ECON 4910 Spring 2007 Environmental Economics Lecture 11

advertisement

ECON 4910 Spring 2007

Environmental Economics

Lecture 11, Chapter 10 Kolstad

Lecturer: Finn R. Førsund

Unknown control cost

1

Designing contracts when purification cost

is unknown to the regulator

Two types, high-cost, H, and low-cost, L

Emissions measurable ex post

Contracts state permitted emission and a tax

The objectives of the contracts

Ensure participation of the firm, i.e. the gross

profit must be non-negative

Give incentive to tell the truth about the cost type,

i.e. tax according to type must induce truth-telling

Unknown control cost

2

Designing incentives

The problem is that type L has an incentive to

choose an H contract if L is not given pure

profit telling the truth. If L chooses an H

contract:

UL(H) = π –TH - cL(eH) = π –TH - cL(eH) + (cH(eH) cH(eH)) = (π –TH - cH(eH)) + cH(eH) - cL(eH) = UH +

cH(eH) - cL(eH) >0

Type L must be given the incentive

UL≥ UL(H) = UH + cH(eH) - cL(eH)

Unknown control cost

3

If type H chooses an L contract:

UH(L) = π –TL - cH(eL) = π –TL - cH(eL) + [cL(eL) cL(eL)] = π – TL - cL(eL) - cH(eL) + cL(eL) = UL cH(eL) + cL(eL)

If minimum for UL is inserted we get

UH(L) = UH + cH(eH) - cL(eH) – (cH(eL) - cL(eL)) < UH

Since type H will always choose an H

contract the tax can be designed so that pure

profit is zero. Type H has an incentive to tell

the truth anyway.

Unknown control cost

4

The regulator’s objective function

The objective function must reflect a conflict

between the two parties:

The benefit of taxes must also be included,

i.e. assuming that tax benefit the consumer

The general consumer experiencing the

environmental damage D(e)

The firm enjoying pure profit, Uj, j=L,H

W = T- D(e) + αU= π - c(e) – U - D(e) + αU =

π - c(e) - D(e) - (1- α)U , 0 ≤ α<1

The regulator must evaluate pure profit less

than environmental damage

Unknown control cost

5

Determining emission- and tax quantities

of the contracts

Maximising the expected value of the

objective function

E{W} = p(π – cL(eL) – D(eL) - (1-α)(cH(eH) - cL(eH) )

+ (1-p)(π – cH(eH) – D(eH) ) (setting UH = 0 )

Differentiating:

E{W }

p (cL (eL ) D(eL )) 0 cL (eL ) D(eL )

eL

E{W }

p (1 )(cL (eH ) cH (eH )) (1 p)(cH (eH ) D(eH )) 0

eH

p(1 )

D(eH ) cH (eH )

(cL (eH ) cH (eH )) cH (eH )

(1 p)

Unknown control cost

6

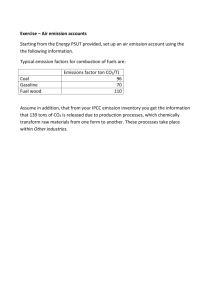

Illustration of giving an incentive to the

high-cost firm to tell the truth

-c’,D’

D’(e)

-cH’

D’ >-cH’

Efficiency loss

-cL’

-cH’

-cL’=D’

Savings in pure profit

Pure profit L

eL*

e

eH*

eH

Unknown control cost

7

Emission tax or quantity regulation

Direct regulation more in use than economic

incentives, why?

Simplifying:

Single firm that can be high-cost, H, or low-cost, L

Emissions not measured ex post

Finding tax t* and quantity regulation e* by

equating (-)expected marginal cost to

marginal damage

Unknown control cost

8

Illustration

Social loss using e* if

L and if H

-E{c’(e)}

D’(e)

Social loss if H

using t*

t*

-cH’

Social loss if L

using t*

-cL’

eL(t*)

eL

e

e*

eH eH(t*)

Unknown control cost

9

Pivoting the marginal damage function

Social loss using e* if

L and if H

-E{c’(e)}

D’(e)

Social loss if H

using t*

t*

-cH’

Social loss if L

using t*

-cL’

e

eL(t*)

eL

e*

eH eH(t*)

Unknown control cost

10

Pivoting the marginal cost functions

Social loss using e* if

L and if H

-E{c’(e)}

D’(e)

Social loss if H

using t*

t*

Social loss if L

using t*

eL(t*)

-cH’

-cL’

eL

e

e*

eH eH(t*)

Unknown control cost

11

Weitzman rule

With uncertain purification costs

Use emission tax if marginal purification cost

curve (absolute value) is relatively steeper than

the marginal damage curve

Use direct regulation if marginal damage curve is

relatively steeper than marginal cost curves

(absolute value)

Unknown control cost

12

Hybrid price/quantity regulation

Type of purification cost function for a single

firm unknown, but the regulator knows the

two types and can form expectations

Regulators quantity benchmark

Min e {E{c(e)} D(e)}

E{c '(e)} D '(e) 0 e e*

The contract stipulates that if ej> e*, then the

firm has to pay a tax t per unit emitted, if ej >

e*, then the firm gets a subsidy s per unit

emitted

Unknown control cost

13

Hybrid price/quantity regulation, cont.

Calculation of tax/subsidy scheme

Tax

Min e j (c j (e j ) t (e j e*) cj (e j ) t for e j e*

Subsidy

Min e j (c j (e j ) s(e * e j ) cj (e j ) s for e j e*

Unknown control cost

14

Illustration of hybrid contract

-E{c’(e)}

D’(e)

t

-cH’

s

-cL’

eL

e

e*

eH

Unknown control cost

15

Regulation with unobserved emission

Kolstad Chapter 11

Regulator cannot (or too expensive) observe

firm emissions, but can observe total amount

of pollutants deposited in the environmental

receptor

Regulator knows the purification cost

functions of each firm and the unit transport

coefficients (may be 1), and the damage

function

Then the regulator can work out the optimal

deposition

Unknown control cost

16

Regulation with unobserved emission,

cont.

Optimal total deposition

N

N

i 1

i 1

Min ei { ci (ei ) D( ai ei )}

N

ci(ei ) ai D( ai ei ) ai D( P), i 1,.., N

i 1

N

ei ei* , P* ai ei*

i 1

Unknown control cost

17

The tax scheme

The tax/subsidy on (unobserved) firm

emission is equal for all firms and

proportional to total exceedence in the

environmental receptor

Taxi t ( P P* )

Firm adaptation

N

Min ei {ci (ei ) t ( P P* )} {ci (ei ) t ( a j e j P* )}

j 1

N

{ci (ei ) tai ei t ( a j e j P* )} ci(ei ) tai

j ì

Unknown control cost

18

Calibration of the common tax rate

From the social solution

ci(ei ) ai D( P)

From the private solution

ci(ei ) tai

The optimal tax rate

t D( P )

Unknown control cost

19

Auditing an emission standard

The total cost of the firm concerning

emissions

c(e) E{F (e)},

( f (e s ) D) e s

F (e)

if

0

e

s

π probability of an audit

f fine per unit of emission above the regulation

D lump-sum fine

Unknown control cost

20

The firm’s decision problem

Assuming that violating the standard is

considered

Min e [c(e) E{F (e)}] c(e) ( f (e s ) D)

c(e) fe ( D s )

c(e) f

Unknown control cost

21

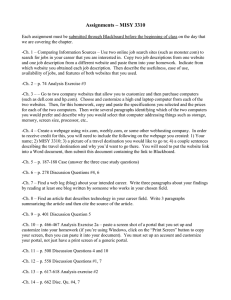

Illustration auditing an emission standard

Corner solution for e

-c’

Regulators choice of πf

(πf)’

πf

e

s

e*

Unknown control cost

22