CERTIFIED FINANCIAL PLANNER CERTIFICATION

PROFESSIONAL EDUCATION PROGRAM

Retirement Planning & Employee Benefits

Session 2

Fundamentals of

Social Security

©2015, College for Financial Planning, all rights reserved.

Session Details

Module

1

Chapter(s) 4

LOs

1-5

1-7

Identify and categorize basic provisions of an

OASDI program: retirement, survivorship, and

disability.

Analyze a given situation to calculate the

taxation of Social Security benefits.

2-2

OASDI

Old Age, Survivors, and

Disability Insurance

has three main

components:

1. Retirement

(old age)

2. Disability

(disability of wage

earner)

3. Survivorship

(death of wage earner)

2-3

Key Terms in OASDI Programs

•

•

•

•

•

•

•

•

•

•

Quarter of coverage ($1,220 in 2015)

Currently insured/Fully insured

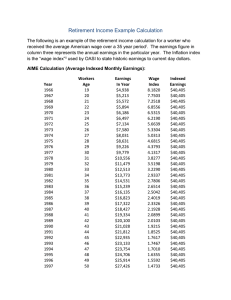

Average Indexed Monthly Earnings (AIME)

Full retirement age (FRA)

Primary Insurance Amount (PIA)

Spousal benefit

Benefit reductions due to age

Benefit reductions due to earnings

Events that trigger the end of benefits

Divorced spouse coverage (married 10 years)

2-4

Full Retirement Age

Born

Full Retirement Age

Age 62 Benefit

65

80%

1938-1942

65 plus monthly adjustment

75-80%

1943-1954

66

75%

1955-1959

66 plus monthly adjustment

70-75%

After 1960

67

70%

Before 1938

2-5

Benefit Reductions Due to Earnings

Age

You will lose

Amount (2015)

62 to year of FRA

$1 in benefits for every

$2 of earnings above

$15,720

Year you reach FRA

$1 in benefits for every

$3 of earnings above

$41,880

After reaching FRA

No benefit reduction

Unlimited

2-6

Retirement Earnings Test Example

Item

Amount

Total Social Security benefits

(75% of maximum FRA amount)

$23,967

Earnings

$41,560

Social Security earnings limit (2015)

$15,720

Excess earnings

$25,840

Reduction in Social Security benefits

(50% of excess earnings)

$12,920

Net Social Security benefits

$ 11,047

2-7

Qualifying for Social Security Disability Benefits

1. Disabled worker must be fully

2.

insured (at least 40 quarters)

and

Have worked for at least 20 of

the last 40 quarters

2-8

Qualifying for Social Security Survivor Benefits

1. Deceased worker

2.

must have been

either fully insured

(40 quarters)

or

Currently insured

(at least 6 of last 13

quarters)

2-9

Social Security Benefit Review

Benefits will be paid to:

Retirement

Disability

Death

Worker, Under FRA

Reduced* PIA

100% of PIA

N/A

Worker, FRA & Over

100% of PIA

Disability benefits cease;

retirement benefits

begin

N/A

No benefit

No benefit

Spouse, age 60 or 61

100% of PIA,

reduced

50% of PIA, reduced

100% of PIA,

reduced

Spouse, FRA or older

50% of PIA

100% of PIA

Spouse, any age, caring

for child under age 16

or disabled

50% of PIA

75% of PIA, reduced

(worker was

currently insured)

50% of PIA

(subject to family maximum)

75% of PIA, reduced

(worker was

currently insured)

Spouse, age 62 to FRA

Unmarried child under

age 18 (19 if in high

school) or any age if

disabled

2-10

Johnson Family Example

• Robert Johnson died at

•

•

age 35. Survivors are:

o Wife, Jane (age 35).

o Daughter, Juli (age 6).

o Son, Bobby (age 3).

His PIA is $1,200.

Maximum family benefit

is $2,250.

2-11

Family Limits

$1,200 PIA X 75% =

$900

$900

Juli’s Benefit, 75% of

PIA Reduced to $750

$900

$2,700

$2,250 family max.

Bobby’s Benefit, 75% of

PIA Reduced to $750

Jane’s Benefit, 75% of

PIA, Reduced to $750

35

40

45

$450 reduction

Jane’s SS =

71.5%† PIA

Widow(er)’s Blackout Period*

47 48

50

55

60

65 66

Jane’s Age

*If widow(er) is disabled within seven years of spouse’s death. Social Security payments may begin at age 50.

† If benefits begin at 60. 71.5% PIA; at 62.75% PIA: at 65, 100% PIA.

2-12

Income Tax on Social Security Benefits

Percent of Social Security

retirement benefit

subject to income tax

Threshold income:

joint filers

Threshold income:

single filers

Less than $32,000

Less than $25,000

None

$32,000 to $44,000

$25,000 to $34,000

Up to 50%

Greater than $44,000

Greater than $34,000

Up to 85%

2-13

Income Tax on Social Security Benefits

Thresholds are arrived at by using “provisional

income.” The main components of provisional

income are:

• AGI

• Tax-exempt interest income (muni bonds)

• One-half of OASDI benefits

2-14

CERTIFIED FINANCIAL PLANNER CERTIFICATION

PROFESSIONAL EDUCATION PROGRAM

Retirement Planning & Employee Benefits

Session 2

End of Slides

©2015, College for Financial Planning, all rights reserved.