Denials are the percentage of trips that were

advertisement

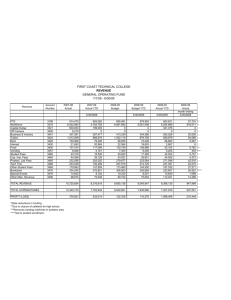

Board Box AUGUST 14, 2015 ITEM 1. BOARD BOX ITEM RECAP OF RECENT LEGISLATIVE ACTIVITIES FOR JULY/AUGUST 2015 STAFF PAGES A. COLAIACE 2-3 4 2. NEW EMPLOYEE UPDATE F. MOSELEY 3. OUT OF STATE TRAVEL UPDATE FOR JULY 2015 C. MOTTA 5-6 4. SAFETY UPDATE FOR JUNE 2015 M. GREENWOOD 7-8 5. UPDATE ROLLING BOARD AGENDA CALENDAR F. JEWELL 9-10 6. KEY PERFORMANCE INDICATORS JUNE 2015 M. THOMPSON 11-17 7. FINANCIAL REPORT FOR JUNE 2015 H. RODRIGUEZ 18-33 8. EXECUTIVE SUMMARY UPDATE FOR JUNE 2015 S. CHANG/S. KELLEY/D. FOSTER 34-37 9. OPERATIONS REPORT FOR JUNE 2015 M. THOMPSON 38-50 BOARD BOX ITEM #1 August 14, 2015 TO: BOARD OF DIRECTORS FROM: ANDRE COLAIACE, DEPUTY EXECUTIVE DIRECTOR, PLANNING AND GOVERNMENTAL AFFAIRS RE: RECAP OF RECENT LEGISLATIVE/MEDIA ACTIVITIES Federal Legislative Activities: The American Public Transportation Association (APTA) Reports: “With the most recent MAP-21 surface transportation bill extension about to expire on July 31, 2015, Congress passed another short-term extension that will keep federal public transportation and highway programs operating through October 29, 2015. After the Senate passage of a six year bill in late July, the focus is now on the House of Representatives this fall. Senate leaders had hoped to have the House adopt the Senate-passed bill before the August recess, but House leaders indicated that they wanted to write their own bill, which would then go to a House/Senate conference committee to produce a compromise package.” On July 30th, the United States Senate passed a six-year transportation reauthorization bill by a vote of 65-34. Overall, APTA supported the bill but had concerns about the levels of transit funding and also the fact that the bill is only funded for its first three years. The overall funding is as follows: MAP21 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2015 Total Transit 10,695.00 11,633.55 11,882.19 12,244.09 12,720.26 13,036.24 13,360.99 Growth over FY -8.78% 11.10% 14.48% 18.94% 21.89% 24.93% 2015 Total Highway 40,256.00 41,625.50 42,896.30 44,331.10 45,759.40 46,882.70 48,032.90 Growth over FY -3.40% 6.56% 10.12% 13.67% 16.46% 19.32% 2015 Sec. 5310 Enhanced Mobility for Seniors and Individuals with Disabilities The bill grows section 5310 by 2 percent, or $5.17 million in FY2016, and authorizes it to grow by 17.31 percent, or over $44 million by FY 2021. Included in the bill is a provision for the coordination of public transportation services with other federally assisted local transportation services, ultimately aimed to develop a costsharing policy. The bill also creates a pilot program that would provide grants to finance innovative projects for the transportation disadvantaged to improve the coordination of transportation services and non-emergency medical transportation services. Access has received a significant allocation of these funds to fund vehicle purchases. 2 State Legislative Activities: According to the California Transit Association (CTA), when lawmakers return to Sacramento, they will have approximately one month to finalize and send to the Governor a final transportation funding package as part of the special session to address the state’s multibillion-dollar backlog of deferred transportation infrastructure maintenance. Various members of the Legislature have introduced a package of bills to address the approximately $72 billion funding shortfall currently faced by California’s transit systems over the next ten years. SB X1 8 (Hill) and AB X1 7 (Nazarian) are identical bills that would increase the percentage of Cap and Trade revenues continuously appropriated to support public transit from 15 percent to 30 percent. SB X1 7 (Allen) and AB X1 8 (Chiu and Bloom) are identical bills which would, beginning July 1, 2016, increase the sales and use tax on diesel fuel from 1.75 percent to 5.25 percent, with the resulting revenue made available to transit operators across the state through the existing State Transit Assistance program formula and allocation mechanisms. Local Legislative Activities: During July and the first part of August: I met with staff from Councilmember and Metro Boardmember Paul Krekorian’s office to discuss Access Services. I attended a luncheon (with Deputy Executive Director Faye Moseley) featuring County Supervisor and current Metro Board Chair Mark Ridley-Thomas. I attended two Women’s Transportation Seminar events: one featuring new Metro CEO Phil Washington and the other featuring three transportation consultants from the offices of Councilmember Mike Bonin, County Supervisor Mike Antonovich and County Supervisor Sheila Kuehl. If you have any concerns or questions, please feel free to contact me at 213/270-6007. 3 BOARD BOX ITEM #2 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: FAYE MOSELEY, DEPUTY EXECUTIVE DIRECTOR, ADMINISTRATION RE: EMPLOYEE UPDATE Employee Promotion There were no employee hires and one employee promotion for Access this past month. Mike Greenwood was recently promoted from Director, Safety & Risk Management to Deputy Executive Director, Operations. In this role, Mike will directly to F Scott Jewell, Chief Operating Officer. His direct reports will include Project Administrators Randy Johnson, Rogelio Gomez and Fayma Ishaq; Jack Garate, Operations Administrator; Rick Streiff, Manager of Fleet Design & Maintenance. He will continue to lead the Safety team - Luis Pacheco and Cynthia Perkins-Stevenson, Safety Analysts and Road Safety Inspectors, Phillip Rice, Alex Chrisman, Colin Obeso and Darwin Brown. Prior to joining the Access, Mike spent 10 years as a Deputy Executive Officer/Transportation Operations Manager with Los Angeles County Metropolitan Transportation Authority (METRO) where he managed contract operations including three bus divisions, freeway service patrol contracts, call box operation contracts, and consultant contracts in support of regional 511 implementation. He also spent 14 years as a Service Development Manager (Section Manager III) with the Orange County Transportation Authority (OCTA) where he worked in various management and leadership capacities including bus operations, service planning, service scheduling, taxicab regulation and special projects. Mike earned his MBA from Cal State Long Beach and Bachelor of Arts in Social Ecology with Specialization in Environmental Planning from UC Irvine. He is a graduate of the Leadership APTA Program, American Public Transportation Association as well as the Center for Transit Leadership Executive Development Program, Eno Foundation. 4 BOARD BOX ITEM #3 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: CHARLENE MOTTA, ADMINISTRATIVE ASSISTANT RE: OUT OF STATE TRAVEL UPDATE FOR JULY 2015 The following is a list of out-of-state conferences/seminars for July 2015. 2015 APTA Transit Board Member/Board Support Seminar Denver, Colorado July 18-21, 2015 The below mentioned Access Services Board members and staff member traveled to Denver, CO for the American Public Transportation Association, Transit Board Member/Board Support Seminar. The annual gathering brought Policymakers and staff together for professional development sessions that focused on Best Practices in Governance and creating policy for public transportation systems. Doran Barnes, Access Board Chair Dolores Nason, Access Board Vice Chair Angela Nwokike, Access Board Member Donna Cisco, Access Service Administrative Manager/ Board Liaison 2015 TRANSED International Conference on Mobility Management Lisbon, Portugal July 25-31, 2015 The below mentioned Access Services staff and Board Chair traveled to Lisbon, Portugal for the TRANSED 14th International Conference on Mobility Management. The International Conference focused on Mobility Management and Transportation for Elderly and Disabled Individuals which attracts between 600 and 1,000 delegates from 40 nations on six continents. The conference took an ambitious goal of enlarging the scope of the conference to all sorts of disabilities and sources of exclusion (e.g. physical, logical/cognitive, economic/financial, temporary/permanent, etc.). This year’s conference theme was “Aim and Manage for Inclusive Access”. 5 Doran Barnes, Access Board Chair Shelly Verrinder, Access Executive Director 2015 ENO Transit Mid-Manager Seminar Salt Lake City, Utah July 27-31, 2015 The below mentioned Access Services staff member traveled to Salt Lake City, UT for the ENO Transit Mid-Manager Seminar. The focus of the seminar was on mid-level managers being the key to implementing an effective public transportation operation by acting as a bridge between senior leadership and public-facing employees. Sessions were offered to learn and develop leadership and management skills in order to be effective. Randy Jackson, Project Administrator 6 BOARD BOX ITEM #4 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: MIKE GREENWOOD, DIRECTOR OF SAFETY & RISK MANAGEMENT RE: SAFETY UPDATE FOR JUNE 2015 Key Safety Indicators Access’ preventable collision rate in June 2015 was 0.92 preventable collisions per 100,000 miles (compared to 0.71 in June 2014). June 2015’s rate was significantly above the target of 0.50. The total number of preventable collisions in June was 34, up from 24 in May. Access’ preventable collision rate over the last 12 months is slightly above the target of 0.50. In response to the increasing collision rate, Access staff has been working with the service providers to identify and address higher risk drivers. Staff is finalizing a pointsbased preventable collision standard that will be applied to individual drivers. 7 Department Activities In June, the Safety & Risk Management Department accomplished the following: One staff member attended the City of Los Angeles’ Disabled and Functional Needs Coalition Meeting at the City’s Emergency Operations Center. One staff member attended the APTA Risk Management Seminar in Salt Lake City, Utah; Installed Rider Conduct Posters at Access’ Eligibility Determination Center; Held its monthly Safety Steering Committee Meeting with service providers; Road Safety Inspectors conducted 206 driver observations and 201 vehicle inspections; and Conducted 8 root cause reviews in response to collisions and incidents. 8 BOARD BOX ITEM #5 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: F SCOTT JEWELL, CHIEF OPERATING OFFICER RE: ROLLING BOARD MEETING CALENDAR The following are items tentatively scheduled to be addressed by the Board through the next three regularly scheduled Board meetings. September 28, 2015 Metro Board Room, One Gateway Plaza Item Description Consideration to Approve Executive Director Compensation Consideration to Approve Access Services Insurance Policies for Fiscal Year 2015/16 Consideration to Approve Access RiderID/TAP Card Reimbursement Agreement Consideration to Approve Security System Maintenance Contract Extension Consideration to Approve Telephone System Maintenance Contract Extension Consideration to Approve Eligibility Determination Contract Extension Consideration to Approve Travel Training Contract Extension Presentation Scheduling and Routing Review October 26, 2015 Metro Board Room, One Gateway Plaza Item Description Information Technology Consulting & Services Consideration to Approve Contract Extension Telecommunication Consulting Services Contract Consideration to Approve Extension 9 October 2015 Access Services Membership Meeting, Location TBD Item Description Consideration to Approve Access Services Fare System November 16, 2015 Board Meeting Canceled due to the Thanksgiving Holiday Item Description 10 BOARD BOX ITEM #6 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: MELISSA THOMPSON, DATA ANALYST RE: KEY PERFORMANCE INDICATORS The following graphs represent key system indicators for the fiscal year as of JUNE 2015. The goal of this communication is to keep everyone informed of the current service performance level in the field and in the call center. The operations and customer service teams use this and other performance information to monitor our performance. Information is also used to determine the level of service that our customers are experiencing when using Access. 11 Operations Performance Trips FY 2014 FY 2015 300,000 272,040 275,000 250,000 225,000 200,000 175,000 150,000 Jul Sep Nov Jan Mar May Trips represent the total number of completed trips. On Time Performance FY 2014 FY 2015 91% Standard 94% 92.07% 92% 90% 88% 86% 84% 82% Jul Sep Nov Jan Mar May On Time Performance is the percentage of trips that are picked up on time or within the 20 minute on time window. The On Time Performance standard is 91% or higher. 12 Late 4 FY 2014 FY 2015 0.10% Standard 0.20% 0.15% 0.10% 0.05% 0.05% 0.00% Jul Sep Nov Jan Mar May Late 4 trips are those picked up 46 minutes or more after the 20 minute on time window. The Late 4 performance standard is 0.10% or less. Complaints per 1,000 Trips FY 2014 FY 2015 6 3.5 4 2 0 Jul Sep Nov Jan Mar May Complaints per 1,000 Trips is the ratio of valid service complaints to completed trips. 13 Average Initial Hold Time FY 2014 FY 2015 120 Sec Standard 140 120 86 100 80 60 40 20 0 Jul Sep Nov Jan Mar May Average Initial Hold Time is the average amount of time, in seconds, that reservation calls were on hold before being answered. The Average Initial Hold Time standard is 120 seconds, 2 minutes, or less. Calls On Hold > 5 Min FY 2014 FY 2015 5% Standard 10% 8% 4.9% 6% 4% 2% 0% Jul Sep Nov Jan Mar May Calls on Hold Over 5 Minutes is the percentage of reservation calls that were on hold five minutes or longer before being answered. The Calls on Hold Over 5 Minutes standard is 5% or less. 14 Denials FY 2014 FY 2015 1% Standard 1.2% 1.0% 0.8% 0.6% 0.4% 0.2% 0.14% 0.0% Jul Sep Nov Jan Mar May Denials are the percentage of trips that were booked more than one hour before or after the customer requested time. The Denial standard is 1% or less. No Shows FY 2014 FY 2015 4.51% National Avg 6.0% 4.5% 3.0% 3.7% 1.5% 0.0% Jul Sep Nov Jan Mar May A trip is considered a No Show when the customer fails to board or show up to the scheduled pickup location when the driver has waited five minutes during the 20 minute on-time window. The National Average for No Shows is 4.51% or less. 15 Customer Service Performance CS Average Initial Hold Time FY 2014 FY 2015 300 Sec Standard 500 400 300 200 90 100 0 Jul Sep Nov Jan Mar May CS Average Initial Hold Time is the average length of time, in seconds, that customer service calls were on hold before being answered. The standard for CS Average Initial Hold Time is 300 seconds, 5 minutes, or less. CS Average Call Duration FY 2014 FY 2015 300 Sec Standard 400 300 200 208 100 0 Jul Sep Nov Jan Mar May CS Average Call Duration is the average duration, in seconds, of customer service calls. The standard for CS Average Call Duration is 300 seconds, 5 minutes, or less. 16 CS Calls On Hold > 5 Min FY 2014 FY 2015 10% Standard 60% 50% 40% 30% 20% 8.5% 10% 0% Jul Sep Nov Jan Mar May CS Calls on Hold Over 5 Minutes is the percentage of customer service calls that were on hold five minutes or longer before being answered. The standard for CS Calls on Hold Over 5 Minutes is 10% or less. CS Abandoned Calls FY 2014 FY 2015 10% Standard 30% 25% 20% 15% 10% 5.7% 5% 0% Jul Sep Nov Jan Mar May CS Abandoned Calls are the percentage of customer service calls that were disconnected by the customer after the first 60 seconds. The standard for CS Abandoned Calls is 10% or less. 17 BOARD BOX ITEM #7 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: HECTOR RODRIGUEZ, CONTROLLER RE: FINANCIAL REPORT FOR JUNE 2015 (unaudited Results) Attached for your review are the draft financial reports for June 2015. Approved FY 2014/15 Budget to Actual Fiscal Year-to-Date Comparison: Passengers: 2.4% over budget Contract Revenue Miles: 3.6% over budget Trips: 2.0% over budget Completed Eligibility Interviews: 6.6% over budget Average Trip Distance: 1.5% over plan at 9.27 miles Total cost per Passenger (before depreciation): 3.1% under budget Administration Function is 7.1% under budget Eligibility Determination Function is 0.3% under budget Paratransit Operations Function is 0.5% under budget Attached are the following reports for your review: Statistical Comparison: June 2014 to June 2015 Expenses by Functional Area Budget to Actual Comparison of Statistics YTD Budget Results Graph: YTD PAX Cost Comparison Detailed Financial Reports 18 Expenses by Functional Area For the YTD Period Ending June 2015 % of Cost YTD Actual YTD Budget Variance % Over <Under> Budget 88.2% $118,179,282 $118,758,685 $(579,403) (0.8)% Eligibility Determination 7.0% $ 9,386,157 $ 9,417,482 (31,325) 4.2% CTSA/Ride Information 0.4% $ $ 458,777 $ 63,729 (11.6)% Administrative 4.4% $ 5,832,676 $ 6,276,935 $ (444,259) (13.5)% $134,911,879 $ (991,258) (1.1)% Paratransit Operations Total Exp before Depreciation 522,506 $133,920,621 $ 19 Statistics - - For the YTD Period Ended June 2015 YTD Actual Number of Completed Cert Interviews Number of PAX Number of Contract Revenue Miles Number of Trips YTD Budget Variance % Over <Under> Budget % over <Under> Previous Yr 65,738 63,689 2,049 6.6% (12.3)% 4,092,766 3,997,142 95,624 2.4% 4.7% 29,266,115 28,246,991 1,019,124 3.6% 5.3% 3,157,388 3,094,524 62,864 2.0% 5.1% 9.27 9.13 0.14 1.5% 0.2% Average Trip Distance Purchased Transportation Cost Cost per Trip $ 34.03 $ 33.78 $ 0.25 0.7% (3.8)% Cost per PAX $ 26.26 $ 26.15 $ 0.11 0.4% (3.5)% Cost per Contract Rev Mile $ 3.67 $ 3.70 $ (0.03) (0.8)% (4.0)% $ 32.72 $ 33.75 $ (1.03) (3.1)% (5.6)% Total Cost per Pax before depreciation 20 Budget Results for FY 2014/2015 For the YTD Period Ending May 2015 YTD Actual Total Expense Before Capital @ June 2015 Other Capital Expenditures Total Capital Expenditure % Over <Under> Budget % over <Under> Previous Yr $133,920,621 $ 134,911,879 $ (991,258) (0.7)% (1.1)% 9,019,891 673,836 9,693,727 9,401,892 395,000 9,796,892 (382,001) 278,836 (103,165) (1.1)% 10.0% 11,710,000 790,345 $ 12,500,345 18,089,589 1,836,335 $19,925,924 (6,379,589) (1,045,990) (7,425,579) (37.3)% Revenue Passenger Fares Other Revenue Total Revenue Capital Expenditures Vehicles YTD Budget Variance Over <Under> Budget Under Budget @ June 2015 Adjustments: Committed Expenses and Capital carry forward to FY 15/16 Budget Total Adjusted over Budget YTD June 30, 2015 $ (8,416,837) 8,460,843 $ 44,006 21 YTD COST PER PASSENGER BEFORE DEPRECIATION AND CAPITAL COST Jul-13 $ 32.84 Jul-14 $ 31.42 Aug-13 $ 32.71 Aug-14 $ 32.28 Sep-13 $ 32.68 Sep-14 $ 32.41 Oct-13 $ 32.64 Oct-14 $ 32.30 Nov-13 $ 32.66 Nov-14 $ 32.45 Dec-13 $ 32.81 Dec-14 $ 32.58 Jan-14 $ 32.90 Jan-15 $ 32.66 Feb-14 $ 33.06 Feb-15 $ 32.76 Mar-14 $ 33.00 Mar-15 $ 32.72 Apr-14 $ 33.01 Apr-15 $ 32.71 May-14 $ 31.97 May-15 $ 32.03 Jun-14 $ 32.90 Jun-15 $ 32.72 22 Access Services Balance Sheet June 30, 2015 DRAFT ASSET S Current Assets: Cash Due from FTA Due from MTA Accounts Receivable-Miscellaneous Prepaid Expenses Deposits 12,195,886 8,309,488 53,093 143,124 7,792,098 14,055 Total Current Assets 28,507,744 Long Term Assets: Property and Equipment: Vehicles & Vehicle Equipment Office Furniture and Equipment Computer & Telephone Equipment Central Reservation Software/IVR Leasehold Improvements Total Property and Equipment Accumulated Amortization & Depreciation Property and Equipment, Net 33,911,180 207,812 2,634,633 2,451,884 162,015 39,367,523 (22,167,341) 17,200,183 Deposits – Long Term Total Long Term Assets 17,200,183 TOTAL ASSETS 45,707,927 23 Access Services Balance Sheet June 30, 2015 DRAFT LIABILITIES AND NET ASSETS Current Liabilities: Accounts Payable-Trade Accounts Payable-Providers Unfunded Pension Liability Insurance Reserve Accrued Expenses Other Liabilities 37,814 5,696,724 2,040,837 2,964,861 8,015,605 - Total Current Liabilities 18,755,841 Other Liabilities: Deferred Revenue 27,365,468 TOTAL LIABILITIES Net Assets: Temporarily Restricted TOTAL LIABILITIES AND NET ASSETS 46,121,309 (413,382) 45,707,927 24 Access Services Statement of Cash Flow For Period Ending June 30, 2015 Cash – Beginning Balance 6/1/15 27,748,935 Cash Receipts: Proposition C revenue from LACMTA FTA Funding Received CMAQ Grant Passenger fare/coupons/ID revenue Interest income Miscellaneous revenues Total Cash Received 801,382 157 96,868 1,207,628 Cash Payments: Vehicles/Vehicle equipment Capital Equipment Prepaid expenses/deposits Payments to contract providers Eligibility Determination expenses Salaries and related benefits Other expenses 737,091 34,529 151,678 13,018,290 455,031 565,341 1,798,716 Total Cash Payments Increase (Decrease) in Cash Reserves Cash – Ending Balance 6/30/15 16,760,677 (15,553,049) 12,195,886 Note: The above statement of cash flow presents the more significant financial categories and their changes for internal use only. This statement is not prepared in accordance with generally accepted accounting reporting standards. 25 Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending June 30, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 26 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending June 30, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 27 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 28 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 29 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget Other Professional Expense 30 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget Amortization and Depreciation Expense Less: Amortization and Depreciation Expense 31 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 152 VEHICLES - (Fleet Replacement) Vehicle Equipment SUBTOTAL - VEHICLES - FY 14/15 13 VEHICLES - Minivan SECTION 16 (Fleet Replacement) Vehicle Related Equip (ATW grant) Vehicle Related Equip (AWC grant) 73 VEHICLES - (Fleet Replacement) 13 VEHICLES - MV-1 (Expansion) 8 VEHICLES - Type I Cutaw ay (Fleet Replacement) 5 VEHICLES - Type II Cutaw ay (Fleet Replacement) 13 VEHICLES - Minivan SECTION 16 (Fleet Replacement) 65 VEHICLES - Access To Work (Fleet Expansion) 3 CNG Staff vehicles (3743) SUBTOTAL - VEHICLES - PRIOR FISCAL YEARS COMPUTER SYSTEM HARDWARE/SOFTWARE REPLACEMENT & UPGRADE SUBTOTAL - OTHER CAPITAL EXPENDITURES - FY 14/15 REGIONAL INTEGRATION OF PARATRANSIT RESOURCES PROJECT CENTRALIZATION SOFTWARE/IVR TETHER STRAPS & MARKING PROGRAM CAPITAL COMPUTER SYSTEM HARDWARE/SOFTWARE REPLACEMENT & UPGRADE PORTION OF EN POINTE-HP SERVER/STORAGE (3729) ADOBE ECHOSIGN SIGNATURE (3742) SUBTOTAL - OTHER CAPITAL EXPENDITURES - PRIOR YEARS 32 % of 14/15 Budget Reached Access Services Statement of Revenue, Expenses and changes in Fund Balance For Period Ending May 31, 2015 Current Month Actual Current Month Budget Current Variance Over (Under) YTD Actual YTD Budget YTD Variance Over (Under) 2014-15 Budget 33 % of 14/15 Budget Reached BOARD BOX ITEM #8 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: ACCESS SERVICES MANAGEMENT STAFF RE: EXECUTIVE SUMMARY UPDATE FOR JUNE 2015 Steve Chang – Deputy Executive Director, Operations Access launched the usage of positioning belts on all Access vans and cutaway vehicles. Access customers riding in mobility devices will be offered the positioning belt to help stabilize them while boarding and disembarking the vehicles and while in transit. In preparation for the implementation of Beyond the Curb and Reasonable Modification Requests policies in July, Access and Provider staff members are being trained for a successful launch. Rogelio Gomez – Project Administrator Southern Region Global Paratransit Inc. (GPI) was busy preparing their entire staff for the implementation of Beyond the Curb and Reasonable Modification Request policies. Access staff conducted several phone and road observations of which only three phone observations and two road observations had some minor deficiencies. All other observations met or exceeded expectations. In addition, a Road Supervisor Trip Completion Audit was completed and resulted in zero findings. Keeping up with an annual tradition, GPI provided tamales, coffee, chips, and fiber bars to their drivers on Fridays for the entire month. Santa Clarita Region Santa Clarita Transit held Safety Meetings to prepare staff for the implementation of Beyond the Curb and Reasonable Modification. Access staff conducted several phone and road observations with no major findings. In addition, a Road Supervisor Trip Completion Audit was completed and resulted in zero findings. Randy Johnson - Project Administrator Eastern Region San Gabriel Transit (SGT) received 162 commendations from Access customers in June. SGT participated in the Access sponsored Job Fair, held at Los Angeles Trade Technical College, to recruit more drivers for the upcoming peak season. SGT staff completed their Beyond the Curb (BTC) and Reasonable Modification Request (RMR) trainings. 34 Access staff performed a community outreach at Casa Colina Adult Day Health Care in Pomona. Program Director, Mary Lyn Barber, stated that she was very pleased with driver performance and staff responsiveness to customer concerns. West Central California Transit Inc. (CTI) completed their Beyond the Curb (BTC) and Reasonable Modification Request (RMR) training. Access staff met with drivers, call takers, and dispatchers to answer questions about BTC/RMR. CTI participated in the Access sponsored Job Fair, held at Los Angeles Trade Technical College, to recruit more drivers for the upcoming peak season. Fayma Ishaq - Project Administrator Northern Region MV Transportation (MV) promoted the positioning belt campaign to focus on rider safety. MV Transportation held a week long promotion on Beyond the Curb and Reasonable Modification Requests to educate staff on the new policies. Antelope Valley Region Access staff performed driver observations on the road with no findings. Training was conducted to educate staff on Beyond the Curb and Reasonable Modification Request policies. The interactive training sessions helped drivers understand that safety will be a critical component when a customer makes a reasonable modification request. Sherry Kelley – Sr. Manager Customer Service – Customer Service Department Update Access Customer Service department received 46,567 calls system wide in the month of June, in comparison to 43,158 calls in May. System wide all performance targets were met. Customer Service and Operations Monitoring Center met 2 out of 4 KPI’s for the month. The Customer Care received a total of 930 service related complaints; 3.5 complaints per 1,000 trips. The Community Advisory Committee (CAC) had a successful meeting in the month of June. There were 877 Staff Commendations (Smiles) filed by our customers in June; 77 of which were filed on behalf of Access call center staff. We would like to congratulate Zachary Strom for receiving the most smiles for the month of June! David Foster - Project Administrator, Eligibility - Eligibility Department Update In June 2015, the number of eligible Access riders reached 169,184, an increase of 1,232 (0.73%) eligible riders from the previous month. Additional statistics can be found within the Operations Report of this Board Box. The Eligibility Department had a busy month working on internal process improvements as well as with other departments: 35 Continued process of finalizing eligibility component of Beyond the Curb (BTC) for July 1, 2015 implementation Continued working with the Delta Services consultant on Comprehensive Operational Review of Eligibility process On Monday, June 22, 2015, the Access Eligibility team met with our new appeals contractor Medical Management Mission (MMM) to discuss policies and procedures with their management and staff. MMM was recently added to the roster of appeals specialists and will begin conducting medical appeals evaluations in the upcoming months. MMM was added to the roster in preparation of anticipated growth in appeals as initial determinations increase. In addition, MMM is located in Encino and previously Access only had medical appeals providers in the Los Angeles and South Bay areas. With the addition of MMM in the San Fernando Valley appellants in the San Fernando Valley and North County will have a shorter distance to travel which provides a better customer service experience. 36 Mobility Management Statistics Report, June 2015 Month Total Number of Calls June 520 Total Total Number of Number of M obility Non Access M anagement Customers Database Spoken List, Spoken With With 190 (37%) 55 (11%) Number of Issues with Phone Numbers 73 (14%) Number of Voice M essages 195 (38%) Number of Last Calls and No Answers 4 (1%) Number of Calls Waiting for Follow-Up. 3 (1%) For the month of June, calls made by Mobility Management staff increased by 17% from the previous month with a total of 520 calls made. Of the 520 calls logged, staff spoke with 245 customers, and the remaining calls were voice-mails and emails messages left by staff or calls made to phone numbers that were no longer in service. Mobility Management staff attended the Jackie Robinson Center’s Summer Senior Day Camp in Pasadena. This program provides services to Pasadena residents and this session focused on transportation options. A group of about 30 seniors in attendance had plenty of questions about changes affecting Access Services, such as Beyond the Curb (BTC) service. Participants were grateful to receive promotional items, information packets and one-on-one attention. 37 BOARD BOX ITEM #9 AUGUST 14, 2015 TO: BOARD OF DIRECTORS FROM: MELISSA THOMPSON, DATA ANALYST RE: OPERATIONS REPORT FOR JUNE 2015 Below is a summary of the key operating statistics for JUNE 2015, as well as, operation data for the previous month (MAY 2015) and Fiscal Year to Date (YTD): MONTHLY OPERATIONS REPORT SUMMARY Current 272,040 Last Month 271,419 % change 0.2% YTD 3,157,388 Passengers per Vehicle Trip 1.30 1.29 0.8% 1.30 Average Trip Distance 9.23 9.30 -0.7% 9.3 488,661 483,596 1.1% 5,606,247 86 82 4.9% 83 4.9% 4.7% 0.2% 4.8% On-Time Performance 92.1% 91.9% 0.2% 91.9% Late 4 Trips 0.05% 0.10% -0.05% 0.09% 169,184 167,952 0.7% 169,184 Total Trips Total Calls to Providers Average Initial Hold Time (seconds) % of Calls on Hold More Than 5 minutes Total Registered Customers 38 MONTHLY PROVIDER SUMMARY: ALL TRIPS Passengers Trips Back Up Trips Passengers per Trip Eligible Passengers per Trip SYSTEM WIDE MAY-15 JUN-15 % Change 350,458 353,295 0.8% 271,419 272,040 0.2% 582 476 -18.2% 1.29 1.30 0.8% 1.00 1.00 0.0% SGT - Eastern Region MAY-15 JUN-15 % Change 96,438 98,399 2.0% 73,874 74,610 1.0% 21 9 -57.1% 1.31 1.32 0.8% 0.93 0.92 -1.1% 91,910 91,719 -0.2% 14 10 -28.6% 1.28 1.28 0.0% 1.02 1.02 0.0% 41,926 42,342 1.0% 547 457 -16.5% 1.31 1.31 0.0% 1.02 1.03 1.0% 50,025 50,009 0.0% 0 0 0.0% 1.26 1.27 0.8% 1.02 1.02 0.0% 10,643 10,651 0.1% 0 0 0.0% 1.36 1.39 2.2% 1.04 1.04 0.0% 3,041 2,709 -10.9% 0 0 0.0% 1.16 1.19 2.6% 1.01 1.02 1.0% GPI - Southern Region MAY-15 117,631 JUN-15 117,808 % Change 0.2% CTI - WC - West Central Region MAY-15 55,062 JUN-15 55,603 % Change 1.0% MV - San Fernando Valley Region MAY-15 63,269 JUN-15 63,411 % Change 0.2% DT - Antelope Valley Region MAY-15 14,523 JUN-15 14,855 % Change 2.3% SCT - Santa Clarita Region MAY-15 JUN-15 % Change 3,535 3,219 -8.9% 39 PROVIDER SERVICE SUMMARY Maintenance Inspections* TOTAL SGT – Eastern Region GPI – Southern Region CTI – West – Central Region MV Transit – San Fernando Valley Region DT – Antelope Valley Region SCT – Santa Clarita Region Current 78 30 4 2 40 2 0 Previous Month 133 0 38 32 41 16 6 YTDAverage 64 13 16 12 18 5 1 * The data above represents the number of vehicles evaluated at the contractor locations. Dispatch Coordination* TOTAL SGT – Eastern Region GPI – Southern Region CTI – West – Central Region MV Transit – San Fernando Valley Region DT – Antelope Valley Region SCT – Santa Clarita Region Current 146 12 65 5 23 16 25 Previous Month 172 32 42 23 26 29 20 YTDAverage 159 24 49 23 23 15 24 * The data above represents the number of observations made for call takers and dispatchers. Comparability of Access Paratransit to Fixed Route Travel Times* Equal to or Shorter than Comparable Fixed Route Trip 1-20 Minutes Longer than Fixed Route Trip 21-40 Minutes Longer than Fixed Route Trip 41-60 Minutes Longer than Fixed Route Trip 60 Minutes Longer than Fixed Route Trip Apr 1Jun 30 Jan 1Mar 31 Oct 1 – Jul 1Dec 31 Sep 30 87.6% 89.0% 89.4% 92.0% 8.6% 2.8% 0.7% 0.3% 7.4% 2.9% 0.5% 0.2% 9.0% 1.0% 0.1% 0.4% 6.1% 1.4% 0.5% 0.0% * The data above (based on a sample of all trips) highlights the degree to which Access Paratransit trips are comparable in terms of travel time to trips of a similar distance, origin and destination taken on local fixed route transit. **Data is recorded and entered at the end of each quarter. 40 North County Trips Transferring at Olive View Antelope Valley to Transfer Point Transfer Point to Antelope Valley Santa Clarita to Transfer Point Transfer Point to Santa Clarita Current 360 293 113 95 RESERVATIONS PHONE REPORTING Standards: Average Initial Hold Time <120 Seconds % of Calls On Hold Over 5 minutes <5% Previous Month 379 317 110 100 YTDAverage 337 293 96 79 Current Previous Month YTD Average Systemwide Calls Answered Average Initial Hold Time % Of Calls On Hold More Than 5 minutes 488,661 86 4.9% 483,596 82 4.7% 5,606,247 83 4.8% SGT - Eastern Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 119,299 82 5.9% 119,879 77 5.3% 1,411,703 76 5.9% GPI - Southern Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 161,669 82 4.9% 159,487 76 4.8% 1,778,827 79 4.2% CTI - West – Central Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 112,817 73 4.8% 110,754 78 5.5% 1,323,701 73 5.6% MV Transit - San Fernando Valley Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 71,907 116 4.2% 71,679 109 3.5% 847,159 109 4.2% DT - Antelope Valley Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 18,952 95 2.7% 17,736 87 1.7% 203,158 93 2.7% 41 SCT - Santa Clarita Valley Region Calls Answered Average Initial Hold Time % of Calls on Hold More Than 5 minutes 4,017 45 2.1% 4,061 52 3.3% 41,699 59 2.7% CUSTOMER SERVICE & OPERATIONS MONITORING CENTER PHONE REPORTING *Standards: Average Initial Hold Time <300 Seconds Average Call Duration<300 Seconds % of Calls on Hold Over 5 minutes <10% % Abandoned Calls <10% Previous Systemwide (CS and OMC) Current Month YTD Calls Answered 46,567 43,158 561,548 Average Initial Hold Time 90 65 114 Average Call Duration 208 210 204 % of Calls on Hold More Than 5 Minutes 8.5% 4.6% 12.0% % of Abandoned Calls 5.7% 4.2% 7.1% Customer Service Center (CS) Access Services Calls Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 Minutes % of Abandoned Calls Southland Calls Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 Minutes % of Abandoned Calls Customer Service Total Calls Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 Minutes % of Abandoned Calls 12,884 117 218 13.0% 6.3% 12,045 87 221 6.3% 4.5% 142,775 201 229 25.2% 10.5% 23,987 72 186 5.1% 4.5% 21,374 43 183 1.8% 2.5% 289,318 52 175 2.6% 2.9% 36,871 88 197 7.9% 5.2% 33,419 59 197 3.4% 3.3% 432,093 101 193 10.0% 5.7% Operations Monitoring Center (OMC) 42 Access Services Call Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 minutes % of Abandoned Calls Southland Call Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 minutes % of Abandoned Calls Operations Monitoring Center Total Call Answered Average Initial Hold Time Average Call Duration % of Calls on Hold More Than 5 minutes % of Abandoned Calls 6,723 105 252 11.6% 8.0% 6,407 75 248 6.6% 6.1% 81,184 191 258 23.5% 13.9% 2,973 81 247 9.0% 7.1% 3,332 109 268 13.4% 9.3% 48,271 93 216 10.4% 6.9% 9,696 98 250 10.8% 7.7% 9,739 87 255 8.9% 7.2% 129,455 155 242 18.6% 11.5% Eligibility Determinations Previous Month YTDAverage 2,665 618 378 750 4,411 2,671 584 479 665 4,399 773 4,178 1,639 2,772 1,717 2,683 5,856 5,221 4,905 15 3 28 15 3 22 15 3 26 Previous Month YTDAverage ADA Paratransit Evaluations Current Completed UNRESTRICTTED 3,035 RESTRICTED 704 TEMPORARY 373 NOT ELIGIBLE 839 TOTAL 4,951 Re-certifications (in Person) New Applicants Eligibility Renewals Recertification Letters Sent Process Time (avg.Days: Individ.) Evaluation to Mail Out (ADA<21 Days) Scheduling Phone Call to Evaluation Scheduling Phone Call to Mail Out ADA Paratransit Eligibility Appeals Current 43 Appeals Requested Closed Withdrawn/Closed Before Completion Pending Increased Decreased Modified Upheld % Appeals not overturned Net Denied Rate (Year-to-Date) Process Time: Appeal Date to Mail Out ADA<30) 179 200 26 368 51 4 5 96 67% 16% 250 239 71 441 53 3 1 71 59% 16% 187 167 28 346 42 3 7 71 66% 14.1% 13 11 14 Previous Month 6,962 1,463 5,499 YTDAverage 8,635 1,821 6,814 OPERATIONS MONITORING CENTER ACTIVITY Logged Calls to OMC* TOTAL CALLS: Late Calls Other (CSC/Reservations) Current 6,312 1,249 5,063 *The data above represents the number of calls logged by the Operations Monitoring Center. Calls are logged by the OMC if the call requires an action by Access. Not all OMC calls are logged. Disposition of Late Calls Back-Up Vehicle Sent ETA Given Help Calls Miscellaneous TOTAL LATE CALLS Late Trip Calls to OMC Resulting in Dispatch of Back-Up Vehicle (5.4.1.6) Avg. Time Between 1st Call and Arrival of back up Vehicle at Customers Location Late Trip Calls to OMC Resulting In “Wait” and Back-Up Vehicles Sent (5.4.1.7) Current 96 673 10 470 1,249 Previous Month 129 811 9 514 1,463 YTDAverage 241 904 36 639 1,821 Current Previous Month YTDAverage 88 51 Previous Month YTDAverage 62 Current 44 Incidence of Vehicles Sent to Wait w/the Customer until Arrival of Accessible Vehicle 10 0 0.8 PROVIDER REPORT CARD Systemwide Percentage of Trips On-Time Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied SGT – Eastern Region Percentage of Trips On-Time Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations – occurrences Denied Trips -% of Next Day Trip Requests Denied CTI – West Central Region Percentage of Trips On-Time Current 92.07% 7.93% 6.32% 1.31% 0.25% 0.05% 3.72% 3 Previous Month 91.88% 8.12% 6.24% 1.44% 0.34% 0.10% 3.53% 0 YTD 91.88% 8.12% 6.29% 1.43% 0.31% 0.09% 3.52% 14 0.14% 0.55% 0.17% Current 93.11% 6.89% 5.19% 1.33% 0.30% 0.06% 2.97% 0 Previous Month 91.44% 8.56% 6.06% 1.74% 0.54% 0.22% 2.95% 0 YTD 91.68% 8.32% 6.08% 1.66% 0.43% 0.15% 3.05% 1 0.83% 0.00% 0.07% Current 91.27% Previous Month 91.34% YTD 91.62% 45 Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied GPI – Southern Region Percentage of Trips On-Time Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied MVT – Northern Next Day Trips Percentage of Trips On-Time Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied DT – Antelope Valley Percentage of Trips On-Time Percentage of Late Trips 8.73% 6.80% 1.49% 0.35% 0.09% 4.19% 1 8.66% 6.50% 1.70% 0.38% 0.08% 4.38% 0 8.38% 6.45% 1.53% 0.32% 0.08% 4.27% 5 0.00% 0.83% 0.07% Current 91.27% 8.73% 7.03% 1.44% 0.22% 0.03% 4.24% 0 Previous Month 91.57% 8.43% 6.57% 1.48% 0.31% 0.07% 3.89% 0 YTD 91.47% 8.53% 6.70% 1.50% 0.28% 0.05% 3.73% 5 0.00% 0.83% 0.14% Current 92.26% 7.74% 6.49% 1.01% 0.21% 0.04% 3.06% 2 Previous Month 92.79% 7.21% 6.05% 0.92% 0.21% 0.03% 2.58% 0 YTD 92.44% 7.56% 6.11% 1.11% 0.25% 0.08% 2.83% 3 0.00% 0.00% 0.07% Current 93.21% 6.79% Previous Month 93.78% 6.22% YTD 93.53% 6.47% 46 Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied SCT – Santa Clarita Valley Percentage of Trips On-Time Percentage of Late Trips Late “1” (1-15 min. late) Late “2” (16-30 min. late) Late “3” (31-45 min. late) Late “4” (>46 min. late)/Missed Trips No Shows Accessibility Violations - occurrences Denied Trips -% of Next Day Trip Requests Denied 5.75% 0.93% 0.11% 0.00% 3.41% 0 5.42% 0.77% 0.03% 0.00% 3.41% 0 5.49% 0.86% 0.11% 0.01% 3.24% 0 0.00% 0.00% 0.07% Current 94.93% 5.07% 3.98% 0.88% 0.13% 0.04% 3.14% 0 Previous Month 96.20% 3.80% 3.18% 0.52% 0.04% 0.00% 2.20% 0 YTD 95.09% 4.91% 4.08% 0.56% 0.08% 0.01% 1.97% 0 0.00% 1.65% 0.64% 47 Customer Reported Service Complaints Current Month ADA Animal Booking Conduct Late Late 4 Procedure Risk Management Routing Wheelchair Securement Service Travel Time Vehicle TOTAL Ratio per 1,000 Trips Commendations System SGT Eastern Region CTI West Central Region GPI Southern Region MVT San Fernando Valley DT Antelope Valley Region SCT Santa Clarita Valley 3 0 92 134 82 10 332 152 57 0 7 50 11 930 3.5 483 0 0 17 47 16 1 90 27 17 0 0 11 4 230 3.6 161 1 0 12 18 13 3 66 23 9 0 2 7 0 154 3.7 93 0 0 50 39 36 2 122 54 11 0 2 21 5 342 3.7 132 2 0 9 16 15 4 44 41 19 0 3 10 1 164 3.3 66 0 0 4 14 2 0 10 6 1 0 0 0 1 38 3.6 31 0 0 0 0 0 0 0 1 0 0 0 1 0 2 1.1 0 48 Travel Training Statistics Travel Training, Fiscal Year 2014-2015 May – 15 June - 15 YTD Average # of Trips per-week, Month 2 21 17 15 15 0 0 22 17 6 18 17 17 18 0 0 21 14 7 270 222 194 264 3 0 244 174 69 Estimated Bus Trips Taken, YTD 21,179 25,516 110,396 Accepted Travel Training Waiting for Travel Training Started Travel Training Completed Travel Training Discontinued Services People Currently in Travel Training Total Follow-up Response Month 2 #Graduates Using Bus After 2 Months *Estimated Bus Trips Taken/YTD: For purposes of this calculation, we assume that individuals who report using the bus after two months will continue to do so. Bus trip statistics are calculated for each month by multiplying the number of graduates who report using the bus after 2 months by the average number of trips they report taking. This sum is then multiplied by the number of weeks that have passed in the fiscal year. 49 Total Trips Comparison FY 13/14 FY 14/15 300,000 250,000 200,000 150,000 100,000 50,000 Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun 50