 17.08x 3.89x 2.48x 30% HUBG 21.62x 17.88x 0.40x 2.25x 10% NSC 14.24x 14.00x 2.23x 2.00x 30% UNP 16.94x 16.25x 2.88x 3.27x #Weight of each company assigned according to their similarity of service line and revenue sources with UNP Sources: Capital IQ Relative Valuation Items EPS (2014) 6.08x Forward EPS (2015) 7.09x Sales per share (2014) 28.15x Book Value per Share (2014) 24.87x Diluted Shares Outstanding 852m Sources: Capital IQ Price Multiples Stock Price (Trailing P/E) $103.02 Stock Price (Forward P/E) $115.21 Stock Price (P/Sales) $81.01 Stock Price (P/BV) $81.28 Weighted Average Current Price (11/4/2015) Upside Potential Weight 25% 25% 25% 25% $95.13 $88.19 7.87% Financial Projections Million Dollars 2010 2011 Actual 2012 16,967 20.0% 19,557 15.3% 20,925 7.0% 21,964 5.0% 23,988 9.2% 24,481 2.1% 26,002 6.2% 4,314 2,486 1,487 4,681 3,581 1,617 4,685 3,608 1,760 4,807 3,534 1,777 5,076 3,539 1,904 5,355 2,171 2,018 Balance Sheet Items Net Properties Deferred Income Taxes Treasury Stock 38,253 11,557 (4,027) 39,934 12,368 (5,293) 41,997 13,108 (6,707) 43,749 14,163 (8,910) 46,272 14,680 (12,064) Cash Flow Items CapEx % Revenue Common Share Repurchases Debt Issued (2,482) 14.6% (1,249) 894 (3,176) 16.2% (1,418) 486 (3,738) 17.9% (1,474) 695 (3,496) 15.9% (2,218) 1,443 (4,346) 18.1% (3,225) 2,588 Revenue Total Revenues % Growth Income Statement Items Compensation and Benefits Fuel Depreciation Sources: Association of American Railroads, Bloomberg 2013 2014 2015 2016 Projection 2017 2018 2019 2020 27,842 7.1% 29,629 6.4% 31,497 6.3% 33,344 5.9% 5,650 2,317 2,119 5,960 2,493 2,225 6,288 2,664 2,336 6,634 2,843 2,453 6,999 3,018 2,576 48,890 15,302 (16,059) 51,657 16,168 (20,059) 54,579 17,083 (20,609) 57,668 18,049 (21,159) 60,931 19,071 (21,709) 64,378 20,150 (22,259) (4,435) 18.1% (3,995) 2,362 (4,420) 17.0% (4,000) 462 (4,733) 17.0% (550) 606 (5,037) 17.0% (550) 1,065 (5,354) 17.0% (550) 578 (5,669) 17.0% (550) 652 WACC Weighted Average Cost of Capital CAPM Risk-Free Rate Market Risk Premium Beta CAPM Cost of Equity Sum of Present Value of FCF 2.17% 7.50% 0.93 Sources: Bloomberg, UNP Q3 10-Q $88.19 852.0 $75,137.88 Market value of Debt $13,319.00 9.17% $143,582 Key Rates Assumption Bussiness Risk Premium WACC Discount Rate Terminal Growth Rate Share Price Diluted Shares Outstanding (mil) Market Value of Equity 0.50% 8.28% 8.78% 3.00% Percent Equity Weight Percent Debt Weight 84.94% 15.06% Cost of Debt Cost of Equity 5.16% 9.17% Tax rate 37.76% WACC 8.28% DCF Valuation Discount Cash Flow (Millions) EBIT Less: Taxes Plus: Depreciation Less: Capital Expenditures Changes in Net Working Capital Less: Increses in A/R Less: Increases in Materials and Supplies Plus: Increases in A/P Free Cash Flow Present Value Sum of Present Value of FCF Sources: UNP Factbook 2014 0 1 2 3 4 5 2015E 10,145 (3,687) 2,018 (4,435) 2016E 10,872 (3,953) 2,119 (4,420) 2017E 11,823 (4,302) 2,225 (4,733) 2018E 12,725 (4,632) 2,336 (5,037) 2019E 13,665 (4,976) 2,453 (5,354) 2020E 14,593 (5,316) 2,576 (5,669) (37) (41) (102) (47) (124) (57) (120) (55) (126) (57) (124) (57) 304 224 271 263 275 272 4,267 4,267 $98,937 4,692 4,314 5,104 4,314 5,481 4,258 5,879 4,199 6,275 4,120 Terminal UNP expects to invest around 16-17% of revenue annually in the capital planning program 111,884 73,465 Final Implied Price Terminal Growth Rate 3.00% Value Per Share Sensitivity Analysis 98,937 2,358 (13,319) 87,976 Share Price $103.26 Sources: Yahoo Finance! Terminal Growth Rate Discount Rate (Millions, Excepts Share Price) Enterprise Value Plus: Cash Less: Debt Market Capitalization $ 103.26 2.0% 2.5% 3.00% 3.50% 4.00% 7.78% $107.15 $116.11 $126.93 $140.29 $157.19 8.28% $97.80 $105.18 $113.97 $124.60 $137.72 8.78% $89.82 $96.00 $103.26 $111.89 $122.32 9.28% $82.95 $88.18 $94.25 $101.38 $109.85 9.78% $76.96 $81.44 $86.58 $92.54 $99.54 Recommendation Improving productivity Favorable mix EPS accretive share repurchase Dividend Yield 2.2% Presence at Mexico gateways Relative Valuation: $95.13 Stock Price Current Stock Price:$88.19 Sources: Yahoo Finance! DCF Valuation:$103.26 Recommendation: BUY 100 shares At current market price Stock Price Potential challenges from crude, ethanol and frac sands Increased competition