Financial Sector Unit Test AP Macroeconomics Chastain Multiple

advertisement

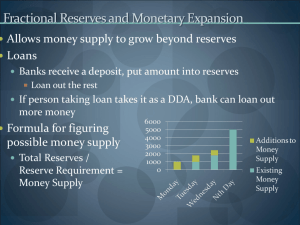

Financial Sector Unit Test AP Macroeconomics Chastain Multiple Choice: Choose the letter of the BEST answer for each question. There is only one possible answer for each question. Do not write on the test! 1. Which of the following is NOT a type of financial asset? a. Bonds b. Stocks c. Bank deposits d. Loans e. Houses 2. When you use money to purchase your lunch, money is serving which role(s)? I. II. III. a. b. c. d. e. Medium of exchange Store of value Standard of value I only II only III only I and III only I, II, and III 3. When you decide you want “$10 worth” of a product, money is serving which role(s)? I. Medium of exchange II. Store of value III. Standard of value a. b. c. d. e. I only II only III only I and II only I, II, and III 4. In the United States, the dollar is a. Backed by silver. b. Backed by gold and silver. c. Commodity-backed money. d. Commodity money. e. Fiat money. 5. Which of the following is the most liquid monetary aggregate? a. M1 b. M2 c. M3 d. Near-moneys e. Dollar bills 6. Which of the following is the best example of using money as a store of value? a. A customer pays in advance for $10 worth of gasoline at a gas station. b. A babysitter puts her earnings in a dresser drawer while she saves to buy a bicycle. c. Travelers buy meals on board an airline flight. d. Foreign visitors to the United States convert their currency to dollars at the airport. e. You use $1 bills to purchase soda from a vending machine. 7. Bank reserves include which of the following? I. II. III. a. b. c. d. e. Currency in bank vaults Bank deposits held in accounts at the Federal Reserve Customer deposits in bank checking accounts I only II only III only I and II only I, II, and III 8. To move the economy closer to full employment, the central bank decides that the federal funds rate must be increased. The appropriate open market operation is to a. Buy b. Sell c. Hold steady d. Raise interest e. Lower interest 9. The fraction of bank deposits actually held as reserves is the a. Reserve ratio. b. Required reserve ratio. c. Excess reserve ratio. d. Reserve requirement. e. Monetary base. 10. Which of the following changes would be the most likely to reduce the size of the money multiplier? a. A decrease in the required reserve ratio b. A decrease in excess reserves c. An increase in cash holdings by consumers d. A decrease in bank runs e. An increase in deposit insurance 11. The purpose of expansionary monetary policy is to correct a. Inflation b. Recession c. Stable economy d. Depression e. Expansion of money supply 12. The monetary base equals a. Currency in circulation. b. Reserves held by banks. c. Currency in circulation – reserves held by banks. d. Currency in circulation + reserves held by banks. e. Currency in circulation/reserves held by banks. 13. Which of the following contributed to the creation of the Federal Reserve System? I. The bank panic of 1907 II. The Great Depression III. The savings and loan crisis of the 1980s a. b. c. d. e. I only II only III only I and II only I, II, and III 14. Which of the following is NOT a role of the Federal Reserve System? a. Controlling bank reserves b. Printing currency (Federal Reserve notes) c. Carrying out monetary policy d. Supervising and regulation banks e. Holding reserves for commercial banks 15. Which of the following is a function of the Federal Reserve System? I. Examine commercial banks II. Print Federal Reserve notes III. Conduct monetary policy a. I only b. II only c. III only d. I and II only e. I, II, and III 16. Which of the following financial services does the Federal Reserve provide for commercial banks? I. Clearing checks II. Holding reserves III. Making loans a. b. c. d. e. I only II only III only I and II only I, II, and III 17. When the Fed makes a loan to a commercial bank, it charges a. No interest. b. The prime rate. c. The federal funds rate. d. The discount rate. e. The market interest rate. 18. If the Fed purchases U.S. Treasury bills from a commercial bank, what happens to bank reserves and the money supply? a. b. c. d. e. Bank Reserves Money Supply Increase Increase Decrease Decrease Increase decrease increase decrease increase no change 19. When banks make loans to each other, they charge the a. Prime rate. b. Discount rate. c. Federal funds rate. d. CD rate. e. Mortgage rate. 20. The real interest rate equals the a. Nominal interest rate plus the inflation rate. b. Nominal interest rate minus the inflation rate. c. Nominal interest rate divided by the inflation rate. d. Nominal interest rate time the inflation rate. e. Federal funds rate. Free Response Questions: Write or graph out your answer for each question. Make sure you answer all parts of the question. 21. The required reserve ratio is 5%. a. If a bank has deposits of $100,000 and holds $10,000 as reserves, how much are its excess reserves? Explain. b. If a bank holds no excess reserves and it receives a new deposit of $1,000, how much of that $1,000 can the bank lend out and how much is the bank required to add to its reserves? Explain. c. By how much can an increase in excess reserves of $2,000 change the money supply in a checkable-deposits-only system? Explain. 22. What are the three major tools (policies) of the Federal Reserve System? a. What would the Fed do with each tool to increase the money supply? Explain for each. 23. Using the data listed below to calculate M1, M2, and M3. Show all components for your answers. a. Currency $350 b. Noncheckable savings deposits $212 c. Checkable deposits $984 d. Large time deposits $1,298 e. Institutional money market funds $4,782 f. Small time deposits $4,289 24. Assume that $10,000 is deposited in the bank, and that each bank loans out all of its excess reserves. The required reserve ratio is 10%. a. What is the value of the required reserves? b. What is the value of the excess reserves? c. What is the deposit expansion multiplier? d. What is the maximum increase in the money supply? e. Suppose the Fed wanted to decrease the money supply from $10,000 to $5,000. i. Will the Fed want to buy or sell existing Treasury securities? Why? ii. What is the money multiplier? iii. What is the value of Treasury securities that need to be bought or sold?