ACCT 5301 Short Answer Questions Module 1 Questions Why

advertisement

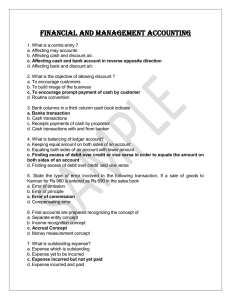

ACCT 5301 Short Answer Questions Module 1 Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Why should a company be liquid? Why should a company be solvent? Why are sufficient earnings necessary? Who or what can overrule the SEC (Securities and Exchange Commission)? Why are footnotes to the financial reports necessary? What does the statement “The stock market is efficient” mean? What is “inside information”? How should it be disclosed? Why will most financial reports filed with the SEC have a clean audit opinion? When we calculate return on assets, what is in the denominator (bottom) of the division? Return on sales times asset turnover will equal what measure? What types of events can change the balance of retained earnings? If we know the Total Assets and the Total Liabilities, how do we find the Total Owners Equity? Module 2 Questions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. What are the 2 requirements for recording an asset? Why are the historical costs of assets, as opposed to market values, considered more reliable? When is an asset considered a current asset? What type of companies may have an operating cycle longer than one year? Under what condition may we record an intangible as an asset? As plant and equipment are used through the years, what accounts are increased? Why do auditors give preference to objective and verifiable amounts in determining fixed asset amounts like real estate? What is an “unearned revenue”? What is a “prepaid expense”? What is an “accrued liability”? Net working capital = __________ - ______________ The term “trade credit” refers to what? Should we prefer a shorter or a longer operating cycle? What is included in the account “additional paid-in capital”? When is preferred stock typically issued? Treasury stock has what type of balance? “Operating Expenses” includes what type of items? Revenue is recognized when ____________. Transitory items are those that are not expected to recur. What are two types of transitory items? Module 3 Questions 1. 2. 3. 4. 5. 6. 7. What are the normal balances for assets, liabilities, and owners’ equity accounts? Give one example each of a contra asset and a contra equity account. What are the two requirements for revenue recognition? Give an example of a prepaid expense, unearned revenue, and an accrued expense. Why are adjusting entries necessary? Which accounts are closed at the end of the year? Why are they closed to retained earnings? What is included in the cash flow from investing and cash flow from financing in the statement of cash flows? 8. How is cash flow from operations calculated with the indirect method, which starts with net income?