accounting i - Canton Area School District

advertisement

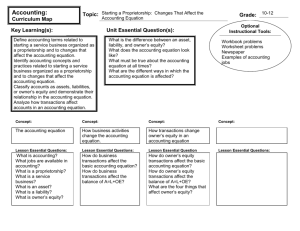

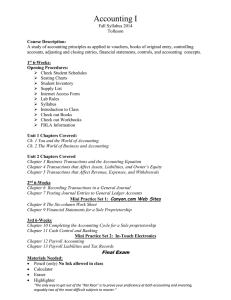

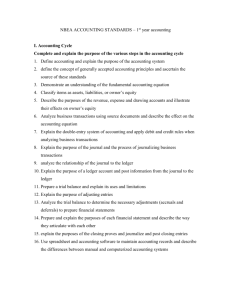

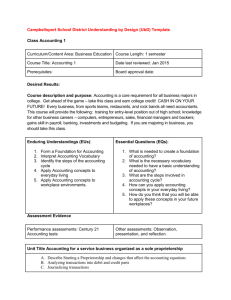

ACCOUNTING I SYLLABUS Contact information: Mr. Robert Rockwell, Room 116, Canton High School 673-5134 Email: brockwell@canton.k12.pa.us Availability: I am in my classroom by 8:00 am in the morning and I will stay after school if a student makes a prearranged appointment for extra work. I am also available during my preparation period. Course Description: This is a full year course which will provide students with a thorough background in the basic accounting procedures used to operate a business. The accounting procedures presented will also serve as a sound background for employment in office jobs and preparation for studying business courses in college. Because the complete accounting cycle is covered, it will be easy for students to see how each employee’s job fits into the cycle for a business, an important qualification to an employer. The course uses the text Century 21 Accounting with an accompanying workbook. We will cover all 17 chapters in the textbook. We will also do 2 real life accounting practice sets. This course is a business elective and counts as 1 credit toward graduation. Discipline procedures: Canton Area School District rules and procedures are followed. Students will receive a copy of specific classroom rules and procedures, which require a student signature and a parent/guardian signature. Respect, courtesy, and manners are important traits to succeed in the world of work and are what the Business Department is preparing students for; students will demonstrate those qualities in the classroom in preparation for life after high school. Because my room is also a computer lab, food and drinks are not permitted in the room. If discipline problems arise and persist, parents and administration are notified. Students are to come to class every day prepared for class. That includes a pencil, straight-edge, textbook, workbook and practice set at times. Homework is assigned on a daily basis. It is also graded daily and entered on the school’s grading system. The assigned work must be completed by the next school day unless of absence, then it is due the following day. Any late work will be given ½ the grade value. Unit quizzes and tests will be given periodically, usually after each chapter. UNITS OF STUDY ACCOUNTING I is taught on the block schedule, thus it is broken down into 2-9 week periods or 1 semester. FIRST SEMESTER: Chapters 1-12Chapter 1-Starting a Proprietorship; 1-week Chapter 2-Starting a Proprietorship: Changes that Affect the Owner’s Equity; 1 week Chapter 3-Analyzing Transactions into Debit and Credit Parts; 1 week Chapter 4-Journalizing Transactions; 1 week Chapter 5-Posting to a General Ledger; 1 week Chapter 6-Cash Control Systems; 1 week Chapter 7-Worksheet for a Service Business; 1 week Chapter 8-Financial Statements for a Proprietorship; 1 week Chapter 9-Recording Adjusting and Closing Entries for a Service Business; 1 week Chapter 10-Journalizing Purchases and Cash Payments; 1 week Chapter 11-Journalizing Sales and Cash Receipts; 1 week Chapter 12-Posting to General and Subsidiary Ledgers; 1 week SECOND SEMESTER: Chapter 13-Preparing Payroll Records-1 week Chapter 14-Payroll Accounting, Taxes, and Reports-1 week Chapter 15-Worksheet for a Merchandising Business-1/2 week Chapter 16-Financial Statements for a Partnership-1/2 week Chapter 17-Recording Adjusting and Closing Entries for a Partnership-1/2 week “Fitness Junction” practice set-2 ½ weeks Assessments used: Practice jobs and assignments, “On Your Own” and “Work Together” problems in the textbook, Mastery and Application problems in the chapter, application quizzes and tests, and practice sets will be used for assessment. ACADEMIC STANDARDS FOR ACCOUNTING I The following Accounting National Business Standards will be used for this course: Standard 1-The Accounting Cycle -Complete the various steps of the accounting cycle and explain the purpose of each step. Standard 2-The Accounting Process -Determine the value of assets, liabilities and owner’s equity according to generally accepted accounting principles, explaining when and why they are used. A) Assets, B) Liabilities, C) Owner’s Equity Standard 3-Financial Statements -Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising and manufacturing businesses. A) Financial Statement Preparation and Analysis, B) Income Statement for the Three Types of Business Operations. Standard 4-Special Applications -Apply appropriate accounting principles to various forms of ownership, payroll, income taxation, and managerial systems. A) Forms of Ownership, B) Payroll, C) Income Taxation, D) Managerial Accounting Principles and Systems. Standard 5-Interpretation and Use of Data -Use planning and control principles to evaluate the performance of an organization of an organization and apply differential analysis. A) Planning and Control, B) Decision Making