Development of Business Models for Deep Energy Retrofits in

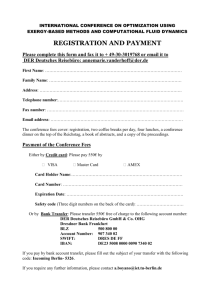

advertisement

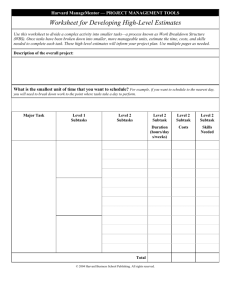

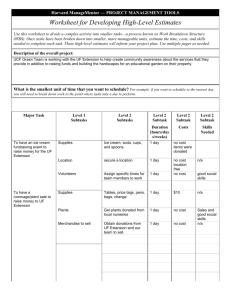

IEA Annex 61 Subtask B: Development of Business Models for Deep Energy Retrofits in Public Buildings Rüdiger Lohse Dan Howett IEA Annex 61 Meeting April 13, 2015 Reading, UK Originally Given By John Shonder TC 7.6 Meeting January 25, 2015 Chicago, IL ORNL is managed by UT-Battelle for the US Department of Energy The Problem • Governments worldwide are targeting more stringent energy reductions in their buildings – In the US, EISA 2007 requires 30% reduction by 2015 compared to a 2003 baseline – EU targets 2050 carbon neutral building stock • Lack of funding and know- how: Funding for projects required to meet these targets is limited • Lack of high effective business models to implement energy conservation in buildings • Private investment – obtained through performance-based contracts – can fill the gap, but these projects have typically yielded savings in the range of 10% to 30% (ESCO business) • IEA-EBC Annex 61 is developing technical and business solutions to allow deeper savings to be achieved using a combination of public and private funding 2 Presentation_name Objective of Subtask B • Develop business models for deep energy retrofit/refurbishment of government buildings and building groups using combined government/public and private funding to overcome existing barriers and to support the necessary increase in pace and quality of refurbishment activities 3 Presentation_name Subtask B Strategy a) Lessons learnt from accomplished DER: Gather case study information on business models used in existing deep retrofit projects planning tools, impacts and investment costs of DER measure bundles, quality assurance mechanisms. Annex 61 Subtask A Reliable planning tools Impacts of DER measure bundles Investment costs for DER bundles Quality assurance mechanisms b) Depict life- cycle cash- flows accounting monetized benefits resulting from DER projects • • Energy related benefits: E- consumption E- source modification 4 Presentation_name • • • • Non energy related savings: Maintenance costs Improved indoor climate Extended floor area Asset value Case study benefits/cash flows: Modeling Results for Office Building 224 kWh/m²yr H / 62 kWh/m²yr. E Scenario 1:”base case” Primary energy savings a)Heating energy savings b)incremental primary investment energy (€/m²) bb) delta primary investment costs in comparison to scenario 1 c)delta cost savings)in comparison to €/m²yr bb/c 5 Presentation_name 3: - 50% 4: Passive House 34% 2: new building adopted 60% 54% 70% 33% 68% 60% 83% 200- 230 300- 330 280- 310 380- 430 100- 110 80- 100 180- 200 - 10 7- 10 10- 14 - 10 10-11 14-18 - Subtask B Strategy • Develop of advanced business model allocating investments and services between building owner and ESCos, development of financing mechanism by accounting and securing life- cycle costs and benefits (table shows new advanced business model for SMESCos in Germany) ESCO Private Equity Building Owner Funding Payment of Performance i.e. energy savings Design Investment DER bundles O&M Performance guarantee Loan Guarantee PPP Quality Assurance Facilitator 6 Presentation_name Subtask B Strategy • Development of advanced financing mechanisms: • a) securing monetary streams between building owner and ESCO (performance guarantee with/without loan guarantee) performance guarantee Building owner ESCO • b) securing third party investments by a quality assurance process such as ICP Private equity Planning process Performance projection ESCO 7 Presentation_name Quality assurance i.e. ICP O&M process Monitoring &verification Subtask B Strategy • Development of advanced financing mechanisms: c) Setting up an inventory of accomplished and evaluated DER and other EE measures in buildings on EU and USA: – Comparison of ex ante / ex prediction/ ex post refurbishment energy consumption – Investment costs – Performance indexes (EUIs etc.) • Business Model Market application: • a) Analyze regulatory framework in the participating countries to determine barriers project implementation • b) Engage with stakeholders (building owners and managers, financial community, and energy services companies) to develop improved business models corresponding to the environment in each country 8 Presentation_name Challenges: Do we really use the appropriate business models? The “owner- directed”/”inhouse”- approach lacks EE incentive mechanisms: • In EU 95% of building refurbishments are carried out in “owner- directed or inhouse” business models: – Architects/planners are responsible for planning, procurement, quality assurance in the construction phase – Building owner- provides (mostly non- experts) funding, engages bank loans for funding and is in charge for the building operations after the accomplishment of the construction phase – Crafts- /Trades Men: construction, maintenance services • Experienced malfunctions of “owner- directed/in- house- business models”: – Open feed back model with no feed- back and response (PERFORMANCE) integrated – Decision making is typically not referring to life- cycle based criteria – lacking stimulation to meet calculated efficiency targets and fixed investment budgets 9 Presentation_name Challenges: do we really use the appropriate business models? • ESPC – Energy Saving Performance Contracting: virtues of performance related business model in comparison to “owner- directed” business models: Strong contract based stimulation for both contract parties to achieve a high cost effectiveness by providing a better savings/investment ratio Guaranteed energy and maintenance cost savings between 25 and 40% in US, EU Bankable energy- and maintenance cost savings create revenue streams which are reliable positions of the funding of deep retrofit projects Cost structure and decision making criteria aligned to life- cycle costs ESCOs are using design and experience based knowledge on different ECM (1) bundles (HVAC/biomass/CHP..) and are performing with satisfactory results EPC in its current approach is not the chosen vehicle for deep retrofit projects • One main target of IEA- Annex 61 is the advancement of existing EPC- related business models for deep retrofit projects (1) 10 Presentation_name ECM Energy Conservation Measures Regional energy efficiency strategies in buildings and neighborhoods Deep Energy Retrofit 50% 25% 75% Energy Savings(%) How to advance EPC into a tool building strategy Energy Supply Contractin g 25 750 11 Presentation_name Regional KEA- EPC Model EPC „first generation“ 50 75 100 Investment /m² (€/m²) 250 500 Market Application: Workshop Investing into Energy Efficiency Projects: Why and How • Organized by Annex 61/ Building Performance Institute/ KEA • Focused on European market • Held in Brussels, Belgium November 9 at the Buildings Performance Institute Europe • Brought together public officials, non-governmental organizations, ESCOs, investors, and technical experts • 12 speakers • 85 individuals in attendance 12 Presentation_name Keynote Address by Paul Hodson, Head of the European Commission's Energy Efficiency Unit Lack of evaluated data from accomplished projects is a major issue: • There is insufficient data on the effectiveness of retrofit projects • Each project is considered to be different and results not comparable • This makes benchmarking difficult • If governments are to see energy efficiency as a resource, there is a need for more and better information on the benefits availablewe 13 Presentation_name Rudiger Lohse, Co-Operating Agent of IEA-EBC Annex 61 • Many barriers to implementing energy efficiency projects in the EU – Market, Financing, Information – Regulatory/Institutional – Technical – Wrong business model is mostly in use • Using public capital alone to implement EE projects brings no measurement of savings, no guarantees, and reduces the viability of future financed projects • Using public capital alone to implement EE projects brings no measurement of savings, no guarantees, and reduces the viability of future financed projects • Annex 61 will focus on performance related business model which will guarantee benefits, reduce demand for third party financing and 14 Presentation_name Mark LaFrance, IEA: Key Policy and Metrics to Enable Investments in Deep Energy Renovation • Each renovation project that is done without incorporating deep energy retrofits is a wasted opportunity • Paradigm shift is needed – Highest priority should be to document and replicate cost effective DER as part of normal building renovation activity. – Establish business case for buildings not currently planned for renovation by targeting a challenging goal and looking beyond energy efficiency. Energy and non- energy related benefits have to be quantitatively valued. – Establish mitigation cost for early renovation – this would likely require carbon trading and be a lower cost option compared to other solutions such as carbon capture and storage. 15 Presentation_name John Coolen, Factor 4, Belgium • Project facilitation is key to guide owners and ESCO through the process • Combine non-energy-related building upgrades with energy retrofits • Provides calculation methods to make the non- energy related savings accountable and gives guidance on how to assess and to verify their performance 16 Presentation_name Ove Moerck on Annex 61 Subtask A • Evaluation of accomplished DER projects in EU and USA • Which major benefits have been achieved • Cost- /benefit- curves • Will be presented in this session 17 Presentation_name Eric Berman, RenESCO (Latvia) on DER EPC business models • Upgrade of Soviet-era residential housing stock • RenESCO upgrades the buildings at no cost to residents • Residents then pay their utility bills to RenESCO, who pays the utility and uses the remainder (savings) to pay debt service on the project financing • Business has been in operation for three years • Difficulties include lack of consistent policies from governments and financial institutions 18 Presentation_name Matt Golden of Environmental Defense Fund, USA and Panama Bartholomy, ICP 19 Presentation_name Main takeaways from Investor’s Day • Large participation in this event shows the great interest in energy retrofit projects in Europe • The barriers to projects include – Lack of information about energy efficiency as a resource – Lack of clear policies at many levels of government, compounded by the autonomy of the European member countries – Lack of private capital – Insufficient business models in use for EE implementation • Investor´s Day is providing a platform to move barriers and to bring together investors, building owners, ESCos and research • Investor´s Day is to be considered as groundwork follow up of EEFIG (Energy Efficiency Financial Institution Group (EEFIG) • Next Investor´s Day will take place in autumn 2015 and will be announced in the next few days 20 Presentation_name