Implats - Amazon Web Services

advertisement

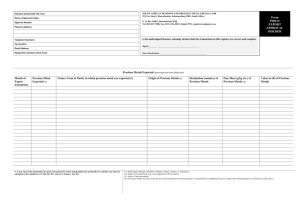

Presentation by Impala Platinum Holdings Limited (“IMPLATS”) to the Parliamentary Portfolio Committee on Minerals and Energy on The Precious Metals Bill [B30-2005] 18 October 2005 Presentation Introducing Implats Submissions of Comments to Precious Metals Bill (“PMB”) Brief Market Review of Platinum (Pt), Palladium (Pd) Focus on Implats refining business through Impala Refining Services (“IRS”): Impala Refining Services Refining Implications of Precious Metals Bill on Impala Refining Services Proposed way forward re PMB 2 Introducing Implats Introducing Implats Implats is in the business of mining, refining and marketing of platinum group metals Contribution by metal Other, 5.50% Second largest PGM producer in the world Employs 31 000 people Produced in FY2005 (end June 2005) approx 1.85 Million ounces refined Platinum (Pt) – around 25% of global supply Palladium, 8.50% Nickel, 10.50% Platinum, 64.80% Rhodium, 10.70% 4 Implats … Contributed R12.5 billion in sales revenue in FY2005 to GDP in South Africa Income tax – R 962.5 million in FY2005 Other taxes (PAYE, RSC Levies, UIF, Skills Levy) Royalties – R414.9 million in FY2005 (primarily Royal Bafokeng Nation and other HDSAs) Committed to transformation Fact sheets with Mining Charter Scorecard as well as more detail on Implats and its operating companies 5 Implats Group structure Implats Mine to market 100% * IRS Impala Marula Zimplats Mimosa Two Rivers Refining Services Strategic holdings 100% 8% AQP 100% * 86.8% 50% Concentrate off-take agreements Concentrate off-take agreements 50.5% 20% Aquarius Platinum SA 45% Toll Refining * BEE currently being negotiated 6 Submissions of Comments to Precious Metals Bill Implats Written Submission of Comments on the PMB Implats’ written submission dated 23 September 2005 focus in detail on concerns relating to the practical implementation of certain provisions of the PMB for the platinum refining industry in SA: Definitions, in particular of “semi-fabricated precious metal” and “unwrought precious metal” Security of tenure in applying for licences, permits and permissions Import permits and Export written approval Transportation and conveyance of precious metal Transitional arrangements Confidentiality of Information 8 Chamber of Mines Submission of Comments on the PMB Implats has participated in the consultation process in the preparation of the Chamber of Mines Submission of Comments on the PMB Implats concurs with both the Chamber’s written submission as well as its verbal submission of Comments on the PMB to the Portfolio Committee on Minerals and Energy 9 Implats Verbal Submission on Comments to the PMB This verbal submission will focus on: the refining business of Implats and the implications of the PMB thereon 10 Brief Market Review Brief Market Review of Platinum, Palladium World Market – autocatalysts, jewellery, industrial Price Takers – London AM and PM Fix for Pt and Pd 12 Platinum supply and demand (000oz) Calendar years 2002 2003 2004 2005 Automobile 2 615 2 995 3 160 3 280 Jewellery 2 840 2 505 2 210 2 210 Industrial/Investment 1 625 1 465 1 610 1 665 Total demand 7 080 6 965 6 980 7 155 Total supply 6 665 6 830 7 035 7 190 -415 -135 55 35 Balance 13 Palladium supply and demand (000oz) Calendar years 2002 2003 2004 2005 Automobile 4 530 4 465 4 515 4 615 Other 2 370 2 325 3 170 3 275 Total demand 6 900 6 790 7 685 7 890 Total supply 7 160 7 415 8 710 8 205 260 625 1 025 315 Balance 14 Focus on Implats refining business through Impala Refining Services (“IRS”) Impala Refining Services (100%) IRS contributes 32% of Implats total sales revenue (R 12,5 bn) – about R4 bn Undertakes processing of third party material - toll-refining activities and concentrate purchases One of the world’s largest refiners of used autocatalysts Headline production of 733,000 oz of platinum in FY2005 - approx 47% is sourced from abroad (primarily USA and Zimbabwe) 1000 IRS platinum production 900 800 700 600 500 Lonplats 400 300 200 100 0 FY01 FY02 FY03 FY04 FY05 16 Simplified Flow Diagram DISSOLUTION ION EXCHANGE IMPALA PLATINUM MINES PURIFICATION & PRECIPITATION RHODIUM PURIFICATION & PRECIPITATION IRIDIUM PURIFICATION & PRECIPITATION PLATINUM HYDROLYSIS PRECIPITATION RUTHENIUM PRECIPITATION PALLADIUM GOLD PRECIPITATION GOLD DISTILLATION MOLECULAR RECOGNITION TECHNOLOGY CONCENTRATOR MILLING - FLOTATION ION EXCHANGE DISSOLUTION PLATINUM METALS REFINERY SMELTER DRYING - SMELTING - CONVERTING NICKEL REDUCTION BASE METALS REFINERY DISSOLUTION OF NICKEL , COPPER AND COBALT COBALT REDUCTION COPPER ELECTROWINNING BRIQUETTING AND SINTERING NICKEL POWDER OR BRIQUETTES COBALT POWDER COPPER CATHODES ACAD DRG No: PRP_STD_P_0240 17 Impala Refining Services Officially created in 1998 as part of Implats’ growth strategy – limited PGM resources Excess capacity at the Impala Platinum Base Metal and Precious Metal Refinery at Springs Dedicated vehicle for toll-refining and metal concentrate purchases Leverage surface assets and expertise - small scale platinum operators Reduce unit costs over entire operations (through economies of scale) Seek growth through strategic alliances and joint ventures 18 Growth Implats’ consistent growth in production – 2.3Moz Pt targeted for FY2010 2500 2000 1500 1000 500 0 FY99 FY00 FY01 Mine to market FY02 FY03 FY04 3rd party processing FY05 FY06 Lonplats FY07 FY08 FY09 FY10 Zimbabwean expansions 19 Key benefits to South Africa and Implats Exploitation of smaller deposits possible by third parties: reduced barriers to entry into the PGM industry; increased supply into the world markets; long term employment creation; additional revenue for SA and taxes Extends current 30 year life of mine of Impala Rustenburg Mine, with associated: Job security Employment benefits Tax benefits to SA Autocatalysts recycled generate additional forex for SA 20 IRS contract structures Metal purchase agreements Metal purchase after an agreed processing period IRS retains agreed proportion of metal value Toll refining agreements Percentage return of market value Refining Smelting Handling charge 21 Metal purchase agreements Metal purchase agreements (Off take agreements) IRS purchases precious metal bearing product from the customer (primary producer). The semi-fabricated precious metal is then produced as “Impala” brand and sold onto the market Used primarily for local ex-mine contracts as well as our Zimbabwe operations Primarily PGM mine concentrate, PGM bearing matte which falls into definition of unwrought precious metal in the PMB 22 Toll Refining Agreements Toll refining agreements: PGM bearing material belonging to third parties is refined - metal is returned to the customer. IRS levy charge for services – part of service fee is to retain semi-fabricated refined precious metals and sell to Impala who market precious metals – proposed clause 3(3) will make this commercial transactions unlawful (“no person may deliver semifabricated precious metal in …. in consideration of any service rendered or to be rendered to him..”) Autocatalysts / industrial catalyst recycling market Primarily used autocatalysts and spent industrial catalysts which may or may not fall into definition of unwrought precious metal 23 Autocatalyst market Current recycle market is approximately 700 000 ounces of platinum Globally, by 2010 the recycling of autocatalysts is estimated to supply: 1 million ounces of refined Pt per annum 1.5 million ounces of refined Pd per annum 0.025 million ounces of refined Rh per annum IRS currently has a significant portion of autocatalysts recycling market and is one of the largest recyclers in the world Approx 90% supplied from abroad – primarily USA 24 Benefits of recycling Benefits associated with recycling of autocatalysts: Reduce pressure on mining to deliver increased quantities of PGMs year on year – globally limited resources Environmental benefits Implats sustainability Recycling of autocatalysts and industrial catalysts is “beneficiation” / added value to South Africa: Allows South Africa to obtain value from the same ounce of metal many times over and again Employment International competitive position 25 Implications of PMB on IRS IRS final product produced: platinum group metals in the form of a sponge, ingot, salt, powder purity level of above 99.90% and therefore “semi-fabricated precious metals”. Final metal is either returned to the customer or purchased by Impala Platinum Limited (depending on contractual arrangements) Accordingly, either Impala, or the customer would seem to require a beneficiation licence – whether the metal is exported or not. 26 27 Solution Application of definitions of “unwrought precious metals” semi fabricated – not clear in this context “any article or substance containing or consisting of precious metal contemplated in paragraph (a), but does not include any article … that has been processed or manufactured for one or more specific industrial, professional or artistic uses.” Distinguish between metal produced ex SA mine and metal produced from already beneficiated material imported into SA 28 Proposed way forward 30