File

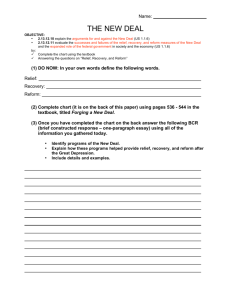

advertisement

A few numbers… • $24 Billion • 6.25% • 10 Years • $44 Billion! Another number… 30% One final number… 10,000 Education Finance Reform: An Overview Myth #1: Property taxes are the problem. What are the real problems? • Antiquated taxation system not based on accepted taxation principles • Property taxes inherently arbitrary and unfair • Inability to pay property tax bills, loss of homes • Out-of-control spending • Lack of effective education cost controls • Education and taxation inequities • Projected cost of education What are the real problems? Short answer: An irreparably broken K-12 public education finance system Myth #2: Property tax “relief” or property tax “reform” is the solution. What’s wrong with tax relief? • Act 50, Act 72, Act 1 local tax shifts • Former HB 1600 tax shift • Act 1 rebates • “Relief” revenue quickly outstripped by relentlessly rising school property taxes • ANY property tax “relief” plan is doomed to failure if the system is not restructured The Three Rs • NO “Relief” • NO “Reform” • NO “Reduction” REPLACE! (Thanks to Randy Bish of the Pittsburgh Tribune-Review) Why NOW is the time for change • Rising homeowner discontent • Act 50, Act 72, Act 1 failures, especially the “relief” from gambling revenues • 2008 Quinnipiac Poll: 89% consider property tax reform “urgent” - The #1 issue among Pennsylvania voters • Allegheny County court ruling: Base year property tax assessments unconstitutional • Pressure from taxpayers’ groups and the media • Diminishing opportunity to fund property tax replacement from a state-level source Why NOW is the time for change • June 2011 American Legislative Exchange Council (ALEC) “Rich States, Poor States” report for Pennsylvania: 46th in economic performance 43rd in economic competitiveness 41st in outmigration • Antony Davies, Duquesne University Economics Professor: “Symptom of increasing property taxes.” Why NOW is the time for change • February 2012 Tax Foundation “Comparative Analysis of State Tax Costs on Business” report for Pennsylvania: 49th of 50 for new firms 50th of 50 for mature, established firms • Bottom line: Runaway property taxes are destroying Pennsylvania’s economy, devastating job-producing small businesses, and driving away its residents The Solution: Replace the school property tax with a more broad-based, equitable funding stream. House Bill 76 Senate Bill 76 HB/SB 76 - Goals • Total elimination of the school property tax • Total elimination to be phased in over a two year period • Total elimination of school board taxing ability with specific exceptions • Stabilization of school funding • Establish realistic limits on increases in K-12 education spending HB/SB 76 - Revenue • Elimination tax swap must be tax revenue neutral • Moderate expansion of the Sales Tax (SUT) base to include more items and services with exemptions for necessities • Increase the sales tax rate to 7% • Increase the state personal income tax rate to 4.34% • Act 1 gambling revenue currently allocated to property tax relief • Small retained property tax for long-term debt HB/SB 76 - Revenue • All property tax replacement revenue to be placed in a segregated lockbox account • Any fund balance that accrues should not exceed 6% of the total property tax replacement funding. If the accrual exceeds the 6% maximum an appropriate reduction in the PIT rate will be mandated HB/SB 76 - School Funding • All districts initially fully funded dollar-for-dollar for total amount of local taxes eliminated • Annual funding increases to all districts based on the increase in the Consumer Price Index (CPI) or available revenue, whichever is less, allocated to each district equally on a percentage basis HB/SB 76 - School Funding • Supplemental school funding through local EIT or PIT All supplemental EIT or PIT to be subject to noexception referendum For specific projects, referendum must state the purpose of the project, cost of the project, the tax rate to be applied, and a sunset date for the tax For general school district funding, mandatory referendum every four years for renewal of the tax HB/SB 76 - Scope This legislation is to be implemented for replacement of local school district taxes only and is not to be integrated in any way with the current Basic Education Subsidy (BES), that funding to continue in whatever form is determined by the General Assembly HB/SB 76 - Guarantee Introduction of separate concurrent legislation proposing a Constitutional Amendment to forever abolish property taxes as a school funding source HB/SB 76 – Certification HB 1776 has been vetted against actual and estimated revenue and expenditure figures supplied by the PA House Appropriations Committee and the Governor’s 2012-2013 budget book to ensure financial viability. The legislation is in full compliance with the financial analysis conducted by the Pennsylvania Independent Fiscal Office (IFO) that was released on September 25, 2012. HB/SB 76 – IFO Analysis The elimination of school property taxes increases the disposable income of property taxpayers. The analysis assumes that 70% of the property tax cut goes to individuals. It further assumes that homeowners spend 90% of the increase in disposable income. (Pages 17-18) The analysis indicates that HB 1776 will cause home values to increase, on average, by more than 10% statewide. (Page 23) HB/SB 76 – IFO Analysis Working age homeowners realize a tax cut. The analysis finds that the increase in federal income tax (through lower itemized deductions), state income tax, and sales tax is more than offset by the reduction in property taxes. (Page 21) Retired homeowners realize a significant reduction in taxes. The analysis finds that the property tax reduction easily offsets any increase from the higher sales tax. (Page 21) HB/SB 76 – IFO Analysis The elimination of property taxes would significantly reduce the property tax share and would clearly increase the attractiveness of the Commonwealth for business location and expansion. (Page 25) Benefits would also accrue to home builders, home developers, and other land owners who convert current land holdings into new housing plots. Employment would increase in the construction sector as well. (Page 23) HB/SB 76 – IFO Analysis (Regarding business entities) … the income flows through to individuals as higher disposable income. For pass through entities, the analysis assumes that owners and shareholders spend 90 percent of the increase and 70 percent is spent on taxable goods and services, yielding another secondary effect of $34 million in increased sales taxes for FY 2013-14. (Page 18) HB/SB 76 – The People’s Bill The Property Tax Independence Act was crafted by members of the General Assembly in full collaboration with the 76 member groups of the nonpartisan grassroots Pennsylvania Coalition of Taxpayer Associations. This plan is unique in that it is OUR legislation in a state that does not allow for citizen initiatives. The PTIA has many lawmaker proponents from both parties and enthusiastic grassroots supporters from across the entire political spectrum. We as taxpayer activists have accomplished what the politicians in both Washington and Harrisburg have been unable to do: work across party lines to reach a sensible and effective solution to a critical problem. A clean bill! HB/SB 76 – Common Objections • The numbers don’t work • Loss of local control • We shouldn’t tax clothing, books, flags, whatever… • The plan shouldn’t eliminate for businesses HB/SB 76 – Ten Reasons 1. Achieve true home ownership 2. Stabilize school funding 3. Help prevent foreclosures 4. Restore plummeting real estate values 5. Boost the sagging housing market HB/SB 76 – Ten Reasons 6. Attract business to Pennsylvania 7. Generate jobs for Pennsylvanians 8. Create a massive stimulus for PA 9. Increase personal wealth 10. Stop costly reassessments “I hope that ‘they’ will do something about it.” “Good luck. I hope that you can do it.” True education finance reform CAN be achieved with your help! Thanks to Alan MacBain of the Pottstown Mercury www.ptcc.us