Ifo 2 - Kolegia SGH

advertisement

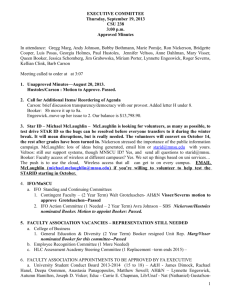

Economic Benefits of TTIP Prof. Gabriel Felbermayr, PhD Ludwig Maximilians Universität München Warsaw School of Economics Nov 30, 2015 Ifo Center for International Economics Ifo Institut 2 POLAND: HOW TRADE MATTERS FOR INCOME Income gains from moving from „autarky“ to status quo of 2008 SVK HUN CZE SVN BEL AUT POL DEU NLD SWE FRA ESP ITA GBR USA Source: Costinot and Rodriguez-Clare (2014). 57% Ifo Institut POLAND: HOW TRADE MATTERS FOR INCOME Income gains from moving from „autarky“ to status quo of 2008 SVK 96% HUN 91% CZE 87% SVN 80% BEL 71% AUT 64% POL 57% DEU 53% NLD 48% SWE 46% FRA 32% ESP 31% ITA 27% GBR 24% 10% USA Source: Costinot and Rodriguez-Clare (2014). 3 Ifo Institut APPROPRIATE RULES FOR XXIst CENTURY TRADE • WTO rules negotiated 1986-2004 to fit XXth century trade • International production sharing: new issues, requiring new rules • Complementarities between trade in final goods, trade in inputs, trade in services, investment, mobility of workers and data • Protection on intellectual property • Coherent regulation, to enable gains from specialization • Problems of multiple taxation through tariffs • Just in time practics: trade facilitation • Contract enforcement • Moral hazard issues related to political risk 4 Ifo Institut TTIP AMBITIONS Feb 2013: Recommendation of a High-Level Working Group „comprehensive“ agreement „contributing to global rules“ • Market access: going „beyond what the U.S. and the EU have achieved in previous trade agreements“ • Investment: „highest levels of liberalization and of protection“ • Regulatory cooperation: „ambitious SPS-plus“ and „ambitious TBT-plus“ chapters; regulatory council After 11 rounds: high-flying ambitions not all achievable 5 Ifo Institut 6 EVALUATING AN AGREEMENT THAT DOES NOT YET EXIST Ex post performance of standard CGE models disappointing: „models drastically underestimated the impact of NAFTA on North American trade” (Kehoe, 2005) • Right trade model? • How define an appropriate scenario ex ante? „Guess“ likely/realistic scenario? Use measured effects of past agreements. Assumption: TTIP lowers trade costs by as much as other already existing deep agreements have (e.g., all US agreements, EU, EU-CHL, …) ifo Approach Ifo Institut 7 GERMAN VICE CHANCELLOR SIGMAR GABRIEL Voodoo Economics Ifo Institut 8 LEADING STUDIES EU COM/CEPR: Francois, Norberg, et al., 2013. EU Com Economic Policy: Egger, Francois et al., 2015 KOF 1 KOF 2 BMWi/ifo: Felbermayr et al., 2013a Bertelsmann/ifo: Felbermayr et al., 2013b Economic Policy: Felbermayr et al., 2015 CEPII: Fontagné, Gourdon, Jean, 2013 CESifo WP/ifo: Aichele, Felbermayr, Heiland, 2014 … and a growing number of more studies Source: ifo. ifo 1 ifo 2 Ifo Institut 9 DIFFERENT APPROACHES, DIFFERENT OUTCOMES Multi Sector Spillovers NTMs top-down ifo 1 ifo 2 Poland +3.51% +1.74% Germany +3.48% +2.48% EU +3.94% USA KOF 1 EU Com KOF 2 +2.32% +4.89% approx. +1.43% EUR 200 +0.48% +2.27% +2.12% per person and year +0.39% +0.97% +2.68% China -0.50% -0.23% -0.27% +0.03% +0.26% ASEAN -0.07% -0.19% +0.38% +0.89% -0.47% World 1.58% 1.32% Source: ifo. +0.14% +2.97% +1.13% Ifo Institut 10 POLAND: DETAILED TRADE EFFECTS Ifo 2 (Aichele et al., 2014) 220% 210% 190% 170% 120% 70% 20% -30% USA - EXP USA - IMP Source: ifo2 (Aichele et al., 2014.) -5% -4% GER EU -1% CHN 1% RUS Ifo Institut 11 ZOOMING IN: EFFECTS OF TTIP ON AGGREGATES IN POLAND bn USD, 2014 Exports Imports GDP Source: ifo. +2.9% +2.1% 217 211 220 215 558 +1.7% 548 TTIP 2014 Ifo Institut 12 POLAND: REAL GDP PER CAPITA EFFECTS OF DIFFERENT SCENARIOS (%) Deep + indir. spillovers 2.3 Deep + dir. spillovers 2.2 Deep + Doha 1.9 Deep 1.7 Shallow Tariff only Source: Aichele et al., 2014. 1.5 0.1 Ifo Institut 13 EFFECTS ON LONG-RUN REAL PER CAPITA INCOME, % Positive net global effects +2,1% +2,7% Ø Non-TTIP: -0,03% Source: ifo 2, Aichele et al., 2014. Ifo Institut MORE (?) AND BETTER JOBS • Displacement effects (Felbermayr et al., 2013) About 1% of labor force 1/3 across sectors, 2/3 within sectors • Labor market effects (Bertelsmann-ifo, 2013) +93 000 Jobs for Poland (=0.5% more jobs) +0.69% real wage • Better jobs (Felbermayr et al., 2015): Newly creaed jobs are paying higher salaries tend to be more secure Source: ifo. 14 -10% -15% -20% Metals nec Petroleum Insurance Textiles Ferrous metals Mining Dwellings Wood Metal products Mineral products Financial… Electricity Communication Paper Recreational… Agriculture &… Motor vehicles Chemicals Transport nec Machinery nec Food, processed Construction Other services Business… -5% 15 Ifo Institut SECTOR EFFECTS Initial shares (%) and rates of change (%), value added, top industries 20% 15% 10% 5% 0% Source: ifo 2, Aichele et al., 2014. Change through TTIP GDP share Ifo Institut 16 SOME „THREATS“ AND WHAT THEY REQUIRE Adjustment costs: displacement effects short-run in nature social policy (European Globalization fund) Higher inequality - Higher competition threat to weak - Market access opportunity for strong Crucial for ‚right‘ incentives fiscal and social policy Constraints on regulatory autonomy Reciprocal constraints on uncoordinated, arbitrary, discriminatory policies are the reason for free trade agreements. Source: ifo. Ifo Institut THANK YOU FOR YOUR ATTENTION 17 Ifo Institut 18 BACKUP Ifo Institut FREQUENT MISUNDERSTANDINGS • Ifo assumes an overoptimistic scenario. WRONG. The scenario is benchmarked to the average of other agreements and is therefore, by construction, feasible. • Because current US-EU trade is low, welfare gains from TTIP cannot be large. WRONG. In all known models, initial trade volumes correlate negatively with the size of potential gains from trade. • The size of ifo gains is implausibly high. WRONG. Modern data-based research attributes the gains from trade for Germany at 30-50%. • Bilateral trade effects are inconsistent with the welfare effects. WRONG. What matters for welfare is not the value (price x quantity) of trade flows, but quantity and quality only. 19 Ifo Institut ADVANTAGES OF THE ifo APPROACH 1. Top-down strategy on trade costs No need to estimate non-tariff measures (NTMs) Comprehensive measure 2. Data-defined scenario for TTIP Capturing „actual“ direct and indirect effects Political feasibility 3. Easily applicable on very large country samples 173 countries, i.e., 29,756 country pairs 4. Perfect theory-econometrics-data match Parameters estimated on baseline date, using structural relationships from the model Confidence intervals easily computed 20 Ifo Institut 21 MACRO- vs. MICRO-PERSPECTIVE MACRO • Single-sector approach • Simple, transparent, low data requirements, established in scientific literature • No stance on patterns of comparative advantage, sectoral trade patterns, and value added networks, … MICRO • Multi-sector approach • Closer to CGE tradition, high data requirements • Patterns of comparative advantage, sectoral trade patterns, and value added networks are modelled but fixed