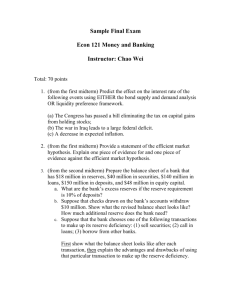

Check Clearing and Collection

advertisement

Bank Reserves and the Money Supply Introduction Examine the relationship between bank reserves and the money supply Money supply (M1) is composed mostly of demand deposits in commercial banks and other financial institutions Bank reserves play a crucial role in creating demand deposits By regulating bank reserves, Federal reserve gets leverage to control amount of demand deposits and thereby nation’s money supply Check Clearing and Collection Many checks and electronic transfers are “cleared” by local banks exchanging them through local clearinghouse associations. Clearinghouses net out the value of checks and transfers drawn on or received by each depository institution in the association. The Fed’s Role in Check Clearing The Fed clears a check by subtracting the amount of the check from the reserve account balance of the bank on which the check was written and by adding the amount to the reserve account balance of the bank that presents the check to the Fed for clearing. Reserve balances are transferred from one bank to another when checks are cleared between them. They do not disappear from the banking system. Float Inter-District Settlement Fund Example: Barbara is on vacation in Atlanta. While shopping at Saks Fifth Avenue, she buys a coat for $500 She writes a check for the purchase amount on her bank in Minneapolis, Norwest Bank. Saks receives the check in its processing area. It deposits the check at its bank, Wachovia Bank, that evening - along with many others. The bank first encodes the dollar amount in magnetic ink on the bottom right-hand side of the check, then batches this check with many others it has received that were written on banks outside the Atlanta area. It transports the checks to the Atlanta Federal Reserve Bank. The Atlanta Fed sorts this check and other unsorted checks it has received, according to the check’s destination (the drawee bank-Norwest Bank). The Atlanta Fed settles accounts, crediting Wachovia Bank’s reserve account according to a prearranged “availability schedule”. After settlement, checks drawn on banks in the 9th District are grouped and sent to the Minneapolis Fed. The Minneapolis Fed returns Barbara’s check to Norwest and debits Norwest’s reserve account (called presentment). Norwest then debits Barbara’s checking account. Sequence of events when a check, drawn on Norwest, is deposited in Wachovia Demand deposits in Wachovia increase with a corresponding increase in assets When the check clears through the Fed check clearing system, Check in process of collection The Fed increases Wachovia’s “deposits in Fed” by the amount of the check There is a corresponding decrease in the deposits of Norwest which is made by the Fed Demand deposits in Norwest decrease when the check clears The Federal Reserve neither gains or loses deposits, only transfers ownership from one bank to another Summary When a bank receives a check drawn on another bank, it gains reserves equal to the amount of the check The bank on which the check was drawn loses reserves of the same amount Check Clearing and Collection The above sequence of events occur whether the banks are members of the Federal Reserve system or not In this case the banks are in different Federal Reserve regions, the two regional banks have a clearing account which permits the transfer of reserves between regions Money Supply Monetary Base = Currency + Reserves M1= Currency + Travelers’ Checks + Demand Deposits M2 = M1 + Savings Deposits + Small Time Deposits + MDA + MMMF Required Reserves and Depository Institution Balance Sheets Required reserve ratios: Fractions of transactions deposit balances that the Federal Reserve mandates that depository institutions maintain either as deposits with Federal Reserve banks or as vault cash. Required reserves: Legally mandated reserve holdings at depository institutions, which are proportional to the dollar amounts of transactions accounts. Depository Institution Balance Sheets Excess reserves: Depository institutions’ cash balances at Federal Reserve banks or in the institutions’ vaults that exceed the amount that they must hold to meet legal requirements. Total reserves: The total balances that depository institutions hold on deposit with Federal Reserve banks or as vault cash. Bank Liquidity Why does a bank need liquidity? Required reserves Not really there to provide liquidity. Excess reserves Deposits are convertible on demand into cash. Accommodate customers when they come for loans. Provide liquidity Expensive Federal funds market – banks short of required reserves can borrow from those that have excess reserves. Discount Window – banks short of required reserves can borrow from the Fed at its discount window. Required Reserves Federal funds market – banks short of required reserves can borrow from those that have excess reserves. Discount Window – banks short of required reserves can borrow from the Fed at its discount window. Deposit Expansion: The Single Bank How much a bank safely can loan depends on the amount its excess reserves. When a bank lends, the borrower receives a checking account (demand deposit) Both sides of balance rise, increase in “demand deposits” (liability) and increase in “loans” (asset) Since demand deposits are part of the money supply, when banks create demand deposits through lending, there is an increase in the money supply Deposit Expansion: The Single Bank A bank can safely lend up to the amount of its excess reserves When proceeds of the loan are withdrawn and the reserves are reduced by the amount of the check, all the excess reserves will be used up. If the bank tries to lend more, there will be insufficient reserves as soon as the borrower withdraws the proceeds from the loan. An individual bank can create money (demand deposits) only if it has excess reserves. As soon as it creates this money, it loses it to another bank when the money is spent Deposit Expansion: The Banking System Although the initial bank lost its excess reserves, another bank gained these excess reserves which permits them to expand their lending and increase the money supply However, ability of the next bank to extend loans is reduced by 10% since some of gain in reserves must be held on deposit with Fed. Process will continue with each successive bank being able to lend only 90% of gained excess reserves and 10% placed on deposit with Fed How the Banking System Creates Money The banking system will have demand deposits that are a multiple of the initial injection of excess reserves into the system. The Fed will have additional required reserves on deposit equal to the initial injection of excess reserves into the system The final state is reached not by shrinking reserves, as in the case of a single bank, but by expanding deposits Deposit Expansion: The Banking System When one bank loses reserves, another bank gains the excess and lends out 90% As banks lend more and more, demand deposit liabilities grow, thereby reducing excess reserves Whereas a single bank can lend the amount of excess reserves, the banking system can create demand deposits up to a multiple of original change in reserves The process of deposit expansion can continue until all excess reserves become required reserves because of growth of demand deposits Demand Deposit Expansion Multiplier The demand deposit expansion simple multiplier is always the reciprocal of the reserve requirement ratio 1 Demand Deposits Re serves x Re serve Ratio Where: 1 Re serve Ratio is the simple multiplier The Money Multiplier This money multiplier formula calculates the maximum possible expansion of M1 because it assumes: 1. 2. everyone deposits their new loans into a checking account at a bank. banks hold no excess reserves. If either of these assumptions are violated, the amount of money actually created in the economy will be smaller than the formula predicts. The money creation process works exactly the same in reverse. For example, if someone withdraws money from a bank, a bank will be short of its required reserves and must reduce loans. M1 will decrease by $900,000 in the example above. Deposit Contraction If a bank starts with deficient reserves, potential change in demand deposits is negative rather than positive Money is destroyed as bank loans are repaid or securities sold The potential multiple contraction in demand deposits (money supply) follows the same principles as expansion of demand deposits Depository Institution Reserves, the Monetary Base, and Money The monetary base (MB): The amount of currency, C, plus the total quantity of reserves (TR) in the banking system, or money produced directly by the government, Multiple Expansion Process The stages of expansion occur neither simultaneously nor in the sequence described above. Some banks use their reserves incompletely or only after a considerable time lag, while others expand assets on the basis of expected reserve growth. The process is continuous and may never reach its theoretical limits. What happens to the quantity of money will vary, depending upon the reactions of the banks and the public. A number of slippages may occur: What amount of reserves will be drained into the public’s currency holdings? To what extent will the increase in the reserve base remain unused as excess reserves? How much will be absorbed by time deposits or other liabilities not defined as money but against which banks must also hold reserves? Appendix—The Complete Money Supply Process Actual change in demand deposits will reach the maximum amount indicated by the simple multiplier if banks lend all excess reserves. Any leakages of cash out of the multiple expansion cycle will result in a smaller expansion of the money supply Federal Reserve can control additional excess reserves but leakages are outside their control and may adversely affect their attempt to expand the money supply Shifts between Currency and Checking Deposits Monetary base (B)—total reserves held by banks plus currency held by nonbanking public When the Federal Reserve injects reserves, it is really adding to the monetary base Public may elect to hold some of the excess reserves as cash instead of demand deposits Draining of currency into the hands of the public depletes bank’s excess reserves Shifts between Currency and Checking Deposits Cash held by the nonbanking public becomes part of the money supply, but it reduces the banking system’s ability to expand demand deposits Due to the uncertainty of the public’s reaction to additional reserves and desire to hold cash, the Fed has more control over the monetary base than total reserves Shifts between Time Deposits and Check Accounts The public may desire to hold time deposits rather than demand deposits Since the required reserves for time deposits is smaller than for demand deposits, placing of funds in time deposits will increase the banking system’s ability to expand credit. Shifts between Time Deposits and Checking Accounts Since time deposits are not part of M1, movement of funds into time deposits will reduce the expansion of the money supply (M1) The reserve multiplier consequences for broader money supply definitions are more complicated than for M1 The Role of Interest Rates Banks not being able or willing to lend all their excess reserves Funds may remain idle in the bank Since banks will be more inclined to lend or purchase securities at higher interest rates, this raises the possibility that the money supply (multiplier) is a function of interest rate levels Implications The Federal Reserve’s ability to control the money supply is not precise It must deal with leakages of money from the demand deposit expansion cycle, factors that are generally determined by public preferences The Money Multiplier During the Great Depression Between 1929 and 1933 bank holdings of excess reserves rose from $25 million to over $2 billion. The currency-to-deposits ratio increased from approximately 17 percent to 33 percent. The Money Multiplier During the Great Depression Why do you think these changes occurred? If the money multiplier is equal to 1 (rdd c / dd ) what happened to M1 during this time? How could the Fed have improved the situation?