Nordex Conf Call

advertisement

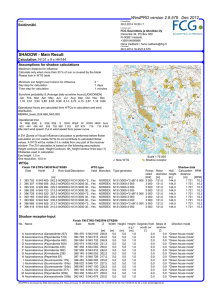

Investor Presentation Nordex AG July 2006 Nordex Management Team Thomas Richterich Dr. Hansjörg Müller CEO / CFO COO Previous positions with MAN, Ferrostaal and Babcock Borsig CFO since 2002, CEO since 2005 Previous positions with Siemens and Roland Berger Since 2004 Nordex board member for Operations Carsten Pedersen Board Member Head of Sales Managing Director of Nordex Energy GmbH since 1987 and Board Member of Nordex Responsible for Sales, since 2001 Page 2 Nordex at a Glance Headquarter: Norderstedt, Germany Founded in 1985 in Denmark Establishment of production operations in Germany (1992) and China (1998) IPO in 2001 Installed Base by Geography Other Europe 30% America 2% Germany 44% Africa 4% Asia 20% Global manufacturer of wind energy systems with a focus on turbines in the “MW class” Installed Base by Segment Small WTG (<750 kW) 6% 2005 Sales of €309m 721 employees Main production sites in Rostock (Germany) and Baoding (China) “MW Class” (1.5-2.5MW) 43% Mainstream (0.75-1.5MW) 51% Total Base (as of Mar-2006): 2,738 Page 3 Investment Highlights 1. Attractive fast growing end-markets 2. Well positioned for strong growth Technology leader Well-positioned across the value chain Positioned in high-growth product segments International expansion 3. Successful completion of turnaround 4. Momentum generation & further upside potential 5. Strong management team with proven track record Page 4 Attractive Fast Growing End-Markets: Growing Importance of Wind Energy CAGR ‘05 – ‘10 350.0 2.7% 1.9% 250.0 Total Installed GW 2.9% 2.4% 300.0 0.7% 0.5% 0.6% 0.3% 0.4% 0.3% 0.1% 0.1% 0.2% 0.2% 0.9% 1.1% 1.2% 1.4% 2.1% ‘10 – ‘15 20% 13% 53% 17% 29% 17% 24% 16% 16% 11% 276.6 1.6% 246.9 219.5 193.9 200.0 170.4 148.8 150.0 124.4 104.2 100.0 87.6 72.6 59.3 50.0 4.8 7.6 6.1 10.2 13.9 18.4 24.9 32.0 40.3 47.9 0.0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 % Increase 27.0 25.8 33.0 Europe 37.2 32.4 35.1 The Am ericas 28.5 25.8 18.9 Asia-Pacific 23.7 22.4 RoW 20.7 19.0 19.4 19.6 14.6 13.8 13.2 12.5 12.0 Wind Pow ers' Share of Total Pow er Market Source: BTM Page 5 Attractive Fast Growing End-Markets: Key Growth Drivers Demand for wind energy driven by renewables regulations, price competitiveness of wind energy and strong worldwide energy demand Growing Energy Consumption World demand for primary energy increased by over 4% in 2004, world petrol demand by 1.5% in 2005 Economic growth in 2006 expected to support oil demand further (+2.2% vs. 2005 in volume terms) IEA estimates worldwide energy demand may double from 2002 to 2030 Rising Energy Costs Favourable Regulatory Environment Oil price more than tripled since 2001, reaching all-time high in spring 2006 with in excess of US$70/barrel Market forward curve for oil swaps implies prices at a level of US$70-75 for next three years Generation Cost in €/MWh Photovoltaic Solar Thermal Conv. Gas/Oil CC Biomass Advanced Gas/Oil CC Wind Kyoto protocol supports renewable energy to help countries achieve their targets IGCC - Coal Regulatory outlook worldwide positive: Geothermal PTC in US extended until end of 2007; widely expected to be extended again Supportive new renewable energy law in China European Parliament reiterates position on renewable energy targets (20% by 2020) Conv. Hydro Advanced Nuclear 0 50 100 150 200 250 €/MWh Source: Goldman Sachs Commodity Research, Bundesverband Wind Energie, Merrill Lynch Commodities Research Page 6 Well Positioned for Strong Growth: Technology Leader Nordex track record of technological innovation Production of the world’s largest series wind turbine (250 kW) 1987 Construction of the world’s first series MW wind turbine Completion of the world’s first series of 80m class 2.5 MW wind turbine Installation of 1st Nordex offshore turbine Current R&D Initiatives Launch of serial production of 90m class 2.5 MW wind turbine New drive train concept with differential gearbox (N90/2500) Upgrade yaw system Upgrade pitch system New platform generation Modular tower concept incl. standardized mounting parts (S70 & N90) Advanced control system (reduced-load operation) Redesign of rotor blade NR45 (until maturity phase) Adoption to international grid codes Development of 100m class turbine 1995 2000 2003 2005 Page 7 Well Positioned for Strong Growth: Well Positioned Across the Value Chain Project development marketing financing Market leader in France (high margin potential) Development of first commercially financed project in China Wind farm system planning Micrositing of 100% of signed projects to review customer layout Supporting customers (codevelopment) to receive necessary approvals and to optimize the park layout Technical realisation Core business: WTG assembly, production of selected components, installation on site, initial operation Wind farm operation Additional service offering: increasing demand due to new wind farm investors, which are only interested in stable cash flow Service and maintenance 2200 turbines are currently under Nordex service Full service contract offering up to 9+3 years duration Page 8 Well Positioned for Strong Growth: Positioned in High-Growth Product Segments Nordex is growing faster than the market and has established a proven technological position in the MW turbine class CAGR ‘01-’05 by MW class Newly installed MW p.a. 12,000 11,203 NM 10,000 8,305 8,000 7,057 8,153 +39.9% 7,417 6,000 4,000 +13.6% 2,000 (35.2)% 0 2001A 2002A < 750 2003A 750 - 1500 1500 - 2500 2004A 2005A > 2500 MW-Class (1500 – 2500 kW) is by far the fastest growing segment and will be the market mainstream in the next 5 years Page 9 Nordex Has Grown Faster Than the Market Leading to Recovery of Market Share Nordex’ World Market Share Recovery in 2005 Market Growth in 2005 3% 2% 3% Market Share 117% Nordex 60% Repower 30% Siemens 24% 17% Enercon Vestas 15% Ecotécnia 12% Mitsubishi 9% 0% Source: BTM 2006 World Market Growth 40% Nordex’ Newly Installed Capacity in MW Suzlon Gamesa 7% 120% GE 500 60% 300 250 190 230 2H 70 1H 2002 2003 2004 2005 Page 10 Well Positioned for Strong Growth: International Expansion As of Mar-2006 Nordex has installed 1,543 turbines outside Germany (56% of total installed base) and is further expanding its international operations. Country Activity Foundation of rotor blade production (4,000 sqm) for N60/1,300 kW in spring 2005 Foundation of production JV for S70/77 (1,500 kW) in spring 2006 Foundation of rotor blade production for S70/77 planned for 2006 USA: Market re-entry in 2006/7 France: Upgrading capacities for project development 17 new projects developed, construction expected in 2006/7 (total capacity: ~240 MW) UK: Successful re-entry achieved in 2006 (first major orders signed) Italy: Successful entry achieved in 2006 (first major order signed) China: Page 11 Momentum Generation: Continuously Increasing Order Intake Order Intake by Region in 1HY-2006 Order Intake Above Budget in 2005 and 1HY 2006 Asia 4% 450 Q1-2: €400m 400 Q1-4: €395m Germany 21% 350 300 Q1-3: €280m Q1: €263m +67% Rest of Europe 75% Total: € 400m 250 Order Intake by Product in 1HY-2006 Q1-2: €158m 200 N60/N62 8% Sub-MW 0% 150 S70/S77 15% 100 50 0 Jan Q1: €35m Feb Mar Apr N80/N90 77% May Jun Jul Aug Sep Oct Nov Dec Total: € 400m Page 12 Further Upside Potential Implementation of EBIT improvement plan started in spring 2005 to achieve sustainable profitability (target: 5 – 10% EBIT margin) Positive market development since autumn 2005 generates good opportunities to secure bottom-line growth short- / medium-term improved utilisation of capacities increasing sales prices EBIT improvement plan will secure profitability long-term Page 13 Main Drivers of Bottom-Line Growth 2006 2007 2008 + 50% + 50% + 50% + ++ ++ - due to shortages of WTG + ++ +/- (3) Increase in material costs - -- - (4) Expenditures in new markets -- - - (5) EBIT improvement program + + + 3.0% 4 – 7% 5 – 10% Target revenue growth (1) Higher utilization of capacity (2) Increase in price per MW Target EBIT margin Page 14 Further Upside Potential: Enhanced Outlook 2006 2006E (old) 2006E (new) Order Intake >€450m ≥€600m (Y-on-Y) +14% +50% Revenues >€400m ≥€460m (Y-on-Y) 30% +50% EBIT Margin 2.5% ≥3.0% Projected revenues secured by order volume: 100% of 2006 revenues secured by unconditional orders Unconditional and conditional orders (> €1bn) secure workload until end of 2007 Mid-term annual growth target of 50% Page 15 Opportunities for and Limitations of Growth Beyond Plan Opportunities Recovery of market share, target 5% New set-up in 1-2 markets p.a. Cautious towards offshore International supply 2-3 supplier strategy Production capacity gear boxes and blades 3. Product development capabilities Solid 2.5 MW technology Scaling up to 4.0 MW Above 4.0 MW completely new design required 4. Production capacities Europe: expandable to 750 (turbines) / 400 (blades) MW North America Further investments in Europe and Asia Max. growth path +50% p.a. Working capital requirements secured due to increased bond lines Investment requirements secured due to capital increase (€ 70m) Page 16 1. Markets 2. Core components Limitations Asia: expandable to 250 (turbines) / 300 (blades) MW 5. Management & organisation Restructuring completed Basis for further improvements 6. Financial capabilities Set-up for business volume with a target of € 1b Investment Highlights 1. Attractive fast growing end-markets 2. Well positioned for strong growth Technology leader Well-positioned across the value chain Positioned in high-growth product segments International expansion 3. Successful completion of turnaround 4. Momentum generation & further upside potential 5. Strong management team with proven track record Page 17 Appendix Page 18 Price Development of Fossil Fuels in % 250 200 150 100 50 Q1/2004 Q2/2004 Q3/2004 Steam Coal ARA $/MT Q4/2004 Q1/2005 Q2/2005 Natural Gas $/MMBTU Q3/2005 Q4/2005 Q1/2006 Crude Oil WTI Spot U$/BBL Increasing prices of fossil fuels have made wind more competitive Source: ARA, WTI, Datastream Page 19 Spot Market Price in 2005 (EEX) Euro/MWh Jan-2005 Feb-2005 Mar-2005 Apr-2005 May-2005 Jun-2005 Jul-2005 Aug-2005 Sep-2005 Peakload EEG max. remuneration (85.9 EUR/MWh) Baseload EEG basic remuneration (53.9 EUR/MWh) Oct-2005 Nov-2005 Dec-2005 Market power price was considerably in excess of the EEG tariff Source: EEX Page 20 The Nordex Group’s Restructuring Concept was based on Five Core Elements 1 2 Focus on attractive core markets Concentration on foreign growth markets Improved marketing efficiency Regaining technical position in upper market segment Elimination of existing deficiencies and lowering production costs Priority: N80/N90 3 5 Elements of restructuring at Nordex Group Harnessing liquidity potential by reducing working capital Creation of a reasonable cost structure to regain competitiveness Elimination of previous organizational shortcomings Pragmatic approach to optimize business processes with immediate activities Avoidance of inventory losses and guarantee expenditure 4 Radical cost-cutting by means of operative and structural measures Creation of a reasonable cost structure to regain competitiveness Page 21 2005 Recapitalisation and Current Shareholder Structure of Nordex Recapitalisation Completed in May 2005 Share Capital • Reverse split 10 : 1 Cash Capital Increase • €41.6m • Capital increase with pre-emptive rights for existing shareholders • All shares from rights not taken up by existing shareholders purchased by CMP and Goldman Sachs Debt-toEquity Swap • Reduction in bank liabilities of €28m • Issue of 12m new shares Credit Facilities • Renewal for a further four years in the Current Shareholder Structure Freefloat 40.04% CMP 26.7% Goldman Sachs 17.4% existing credit facilities • €60 million in additional credit facilities Nordvest 4.1% HypoVereinsbank 4.3% Capital Increase in May 2006 HSH Nordbank 3.8% Morgan Stanley 3.7% € 70.4m from issue of 5.5m new shares Page 22 Monthly Index Ranking TecDAX 6/30/2006 Company Rank Market Cap in million* Rank Turnover in million** 18 342.68 15 563.58 ……… ……… NORDEX ………. ………. 30 )* on basis of freefloat )** 12 Month Page 23 Product Overview Type Capacity Regulation Certification Nordex N60 1,300kW stall GL1/GL2 Nordex S70/77 1,500kW pitch GL2/IEC 3a Nordex N80 2,500kW pitch IEC 1a Nordex N90 2,300kW pitch GL2 Nordex N90 2,500kW pitch IEC 1b (HS) IEC 2a (LS) Page 24 Production Facilities Yinchuan: S70/77 JV NR-34/37 120 blades/year NR-40/45 180 blades/year 8-10 WTG MWclass/week 99 blades/year 2 WTG 600 kWclass/week Page 25 Income Statement (IFRS) Fiscal 2005 01-Oct-200330-Sep-2004 01-Jan-200531-Dec-2005 Sales 221.6 309.0 87.4 39.4% Total Revenues 218.8 319.4 100.6 46.0% Cost of materials as a percentage of total revenues (173.3) 79.2% (251.3) 78.6% 78.0 45.0% Personnel costs as a percentage of total revenues (34.5) 15.8% (34.1) 10.7% (0.4) (1.3)% Depreciation/amortisation as a percentage of total revenues (12.1) 5.5% (11.7) 3.7% (0.4) (3.3)% Other operating income/expenses as a percentage of total revenues (24.0) 11.0% (22.1) 6.9% (1.9) (7.9)% EBIT (operational) (25.5) 0.3 25.8 101.2% One-off items (2.5) (5.4) (2.9) (116.0)% Financial result (5.1) (3.0) 2.1 41.4% 0.4 0.1 0.3 (33.5) (8.2) 25.3 €m Tax Net income/loss 75.4% Page 26 Income Statement (IFRS) Q1/2006 €m 01-Jan-200531-Mar-2005 01-Jan-200631-Mar-2006 Sales 34.9 124.7 Total Revenues 40.7 122.8 Cost of materials (30.6) (101.2) Personnel costs (8.8) (9.1) Depreciation/amortisation (2.8) (2.9) Other operating income/expenses (6.0) (7.3) EBIT (operational) (8.7) 3.7 One-off items (1.6) 0.0 Financial result (0.9) (1.0) 0.1 0.0 (9.5) 2.6 Tax Net income/loss Page 27 Balance Sheet (IFRS) Q1/2006 €m Fixed assets Shareholder‘s equity 63.5 136.5 Provisions 55.8 57.7 80.6 Liabilities 105.2 134.6 94.2 Banks 7.1 3.0 Trade payables 64.1 62.7 Other liabilities 34.0 68.8 Others 6.9 7.2 231.4 336.0 55.4 55.5 150.0 183.7 Net inventories 71.1 Receivables and other assets 59.4 Current assets Liquid funds 31-Dec-2005 31-Mar-2006 (as if incl. cap. Increase) 31-Dec-2005 31-Mar-2006 (as if incl. cap. Increase) 19.5 79.3 Other assets 26.0 26.4 Total Assets 231.4 336.0 Total liabilities and equity € 70.4 m net proceeds from capital increase as of May 2006 Page 28 Cash Flow Statement (IFRS) Fiscal 2005 €m Net income/loss 01-Oct-200330-Sep-2004 01-Jan-200531-Dec-2005 (33.5) (8.2) Depreciation 12.2 11.7 Change in provisions (4.6) (6.3) Change in inventories 41.8 (23.5) Change in trade receivables and other assets (6.6) (12.6) Change in trade payables and other liabilities (8.6) 18.6 Other changes from operating activities 0.1 (0.3) Cash flow from operating activities 0.8 (20.6) Cash flow from investing activities (3.3) (8.6) Cash flow from financing activities (0.4) 39.0 (2.9) 9.9 Change in liquidity Page 29 Contact Nordex AG Ralf Peters Bornbarch 2 22848 Norderstedt Head of Corporate Communication/ Investor Relations Germany Phone: +49 (0)40/500 98 522 Fax: +49 (0)40/500 98 333 eMail: rpeters@nordex-online.com www.nordex-online.com Page 30 Financial Calendar Report on the first half of 2006 August 25, 2006 Report on the third quarter of 2006 November 23, 2006 Report on fiscal 2006 April 26, 2007 Page 31