Monday, April 9, 2012 - MBoatner-SHS

advertisement

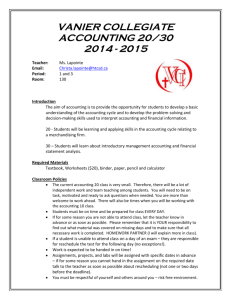

Monday, April 9, 2012 Essential Question: What is the accounting procedure for a merchandising business organized as a corporation? Key Questions: Can you record and post transactions for a merchandising business organized as a corporation? Can you verify the accuracy of your postings using a schedule of AR & AP? DO NOW: Keytrain.com – 1st 15 minutes First Part of Period: Go over test. Second Part of Period: Begin Reinforcement Activity 2-A on p. 398401. Save the Excel workbook from the Useful Links page of my wiki to complete this Reinforcement. You may use your working papers, but you must transfer all work to the Excel Workbook for grading purposes. Instructional Strategies and Activities: After opening the file, be sure to do a "save as..." Record the transactions, ignore posting instructions After recording the last transaction on December 31, Print and turn in: o a trial balance o schedule of accts receivable o schedule of accounts payable Instructor will check for accurate account balances. If any errors are found, instructor will give printouts back and you will have the opportunity to find and fix your errors. If no errors are found in account balances, instructor will let you know and you can then print your file for grading. Summarizing What did you get accomplished on RA? Strategy: Assessment: Workbook activities, written test Resources: Workbook, Automated Accounting GPS: BCS-PAI-4, 5, 6, 7, 8, 10 Tuesday, April 10, 2012 Essential Question: What is the accounting procedure for a merchandising business organized as a corporation? Key Questions: How do you analyze payroll transactions and record a payroll? How do you record employer payroll taxes? How do you prepare payroll tax reports? How do you pay and record withholding and payroll taxes? Activating Strategy: Keytrain – 1st 15 minutes Continue Reinforcement Activity 2-A on p. 398-401. Instructional Strategies and Activities: After opening the file, be sure to do a "save as..." Record the transactions, ignore posting instructions After recording the last transaction on December 31, Print and turn in: o a trial balance o schedule of accts receivable o schedule of accounts payable Instructor will check for accurate account balances. If any errors are found, instructor will give printouts back and you will have the opportunity to find and fix your errors. If no errors are found in account balances, instructor will let you know and you can then print your file for grading. Summarizing Make sure you turn in your test to the tray and the V drive. Strategy: Assessment: Workbook activities, written test Resources: Workbook, Excel GPS: BCS-PAI-10. Students will apply Generally Accepted Accounting Principles (GAAP) to various forms of ownership and payroll. b. Prepare and maintain payroll records using manual and computerized systems. c. Calculate earnings at an hourly and piece rate and on a salary, commission, and salary/commission basis. d. Compute employee gross earnings, deductions, and withholdings to determine net pay. e. Calculate employer’s payroll taxes including Social Security, Medicare, federal unemployment, state unemployment, other taxes, and other employee benefits paid by the employer. f. Prepare federal, state, and local payroll reports. Wednesday, April 11, 2012 Essential Question: What is the accounting procedure for a merchandising business organized as a corporation? Key Questions: What are dividends? How do you declare a dividend? How do you pay dividends to stock holders? How do you prepare a worksheet for a corporation? What adjustments are made? How do you calculate federal income tax? DO NOW: Preview terms on p. 402 Discuss Chapter 14: Distributing Dividends and Preparing a Work Sheet for a Merchandising Business Section 14-1: Distributing Corporate Earnings to Stockholders What is "retained earnings" and what are "dividends"? Who can "declare a dividend"? What is the transaction to record declaring a dividend? What is the transaction to pay a declared dividend? Do work together and on your own p. 408 Section 14-2: Beginning an 8-Column Work Sheet for a Merchandising Business Instructional Strategies and Activities: Prepare the Trial Balance Section Plan Adjustments o Supplies (Office and Store) Adjustments o Prepaid Insurance Adjustment Do work together and on your own p. 414 Section 14-3: Planning and Recording a Merchandise Inventory Adjustment What is Merchandise Inventory? Merchandise Inventory Adjustment o Inventory is less at end o Inventory is greater at end Do work together and on your own p. 418 Section 14-4: Planning and Recording an Uncollectible Accounts Adjustment What is uncollectible accounts? Estimating uncollectible accounts Uncollectible Accounts Adjustment Do work together and on your own p. 422 Section 14-5: Planning and Recording Depreciation Adjustments What are current assets vs plant assets? What is depreciation? How do you determine depreciation? Depreciation Expense Adjustment Do work together and on your own p. 426 Section 14-6: Calculating Federal Income Tax and Completing a Work Sheet How do you calculate the amount of federal income tax a corporation owes? Federal Income Tax Adjustment Completing the Work Sheet Do work together and on your own p. 436 Begin Applications 14-1 through 14-6 Summarizing Review Key points from today's lesson Strategy: Assessment: Workbook activities, written test Resources: Workbook GPS: BCS-PAI-4. Students will understand and apply the various steps of the accounting cycle for proprietorships and corporations and explain the purpose of each step. e. Analyze the effects of revenue, expense, and drawing accounts on owner’s equity. g. Analyze business transactions and their effect on the accounting equation. h. Apply the double-entry system of accounting to record business transactions and prepare a trial balance. i. Prepare and use an 8- and/or 10-column worksheet. j. Explain the need for adjusting entries and record adjusting entries. BCS-PAI-5. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of assets. e. Create and maintain the accounts receivable subsidiary ledger and account for credit card sales and apply appropriate accounting techniques for uncollectible accounts. h. Calculate depreciation and apply appropriate accounting concepts and techniques for acquisition, depreciation, and disposal of property, plant, and equipment. BCS-PAI-7. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of owners’ equity. b. Explain the purpose of the following capital accounts for a corporation: common stock, preferred stock, paid-in capital, retained earnings, and dividends. c. Analyze and record investments by stockholders and the declaration and payment of dividends for a corporation. d. Differentiate between stockholders’ equity and retained earnings. e. Use manual and computerized accounting systems for stockholders’ equity. Thursday, April 12, 2012 Essential Question: What is the accounting procedure for a merchandising business organized as a corporation? Key Questions: What are dividends? How do you declare a dividend? How do you pay dividends to stock holders? How do you prepare a worksheet for a corporation? What adjustments are made? How do you calculate federal income tax? DO NOW! Get your materials from yesterday and open your books to chapter 14. Continue with discussion on Chapter 14: Distributing Dividends and Preparing a Work Sheet for a Merchandising Business Section 14-4: Planning and Recording an Uncollectible Accounts Adjustment What is uncollectible accounts? Estimating uncollectible accounts Uncollectible Accounts Adjustment Do work together and on your own p. 422 Section 14-5: Planning and Recording Depreciation Adjustments Instructional Strategies and Activities: What are current assets vs plant assets? What is depreciation? How do you determine depreciation? Depreciation Expense Adjustment Do work together and on your own p. 426 Section 14-6: Calculating Federal Income Tax and Completing a Work Sheet How do you calculate the amount of federal income tax a corporation owes? Federal Income Tax Adjustment Completing the Work Sheet Do work together and on your own p. 436 Begin Applications 14-1 through 14-6 Summarizing Review Key points from today's lesson Strategy: Assessment: Workbook activities, written test Resources: Workbook BCS-PAI-4. Students will understand and apply the various steps of the accounting cycle for proprietorships and corporations and explain the purpose of each step. e. Analyze the effects of revenue, expense, and drawing accounts on owner’s equity. g. Analyze business transactions and their effect on the accounting equation. h. Apply the double-entry system of accounting to record business transactions and prepare a trial balance. i. Prepare and use an 8- and/or 10-column worksheet. j. Explain the need for adjusting entries and record adjusting entries. BCS-PAI-5. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of assets. GPS: e. Create and maintain the accounts receivable subsidiary ledger and account for credit card sales and apply appropriate accounting techniques for uncollectible accounts. h. Calculate depreciation and apply appropriate accounting concepts and techniques for acquisition, depreciation, and disposal of property, plant, and equipment. BCS-PAI-7. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of owners’ equity. b. Explain the purpose of the following capital accounts for a corporation: common stock, preferred stock, paid-in capital, retained earnings, and dividends. c. Analyze and record investments by stockholders and the declaration and payment of dividends for a corporation. d. Differentiate between stockholders’ equity and retained earnings. e. Use manual and computerized accounting systems for stockholders’ equity. Friday, April 13, 2012 Essential Question: What is the accounting procedure for a merchandising business organized as a corporation? Key Questions: What are dividends? How do you declare a dividend? How do you pay dividends to stock holders? How do you prepare a worksheet for a corporation? What adjustments are made? How do you calculate federal income tax? Activating Strategy: Begin working on assignments below Finish Applications 14-1 through 14-6 Instructional Strategies Do 14-7 (mastery) and Activities: Do Practice Test Summarizing Go over answers together Strategy: Assessment: Workbook activities, written test Resources: Workbook GPS: BCS-PAI-4. Students will understand and apply the various steps of the accounting cycle for proprietorships and corporations and explain the purpose of each step. e. Analyze the effects of revenue, expense, and drawing accounts on owner’s equity. g. Analyze business transactions and their effect on the accounting equation. h. Apply the double-entry system of accounting to record business transactions and prepare a trial balance. i. Prepare and use an 8- and/or 10-column worksheet. j. Explain the need for adjusting entries and record adjusting entries. BCS-PAI-5. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of assets. e. Create and maintain the accounts receivable subsidiary ledger and account for credit card sales and apply appropriate accounting techniques for uncollectible accounts. h. Calculate depreciation and apply appropriate accounting concepts and techniques for acquisition, depreciation, and disposal of property, plant, and equipment. BCS-PAI-7. Students will use Generally Accepted Accounting Principles (GAAP) to determine the value of owners’ equity. b. Explain the purpose of the following capital accounts for a corporation: common stock, preferred stock, paid-in capital, retained earnings, and dividends. c. Analyze and record investments by stockholders and the declaration and payment of dividends for a corporation. d. Differentiate between stockholders’ equity and retained earnings. e. Use manual and computerized accounting systems for stockholders’ equity.