PowerPoint

advertisement

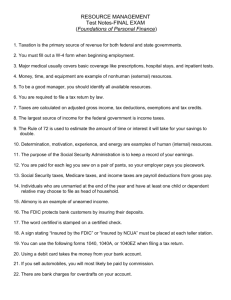

Banking vocabulary balance - the current amount in your account ($$$) bounce: a check is written for more money than is in the account check - a piece of paper (usually) that orders payment of money check register - where you record all account transactions checking account - a place where you can deposit and withdraw money credit - money that goes into your account debit - money that comes out of your account deposit - money put into your account depository institution – financial institution that accepts deposits from consumers endorse - sign your name on the back of a check Source: PDESAS.org, Wikipedia Banking Vocabulary memo line - record what the check was written for mutual fund - investment portfolio shared with others outstanding - transaction not appearing on your bank statement overdraft - when you write a check with too little money in the bank reconcile - you and the bank agree on how much money is in your account routing number - identifies the bank where you have your account signature card - form you need to fill out at the bank to open an account withdrawal - money taken out of your account Sources: PDESAS.org, Wikipedia Depository Institution 0 Accepts money in the form of deposits from consumers. 0 Uses that money to generate profits through loans and investments 0 Includes: 0 0 0 0 Savings banks Savings and loan associations Commercial banks Credit unions 0 Differences: 0 Purposes 0 Customers and products 0 Regulation 0 For-profit or non-profit Note: Check cashing businesses are financial institutions but are not depository institutions. More at: check cashing.com Savings Banks 0 Main purpose: accepts deposits for savings 0 Also called retail banks 0 Deals primarily with consumer accounts as opposed to business accounts 0 Deposit account earnings are applied to individual accounts as interest payments 0 Have the letters SSB or FSB after the name to indicate whether they are a state savings bank or a federal savings bank. Savings and Loan Associations 0 Main purpose: mortgages and other consumer loans 0 By law, must have at least 70 % their assets in residential mortgages or mortgage-backed securities (assets backed by residential mortgages). 0 Primarily regulated by the Office of Thrift Supervision and the state where it resides Sources: theNest.com, Wikipedia Commercial Banks 0 Main purpose: provides financial services to businesses 0 Also called national banks 0 Greater emphasis on business customers 0 Generally deal with larger amounts of money 0 Regulated federally by the Office of the Comptroller of the Currency (Treasury Department). 0 Services: 0 accepting deposits, 0 giving business loans 0 basic investment products. Credit Unions 0 Main purpose: consumer deposit and loan services 0 Non-profit 0 Financial cooperatives – owned by members of some group 0 Deposits = purchases of shares (partial ownership in the business) 0 Credit Union earnings returned to members in the form of dividends 0 Lower interest rates on loans and higher rates on savings because they are non-profit Source: wdfi.org Federal Deposit Insurance Corporation (FDIC) What is the FDIC? 0 An independent agency of the U.S. government that protects you against the loss of your deposits if an FDIC-insured bank or savings association fails. 0 FDIC insurance is backed by the full faith and credit of the U.S. government. 0 Since the FDIC's creation in 1933, no depositor has ever lost even one penny of FDIC-insured deposits. 0 Insures deposits up to $250,000 More information at FDIC.gov Money Talks Let’s go back to the “Money Talks” Newsletter Review Questions Answer these questions using your own words. Write your responses in your notebook. We will go over the answers before you leave if there is time. Question #1 What is a “depository institution”? Question #2 How do banks make money? Question #3 What is a key difference between a Credit Union and other depository institutions? Question #4 What is the main purpose of a Savings and Loan? Question #5 Which type of depository institution would the Casino Theater go to if they wanted to open a second restaurant/theater in another location? Question #6 How much does the FDIC insure deposits for? End of lesson The rest is for another day Types of Deposit Accounts: Regular Accounts 0 Single – one account holder 0 Joint – more than one account holder 0 Checking accounts 0 Personal 0 Student / youth account 0 Business 0 Passbook savings 0 Statement savings 0 Christmas / Vacation Clubs More information at moneymatters Types of Accounts: CD’s Certificates of Deposit (CDs) 0 Deposit a specific dollar amount for a specific period of 0 0 0 0 0 time Low risk investment Fixed interest rate Fees for early withdrawal (usually) More information at FDIC.gov How to calculate CD earnings (this is a bit advanced but some of you might be interested) Rate samples at PNC Bank Which account is right for you questionnaire Money Market 0 A type of checking account that pays a higher interest rate in exchange for limited access to the account. For example, you may only be able to write 4 checks per month More info and video at Investopedia. Mutual Funds 0 These funds allow you to pool your money with other investors in order to maximize return (the money your earn on your investment) and minimize risk through diversification (spreading your money over a large number of investments). 0 Every fund has a portfolio manager who buys and sell investments in order to make a profit for the mutual fund members. 0 Mutual fund portfolios often include a variety of stocks and bonds. More information at CNN Money 101and Wikipedia Types of Accounts: Accounts with Tax Savings 0 College savings plan (529) 0 Individual Retirement Account (IRA) 0 Generally long term investments but there are many types of accounts that can be opened as IRA’s 0 Tax incentives 0 Roth IRA – after tax money 0 Traditional IRA – before tax money 0 More information at The Motley Fool 0 401(k) and 403(b) accounts have money take directly from your paycheck Types of Loans 0 Personal loans 0 Car loans 0 Student loans at CollegeBoard.org 0 Mortgages 0 0 0 0 Primary mortgage (first loan on a house) Second mortgage (additional loan on a house) Home equity line of credit (based on equity in house) Refinance (pay off mortgage and redo to save money or pay for something expensive) 0 Business loans Other Bank Services 0 Debit cards 0 Credit cards 0 Telephone bill pay 0 Online banking 0 Online statements 0 Investment advice Today’s Assignment Read through the Money Matters newsletter. Then Complete the puzzle on the handout.