wo Complementary EVM Cost-Risk Tools

advertisement

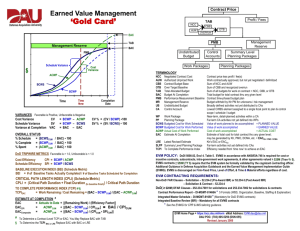

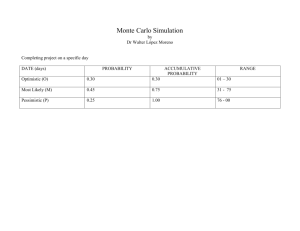

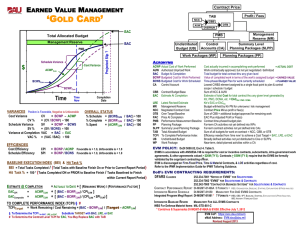

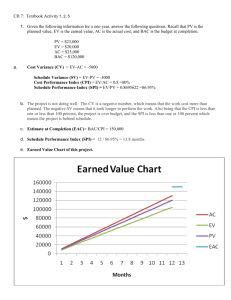

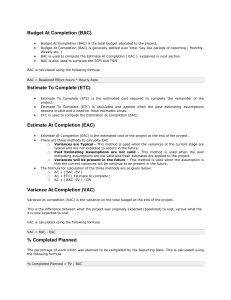

Two Complementary EVM Cost-Risk Models 1. Use of EVM Trends to Forecast Cost Risks 2. Integrated Cost-Risk Model (ICRM) Utilizing ACEIT For 18 MAR SoCal ICEAA Workshop David R. Graham Consultant, Salient Federal Solutions Carlsbad, CA dgmogul1@verizon.net 703-489-6048 Use of EVM Trends to Forecast Cost Risks Some Charts from Original Presentation at 2011 ISPA/SCEA Conference, Albuquerque, NM Dr. Roy Smoker* MCR LLC rsmoker@mcri.com (Other Charts Added by David R. Graham) *Roy E. Smoker (2011): Use of Earned Value Management Trends to Forecast Cost Risks, Journal of Cost Analysis and Parametrics, 4:1, 31-51 (C)2011 MCR, LLC Main Points of Paper 1. EVM data is taken from the PMB’s S-curve at it’s most linear section – The early part of the PMB’s S-curve represents start up so is not linear – The ending part of the PMB’s S-curve represents contract ending so is also not linear – Linear regression equations work best when data is linear 2. Regression equation developed to forecast BAC – Unique from most regression equations used in EVM performance projections – Basis: BAC grows due to learning more about the nature of the work as the effort proceeds and additional work is put on contract through ECOs 3. Ending month of contract can also be forecasted using regression equations – Basis: At end of contract BCWP must equal BAC – Regression equations for BCWP and BAC are set equal to solve for months • BCWP = BAC $86.35M*Months = $4,970.56 + $31.76M * Months • Then just solve for months = 91.06 – NOTE: Calculation made at month 42 - Coefficients change depending on month selected due to amount of available EVM data increasing over time – Preferred over usual BAC/Avg BCWP or Lipke’s Earned Schedule Main Points of Paper (cont) 4. Regression equation developed to forecast percent complete (PC) – – PC = 0 + 0.013772546*Month (“0” is the intercept, that is, at 0 time there is 0 percent complete) At month 42, “0.013772546” is the rate of PC/month so, at that rate the completion month is: Completion Month = 100% Complete/1.3772546 %= 72.6 months • The PC was measured as the raw value of each monthly BCWP divided by the value of the BAC for month 42 – 5. NOTE: Percent complete (PC) using this method understates completion months due to not taking into account rate at which BAC is growing Variance at Completion (VAC) is a quantification of value of risk that must be burned down – Regression equation developed to forecast EAC – Subtract forecasted EAC from forecasted BAC = forecasted VAC – True significance of forecasted VAC: • Some risk issues that are part of VAC are known and should be described on Format 5 • Unexpected risks have not yet been discovered but are part of this forecasted VAC 18 Months of Data Equations: (1) BCWS18 = $89.12M * Months (0.7525) T-stat = 118.44 R2 = 0.9988 (2) BCWP18 = $86.35M * Months (0.6925) T-stat = 124.68 R2 = 0.9989 (3) BAC18 = $4,970.56M + $31.76M * Months ( 86.92) ( 2.56) R2 = 0.9056 T-stats 57.19 12.39 (4) EAC18 = $4,393.13M + $52.62M * Months ( 106.65) ( 3.15) R2 = 0.9459 T-stats 41.19 16.73 Regressions run in Excel. EOM # Months Cum Cum Cum BCWS BCWP ACWP LRE BAC EAC Sep-95 Oct-95 Nov-95 Dec-95 Jan-96 Feb-96 Mar-96 Apr-96 May-96 Jun-96 Jul-96 Aug-96 Sep-96 Oct-96 25 26 27 28 29 30 31 32 33 34 35 36 37 38 $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2,034 2,150 2,247 2,358 2,477 2,586 2,705 2,817 2,921 3,038 3,152 3,245 3,370 3,479 Nov-96 39 $ 3,579 $ 3,470 $ 3,656 $ 6,118.34 $ 6,396.00 Dec-96 40 $ 3,667 $ 3,554 $ 3,571 $ 6,145.90 $ 6,424.00 Jan-97 41 $ 3,765 $ 3,647 $ 3,869 $ 6,292.16 $ 6,570.00 Feb-97 42 $ 3,866 $ 3,738 $ 3,978 $ 6,269.68 $ 6,548.00 $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,988 2,095 2,191 2,294 2,400 2,501 2,617 2,729 2,828 2,939 3,047 3,138 3,258 3,373 $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2,017 2,142 2,243 2,353 2,462 2,565 2,694 2,817 2,932 3,051 3,169 3,274 3,407 3,535 $ $ $ $ $ $ $ $ $ $ $ $ $ $ 5,750.00 5,776.00 5,785.00 5,822.94 5,870.95 5,906.54 5,961.16 6,000.22 6,088.19 6,160.98 6,156.54 6,132.15 6,211.78 6,173.79 All Cost are $M Note: Even with the significance in the parameters in these equations there is a good degree of variability as indicated by their standard errors in parenthesis. (C)2011 MCR, LLC 5 $ $ $ $ $ $ $ $ $ $ $ $ $ $ 5,750.00 5,776.00 5,785.00 5,823.00 5,871.00 5,917.00 5,972.00 6,017.00 6,146.00 6,350.00 6,344.00 6,352.00 6,401.00 6,363.00 Full 43 Months of EVM Data (months 25 through 67) (from the Excel based EVM Trend Tool) Essentially Linear Data Research: Can we predict the performance of a long term contract from only 18 months of data covering months 25 thru 42 using linear assumptions? Answer: Perhaps apply the approach to other, completed programs to validate the results presented in Dr. Smoker’s paper. EVM Trend Data (Months 25 thru 67) $9,000 $8,000 $7,000 $6,000 TY $M Question: What do you get when you remove the initial start up months and the contract closeout months from the usual S-curve? Answer: A data set that exhibits the graphic forms shown here. Note, there is a hint of an S-curve without the usual tails. BCWS $5,000 $4,000 BCWP $3,000 ACWP $2,000 BAC $1,000 EAC $0 20 40 60 80 Months We know: Monthly BAC but not the final BAC Monthly EAC but not the final EAC Monthly VAC but not the final VAC We don’t know the month of the final VAC (C)2011 MCR, LLC 7 BAC & EAC as a Function of Time • However, both equations based on 18 monthly observations are significant and can be used to predict the growth of both BAC and EAC thru time EAC vs BAC by Month TY $M • The uncertainty in the BAC, based on program office decisions to remove work and add work to the contract, also creates uncertainty in the EAC as shown here $6,700 $6,600 $6,500 $6,400 $6,300 $6,200 $6,100 $6,000 $5,900 $5,800 $5,700 $5,600 EAC = 52.618x + 4393.1 R² = 0.9459 BAC BAC= 31.762x + 4970.6 R² = 0.9056 0 10 20 30 40 EAC 50 Months With EAC growing faster than BAC, the question is when will this contract reach completion so that VAC stops growing? (C)2011 MCR, LLC 8 VAC as a Measure of Risk • Risk is measured in EVM terms as any deviation from the original baseline. – That is, risk is anything that results in a variance • Therefore, VAC is the basic measure of risk encountered by the end of the contract effort – Whether the risk is rooted in opportunity with a positive variance – Or, is rooted in issues related to planning of scope, estimating, scheduling, or technical criteria that are identified during testing and generally associated with a negative variance (C)2011 MCR, LLC 9 Risk Burn down (1 of 2) • The final VAC may be estimated as the difference between the linear forecast of BAC and EAC • Risk burn down may be measured as the amount of VAC that has been worked off • Therefore, it is possible to show the %risk burn down as a function of the amount of cumulative VAC that has been incurred relative to the final VAC (C)2011 MCR, LLC 10 Risk Burn down (2 of 2) • Here the green line represents the %Risk that has been burned down and measured as: 1 - Cum VAC/Final VAC • It is interesting to note that early in this program, risk is being burned down faster than the remaining work is being accomplished. Finally, Risk is burned down to zero as remaining work is reduced to zero and percent complete approaches 100% • (C)2011 MCR, LLC 11 Summary – Contract Scope • We have learned – An S-curve with its tails removed exhibits significant linearity with variability – The scope of a contract grows across time – New work pushes out the expected completion date – There is a future date where • BCWP will equal BAC • From this equivalency the expected completion date can be calculated – Each monthly %complete drops as BAC grows (C)2011 MCR, LLC 12 Summary – Trend Analysis • We have learned – Normal monthly EACs fall short of final EAC • Due to same contract scope growth that affects BAC – Trend analysis • Helps identify the completion date – Can then estimate the final EAC – Can then estimate the final BAC – Final VAC • Can be estimated as: (Final BAC – Final EAC) • VAC appears useful in measuring the value of a program’s risks (planning, estimating, scheduling, technical) • May be used to measure how risks get burned down across the period of performance from ATP to Estimate Completion Date (C)2011 MCR, LLC 13 Integrated Cost-Risk Model (ICRM) Utilizing ACEIT David R. Graham Consultant, Salient Federal Solutions Carlsbad, CA dgmogul1@verizon.net 703-489-6048 NOTE: Special thanks to Darren Elliott of Tecolote, Inc., for actual ICRM programming Outline • • • • • • • • What ICRM Brings ICRM Model Overview Narrative ICRM Model Structure Illustration Note on Simulation Assumptions Used in the ICRM Model 5X5 Risk Matrix Rating Scales Dominant Likelihood Algorithm DAU EVM 201 LAR Risk Register ICRM Mechanics General Overview • • • • ICRM WBS Element and Risk Prioritization Tornado Charts & PDF/CDF Graphs ACEIT Workscreen Examples ICRM Customization Summary What ICRM Brings 1. EVM data and risk register results into a probabilistic context using the DAU Light Assault Reconnaissance (LAR) Vehicle case study as the database for illustrating the ICRM 2. True confidence levels of contractor WBS-level EACs – Through applying a range of WBS-level EVM PFs to create a distribution of possible ‘adjusted’ BCWR values at the WBS element level (cum ACWP + adjusted BCWR = EAC) – Allowing identification of where contractor WBS-level EACs fall in the distributions 3. WBS-level Risk Register-driven cost-risk distributions – Identifies risk register risks to affected WBS elements – Applies risk likelihoods and cost consequence ranges to WBS element BCWR values 4. Integration of both WBS PF-based and WBS Risk Register-based distributions by statistically summing them through monte carlo simulations in ACEIT producing an overall EAC cost-risk distribution What ICRM Brings (cont) 5. Enables prioritization – By WBS elements most cost-impacted by risks, and – By risks causing the most significant cost impacts 6. These results provide the basis for an ongoing meaningful dialogue that is not happening today between the EVM analysts, technical risk management teams, cost estimators, schedule analysts, project officers and, ultimately, the program managers based on cost impacts caused by risks ICRM Model Overview Narrative • • Enter in EVM data (e.g., BCWS, BCWP, ACWP cum-to-date) Non-Probabilistic EAC calculation – – • Derive BCWR (BAC-BCWP); adjust by performance factor; develop EAC (i.e., ACWP cum-to-date + adjusted BCWR) NOTE: Can use BAC assuming growth derived from EVM Trends Approach Performance Factors range data – Use CPI; SPI; CPI*SPI; (can use other PFs) as separate cases or two at a time in a Min & Max uniform distribution – Utilize ACEIT’s capability to identify minimum/maximum results to construct a PF-based range distribution relaxing the analyst’s workload • Risk Register data – Identify risks and their impacts to specific WBS elements • One risk to one WBS; one risk to many WBSs; many risks to one WBS – Use midpoint of risk likelihoods (e.g., if range=5%-20%, use 12.5%) – Identify risk cost consequence ranges (i.e., low, most likely & high values) and apply resulting percent impacts on adjusted BCWRs • Incorporate all risks in Latin Hypercube ACEIT simulations and calculate EAC as a total value that includes all risk effects ICRM Model Structure Illustration Statistical PF Range & Risk Register-Impacted EAC Risk Register Risk Inputs (ID WBSs impacted; Cost Consequences; Likelihoods) Performance Factor Range Impact Calculation (Range * affected WBS items) EAC Calculations Based on Single Performance Factor (PF) Note on ICRM Simulation Assumptions • Decision Rule on Whether the Risk Actually Happens – Random number generator produces a number between “0” & “1” that compares against the risk register’s likelihood • The “Dominant Likelihood” algorithm determines the ‘winner’ of the comparison and either includes the full risk’s cost consequence or none of the consequence 5x5 Risk Matrix Rating Scales • Level Likelihood of Occurrence – – – – – 1 Not Likely (5% - 20%) 2 Low Likelihood (21% - 40%) 3 Likely (41% - 60%) 4 Highly likely (61% - 80%) 5 Near certainty (81% - 99%) (Note: Percentages from DoD range guidance) • Cost Consequence Rating (see notes, Alternatives 1,2 &3) • 5 Critical (23% - 28%) • 4 Serious (15%- 20%) • 3 Moderate (10% - 15%) • 2 Minor (5% - 10%) • 1 Negligible (1% - 5%) • OPP (opportunities) Potential cost savings (added to matrix) Consequence Definitions From Program’s Risk Management IPT 5 4 3 2 1 OPP 0 0 0 2 0 1 2 1 0 1 1 2 0 0 0 1 4 1 0 2 0 1 0 0 0 0 0 0 0 1 2 3 4 5 Likelihood Total Risks = 19 High = 5 Medium = 9 Low = 5 Opportunities = 0 NOTES ON COST CONSEQUENCE APPROACHES Alternative 1: Percent of last approved cost estimate Alternative 2: Percent of affected WBS element’s BCWR (i.e., S/C, P/L, etc.) Alternative 3: Percent additional resources taken as a function of burn rate per schedule slip on WBS element(s) affected (Note: Percentages from DoD range guidance) NOTE: Number of risks in above example are from DAU EVM 201 LAR Risk Assessment Dominant Likelihood Algorithm General Process Overview 5 2). Estimate Consequence WBS, Months delay, Phase of Delay WBS % Increase in NRE, REC or both Convert both to $ NOTE: Random # Draw = > 0 and < 1 M H H H H Consequence 1 2 3 4 1). Identify Discrete Risks Risk #1 Risk #2 Risk #3 … L M H H H L M M H H L L M M H L L L L M 1 2 3 4 Likelihood 5 Max. # Risks Likelihood > Random # Draw Yes No N=1 Add full consequence Don’t add consequence } 3). Estimate Likelihood Remote, Unlikely, Likely, Very Likely, Near Certainty Run appropriate # of iterations Develop Cumulative Distribution 100% 90% Percent Likelihood of Coming in on Budget (%) 80% 5x5 Risk Distribution Best Case Most-Likely Scenario Worst Case Scenario 70% 60% 50% 40% 30% 20% 10% 0% 0% 10% 20% 30% 40% 50% Percent Cost Reserve Over Baseline Contract Costs (Without Launch Vehicles) 60% DAU EVM 201 LAR Risk Assessment High: Medium 6. Fuel System 7. Controls/Instrument 8. Subsystem Test 9. Armament 10. Integration/Assembly LIKELIHOOD 1. Engine 2. Cooling 3. Exhaust 4. Suspension/Steering 5. Power Pac/Sub Sys Design 5 . . . . 1, 3 4 . 9 4, 5 4,5 2 . 3 15 8 6, 7 . . 10 . . . 3 4 CONSEQUENCE 5 2 . 14 11, 12 13, 16 1 17, 18 . 19 1 2 Low 11. Frame 12. Aux Automotive 13. Body Cab 14. Communications 15. Sys Engineering & PM 16. Sys Test & Evaluation 17. Training 18. Data 25 19. Peculiar Supt Equipment As of Dec 2003 Mechanics General Overview • A basic assumption in using this ACEIT-based ICRM model is that program EVM analysts are not expected to be proficient ACEIT users but can work with their cost estimator counterparts who are proficient • The ACEIT v7.3a ICRM capability is enabled with the new “Probability of Occurrence” column – This enables the ‘likelihood’ part of the risk register to be a direct input into ACEIT and function in its Latin Hypercube monte carlo simulations IAW the Dominant Likelihood algorithm • This particular ICRM model incorporates this new ACEIT capability plus custom ACEIT Dynamic Equation Columns (DECs) – These DECs enable EVM metrics and index information to be used in calculating an EAC range that is probabilistically derived – These DECs also provide new variables and functions used in ICRM calculations Mechanics General Overview (cont) • The ICRM ACEIT model’s Workscreens enable analysis functions – These analysis functions exist in the interplay between the Equation/Throughput columns, DECs and within the INPUT VARIABLES sections of each of the Workscreens – These analysis functions enable the essential calculations for the probabilistic EAC to be produced • Calculations incorporate both EVM best and worst case EVM Indexderived EACs and risk register likelihoods and cost consequences Cost Impact Prioritization by WBS Quantitative Ranking – 70% Tail ICRM Customization • Future versions of ICRM can be easily customized – Add or subtract Workscreens to make it more efficient – Different distributions can be specified for risk register impacts – Different EVM performance factors can be applied – EVM analysis can be applied to risk register cost consequences – Cost estimator analysis can be applied to risk register cost consequences