Syllabus

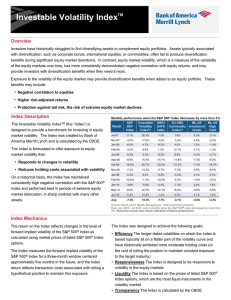

advertisement

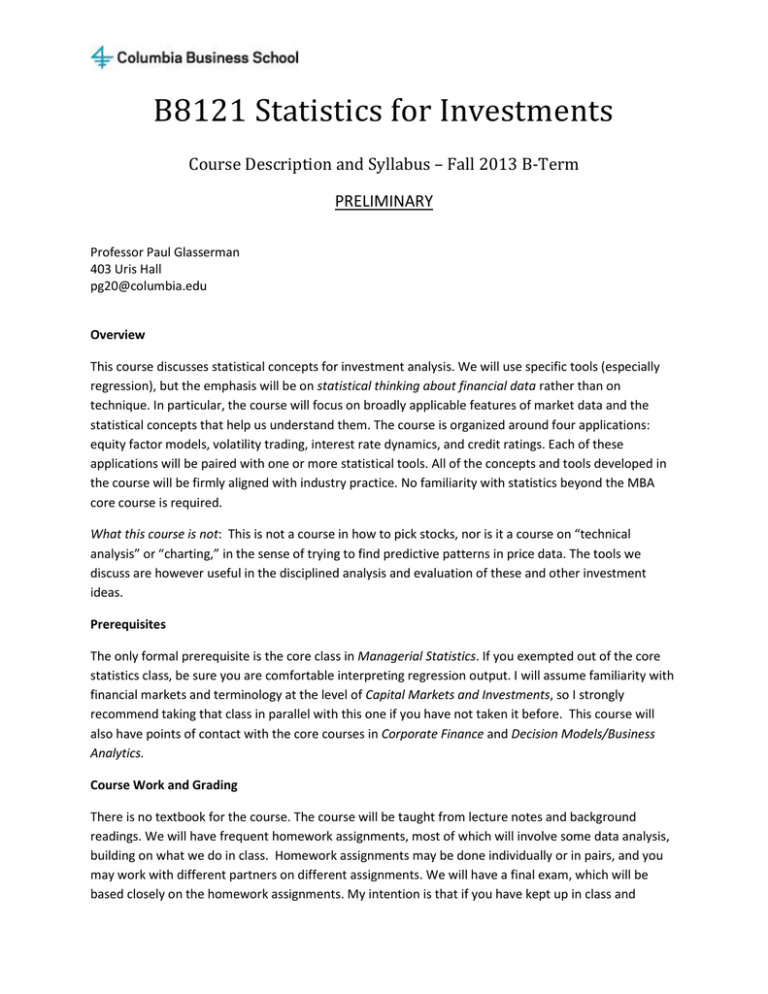

B8121 Statistics for Investments Course Description and Syllabus – Fall 2013 B-Term PRELIMINARY Professor Paul Glasserman 403 Uris Hall pg20@columbia.edu Overview This course discusses statistical concepts for investment analysis. We will use specific tools (especially regression), but the emphasis will be on statistical thinking about financial data rather than on technique. In particular, the course will focus on broadly applicable features of market data and the statistical concepts that help us understand them. The course is organized around four applications: equity factor models, volatility trading, interest rate dynamics, and credit ratings. Each of these applications will be paired with one or more statistical tools. All of the concepts and tools developed in the course will be firmly aligned with industry practice. No familiarity with statistics beyond the MBA core course is required. What this course is not: This is not a course in how to pick stocks, nor is it a course on “technical analysis” or “charting,” in the sense of trying to find predictive patterns in price data. The tools we discuss are however useful in the disciplined analysis and evaluation of these and other investment ideas. Prerequisites The only formal prerequisite is the core class in Managerial Statistics. If you exempted out of the core statistics class, be sure you are comfortable interpreting regression output. I will assume familiarity with financial markets and terminology at the level of Capital Markets and Investments, so I strongly recommend taking that class in parallel with this one if you have not taken it before. This course will also have points of contact with the core courses in Corporate Finance and Decision Models/Business Analytics. Course Work and Grading There is no textbook for the course. The course will be taught from lecture notes and background readings. We will have frequent homework assignments, most of which will involve some data analysis, building on what we do in class. Homework assignments may be done individually or in pairs, and you may work with different partners on different assignments. We will have a final exam, which will be based closely on the homework assignments. My intention is that if you have kept up in class and understood the homework assignments, you will find the final exam straightforward; and if you have not kept up in class or not been conscientious about the homework, you will find the final exam difficult. Style and Level of Difficulty of the Course A good way to get a feel for what this course will be like is to look at Chapters 1-3 of B.R. Fischer and R. Wermers (2013), Performance Evaluation and Attribution of Security Portfolios, Academic Press, which you can read on-line through the Columbia library. These chapters overlap with the first topic we’ll be covering, equity factor models. Class Schedule – Preliminary 1. Introduction Course overview Quantitative investment management Review of the CAPM and regression – what works and what doesn’t work in the CAPM and why it’s relevant to investment analysis Using the market factor to evaluate performance and risk 2. Equity factor models Why factor models? Fama-French factors – size and value Momentum Alternative beta 3. Equity factor models Fundamental factors Macroeconomic factors Evaluating fund performance 4. Equity investment performance analysis Sharpe ratio, information ratio, and related measures Performance attribution Skill versus luck 5. Time series analysis Properties of macroeconomic data Trend, seasonality, stationarity Autocorrelation Autoregressive models 6. Volatility Measuring volatility: realized, implied, VIX Persistence; GARCH Leverage effect 7. Volatility and Trading Volatility risk premium; covered calls; tail risk Low-risk anomaly; risk parity 8. Dynamics of interest rates Properties of interest rate data Yield curve risk Nelson-Siegel model; level, slope, and curvature Forecasting the coefficients 9. Dynamics of interest rates Macro factors in term structure models Taylor rule 10. Modeling multiple curves Credit spreads and risk-free rates Bond portfolios 11. Credit risk and credit scoring Altman Z-score; discriminant analysis 12. Credit risk and credit scoring Logistic regression Credit ratings The final exam will be held during exam period.