FORM 335 - Harrisburg Area Community College

advertisement

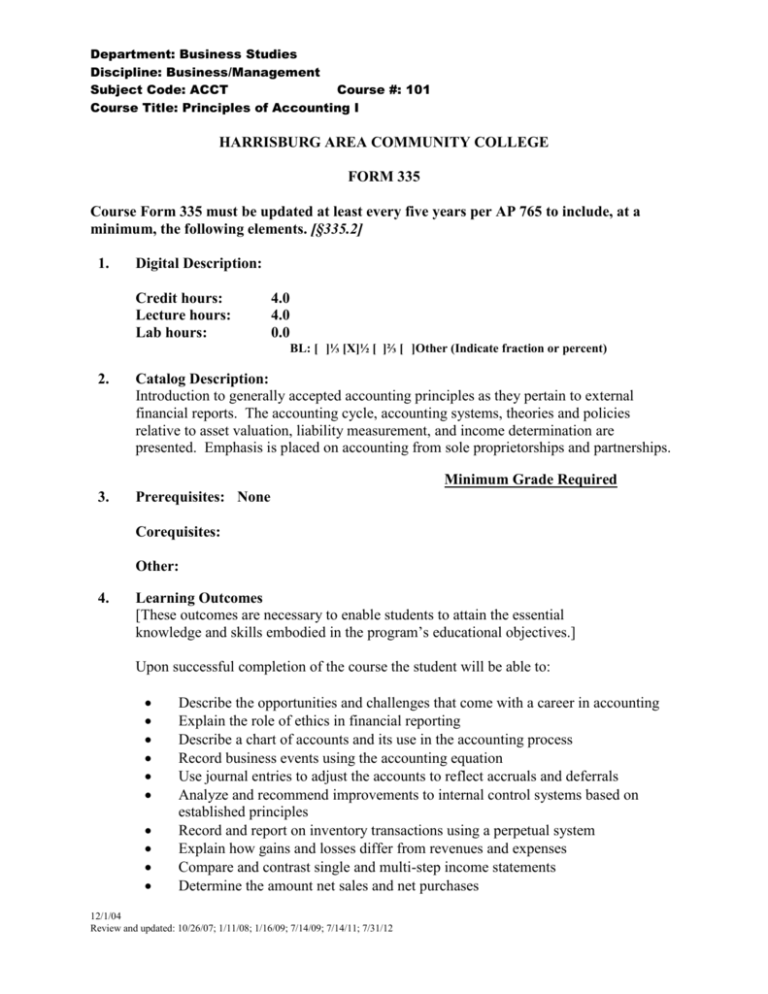

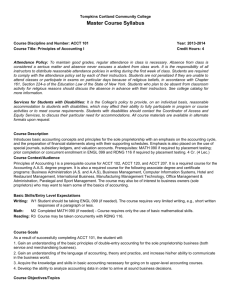

Department: Business Studies Discipline: Business/Management Subject Code: ACCT Course #: 101 Course Title: Principles of Accounting I HARRISBURG AREA COMMUNITY COLLEGE FORM 335 Course Form 335 must be updated at least every five years per AP 765 to include, at a minimum, the following elements. [§335.2] 1. Digital Description: Credit hours: Lecture hours: Lab hours: 4.0 4.0 0.0 BL: [ ]⅓ [X]½ [ ]⅔ [ ]Other (Indicate fraction or percent) 2. Catalog Description: Introduction to generally accepted accounting principles as they pertain to external financial reports. The accounting cycle, accounting systems, theories and policies relative to asset valuation, liability measurement, and income determination are presented. Emphasis is placed on accounting from sole proprietorships and partnerships. Minimum Grade Required 3. Prerequisites: None Corequisites: Other: 4. Learning Outcomes [These outcomes are necessary to enable students to attain the essential knowledge and skills embodied in the program’s educational objectives.] Upon successful completion of the course the student will be able to: Describe the opportunities and challenges that come with a career in accounting Explain the role of ethics in financial reporting Describe a chart of accounts and its use in the accounting process Record business events using the accounting equation Use journal entries to adjust the accounts to reflect accruals and deferrals Analyze and recommend improvements to internal control systems based on established principles Record and report on inventory transactions using a perpetual system Explain how gains and losses differ from revenues and expenses Compare and contrast single and multi-step income statements Determine the amount net sales and net purchases 12/1/04 Review and updated: 10/26/07; 1/11/08; 1/16/09; 7/14/09; 7/14/11; 7/31/12 Department: Business Studies Discipline: Business/Management Subject Code: ACCT Course #: 101 Course Title: Principles of Accounting I 5. Planned Sequence of Learning Activities [These must be designed to help students achieve the learning outcomes.] 6. Calculate cost of goods sold and ending inventory using different cost flow assumptions. Apply lower-of-cost-or-market rule to inventory valuation Prepare a bank reconciliation Differentiate between forms (corporation and sole proprietorship) of organization for business Explain the accounting principles and reporting of the allowance method for accounting for doubtful accounts and how it affects financial statements Account for notes receivable, notes payable and accrued interest Explain how credit card sales affect the financial statements Determine how to record the acquisition and use of long-term assets Determine how gains and losses on the disposal of long-term assets affect the financial statements Show how changes in estimates and continuing expenditures for long-term assets affect the financial statements Illustrate the effect of warranties on the financial statements Determine payroll taxes and demonstrate how they affect the financial statements Record transactions using the general journal format and show their effect on the financial statements Use a trial balance to prepare financial statements and interpret what they mean Accounting as the Language of Business Analyzing Transactions, Recording and Summarizing Journal Entries Adjusting Entries and Financial Statement Preparation Accounting for Merchandising Operations Inventories and Cost of Sales Accounting Information Systems Cash and Internal Control Accounting for Receivables Plant Assets, Natural Resources, and Intangible Current Liabilities and Payroll Accounting Assessment of Student Learning [Methods of assessment should be appropriate for Learning Outcomes listed above.] Assessment of student learning outcomes for the course, as required by AP 765, is part of regular curriculum maintenance and/or improvement. The specific assessment plan will consist of embedded accounting problem questions that will be the same for all sections and address on a rotational basis the learning outcomes shown above. The specific 12/1/04 Review and updated: 10/26/07; 1/11/08; 1/16/09; 7/14/09; 7/14/11; 7/31/12 Department: Business Studies Discipline: Business/Management Subject Code: ACCT Course #: 101 Course Title: Principles of Accounting I problems and details on how they should be administered will be determined by the discipline faculty and maintained in the College’s assessment management system. 7. List of Texts, References, Selected Library Resources or other Learning Materials (code each item based on instructional use): C-Lecture/Laboratory, A-Lecture, BLaboratory, LC-Lecture/Clinical, CLN-Clinical, I-Online, BL-Blended, D-Independent Study, P-Private Lessons, E-Internship, F-Cooperative Work-Study, FE-Field Experience. [These resources must be easily accessible to students.] Wild, John J., Kermit D. Larson, & Barbara Chiapetta. Fundamental Accounting Principles, 21st Edition, Irwin McGraw-Hill Publishing, 2013. OR Hoyle, Joe & C.J. Skender. Financial Accounting. 2nd edition, FlatWorld Knowledge, 2012 8. Prepared by Faculty Member: Joseph Plebani Date: 4/16/13 9. Approved by Department Chairperson: Michelle Myers Date: 4/16/13 10. Approved by Academic Division Dean: Cheryl L. Batdorf Date: 4/30/13 This course meets all reimbursement requirements of Chapter 335, subchapters A / B. This course was developed, approved, and offered in accordance with the policies, standards, guidelines, and practices established by the College. It is consistent with the college mission. If the course described here is a transfer course, it is comparable to similar courses generally accepted for transfer to accredited four-year colleges and universities. 11. Director, Curriculum Compliance: Erika Steenland Date: 5/6/13 12. Provost & VP, Academic Affairs: James E. Baxter, P.G. Date: 5/7/13 13. Original Date of course approval by the college: 196510 14. Date(s) of subsequent reviews [Indicate change: Learning Outcomes; textbook(s)]: 4/19/10 (Type of Instruction) 2/4/11 (Updated Textbook Edition) 4/18/13 – Textbook, learning outcomes, sequence of instruction, & Assessment 12/1/04 Review and updated: 10/26/07; 1/11/08; 1/16/09; 7/14/09; 7/14/11; 7/31/12

![Program Review: Full-Time Faculty/Adjunct Staffing Request(s) [Acct. Category 1000]](http://s2.studylib.net/store/data/011490644_1-b1b8a74cd86d109284e1ae6d3b8a76f4-300x300.png)