Traditional IRA - Pioneer Investments

advertisement

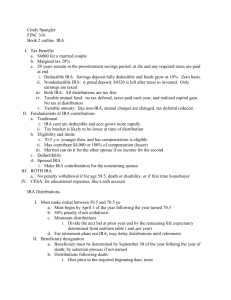

The Power of Roth Revolutionized for 2010 This material is not intended to replace the advice of a qualified attorney, tax advisor, investment professional or insurance agent. Before making any financial commitment regarding the issues discussed here, consult with the appropriate professional advisor. Not FDIC insured May lose value No bank guarantee Roth IRAs in the News… The Roth Conversion -Wall Street Journal, December 29, 2009 5 Reasons to Convert to a Roth IRA -SmartMoney, September 15, 2009 New Rules Ease Roth Conversion, but Benefits Vary -NYTimes, January 9, 2010 You Can’t Take It with You, but You Can Convert -Barron’s, January 18, 2010 How Will You Pay for a Roth Conversion? Should You Roth? -Time Magazine, January 8, 2010 -Business Week, October 22, 2009 23285-02-0210| February 2010 | Page 2 Agenda The Roth Advantage Converting to Roth in 2010 Roth and Preparing for the Future 23285-02-0210| February 2010 | Page 3 IRAs Can Provide Flexibility to Meet Multiple Objectives Retirement Planning Estate Planning IRA Investment Planning Tax Planning 23285-02-0210| February 2010 | Page 5 Not All IRAs Are Created Equal Traditional IRA and Roth IRA — what is the difference? Feature Maximum Annual Contribution (50 or older) Income Restrictions (2010 Modified AGI) Who May Establish Mandatory Withdrawals at 70½ (Required Minimum Distributions—RMDs) When do you pay taxes Traditional IRA Roth IRA $5,000 $5,000 ($6,000) ($6,000) None $120,000 (single) $177,000 (joint) Age limit 70 ½ No age limit Yes No (not for original shareowner) Tax-deferred growth (taxes paid on withdrawals) Tax-free growth, Taxfree income1 (taxes already paid on contributions) 1A qualified Roth distribution is a withdrawal from a Roth IRA account that has been established for at least 5 years AND the account holder is 59½, disabled or passed away. 23285-02-0210| February 2010 | Page 6 The Roth Advantage Combine tax-free compounding growth with tax-free income Roth contributions made with “after-tax” dollars Contributions can be withdrawn tax-free — at anytime Earnings can be withdrawn tax and penalty-free when: – Roth account established for 5 or more years AND – Attained 59½, death or disabled Non-qualified distributions of earnings would be subject to income tax and, if made prior to age 59½, may be subject to an additional 10% federal tax penalty. 23285-02-0210| February 2010 | Page 7 When Is Roth Beneficial? Conventional wisdom is to pay taxes at the lowest rate Expected Tax Rate in Retirement Traditional IRA is more beneficial Roth IRA is more beneficial Higher (Pay taxes today at the lower rate) Same Lower (Pay taxes later at the lower rate) Indifferent 23285-02-0210| February 2010 | Page 8 The Roth Advantage Ways to invest in Roth IRA Contributions – Up to $5,000 ($6,000 if age 50 or older) – Income < $120,000 for single filers ($177,000 for married filing joint) Rollovers: Directly from 401(k), 403(b), pensions, profit sharing plans, etc., to Roth IRA – If allowed by plan – Became available with the passage of the Pension Protection Act (PPA) of 2006 Conversions: Change Traditional IRA to Roth IRA – No income or age limits – Conversion may be full or partial 23285-02-0210| February 2010 | Page 9 Agenda The Roth Advantage Converting to Roth in 2010 Roth and Preparing for the Future 23285-02-0210| February 2010 | Page 10 Why Consider Roth Conversion Now? Reasons to take another look at Roth Income limits on conversion lifted in 2010 Tax rates scheduled to increase in 2011 – Recent stimulus bills may put further pressure on future tax rates Spread tax liability Flexibility regardless of market conditions 23285-02-0210| February 2010 | Page 11 Roth Now Available to Everyone: Income Limits Lifted for Conversions But income limits for Roth IRA contributions remain in effect Before 2010 Modified Adjusted Gross Income (AGI)* limitation Under $100,000 household income Marital Status limitation Married, filing separately not permitted 2010 and Beyond No restrictions No restrictions *Modified Adjusted Gross Income. See IRS Publication 590 which contains a worksheet for determining MAGI for Roth conversion purposes. Income limits for Roth contributions remain in effect and are $120,000 AGI for single filer; $177,000 AGI for married filing jointly 23285-02-0210| February 2010 | Page 12 Taxes for Conversions in 2010 — Choose When to Pay Your Taxes Spreading taxes not available for conversions in 2011 and beyond 2010 Option A Convert anytime during year 2011 2012 2013 Declare 100% of taxable conversion amount as income on 2010 tax return Due 4/15/11* Option B Convert anytime during year Declare 50% of taxable conversion amount as income on 2011 tax return Declare 50% of taxable conversion amount as income on 2012 tax return Due 4/15/12* Due 4/15/13* *April 15th is the tax filing due date for most individuals. Check with your tax advisor if you are unsure. 23285-02-0210| February 2010 | Page 13 Making The Decision — Impact of Future Tax Rates Tax rates scheduled to increase in 2011 Most tax brackets will see an increase of 10% or more in taxes beginning in 2011 2010 2011 Highest 35% 39.6% 5th Bracket 33% 36% 4th Bracket 28% 31% 3rd Bracket 25% 28% 2nd Bracket 15% 15% Lowest Bracket 10% 15% 23285-02-0210| February 2010 | Page 14 IRS Allows You to Undo (Recharacterize) the Conversion Turn Roth IRA back to Traditional IRA without tax or penalty; can reconvert at later date Ability to “undo” conversion (recharacterize) if market goes down – Treats the conversion as if it never happened – “Undoes” the corresponding tax liability – Recharacterize until October 15 of year following the conversion “Redo” conversion (reconvert) at later of: – January 1 of year following conversion – If conversion happens after January of year following conversion, can reconvert 30 days after recharacterization 23285-02-0210| February 2010 | Page 15 Example: Recharacterization after Market Drop Recharacterization allows you to undo a conversion if the market drops Mary has a $100,000 Traditional IRA and is in 25% tax bracket Traditional IRA account value $100,000 Converts to Roth IRA Will owe $25,000 in taxes Traditional IRA account value would have been $80,000 If Mary had waited 6 months to convert… Would only owe $20,000 in taxes Can Mary lower the tax bill on her conversion if her Roth IRA account value is lower? 23285-02-0210| February 2010 | Page 16 “Undo” (Recharacterize) the Conversion Undo conversion if market declines — can “redo” conversion later Mary can “undo” her conversion if the market value drops The steps are: Recharacterize back to Traditional IRA (undo the conversion) This will restore the Traditional IRA with $80,000 (value of Traditional IRA on date of recharacterization) – No taxes on the recharacterized amount – No taxes on the initial conversion Can “Redo” conversion at later date * Recharacterization, or the ability to “undo” a conversion must take place by October 15th of the year following the conversion. The later of 30 days must pass after recharacterization (or after January 1st of following year) before a new conversion can take place. 23285-02-0210| February 2010 | Page 17 Agenda The Roth Advantage Converting to Roth in 2010 Roth and Preparing for the Future 23285-02-0210| February 2010 | Page 18 How Can Roth Help Prepare for the Future? Help maximize Social Security benefits Provide flexibility in retirement income Create a greater legacy for future generations 23285-02-0210| February 2010 | Page 19 Your Social Security Benefits Roth IRA distributions may help maximize your Social Security Benefits Did you know that Social Security Benefits may be taxed if Adjusted Gross Income (AGI) exceeds certain thresholds? $32,000 for married couples filing jointly $25,000 for single filers Examples of income sources that would be included in income calculations Employment or rental income Traditional IRA distributions Qualified Roth IRA distributions1 are not included in income calculations 1A qualified Roth distribution is a withdrawal from a Roth IRA account that has been established for at least 5 years AND the account holder is 59½, disabled or passed away. 23285-02-0210| February 2010 | Page 20 What’s Your Retirement Income Strategy? With Roth IRAs, you have access to tax-free income when you choose Traditional IRAs require that the account owner must begin taking Required Minimum Distributions (RMDs) at age 70½ – Amount determined by age – RMDs from Traditional IRAs are generally taxable RMDs are not required for Roth IRAs for the original account owner and spouse* – As a Roth IRA owner, you choose when withdrawals begin and how much you want to take – Don’t need to take withdrawals??—Pass it on! *If surviving spouse assumes Roth IRA upon inheritance 23285-02-0210| February 2010 | Page 21 Building a Legacy Roth IRA is one of the most tax-efficient assets you can leave your heirs No RMDs required, which can erode inheritance Tax-free compounded growth over time Tax-free income for your heirs* *A qualified Roth distribution is a withdrawal from a Roth IRA account that has been established for at least 5 years AND the account holder is 59½, disabled or passed away. 23285-02-0210| February 2010 | Page 22 Case Study: Traditional IRA vs. Roth IRA — Impact of RMD on Legacy Building Husband and wife want to maximize legacy, avoid RMDs Father is 67 years old, Mother is 65 years old Son is currently 41 years old, granddaughter is currently 11 years old Father has a Traditional IRA worth $200,000 Father and mother are in the 25% tax bracket They want to draw retirement income from other sources, will not need RMD income Goal: Want to leave as much money to son as possible Is it better for the father to convert to Roth IRA or stay with Traditional IRA? 23285-02-0210| February 2010 | Page 23 Case Study: Traditional IRA vs. Roth IRA — Impact of RMD on Legacy Building Assume conversion taxes paid from Traditional IRA If father converts to the Roth IRA, he will pay $50,000 in taxes (25% x $200,000) Assuming he pays taxes from Traditional IRA, he starts the Roth IRA with $150,000 Additional Assumptions – Tax rate remains at 25% across all lives – Assumed annual growth rate is 6% across all lives Note: It is usually most advantageous to pay taxes from outside sources. This example illustrates the worst case scenario of using your Traditional IRA to pay taxes on the conversion. Please consult a qualified tax advisor. 23285-02-0210| February 2010 | Page 24 Case Study: Traditional IRA vs Roth IRA — Impact of RMD on Legacy Building RMD in Traditional IRA works against father’s legacy goal Father’s beginning account value Traditional IRA Roth IRA $200,000 pre-tax $150,000 after-tax Number of years of 6 years RMD (father’s life) None Total RMDs during his lifetime $42,000 after-tax None Account value at father’s death (age 75) $250,000 pre-tax $240,000 after-tax RMD begins when father is 70½; readjusted each year based on his life expectancy Assume 6% growth rate and 25% tax rate 23285-02-0210| February 2010 | Page 25 Case Study: Traditional IRA vs. Roth IRA—Impact of RMD on Legacy Building RMD in Traditional IRA works against surviving spouse’s legacy goal Traditional IRA Roth IRA Wife’s beginning account value (age 73) $250,000 pre-tax $240,000 after-tax Number of years of RMD (mother’s life) 9 None Total RMDs during her lifetime $85,000 after-tax None Account value at mother’s death (age 81) $270,000 pre-tax $405,000 after-tax Wife does not cash out IRA. She assumes the IRA as her own and continues RMDs based on her life expectancy (not her husband’s). RMDs are readjusted each year based on her life expectancy. Assume 6% growth rate and 25% tax rate 23285-02-0210| February 2010 | Page 26 Case Study: Traditional IRA vs Roth IRA — Impact on RMD on Legacy Building Son begins “Stretch”; Roth IRA generates substantial legacy advantage over Traditional IRA Traditional IRA Roth IRA Son’s beginning account value (age 59) $270,000 pre-tax $405,000 after-tax Number of years of RMD (son’s life) 20 20 Total RMDs during his lifetime $285,000 after-tax $570,000 after-tax Account value at son’s death (age 78) $205,000 pre-tax $300,000 after-tax Initial RMD based on son’s life expectancy; future RMDs adjusted by a factor of one each year. Assume 6% growth rate and 25% tax rate 23285-02-0210| February 2010 | Page 27 Case Study: Traditional IRA vs. Roth IRA — Impact on RMD Legacy Building Roth continues to provide Granddaughter nearly double the after-tax income Traditional IRA Roth IRA Granddaughter’s beginning account value (age 48) $205,000 pre-tax $300,000 after-tax Number of years of continued RMD payments (based on son’s – her father’s- life expectancy) 6 6 Total RMDs during her lifetime $180,000 aftertax* $350,000 after-tax Initial RMD based on son’s life expectancy; future RMDs adjusted by a factor of one each year. Granddaughter takes over RMDs based on her father’s life expectancy; forced to cash out after year 6. Granddaughter’s age doesn’t factor into this example. Assume 6% growth rate and 25% tax rate * Pre-tax distributions were $235,000 23285-02-0210| February 2010 | Page 28 Case Study: Traditional IRA vs. Roth IRA — Impact of RMD on Legacy Building Roth provides more after-tax income to heirs Son Granddaughter $1,000,000 $920,000 $800,000 $350,000 $600,000 $465,000 $400,000 $180,000 $570,000 $200,000 $285,000 $0 Traditional IRA (after-tax) Roth IRA Assumptions: 6% assumed growth rate, 25% taxes across all lives; RMD for Traditional IRA begins with the parent’s lives; RMD for Roth IRA begins when the beneficiary inherits the account. The RMD during the parents’ lives on the Traditional IRA plays a large role in reducing the account balance that the heirs inherit. 23285-02-0210| February 2010 | Page 29 Case Study: Traditional IRA Stretch vs. Roth IRA Stretch – Cumulative Taxes Roth IRA may provide multi-generational tax optimization Father's Life $200,000 Mother's Life Son's Life Granddaughter's Life $198,000 $60,000 $150,000 $156,000 $100,000 $96,000 $50,000 $50,000 $28,000 $0 $50,000 $14,000 Traditional IRA Roth IRA Assumptions: 6% assumed growth rate, 25% taxes across all lives; RMD for Traditional IRA begins with the parent’s lives; RMD for Roth IRA begins when the beneficiary inherits the account. The RMD during the parents’ lives on the Traditional IRA plays a large role in reducing the account balance that the heirs inherit. 23285-02-0210| February 2010 | Page 30 Tax Considerations Avoid unexpected taxes for conversions Conversion may bring you up and over your next tax bracket 10% early withdrawal penalty – Waived on converted assets – Not waived on amounts taken from Traditional IRA to pay conversion taxes State tax considerations Conversion must be completed by end of calendar year (unlike contributions which can be made until April 15) Conversion may be full or partial Convergent Retirement Plan Solutions, LLC© 23285-02-0210| February 2010 | Page 31 Is a Roth Conversion Right for You? Talk to your financial advisor Questions ??? 23285-02-0210| February 2010 | Page 32 Investment Suitability Is Important Neither Pioneer, nor its representatives are legal or tax advisors. In addition, Pioneer does not provide advice or recommendations. The investments you choose should correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, please consult an investment professional. Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Pioneer Investments for a prospectus containing this information. Read it carefully. Securities offered through Pioneer Funds Distributor, Inc. Underwriter of Pioneer mutual funds, Member SIPC 60 State Street Boston, Massachusetts www.pioneerinvestments.com 2010 Pioneer Investments 23285-02-0210| February 2010 | Page 33 About Pioneer Founded in 1928 Pioneer Fund - Third oldest mutual fund Diversified fund family including Pioneer Ibbotson Asset Allocation Series Serve over 1 million shareholders 23285-02-0210| February 2010 | Page 34 Appendix 23285-02-0210| February 2010 | Page 36 Over Half of Traditional IRA Contributions Are Nondeductible Nondeductible Contributions Impact Taxable Amount of Roth Conversions Traditional IRA may consist of: – Tax-deferred earnings – Previously deducted contributions • Available when income below $56,000 for single filers, $89,000 for married couples filing jointly • Received income tax deduction for contributions • Owe income taxes on withdrawals or conversions – Nondeductible contributions • Required when income exceeds $56,000 for single filers, $89,000 for married couples filing jointly • Did not receive income tax deduction for contributions • Do not owe income taxes on contributions when withdrawn or converted For a full discussion of nondeductible contributions please see Publication 590. Source: Accumulation and Distribution of Individual Retirement Arrangements, 2004 ; IRS Statistics of Income Bulletin, Spring 2008 23285-02-0210| February 2010 | Page 37 Conversion with Nondeductible IRA Contributions IRS Considers All of a Client’s Traditional IRAs to Be “One Big IRA” All withdrawals and conversions represent proportionate share of tax-deferred earnings, previously deducted contributions and nondeductible contributions % of conversion that is non-taxable is: Total non-deductible contributions Total December 31 balance all Traditional, SEP or SIMPLE IRAs in year of conversion x amount converted A nondeductible contribution is a contribution to a Traditional IRA that does not qualify for tax deductions. Assuming the client or spouse participates in an employer’s retirement plan, the 2010 deduction for traditional IRA contributions begin to phase out at $56,000 for single filers, $89,000 for married couples filing jointly. 23285-02-0210| February 2010 | Page 38 Case Study: Conversion with Non-Deductible Contributions Calculating Conversion Taxes When Nondeductible Contributions Are Comingled John has $30,000 Traditional IRA – $25,000 is nondeductible contributions – $5,000 is earnings If he converts, what amount will he owe taxes on? A nondeductible contribution is a contribution to a Traditional IRA that does not qualify for tax deductions. Assuming the client or spouse participates in an employer’s retirement plan, the 2010 deduction for traditional IRA contributions begin to phase out at $56,000 for single filers, $89,000 for married couples filing jointly. 23285-02-0210| February 2010 | Page 39 Case Study: Conversion with Non-Deductible Contributions Pro-Rata Rule Used to Calculate Conversion Taxes $30,000 Traditional IRA Earnings NonDeductible Contributions $5,000 (17% of IRA) $25,000 (83% of IRA) Of the $30,000 that is converted, John will only pay taxes on $5,000 Assumes John only has Traditional IRA 23285-02-0210| February 2010 | Page 40 Case Study: Conversion with Rollover & Non-Deductible Contributions Rollovers Dilute Tax-free Benefits of Converting Non-Deductible Contributions Assume John will be retiring or changing jobs in the next year 401(k) balance on December 31 is $220,000 John also has the Traditional IRA from the previous example worth $30,000 – $25,000 consists of non-deductible contributions John wants to convert $30,000 John converts after the rollover, what will be the tax consequence? 23285-02-0210| February 2010 | Page 41 Non-Deductible Contributions Effect Taxable Portion of Conversion Step 1: Determine non-deductible portion of Traditional IRA $250,000 Traditional IRA $220,000 Rollover from 401(k) $30,000 from prior IRA Rollovers and Earnings NonDeductible Contributions $225,000 (90% of IRA) $25,000 (10% of IRA) 90% of Traditional IRA is pre-tax Assumes client only has Traditional IRA 23285-02-0210| February 2010 | Page 42 Non-Deductible Contributions Lower the Taxes Owed on Conversion Step 2: Pre-tax portion is same percent as taxable portion of conversion 90% of IRA is pre-tax $30,000 Partial Roth Conversion Taxable $27,000 (90% of conversion) Non-Taxable $3,000 (10% of conversion) Of the $30,000 that is converted, now John pays taxes on $27,000 23285-02-0210| February 2010 | Page 43 Case Study: Conversion with Rollover & Non-Deductible Contribution Case Study Takeaway: tax cost of conversion increases if John converts after a rollover If John converts before the rollover, he pays taxes on $5,000 Total taxes based on 25% tax rate = $1,250 If John converts after the rollover, he pays taxes on $27,000 Total taxes based on 25% tax rate = $6,750 23285-02-0210| February 2010 | Page 44 Case Study: Conversion with Non-Deductible Contributions Goal: Careful Preparation Can Reduce Conversion Taxes Reduce taxable amount of conversion by: Waiting to roll over retirement plans from former employers until year after conversion If rollover already occurred, roll back to employer sponsored retirement plan, if permitted, by December 31 in year of conversion 23285-02-0210| February 2010 | Page 45 Form 8606 Should be Filed for Non-deductible Contributions Form 8606: Instructions to Calculate Taxable Conversion Amount 23285-02-0210| February 2010 | Page 46