Background document - The European Network for Rural

advertisement

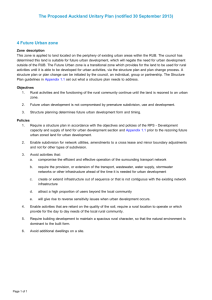

Thematic Group Smart and Competitive Rural Areas Draft Scoping Paper November 2015 1 Contents Introduction .............................................................................................................................................3 2. Smart and Competitive Rural Areas: Background ..........................................................................4 1. Needs and Objectives .................................................................................................................. 4 2. Rural Development Tools for adding value ................................................................................. 5 3. Smart Farming ............................................................................................................................. 6 4. Smart Supply Chains .................................................................................................................... 7 5. Smart Villages .............................................................................................................................. 7 6. Overall Approach to the thematic group. ................................................................................... 8 3. Working methods and expected contribution from Members ......................................................9 4. Expected outcomes and their dissemination .............................................................................. 10 2 Introduction The theme of Smart and Competitive Rural areas was identified during the first year of delivery of the ENRD Contact Point 2014-2020, and refined through the Steering Group of June 2015. This thematic group will concentrate on the strategies and tools available for enabling different types of rural areas to be economically competitive while at the same time preserving their natural resources and social cohesion. This requires an ability to reach new markets and attract new clients while being able to adapt to change and have the resilience to withstand external shocks in a rapidly evolving world. The theme links to priorities P2 “Empowering advisory services – Knowledge transfer – Broader innovation” and P3 “Local food – Short Supply Chain – Rural-urban partnership – Small farms”. The theme also links to areas identified through other research such as the need for improved rural broadband and digital services, and to farm modernisation and improved rural tourism. This paper sets out the background to the thematic group and proposes a delivery ‘toolkit’ for bringing about change through the use of Rural Development measures and through networking. The overall approach to the theme is identified in this paper, but it is expected that this will be further refined when the group meets. Smart and Competitive Rural Areas is a broad theme, which covers a wide range of topics such as markets, business improvement, skills, funding and rural connectivity. It therefore links to a wide range of delivery both within the sphere of rural development such as the EIP-AGRI focus group on short supply chains and on precision farming, but also to other policy areas and workstreams within the European Commission. So it will be necessary to focus the activity of the thematic group on topics where it is possible to add value to what has already been done in the past by other projects, and on those measures and interventions where there are most opportunities for change. 3 2. Smart and Competitive Rural Areas: Background The thematic groups’ priority development areas have been informed through a number of inputs: The recommendations of, the RN Assembly and Steering Group meetings and discussions at NRN meetings Input from MAs, NRNS and stakeholders via thematic groups A preliminary review of ongoing activities of external stakeholders A review of RDP priorities Feedback from the European Commission Consideration has also been given to the priorities of “The New Start for Europe”1 specifically looking at rural broadband and jobs & growth. As a result of these discussions we propose that the TG should cover the following broad fields: Smart Agriculture Smart Supply Chains Smart Villages 1. Needs and Objectives It is important to consider the overall requirements of producers, and in this consideration has been taken of the main recommendations from the Rural Network Assembly and Steering Group, where focus was on three specific areas directly relevant to this Thematic Group: Empowering advisory services, knowledge transfer and broader innovation Local foods, short supply chain, rural-urban partnerships and small farms Multi-fund approaches In addition to this, one other relevant theme raised within the Assembly and Steering Group was in considering Pillar 1- Pillar 2 linkages, and where other projects have delivered actions that relate to the topics identified, such as in developing smart specialisation, ICT use and the 1 4 A New Start for Europe, Jean Claude Juncker, 15 July 2014, http://ec.europa.eu/priorities/docs/pg_en.pdf experience economy. Other topics will be identified and prioritised by Thematic Group members 2. Rural Development Tools for adding value One of the aims will be to create a toolkit composed of the tools and measures within rural development that are available to support smart and competitive rural areas. It is proposed that the Thematic Group will focus on those components which have the greatest opportunity of achieving change. The toolkit will provide examples of the measures and focus areas and on developing interventions which are most appropriate to ensure continued market and infrastructure development. The toolkit will be broken down into a series specific areas of intervention capable of having a major impact on the competiveness of rural areas: Digital services and rural broadband (supported by basic services and village renewal) Knowledge development support (knowledge transfer, advisory services, cooperation) Investment support (investment in physical assets, other funding) Digital Services and Rural Broadband One of the key areas will be using technology to develop markets, and the appropriate online, mobile and smart tools available to access these markets, and the linkages necessary to target specific visitor groups, including local urban populations. The development of tools for the rural sector in accessing markets includes the ability to compete to attract the modern consumer, and this approach includes the uptake of technological resources or digital tools and the ability to access broadband connections. A number of Good Practices now exist in the development of rural broadband2, and examples also of the desire to improve access to broadband exist across the EU-28. In order to effectively compete for consumers, rural businesses will need to have the appropriate connections, but also be up to date with the appropriate tools used and taken up by consumers, in an area crowded with suppliers including social media training. The use of technology or even leading edge techniques and early stage adoption should be highlighted where it can impact on competitiveness, and this will be the focus in considering the toolkit available for rural areas. There are also opportunities to develop smart agriculture through precision farming, GPS, data collection and drone monitoring which can be explored. 5 2 Including the European Commission’s Guide to High Speed Broadband Investment 2014 Knowledge development support Underpinning all of the strands for smart, competitive rural areas will be the ability of support services and networks to develop co-operation, stimulate uptake of technologies, and to have the skills to offer support in the development of technologies and support. The successful deployment of the M16 for cooperation could play a major role, and is anticipated to be a major focus area. Advisory services will be an important resource in this area, and the opportunities offered within RDPs to develop these areas. Knowledge development and research must also be considered, including the work of EIP. Investment support Alongside soft measures for knowledge development it is important to design packages of investment support involving various RDP measures, financial instruments and even EFSI funds. Multi-fund approaches should be a strong consideration in illustrations provided. The TG can identify good practices related to the needs of different types of rural areas. Focus on outcomes will include consideration of jobs and growth 3. Smart Farming Considerable research has been undertaken on the opportunities available to rural producers to improve competitiveness3. For primary agriculture this involves considering the tools to develop comparative advantage through applications of available technology in rural areas. This may be through Global Navigation Satellite Systems (GNSS), sensor technology, and drone monitoring or automated processes, among others. This is usually defined as Precision Farming, and therefore linked to reductions in environmental impacts while improving profitability. Smart farming also means accessing information, whether through ICT or in direct advice through advisory systems to increase yields and performance. This can identify solutions for improvement in efficiency and meeting market demand, and can also include consideration 3 Economic competitiveness: ability of the players involved to create and retain maximum added value in the area by strengthening links between sectors and by turning their combined resources into assets for enhancing the value and distinctiveness of their local products and services; http://ec.europa.eu/agriculture/rur/leader2/rural-en/biblio/com-soc/pre.htm 6 of cooperation advantages both within producer groups and with other elements of the supply chain. 4. Smart Supply Chains Smart supply chain strategies involve responding effectively to appropriate markets that rural producers can access and putting in place all the steps that help them reach those markets. It is essentially about vertical integration around promising supply chains. Research on competitiveness has also identified the needs to develop markets4. In the previous programming period (2007-2013) this has identified a number of opportunities for further intervention such as: Co-operative development (sectoral and regional) Improving routes to market, including distribution and technology; creating smart supply chains Specific opportunities such as Public Procurement and the continued development of the foodservice sector There are opportunities, and clearly indicated interest from stakeholders in developing these strands. In the case of co-operative development, the growth in shorter supply chains has led to both formal and informal co-operatives emerging to develop their markets. The clear emerging area in this is Public Food. Initiatives in previous research has focussed on accessing school markets5, but new activity in this area focuses on other markets which are under public authority contracts – hospitals, prisons, airports and other public building. The continuing improvement in the accessibility of these markets thanks to pilot initiatives spreading to other areas in countries such as France, the UK, Sweden and Slovenia means that producers can target individual premises such as an airport or prison, rather than being bound to a larger supply contract. The various models can be explored, including the ‘disaggregation of contracts’ which allows for tender lots to be split into smaller packages, so that producers do not have to supply the full range of produce required. 5. Smart Villages The focus in this area will be on the different measures and tools that can be used to attract consumers to rural areas, creating “smart villages “which are connected and promoted to their 4 These are referred to in Error! Reference source not found., but include projects such as Compete, and Glamur under FP7 7 the research undertaken in Foodlinks 5 Including pilot initiatives such as Agrilocal in France and external environments., This builds on work in creating rural destinations. Whereas the last section dealt primarily the steps linking producers to markets along vertical supply chains, this deals more with horizontal connections between firms New market development areas of specific interest are in attracting urban populations through the high interest level in food provenance, and the opportunities provided for transformation of activities based on building regional destinations, trails and added value activity6. Consideration will be given to where market demand can be increased for rural activity by making them attractive locations for leisure, work, retirement, bringing up children and so on. This goes with and beyond local food, and the development of on-farm activity and diversification. This includes activity, trails and accommodation, and how clusters of the rural sector can develop themselves as destinations both locally and internationally. Rural tourism and the ability for areas to drive visitors from residential economies can also be topics for consideration. One specially promising field of activity which could become the main subject for a TG meeting concerns how broadband and information technology can also add value to rural sectors. This includes issues such as smart farming, GPS data, and digitised machinery, how modernisation is approached in different regions and countries, smart villages and so on 6. Overall Approach to the thematic group. The TG will organise a series of up to four workshops. The first workshop will look at the rural development tools available, and try identify those that can have most impact on smart and competitive rural areas. On this basis it will agree the priorities for the following workshops. Thereafter the workshops could focus on a promising topic within each of the broad strategies mentioned earlier. The toolkit of support services could be both an input to the process, as well as an output to be disseminated. The workshops would then focus on market areas which can be targeted through the support of the wider ENRD. 6 Research including the JRC Technical Report “Smart Specialisation and Innovation in Rural Areas” 8 9 3. Working methods and expected contribution from Members The work of the Thematic Group is based on the active exchange of views, knowledge and experience among its members and the development of analysis, proposed actions, initiatives and solutions. This is mainly done through participating in face-to-face meetings, contributing to specific tasks and taking part in online discussions. The ENRD Contact Point supports and animates the work of the Group by: hosting, designing and facilitating discussions and activities; analysing and presenting information both independently collected and provided by the TG members; formalising the outcomes of the group’s work in meeting reports, discussion papers, final reports; disseminating the results of the TG at the EU level. A commitment to active participation by the TG members is an essential prerequisite for membership of the Thematic Group. This is essential to progress the work and achieve concrete, relevant and applicable outcomes. In particular, members are expected to: - commit to attending the meetings of the Group and participate in its activities; - share their experiences, specifically with regards to main challenges and opportunities for the effective implementation of RDPs; - bring concrete examples, relevant practices or approaches they have knowledge about or are dealing with, especially those that can hold a potential for learning or can suggest effective ways to deal with recognised bottlenecks; - if necessary, provide evidence and data to support background analysis and recommendations; - contribute to review interim outcomes, providing suggestions and recommendations for improvements and contribute to make the TG work relevant to stakeholders’ needs and result-oriented; - ensure – as far as possible – continuity in meetings and exchanges in-between meetings, reacting to discussions and contributing to the flow of information among members; - inform and disseminate the knowledge gained among their organisations and invite those interested to join/contribute to the work of the TG - use and disseminate more broadly the outcomes of the TG work. 10 4. Expected outcomes and their dissemination The main outcomes for this Thematic Group are best couched in terms of its overall theme and objective; ‘Smart and Competitive Rural Areas’ and ‘maximising the added value that the RDPs can create’. If the transition is to be promoted effectively and progress is to be made it is vital that these outcomes are disseminated effectively via the outputs of the Group, that is to say the messages have to be sufficiently clearly communicated, received and understood in order that they may be implemented. Some of these will be delivered during the lifespan of the Thematic Group whilst others will be focused more on the longer term. This therefore implies careful consideration of the nature, means and targeting of this dissemination. This will be a primary consideration for the working group and as such an integral part of the whole work package. These outputs and outcomes will therefore emerge as a result of the work of the group and the nature of these cannot be pre-empted at this preparatory stage. The main outcomes expected therefore take the form the conclusions, recommendations, examples and illustrations of how RDPs and their supported actions can contribute to this transition. The main outputs will be those products and activities through which these outcomes will be pursued. Indicatively these may be expected to include: An enhanced knowledge and evidence base; Examples of relevant and transferable good practices; Publications and other communications, including both dedicated materials and contributions to other ENRD and partner materials; Contributions to the Rural Networks Assembly, its subgroups and other EU, stakeholder and Member State events; The development of a cluster and / or community of practice / interest; The establishment of links and joint working with other networks and initiatives (including specifically the EIP Focus Groups); and An ENRD seminar. 11