Tutorial 11 Chapter 14: Asset markets Multiple choice questions

advertisement

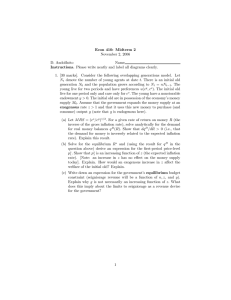

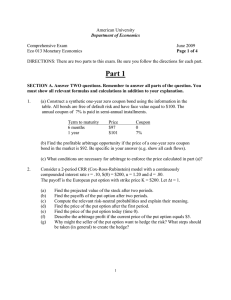

Tutorial 11 Chapter 14: Asset markets Multiple choice questions Question 1 Which ONE of the following is NOT an economic function of assets markets? a. Offering compensation to those willing to bear risk. b. To isolate present asset prices from expected future developments. c. To insure oneself against financial uncertainty. d. To channel resources from savers to borrowers and investors. Question 2 Which ONE of the following factors would NOT contribute to an increase in a stock’s price today? a. An increase in the expected dividend. b. An increase in the expected future price of the stock. c. An increase in the safe interest rate. d. A decrease in the risk premium in relation to the safe interest rate. Open questions: Exercises 5 and 6 from the book. Chapter 15: The exchange rate Multiple choice questions Question 1 If St is the nominal exchange rate at time t, Ft is the one-period forward exchange rate, i is the domestic rate of interest, and i* is the foreign interest rate. Which ONE of the following is the covered interest parity condition? a. Ft (1 i*) / S t (1 i) b. S t (1 i*) / Ft (1 i) c. S t /(1 i) Ft /(1 i*) 0 d. Without knowing the risk premium, we do not have enough information. Question 2 What are the appropriate algebraic signs with which to make the following a correct statement of the uncovered interest parity condition for a British investor who is interested in holding euro-denominated assets? a. b. c. d. Open question: Exercise 6 from the book. Extra questions: Exercise 2 from the book. Chapter 17: Fiscal policy, debt, and seigniorage Multiple choice questions Question 1 Which ONE of the following describes the issue of government debt stabilization? a. How to pay off the government debt. b. Maximizing seigniorage, while minimizing the inflation tax. c. An intertemporal equity–efficiency trade-off. d. The sustainability of the present and future paths of government deficits and surpluses. Question 2 It becomes increasingly difficult for a government to get away with an inflation tax because purchasers of government bonds will do all EXCEPT which ONE of the following? a. Demand higher nominal interest rates. b. Refuse all but the shortest term bonds. c. Demand price level indexed bonds. d. Demand a seigniorage premium. Question 3 Which ONE of the following measures would NOT help to stabilize a country’s government debt? a. Reducing government spending. b. Increasing net taxes. c. Reducing seigniorage. d. Requiring existing government bondholders to accept a longer term bond at a lower interest rate than before. Extra questions: Exercises 3, 4, and 6 from the book.