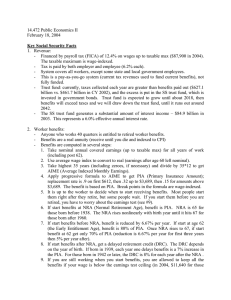

Retirement Income Example Calculation The following is an

advertisement

Retirement Income Example Calculation The following is an example of the retirement income calculation for a worker who received the average American wage over a 35 year periodi. The earnings figure in column three represents the annual earnings in the particular year. The Inflation index is the “wage index”ii used by OASI to state historic earnings to current day dollars. AIME Calculation (Average Indexed Monthly Earnings): Year 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 Workers Age 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Earnings In Year $4,938 $5,213 $5,572 $5,894 $6,186 $6,497 $7,134 $7,580 $8,031 $8,631 $9,226 $9,779 $10,556 $11,479 $12,513 $13,773 $14,531 $15,239 $16,135 $16,823 $17,322 $18,427 $19,334 $20,100 $21,028 $21,812 $22,935 $23,133 $23,754 $24,706 $25,914 $27,426 Wage Index 8.1820 7.7503 7.2518 6.8556 6.5315 6.2190 5.6639 5.3304 5.0313 4.6815 4.3793 4.1317 3.8277 3.5198 3.2290 2.9337 2.7806 2.6514 2.5042 2.4019 2.3326 2.1928 2.0899 2.0103 1.9215 1.8525 1.7617 1.7467 1.7010 1.6355 1.5592 1.4733 Indexed Earnings $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 51 52 53 54 55 56 57 58 59 60 61 62 $28,861 $30,470 $32,155 $32,922 $33,252 $34,065 $35,649 $36,953 $38,651 $40,405 $41,335 $0 1.4000 1.3261 1.2566 1.2273 1.2151 1.1861 1.1334 1.0934 1.0454 1.0000 1.0000 0.0000 Total of highest 35 years Divisor - 420 months AIME $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $40,405 $41,335 $0 $1,415,121 420 $3,369 PIA (Primary Insurance Amount) – Retirement at age 66, monthly benefit payment: First Bend Second Bend Third Bend AIME PIA at age 62 Rounded to nearest $.10 Bend Point $744 $4,483 Excess AIME Applied $744 $4,483 $0 $3,369 Bend Percent 90% 32% 15% PIA $669.60 $840.11 $0 $1,509.71 $1,509.70 PIA – Early Retirement at age 62, monthly benefit payment: In the example above the worker would receive a pension amount of $1,509.70 if they retired at age 66, the full retirement age. If the worker continued to work up until age 66 the additional earnings could substitute for past earnings and raise his PIA. If the worker were to retire early the PIA is reduced by a percentage for each month of early retirement. The earliest that an individual can receive OASI benefits is at age 62 which is 48 months early and would cause a reduction to the PIA of 25%. Therefore in the example above the worker would receive a pension of $1,132.00 which would grow each year with inflation. PIA with nonworking spouse of retirement age, monthly benefit payment: If a worker has a spouse that is also age 66 or older and who did not work enough to qualify for an OASI benefit, then the PIA amount is raised by 50%. In the above example, the pension would be raised to $1886.00 and would increase each year with inflation. The higher benefit would be payable for as long as the couple lived and would drop down to the initial PIA upon the death of the husband or wife. i Retirement benefits of average wage earner, Table 2.A26; Annual Statistical Supplement to the Social Security Bulletin: 2010, February 2011. ii The wage index is determined by OASI by comparing the average earnings for all Americans. Therefore in this example indexed earnings total $40,500 for each year.