COMPREHENSIVE EXAMINATION IN ADVANCED MAINSTREAM THEROY

advertisement

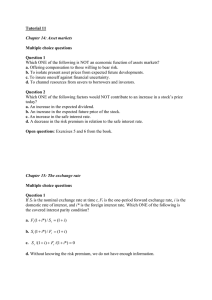

AMERICAN UNIVERSITY Department of Economics Comprehensive Examination Econ 01C January 2007 Page 1 of 3 COMPREHENSIVE EXAMINATION IN ADVANCED MAINSTREAM THEROY Instructions: Answer ALL questions in EACH section and show ALL your work. Microeconomics Section 1. Explain, with reference to an example, how subjective beliefs about the type of other players in a game can be modeled by the concept of Bayesian game. Comment on the role of “common knowledge” in this modeling approach. 2. Consider the following static Bayesian game: 1. Nature determines whether the payoffs are as in Game 1 or as in Game 2, each game being equally likely. 2. Player 1 (the row player) learns whether nature has drawn Game 1 or Game 2, but player 2 does not. 3. Player 1 chooses either T or B and Player 2 simultaneously chooses either L or R. T B L R 1, 1 2, 0 0, 0 0, 2 L T B Game 1 R 1, 1 0, 0 2, 3 3, 1 Game 2 i. Find all the pure strategy Bayesian Nash equilibria. ii. Consider the game in part (i), but assume that Player 2 observes Player 1’s choice before choosing either L or R. Find all the pure strategy pooling and separating perfect Bayesian equilibria in the resulting signaling game. Be sure to specify the equilibrium strategies and beliefs in each case. 4. A consumer with initial income I=100 can face either of the 2 states of nature. In state of nature 2 ("accident"), which occurs with probability, he incurs a loss with monetary equivalent L=80. In state of nature 1 ("no accident"), which occurs with probability (1-θ), he incurs no loss. There are two types of consumers in the market: low-risk type with probability of accident θL=0.1 and high-risk type with probability of accident θH = 0.3. The fraction of high-risk consumers in the 1 population is λ . All consumers have the same von Newmann and Morgenstern utility function u(W)=lnW over income W. A risk-neutral monopoly supplies insurance to the consumers. An insurance contract is a pair (p,s), where p is the premium to be paid in all states of nature, and s is the amount the firm reimburses to the consumer in case of an accident. a. Find the equilibrium under symmetric information (i.e., when the form can identify the risk type of each consumer). b. Prove that high-risk consumers get full insurance in equilibrium, while low-risk consumers get partial insurance at best. Macroeconomics Section 1. (i) Assume that the government’s budget identity in period t is: Gt + it–1Bt–1 = Tt + (Bt – Bt–1) + CBPt where G is government spending, B is government debt, i is the nominal interest rate, T is tax revenues, and CBP is profits from the central bank that are returned to the government. Transform this identity so that you can demonstrate directly the linkage between monetary and fiscal policy in the consolidated government’s budget identity. (ii) Seigniorage is often said to be the “inflation tax.” When thinking about seigniorage as a tax, what is the tax base and what is the tax rate? (iii) Use the Cagan money demand function: ln(M/P) = α – βi + lnY where M/P is real demand for money balances, i is the nominal interest rate, and Y is real income (α and β are positive constants). Derive the optimal seigniorage in the steady state. (iv) What are the key assumptions about the steady state that you used to derive optimal seigniorage above? Why is hyperinflation not part of the steady state? (v) Sargent (1982) noted in his case study that one of the common features of the four hyperinflations he examined was a rise in the stock of high-powered money immediately following the end of rapid inflation. How can you explain this? 2. What is time inconsistency? Discuss in words how time inconsistency might arise in the taxation of capital. (i) How does time inconsistency rely on the existence of a distortion? Provide an example in which the existence of a non-distortionary policy eliminates the time inconsistency problem. (ii) Assume that the central banker’s loss function in a given period t is as follows: Zt = [(a/2) (πt)²] – [b (πt – πte)] where π is inflation, πe is expected inflation, and a, b are positive parameters. Assume further that the policymaker has perfect control over π and individuals set expectations. 2 (iii) If the policymaker pre-commits to a rule (and individuals believe this rule), what is the optimal value for inflation? (iv) If the policymaker instead follows a discretionary policy, what is the optimal value for inflation? (v) Why is the solution you derived in (iii) time inconsistent? Demonstrate that the policymaker can improve welfare by cheating. (vi) Why are some central bankers so critical of time inconsistency analysis? What important real-world concern does the model ignore that might make discretionary policy necessary? (vii) How does Rogoff’s model of the conservative central banker mitigate the time inconsistency problem? (viii) Discuss central bank independence and its relation to the time inconsistency problem. 3