Business Law

advertisement

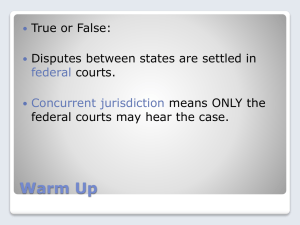

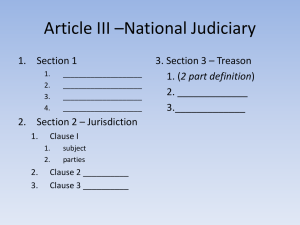

>>>>>>>> Appendix A Business Law • The judiciary is the court system, the brand of government responsible for settling disputes under the law. – General jurisdiction courts, trial courts hear a wide range of cases • • • • Both criminal and civil U.S. District Courts Circuit Courts Superior Courts, Common Plea Courts, District Courts – Lower probate courts settle estates and small claims. • The appeals process allows a higher court to review the case and correct any lower court error. • Both federal and state systems have appellate courts. • Appeals from decisions of the U.S. circuit courts of appeals can go all the ay to the nation’s highest court – The U.S. Supreme Court. • U.S. Tax Court • U.S. Court of Claims • Administrative Agencies – Bureaus, Commissions, Boards – Decide cases at all government levels – Derive power from state and federal statues • Law – standards set by government. • Common Law – law arising from judicial decisions. • Statutory Law – written law, state and federal constitutions, legislative enactments, treaties and ordinances. • International Law – regulations that govern international commerce. • Business Law – law that influences the management of business activity. • Antitrust and Business Regulation – Guard against monopolies – Protecting employment – USA Patriot Act • Business Deregulation – Strong deregulation push in the 1970s – Utilities, airlines – Led to lower prices • Numerous laws have been passed to protect consumers in the past 100 years. – Consumer Product Safety Commission – Food and Drug Administration Amendments Act of 2007 • Many recent events/concerns have required updates to existing laws. • Employees must be protected from unfair practices by employers. • Employment law should be a large area of concern for employers. – – – – – – – Fair Labor Standards Act (1938) OSHA Act (1970) American with Disabilities Act (1991) Family and Medical Leave Act (1993) Uniformed Services Employment & Reemployment Rights Act (1994) American Jobs Creation Act (2004) Pension Protection Act (2006) Securities Exchange Act (1934) Bank Secrecy Act (1970) Sarbanes-Oxley Act (2002) • Computer Fraud and Abuse Act (1986) • Children’s Online Privacy Protection Act (1998 • Identity Theft and Assumption Deterrence Act (1998) • Anticybersquatting Consumer Protection Act (1999) • Homeland Security Act (2002) • Amendments to the Telemarketing Sales Rules (2003) • Check Clearing for the 21st Century Act (2003) • Contract Requirements – Agreement – Consideration – Capacity – Legal and Serious Purpose • Breach of Contract – violation of a valid contract • Law of Agency – one party, the principal is agreed to be represented by an agent Basis for Most U.S. Business Law • Sales Law – Sale of goods and services for money or credit • Warranties – Warranties relied to sales transactions, either implied or express. • Negotiable Instruments – Commercial paper like checks. • Property rights are protected by the U.S. Constitution. – Tangible Personal Property – Intangible Personal Property – Real Property • Bailment is the surrender of personal property by one person to another. • Trademark – words, symbols or other designations used by a firm. – The Landham Act (1946) provides for registration of trademarks. • Patent – guarantees an inventor exclusive rights to an invention • Copyright – protect written or printed material. • Torts may be intentional or caused by negligence. • Product liability is specific tort law that holds businesses liable for product negligence. Multiple Plaintiffs Efficient Processing under one lawsuit Class-Action Fairness Act of 2005 Bankruptcy is the legal nonpayment of financial obligations Personal Bankruptcy More difficult under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 Business Bankruptcy Mismanagement, plunging sales and changes in the marketplace can drive a business to bankruptcy. • Federal, state and local governments and special taxing authorities all levy taxes: – Income – Sales – Business Receipts – Property – Assets